Berkshire Hathaway And Apple: What Happens After Buffett Steps Down?

Table of Contents

Berkshire Hathaway's Succession Plan and Leadership Transition

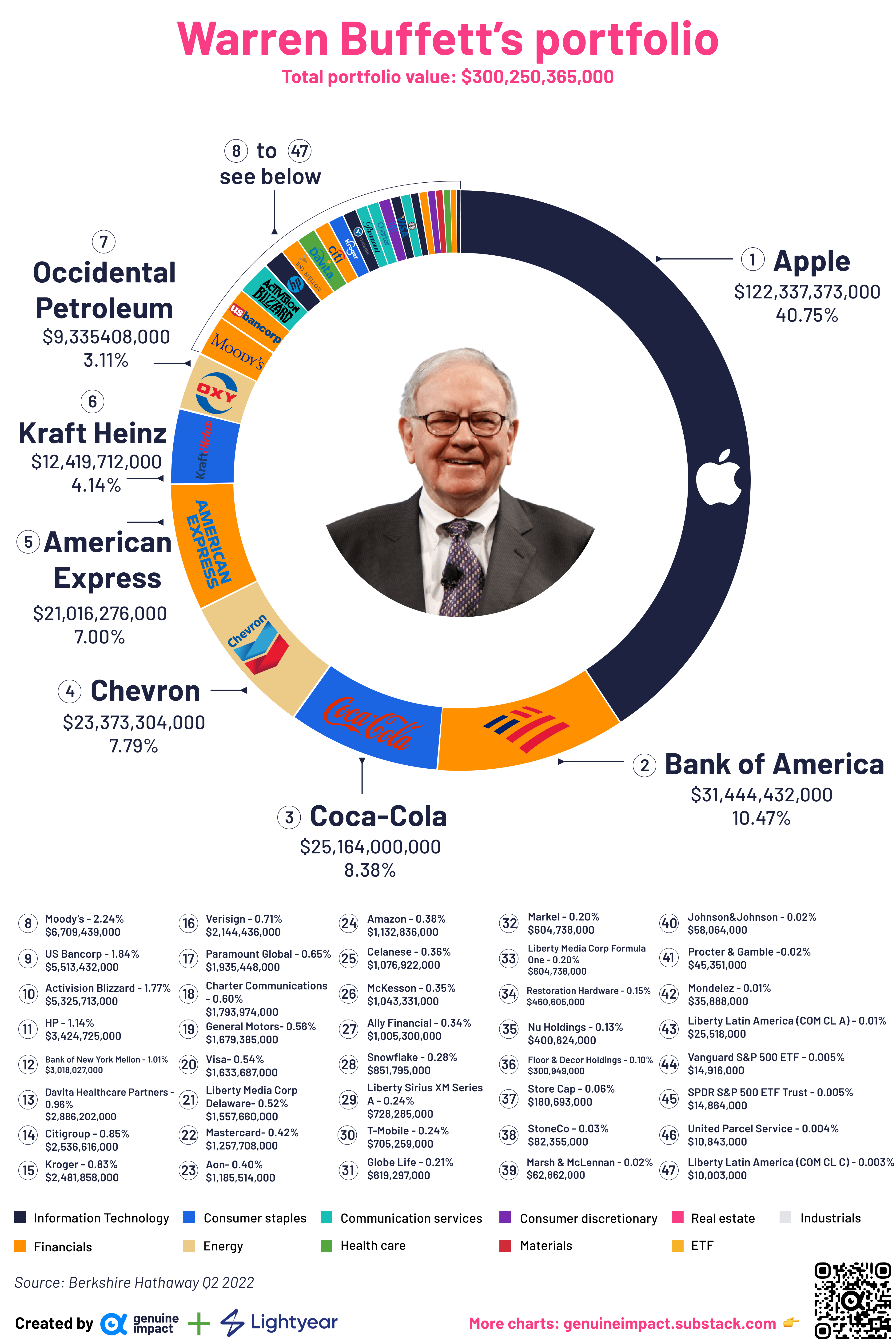

Berkshire Hathaway's succession plan is a critical factor in determining the future trajectory of the company and its Apple investment. The company has designated Greg Abel and Ajit Jain as successors, each with unique strengths and potentially differing investment philosophies compared to Buffett.

Greg Abel, currently Vice Chairman of Non-Insurance Operations, oversees a vast portfolio of businesses. His background suggests a more operational and potentially active management approach compared to Buffett's famously patient value investing style. Ajit Jain, Vice Chairman of Insurance Operations, has a strong background in risk assessment and underwriting. His influence may be felt more in the risk management aspects of Berkshire's investment decisions.

- Potential changes in investment approach: We may see a shift towards more active management of portfolio holdings, including a greater emphasis on growth stocks. Sector diversification beyond Buffett's traditional focus could also emerge.

- Impact on Apple's position within the Berkshire Hathaway portfolio: While the core holdings are unlikely to be drastically altered immediately, a shift in investment philosophy could impact Apple's relative weight within the overall portfolio over time. A more active approach might lead to a more dynamic re-allocation of assets.

- Concerns regarding maintaining the company's long-term growth trajectory: The biggest concern for investors is whether the new leadership can replicate Buffett's remarkable success and maintain Berkshire Hathaway's consistent long-term growth. This requires not just maintaining existing holdings but also identifying and capitalizing on future opportunities.

The Future of Berkshire Hathaway's Apple Investment

Berkshire Hathaway's massive Apple investment is a key focus for investors contemplating the post-Buffett era. Several scenarios are possible:

- Continued large holding: The new leadership might maintain the significant Apple stake, recognizing its long-term potential and the synergies with Berkshire's other holdings. This would provide stability and continuity.

- Partial divestment: A strategic decision might involve gradually reducing the Apple stake to diversify the portfolio and re-allocate capital into other promising areas. This could be driven by market conditions or emerging investment opportunities.

- A complete sale: While unlikely, a complete sale of the Apple stock remains a possibility, albeit a controversial one given its current value and contribution to Berkshire Hathaway's overall returns. This scenario is less likely given the history of Buffett's long-term investment strategy.

Factors influencing this decision will include:

-

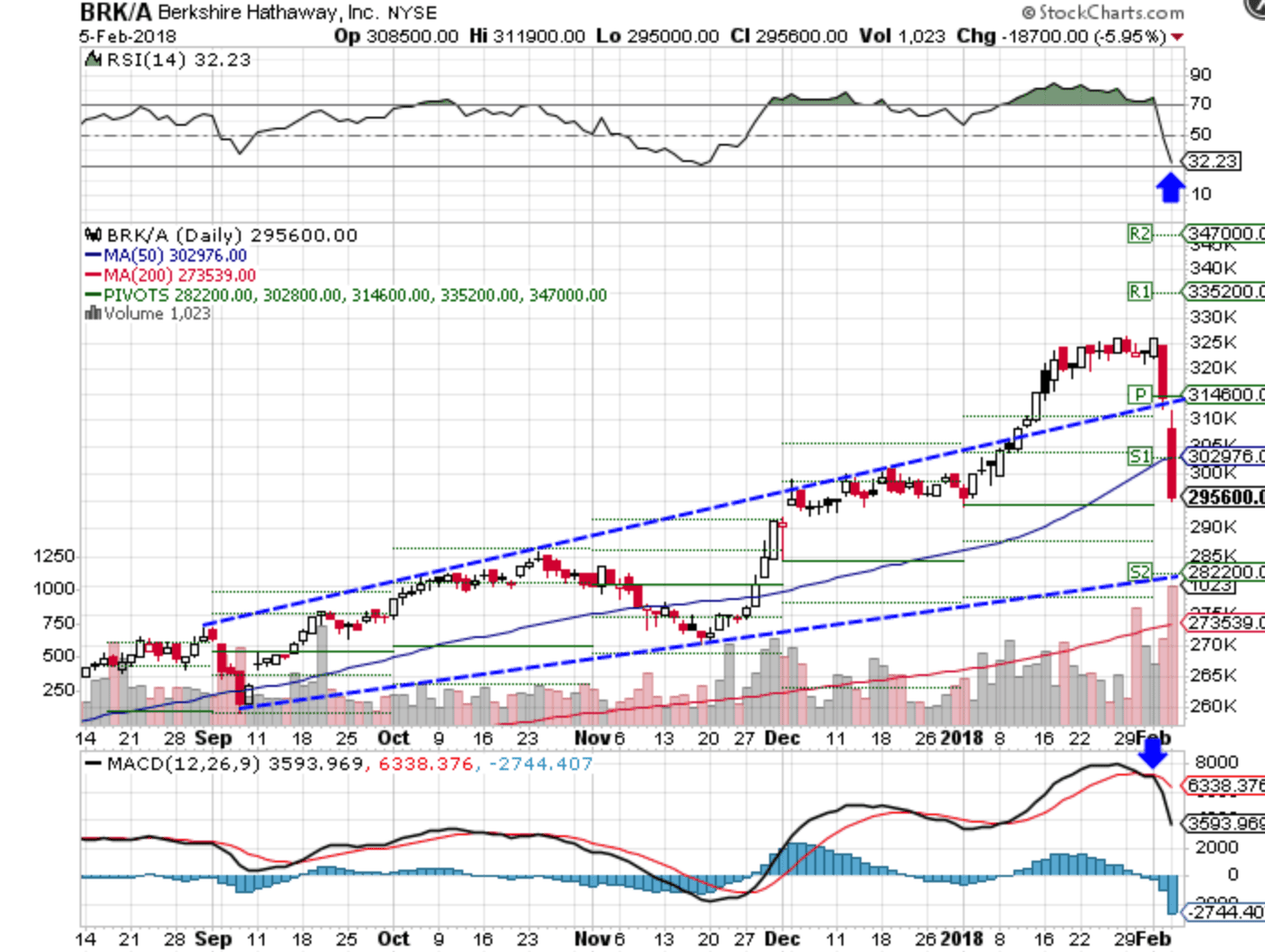

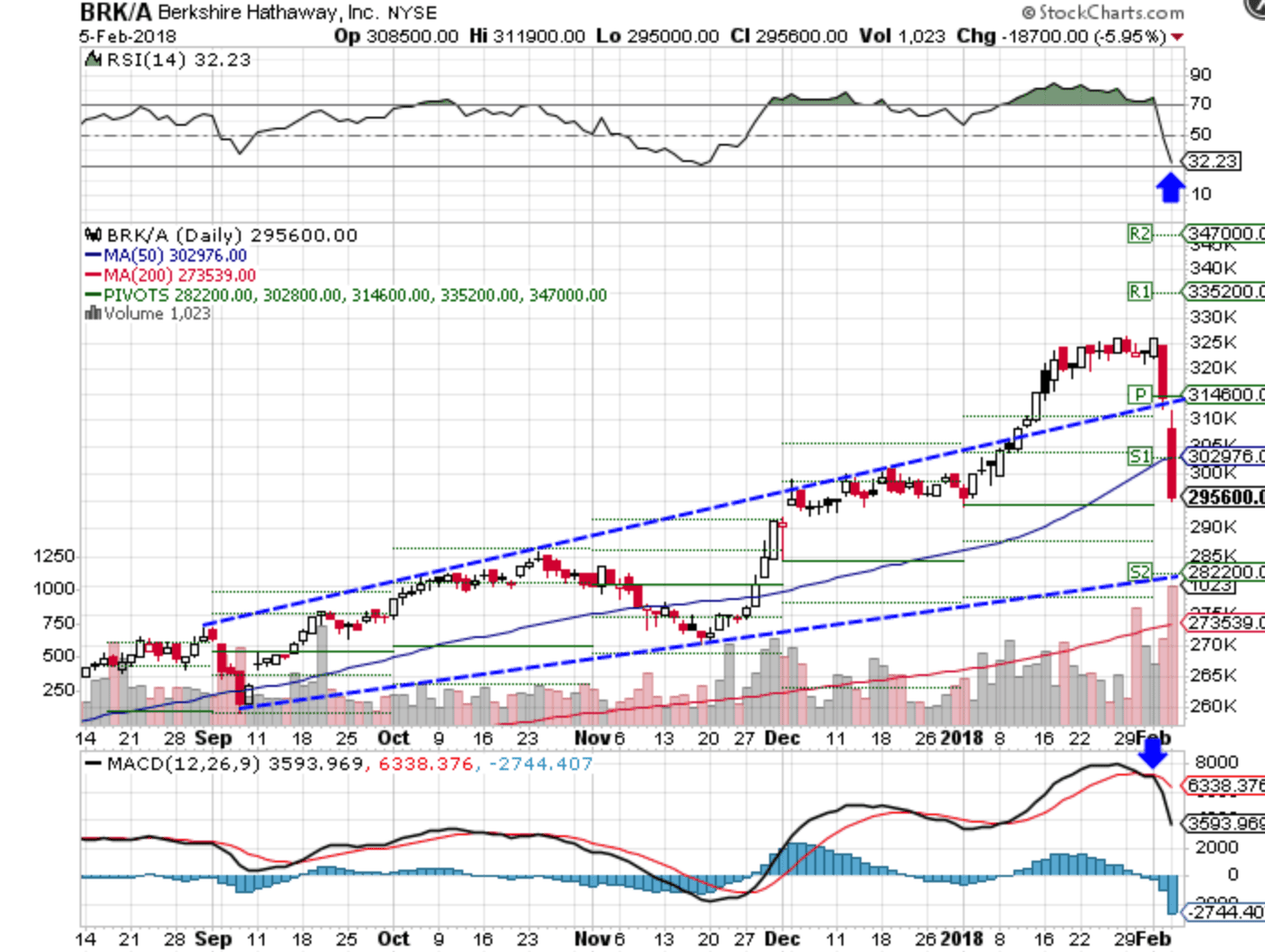

Market conditions: Economic downturns or market volatility could prompt adjustments to the Apple investment strategy.

-

Apple's performance: Apple's future growth and profitability will significantly influence Berkshire Hathaway’s decision-making process.

-

Alternative investment opportunities: Attractive opportunities in other sectors could lead to reallocation of resources away from Apple.

-

Impact of a change in leadership on Apple stock price: The market's reaction to a change in investment strategy will inevitably impact Apple's stock price, potentially causing short-term volatility.

-

Potential for increased or decreased Apple stock allocation: The new leadership could adjust Apple's weighting in the portfolio depending on its assessment of future growth and market opportunities.

-

Diversification strategies and their potential effect on Apple's influence: A move towards greater diversification could reduce Apple's dominance within the Berkshire Hathaway portfolio.

Analyzing Alternative Investment Strategies for Berkshire Hathaway Post-Buffett

The post-Buffett era could witness significant shifts in Berkshire Hathaway's investment focus. Several sectors are likely to attract increased attention:

-

Technology: While already a significant part of the portfolio through Apple, further investments in other technology companies are likely, especially those aligned with emerging trends like AI and cloud computing.

-

Renewable energy: Berkshire Hathaway is already making inroads into this sector. A greater emphasis on sustainable energy could be a defining feature of the post-Buffett era.

-

Healthcare: Given the aging global population and increasing demand for healthcare services, this sector could become a major investment focus.

-

Evaluation of potential new acquisitions and their strategic implications: The new leadership will actively assess potential acquisitions aligning with their revised investment strategies and growth plans.

-

Exploration of different investment styles beyond Buffett's value investing approach: We might see a more eclectic mix of investment styles, incorporating elements of growth investing and potentially even more active management strategies.

-

Impact of evolving market trends on Berkshire Hathaway's future performance: The ability to adapt to emerging market trends and technological advancements will be crucial for the company's future success.

Impact on the broader stock market

Significant changes in Berkshire Hathaway's investment strategy will undoubtedly create ripples throughout the broader stock market.

- Market reactions to leadership changes and portfolio adjustments: The market will closely scrutinize any shifts in Berkshire Hathaway's holdings, potentially triggering volatility in the prices of affected companies, including Apple.

- Potential volatility and investor sentiment shifts: Investor confidence and market sentiment will be influenced by the perceived success or failure of the new leadership in managing the portfolio and achieving comparable returns to the Buffett era.

- Long-term consequences for the stock market's stability: Berkshire Hathaway's actions play a significant role in shaping market sentiment and stability. Changes in its investment strategies could have long-term consequences, impacting investor confidence and broader market trends.

Conclusion

Warren Buffett's legacy at Berkshire Hathaway, especially its significant investment in Apple, is undeniable. However, the transition of leadership presents both opportunities and uncertainties. Understanding the potential scenarios concerning Berkshire Hathaway's succession plan, its future investment strategy, and the fate of its Apple holdings is crucial for investors. The future direction of the company will likely influence not only its own performance but also have broader market implications. The interplay between Berkshire Hathaway and Apple post-Buffett will be a compelling story to follow.

Call to Action: Stay informed about the developments at Berkshire Hathaway and the implications for Apple and other investments by regularly reviewing financial news and analyses. Understanding the dynamics of Berkshire Hathaway and Apple post-Buffett era is crucial for making informed investment decisions.

Featured Posts

-

Apple Stock Under Pressure Analyzing The Impact Of Tariffs On Buffetts Portfolio

May 24, 2025

Apple Stock Under Pressure Analyzing The Impact Of Tariffs On Buffetts Portfolio

May 24, 2025 -

Kak Khorosho Vy Znaete Roli Olega Basilashvili Test

May 24, 2025

Kak Khorosho Vy Znaete Roli Olega Basilashvili Test

May 24, 2025 -

South Florida Hosts Electrifying Ferrari Challenge Racing Days

May 24, 2025

South Florida Hosts Electrifying Ferrari Challenge Racing Days

May 24, 2025 -

Assessing Jordan Bardellas Electoral Strategy For The Next French Election

May 24, 2025

Assessing Jordan Bardellas Electoral Strategy For The Next French Election

May 24, 2025 -

Dutch Economy Feels The Heat Stock Market Plunge Linked To Us Trade Tensions

May 24, 2025

Dutch Economy Feels The Heat Stock Market Plunge Linked To Us Trade Tensions

May 24, 2025

Latest Posts

-

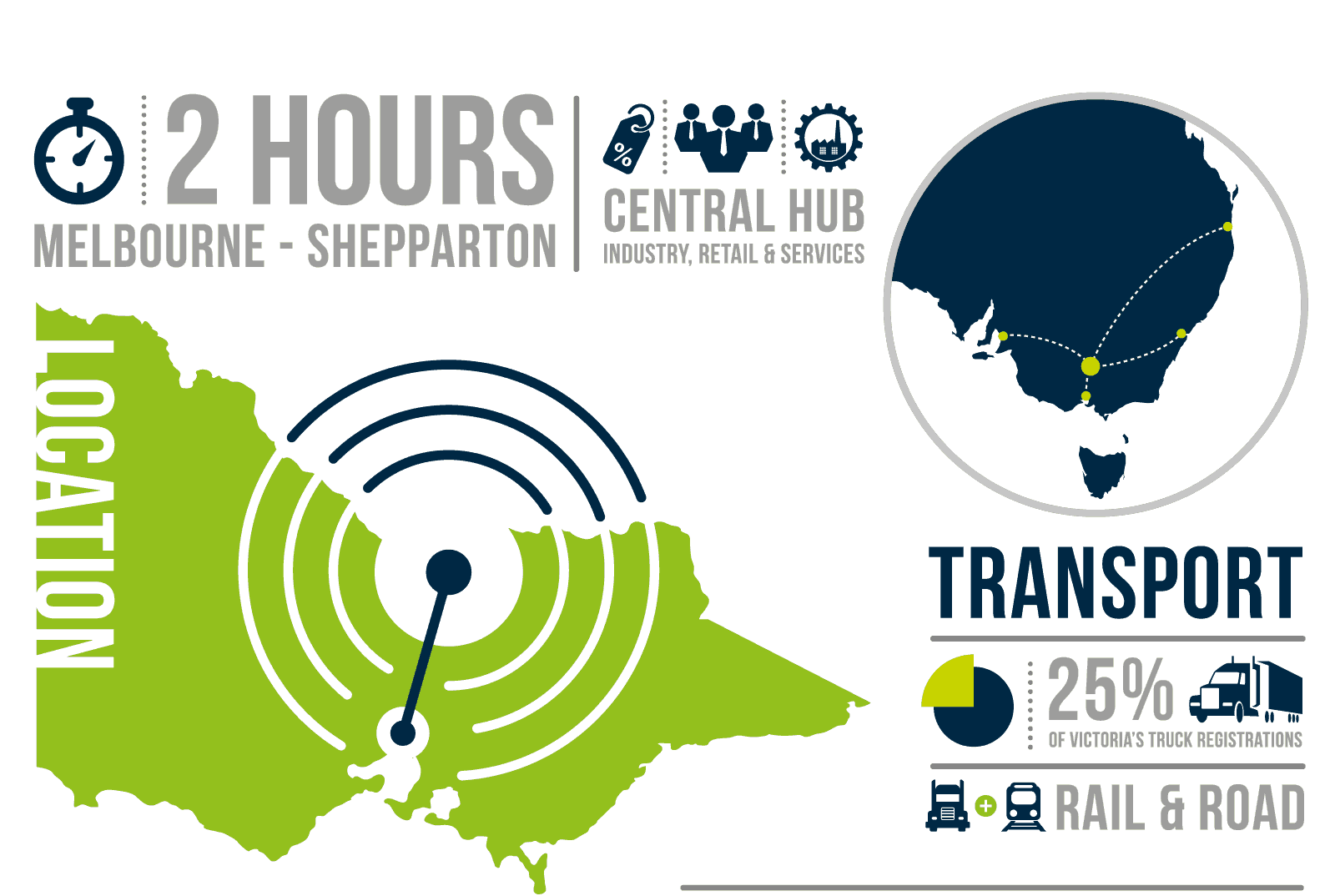

Understanding The Growth Of The Countrys Leading Business Centers

May 24, 2025

Understanding The Growth Of The Countrys Leading Business Centers

May 24, 2025 -

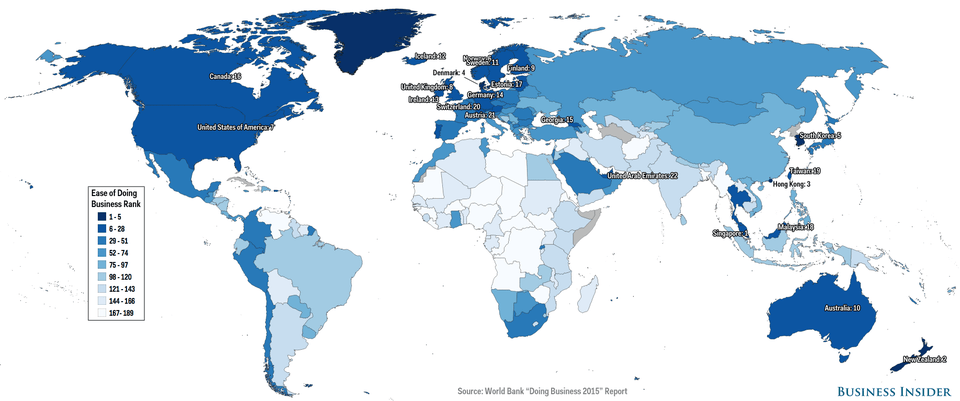

A Data Driven Map Of The Countrys Top Business Hotspots

May 24, 2025

A Data Driven Map Of The Countrys Top Business Hotspots

May 24, 2025 -

The Countrys Business Landscape Unveiling The Hottest New Markets

May 24, 2025

The Countrys Business Landscape Unveiling The Hottest New Markets

May 24, 2025 -

Identifying And Analyzing The Countrys Fastest Growing Business Areas

May 24, 2025

Identifying And Analyzing The Countrys Fastest Growing Business Areas

May 24, 2025 -

Mapping The Countrys Newest Business Hotspots

May 24, 2025

Mapping The Countrys Newest Business Hotspots

May 24, 2025