Buffett's Succession At Berkshire Hathaway: Impact On Apple Investment

Table of Contents

The Significance of Buffett's Leadership in Berkshire Hathaway's Apple Investment

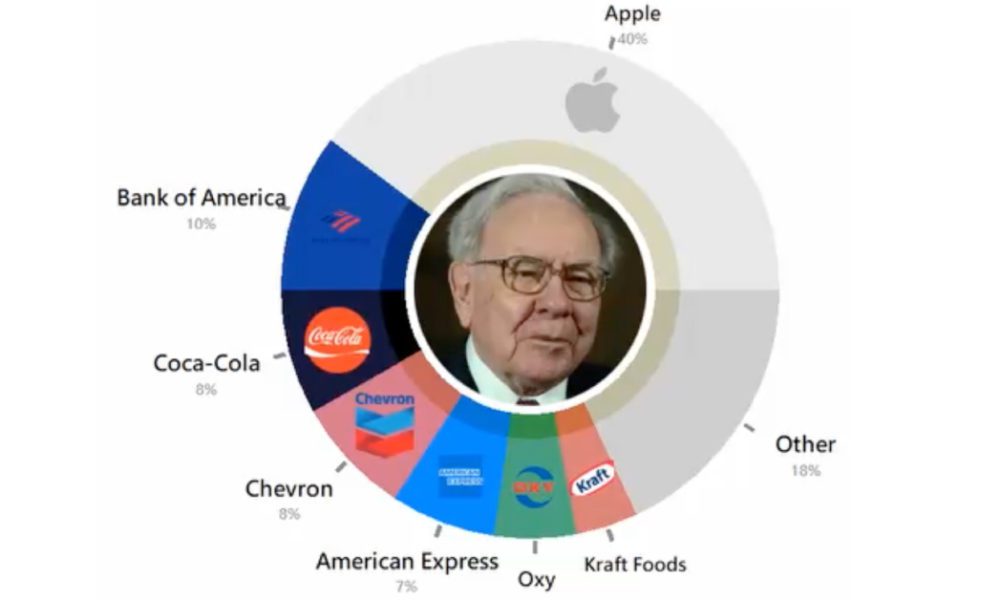

Warren Buffett's personal involvement in the Apple investment decision was pivotal. His endorsement, stemming from his admiration for Apple's products and robust business model, wasn't just a financial decision; it was a testament to his belief in the company's long-term potential. This aligns perfectly with his renowned long-term value investing philosophy, a cornerstone of Berkshire Hathaway's success.

- Buffett's reputation for long-term value investing: His strategy prioritizes steady growth and sustainable returns over short-term gains, a perfect fit for a company like Apple.

- His personal endorsement of Apple's products and business model: This wasn't just a calculated investment; it reflected a genuine belief in the brand's strength.

- The significant returns generated by the Apple investment under his leadership: The Apple investment has been a major contributor to Berkshire Hathaway's overall performance, highlighting the success of Buffett's approach.

However, the significant concentration in one stock, even as successful as Apple, presents inherent risks. A downturn in Apple's performance could disproportionately impact Berkshire Hathaway's overall portfolio. This risk is a key factor to consider as we analyze the potential impact of Buffett's succession.

Potential Shifts in Investment Strategy Post-Buffett

The succession plan, focusing on Greg Abel and Ajit Jain, introduces uncertainty regarding the future of Berkshire Hathaway's Apple investment. While both successors have proven track records, their investment philosophies may differ from Buffett's. Will they maintain the current significant holding in Apple? Or will we see a shift in strategy?

- Analysis of Greg Abel and Ajit Jain's investment styles: Understanding their individual approaches is crucial in predicting future investment decisions. While details are scarce, their past actions offer some insight.

- Potential impact of a more decentralized investment approach: A shift away from Buffett's highly centralized style could lead to a more diversified portfolio, potentially reducing the Apple investment's relative weight.

- Consideration of market conditions and industry trends: Future market dynamics and emerging technological trends will undoubtedly influence investment decisions, potentially impacting the Apple holding.

The implications for Apple's stock price are significant. Any perception of a reduced commitment from Berkshire Hathaway could cause market volatility, underscoring the importance of this transition.

Analyzing the Future of Berkshire Hathaway's Apple Investment

The long-term prospects of Apple are inextricably linked to Berkshire Hathaway's future. Apple's consistent innovation, loyal customer base, and strong financial health support its continued success. However, competition and regulatory challenges pose risks.

- Apple's future product innovation and market share: Continued innovation is vital for maintaining market leadership and growth.

- Analysis of Apple's financial health and stability: Strong financials provide a buffer against market fluctuations, but risks remain.

- Potential regulatory challenges facing Apple: Increasing regulatory scrutiny in various markets presents a potential hurdle.

Apple's dividends also play a crucial role in Berkshire Hathaway's returns, offering a steady stream of income that complements capital appreciation. A realistic forecast must consider these factors alongside the potential impact of new leadership. We might see a cautious approach, with a gradual diversification away from Apple, or a continuation of the current strategy with minor adjustments.

The Role of Technology in Berkshire's Future Investment Decisions

Under new leadership, Berkshire Hathaway's approach to technology investments could evolve significantly. The increasing importance of technology in the global economy demands a strategic focus.

- Opportunities in emerging technologies (AI, etc.): Investments in AI and other disruptive technologies could become a priority.

- Potential for increased investment in tech startups: A more aggressive approach to venture capital investments might emerge.

- Strategic partnerships with tech companies: Collaborations with tech leaders could provide access to innovative technologies and markets.

Conclusion

Buffett's succession at Berkshire Hathaway represents a pivotal moment for the company's investment strategy, particularly concerning its significant Apple investment. The potential shifts in investment philosophy from the new leadership, coupled with the ongoing evolution of the tech landscape and inherent market risks, necessitate careful monitoring of the situation. While Apple’s future looks bright, the weight of Berkshire’s investment in the company and the overall strategic direction under new leadership remain uncertain. The long-term outlook for Berkshire Hathaway’s Apple investment will depend on the successful integration of new leadership, the continued success of Apple's business model, and the broader economic climate.

Stay informed about the ongoing developments surrounding Buffett's Succession and its influence on Berkshire Hathaway's Apple Investment. Regularly check back for updates and analyses on this significant event in the world of finance.

Featured Posts

-

Three Day Slump Amsterdam Stock Exchange Experiences Significant Losses

May 24, 2025

Three Day Slump Amsterdam Stock Exchange Experiences Significant Losses

May 24, 2025 -

Nasledie Nashego Pokoleniya Chto My Sozdali I Chto Ostavim Potomkam

May 24, 2025

Nasledie Nashego Pokoleniya Chto My Sozdali I Chto Ostavim Potomkam

May 24, 2025 -

Live Updates Pedestrian Struck By Vehicle On Princess Road

May 24, 2025

Live Updates Pedestrian Struck By Vehicle On Princess Road

May 24, 2025 -

How Nicki Chapman Made 700 000 From A Country Property Investment

May 24, 2025

How Nicki Chapman Made 700 000 From A Country Property Investment

May 24, 2025 -

Best Of Bangladesh A Netherlands Business And Investment Showcase

May 24, 2025

Best Of Bangladesh A Netherlands Business And Investment Showcase

May 24, 2025

Latest Posts

-

Sse Responds To Slowing Growth With 3 Billion Spending Reduction

May 24, 2025

Sse Responds To Slowing Growth With 3 Billion Spending Reduction

May 24, 2025 -

Rio Tinto Addresses Concerns Over Pilbara Sustainability Following Forrests Comments

May 24, 2025

Rio Tinto Addresses Concerns Over Pilbara Sustainability Following Forrests Comments

May 24, 2025 -

3 Billion Cut To Sse Spending Impact Of Reduced Growth

May 24, 2025

3 Billion Cut To Sse Spending Impact Of Reduced Growth

May 24, 2025 -

Environmental Concerns In The Pilbara Rio Tintos Perspective

May 24, 2025

Environmental Concerns In The Pilbara Rio Tintos Perspective

May 24, 2025 -

Andrew Forrest Vs Rio Tinto A Debate On The Future Of The Pilbara

May 24, 2025

Andrew Forrest Vs Rio Tinto A Debate On The Future Of The Pilbara

May 24, 2025