The Future Of Berkshire Hathaway's Apple Holdings: A Post-Buffett Analysis

Table of Contents

Succession Planning and its Impact on Apple Holdings

The succession of Warren Buffett's leadership at Berkshire Hathaway marks a pivotal moment, raising questions about the future management of its substantial Apple stock holdings. Understanding the new leadership's investment philosophy is crucial to predicting the future of this significant partnership.

The New Guard's Investment Philosophy

Will Greg Abel and the new leadership team maintain Buffett's long-term, value-investing approach to Apple? This is a key question for investors. Buffett's strategy of "buy and hold" has proven successful, but the new leadership might adopt a different approach.

- Abel's past investment decisions: Analyzing Greg Abel's previous investment strategies offers valuable insights into his potential approach to managing Berkshire's Apple holdings. His track record will indicate whether he favors a similar long-term strategy or a more active, potentially diversified, investment approach.

- Potential scenarios: Several scenarios are possible: maintaining the current stake in Apple, a partial divestment to diversify the portfolio, or a strategic reallocation of funds into other sectors.

- Risk tolerance: The succession plan implicitly influences Berkshire's risk tolerance. A more risk-averse approach might lead to some diversification away from Apple, while a more aggressive stance could see the company increasing its holdings.

Maintaining Berkshire's Long-Term Vision

Berkshire Hathaway's long-term commitment to Apple has been a cornerstone of its success. However, the shift in leadership necessitates a reevaluation of this commitment.

- Benefits of continued long-term holding: Continued holding offers potential benefits, including consistent dividend income and the possibility of further capital appreciation as Apple continues to grow.

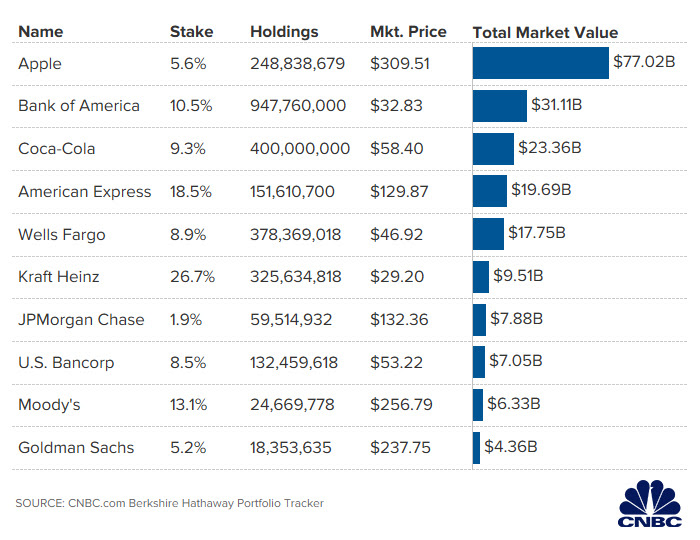

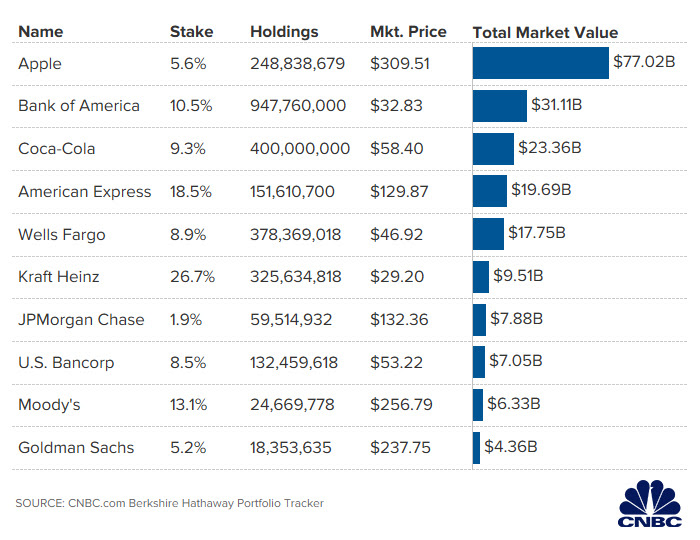

- Risks of concentration: The significant concentration of Berkshire's portfolio in a single stock, however lucrative, exposes it to considerable risk. A downturn in Apple's performance would severely impact Berkshire's overall profitability.

Apple's Future Growth and its Influence on Berkshire's Holdings

Apple's future growth trajectory is inextricably linked to the value of Berkshire Hathaway's investment. Sustained innovation and market dominance are crucial for maintaining the attractiveness of this substantial holding.

Sustaining Apple's Innovation and Market Dominance

Can Apple continue its reign as a technological innovator and maintain its dominant market share? This is a critical factor influencing the long-term value of Berkshire's investment.

- Key growth drivers: Several factors will influence Apple's future growth, including the launch of innovative new products, expansion into new markets, and continued technological advancements.

- Competitive landscape: The increasing competition from other technology giants, particularly in the smartphone and services markets, poses a significant challenge to Apple's continued dominance. This competitive pressure needs to be considered.

Analyzing the Current Market Landscape and its Implications

The current economic climate, marked by inflation and recessionary fears, significantly impacts the outlook for both Apple and Berkshire Hathaway.

- Economic fluctuations and Apple's stock price: Economic downturns can significantly impact Apple's stock price, creating volatility and influencing investment decisions.

- Impact on investment strategy: The current economic uncertainty could force Berkshire Hathaway to re-evaluate its investment strategy, potentially leading to adjustments in its Apple holdings.

- Macroeconomic factors: Broad macroeconomic factors influencing the technology sector, including interest rates and government regulations, will also play a critical role.

Alternative Investment Strategies and Portfolio Diversification

Given the significant concentration in Apple, the possibility of portfolio diversification for Berkshire Hathaway is a crucial consideration in a post-Buffett era.

Exploring Potential Diversification

Reducing dependence on a single investment is a standard risk-management principle. Berkshire Hathaway might explore diversification into other promising sectors.

- Potential investment areas: Berkshire Hathaway could allocate resources to sectors like renewable energy, healthcare, or other technology companies to diversify its portfolio.

- Advantages and disadvantages of diversification: Diversification reduces risk but might also dilute potential high returns from a concentrated position like Apple.

- Implications for risk management: Diversification is a key element in reducing overall portfolio risk and enhancing stability.

Assessing the Risk-Reward Profile of Maintaining the Apple Stake

Maintaining Berkshire's significant Apple position involves a careful assessment of the risk-reward profile.

- Risk-reward comparison: Comparing the risk-reward profile of maintaining the Apple stake versus alternative investment strategies is critical for informed decision-making.

- Importance of a balanced portfolio: A well-balanced portfolio, incorporating diversification and risk mitigation strategies, is crucial for long-term success.

Conclusion

The future of Berkshire Hathaway's Apple holdings is intertwined with several factors: the new leadership's approach, Apple's ongoing innovation, and the broader economic climate. While maintaining a significant stake offers the potential for high returns, diversification is essential for risk mitigation. Continuous monitoring of Apple's performance, economic conditions, and Berkshire Hathaway's evolving investment strategy is crucial. Understanding the post-Buffett era's impact on this vital investment requires diligent analysis. Further research into the new leadership's plans and Apple's market position is essential for investors seeking to understand the future of this significant partnership. Stay informed about Berkshire Hathaway's Apple holdings and adapt your investment strategies accordingly.

Featured Posts

-

Pertimbangan Investasi Mtel And Mbma Di Msci Small Cap Index

May 24, 2025

Pertimbangan Investasi Mtel And Mbma Di Msci Small Cap Index

May 24, 2025 -

The Demna Gvasalia Era What To Expect From Guccis Creative Redesign

May 24, 2025

The Demna Gvasalia Era What To Expect From Guccis Creative Redesign

May 24, 2025 -

Actor Sean Penn Expresses Doubts About Dylan Farrows Account

May 24, 2025

Actor Sean Penn Expresses Doubts About Dylan Farrows Account

May 24, 2025 -

Live Updates Pedestrian Struck By Vehicle On Princess Road

May 24, 2025

Live Updates Pedestrian Struck By Vehicle On Princess Road

May 24, 2025 -

Za Den Na Kharkovschine Pozhenilis Pochti 40 Par Fotoreportazh

May 24, 2025

Za Den Na Kharkovschine Pozhenilis Pochti 40 Par Fotoreportazh

May 24, 2025

Latest Posts

-

Impact Of G 7 De Minimis Tariff Talks On Chinese Made Products

May 24, 2025

Impact Of G 7 De Minimis Tariff Talks On Chinese Made Products

May 24, 2025 -

Understanding The Value Of Middle Management In Modern Organizations

May 24, 2025

Understanding The Value Of Middle Management In Modern Organizations

May 24, 2025 -

Ftc To Appeal Activision Blizzard Deal A Deep Dive

May 24, 2025

Ftc To Appeal Activision Blizzard Deal A Deep Dive

May 24, 2025 -

Increased Trade Between Us And China Exporters Scramble Before Trade Truce Ends

May 24, 2025

Increased Trade Between Us And China Exporters Scramble Before Trade Truce Ends

May 24, 2025 -

Post Roe America How Otc Birth Control Changes The Landscape

May 24, 2025

Post Roe America How Otc Birth Control Changes The Landscape

May 24, 2025