Will Berkshire Hathaway Sell Apple Stock After Buffett's Departure?

Table of Contents

Buffett's Influence on Berkshire Hathaway's Apple Investment

Warren Buffett's personal admiration for Apple and its business model is well-documented. His belief in Apple's strong brand loyalty, robust ecosystem, and exceptional management team played a pivotal role in Berkshire Hathaway's gradual acquisition of its significant Apple stake. The investment, initially a modest foray, blossomed into a substantial holding, reflecting Buffett's confidence in Apple's long-term growth potential. His consistent praise of Apple's leadership, particularly Tim Cook, further solidified this strategic bet.

- Buffett's Investment Philosophy: Buffett's value investing approach emphasizes identifying strong companies with durable competitive advantages and holding them for the long term. His conviction in Apple aligns perfectly with this philosophy.

- Past Statements on Apple: Buffett's public statements about Apple's prospects have always been positive, indicating a strong belief in its sustained profitability and market dominance. These pronouncements influenced market sentiment and reinforced Berkshire Hathaway's investment strategy.

- Portfolio Diversification: While Apple represents a significant portion of Berkshire's portfolio, it's crucial to remember that the conglomerate holds a diversified range of assets. However, Apple’s success significantly impacts Berkshire’s overall performance.

Potential Scenarios After Buffett's Departure

The succession plan within Berkshire Hathaway will significantly influence the future of its Apple investment. While Greg Abel and Ajit Jain are considered potential successors, their investment philosophies might differ from Buffett's. This difference could lead to a variety of outcomes for Berkshire Hathaway's Apple stock.

-

Gradual Divestment or Complete Sell-Off: A gradual reduction of Apple holdings might occur to rebalance the portfolio or to fund other investment opportunities. Conversely, a complete sell-off is possible, although less likely given the scale of the investment.

-

Maintaining the Current Strategy: The successors could choose to maintain the current investment strategy, recognizing Apple's continued strength and long-term potential. This scenario depends heavily on Apple's performance and the risk tolerance of Berkshire's new leadership.

-

Market Conditions and Economic Forecasts: External factors like economic downturns or regulatory changes could influence decision-making. A downturn might prompt a partial sale to mitigate risk, while favorable market conditions could embolden a continued hold.

-

Successor's Investment Strategies:

- Greg Abel: Known for his operational expertise, Abel might prioritize investments aligning with Berkshire's operational strengths.

- Ajit Jain: With a focus on insurance and reinsurance, Jain’s approach might lead to a more conservative investment strategy.

-

Internal Disagreements: Differences of opinion amongst Berkshire Hathaway's investment managers regarding Apple's future prospects could influence the decision-making process.

-

Apple's Performance: Any significant decline in Apple's financial performance or market share could trigger a reevaluation of Berkshire's investment strategy.

-

External Factors: Regulatory changes impacting the tech industry or increased competition could influence the long-term outlook for Apple and, consequently, Berkshire's investment.

The Role of Apple's Future Performance

Apple's continued success is paramount to Berkshire Hathaway's decision. However, challenges exist. Increased competition from other tech giants and the potential impact of economic slowdowns could affect Apple's future performance, thus impacting Berkshire's investment.

- Innovation and New Product Launches: Apple’s ability to consistently innovate and launch successful new products is vital for maintaining its market leadership and sustaining its growth. A slowdown in innovation could negatively impact Berkshire's outlook.

- Emerging Technologies: The impact of emerging technologies like augmented reality and artificial intelligence on Apple's market position will be crucial in shaping Berkshire's future decisions.

- iPhone Dependence: Apple's significant reliance on iPhone sales poses a risk. Any decline in iPhone demand could significantly impact Apple's overall financial performance and Berkshire Hathaway's investment.

Analyzing the Berkshire Hathaway Investment Portfolio Beyond Apple

Berkshire Hathaway’s portfolio diversification is critical in understanding the potential for shifts in its Apple holdings. A re-allocation of funds from Apple to other sectors is possible, depending on the overall investment strategy adopted by the new leadership.

- Other Key Investments: Berkshire Hathaway boasts a diverse portfolio encompassing various sectors, including insurance, energy, and railroads. These holdings provide a cushion against any potential losses from the Apple investment.

- Portfolio Balancing: Maintaining a balanced portfolio is crucial for risk management. Reducing the Apple stake might be seen as a way to achieve better portfolio diversification.

- Impact on Market Capitalization: Any significant change to Berkshire Hathaway's Apple holdings will have a considerable impact on its overall market capitalization, impacting investor confidence.

Conclusion

The future of Berkshire Hathaway's Apple stock after Buffett's departure remains uncertain. Several scenarios are plausible, ranging from a continuation of the current strategy to a complete divestment. The decisions will depend on factors including Apple's future performance, the investment philosophies of Buffett's successors, and prevailing market conditions. Ongoing monitoring of Berkshire Hathaway's actions and thorough market analysis are crucial for understanding future developments.

Call to Action: Stay informed about the future of Berkshire Hathaway's Apple investment. Keep up-to-date on financial news and analysis related to Berkshire Hathaway's Apple stock and the investment strategies of its potential successors to stay ahead of any major developments. Continue researching and understanding the strategies employed by Berkshire Hathaway to make informed investment decisions of your own.

Featured Posts

-

Kyle Walker Peters Crystal Palaces Free Transfer Pursuit

May 24, 2025

Kyle Walker Peters Crystal Palaces Free Transfer Pursuit

May 24, 2025 -

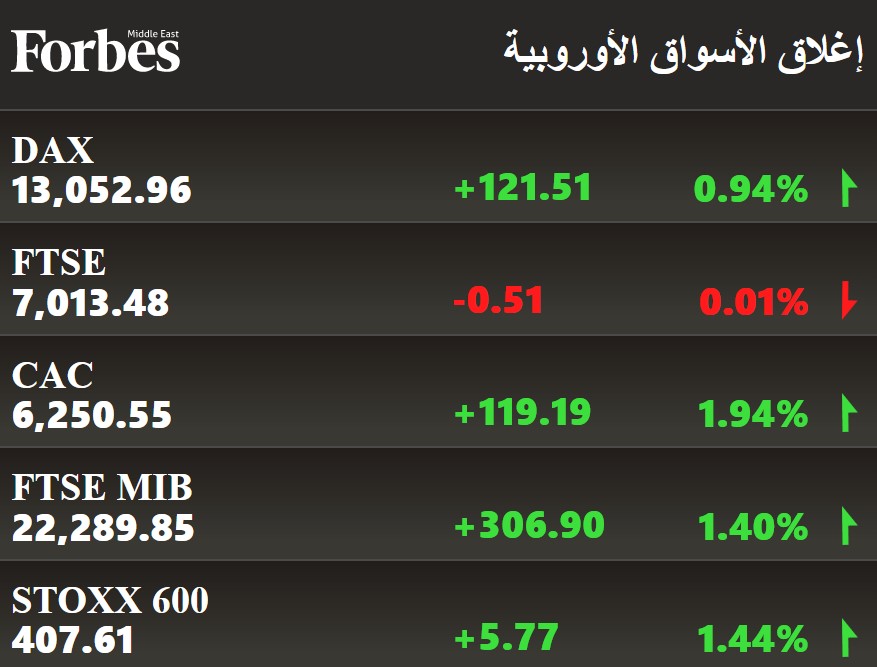

Artfae Mfajy Fy Mwshr Daks Alalmany Dwr Atfaq Washntn Wbkyn

May 24, 2025

Artfae Mfajy Fy Mwshr Daks Alalmany Dwr Atfaq Washntn Wbkyn

May 24, 2025 -

Best Of Bangladesh A Netherlands Business And Investment Showcase

May 24, 2025

Best Of Bangladesh A Netherlands Business And Investment Showcase

May 24, 2025 -

Lauryn Goodman Addresses Italy Move Amidst Kyle Walker Transfer Rumors

May 24, 2025

Lauryn Goodman Addresses Italy Move Amidst Kyle Walker Transfer Rumors

May 24, 2025 -

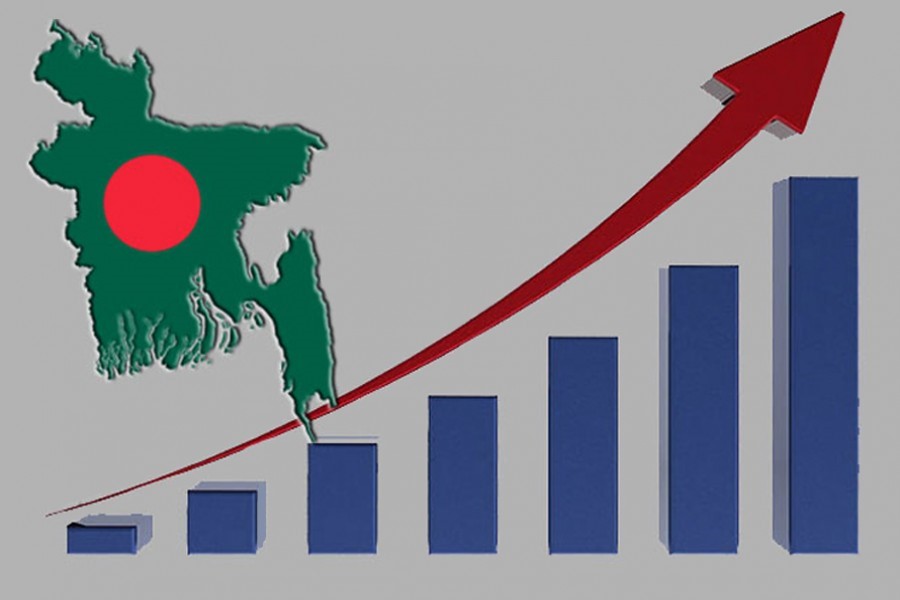

Economic Growth In Europe The Future Of Bangladeshs Partnerships

May 24, 2025

Economic Growth In Europe The Future Of Bangladeshs Partnerships

May 24, 2025

Latest Posts

-

Thames Waters Executive Pay Scandal Or Standard Practice

May 24, 2025

Thames Waters Executive Pay Scandal Or Standard Practice

May 24, 2025 -

Sse Responds To Slowing Growth With 3 Billion Spending Reduction

May 24, 2025

Sse Responds To Slowing Growth With 3 Billion Spending Reduction

May 24, 2025 -

Rio Tinto Addresses Concerns Over Pilbara Sustainability Following Forrests Comments

May 24, 2025

Rio Tinto Addresses Concerns Over Pilbara Sustainability Following Forrests Comments

May 24, 2025 -

3 Billion Cut To Sse Spending Impact Of Reduced Growth

May 24, 2025

3 Billion Cut To Sse Spending Impact Of Reduced Growth

May 24, 2025 -

Environmental Concerns In The Pilbara Rio Tintos Perspective

May 24, 2025

Environmental Concerns In The Pilbara Rio Tintos Perspective

May 24, 2025