XRP's Surge: Outpacing Bitcoin After SEC Acknowledges Grayscale XRP ETF Application

Table of Contents

The SEC Acknowledgment and its Ripple Effect on XRP

The SEC's acknowledgment of Grayscale's application for an XRP exchange-traded fund (ETF) marks a significant turning point in the regulatory landscape surrounding XRP. This action carries substantial weight, considering the SEC's previous stance on XRP and its protracted legal battle with Ripple.

-

Historical Context: The SEC's lawsuit against Ripple, alleging the unregistered sale of securities, cast a long shadow over XRP's price and market sentiment. This acknowledgment suggests a potential shift in the SEC's perspective, at least regarding the potential for an XRP ETF.

-

Implications of an Approved XRP ETF: An approved XRP ETF would dramatically increase market liquidity and accessibility for institutional investors. This influx of capital could propel XRP's price higher and drive wider adoption. Currently, investing in XRP directly involves navigating various cryptocurrency exchanges, which can be less accessible to institutional players.

-

Contrast with Previous Regulatory Uncertainty: The SEC's action starkly contrasts with the regulatory uncertainty that plagued XRP for years. This newfound clarity is a major catalyst for the current price surge, restoring investor confidence and signaling a more favorable regulatory environment.

-

Impact on Investor Sentiment: The positive market reaction demonstrates the powerful influence of regulatory clarity on investor sentiment. The acknowledgment has breathed new life into the XRP market, leading to a significant price increase and renewed interest from both retail and institutional investors. Keywords: SEC regulation, XRP ETF approval, Ripple lawsuit, investor confidence, market capitalization

XRP's Price Performance Compared to Bitcoin

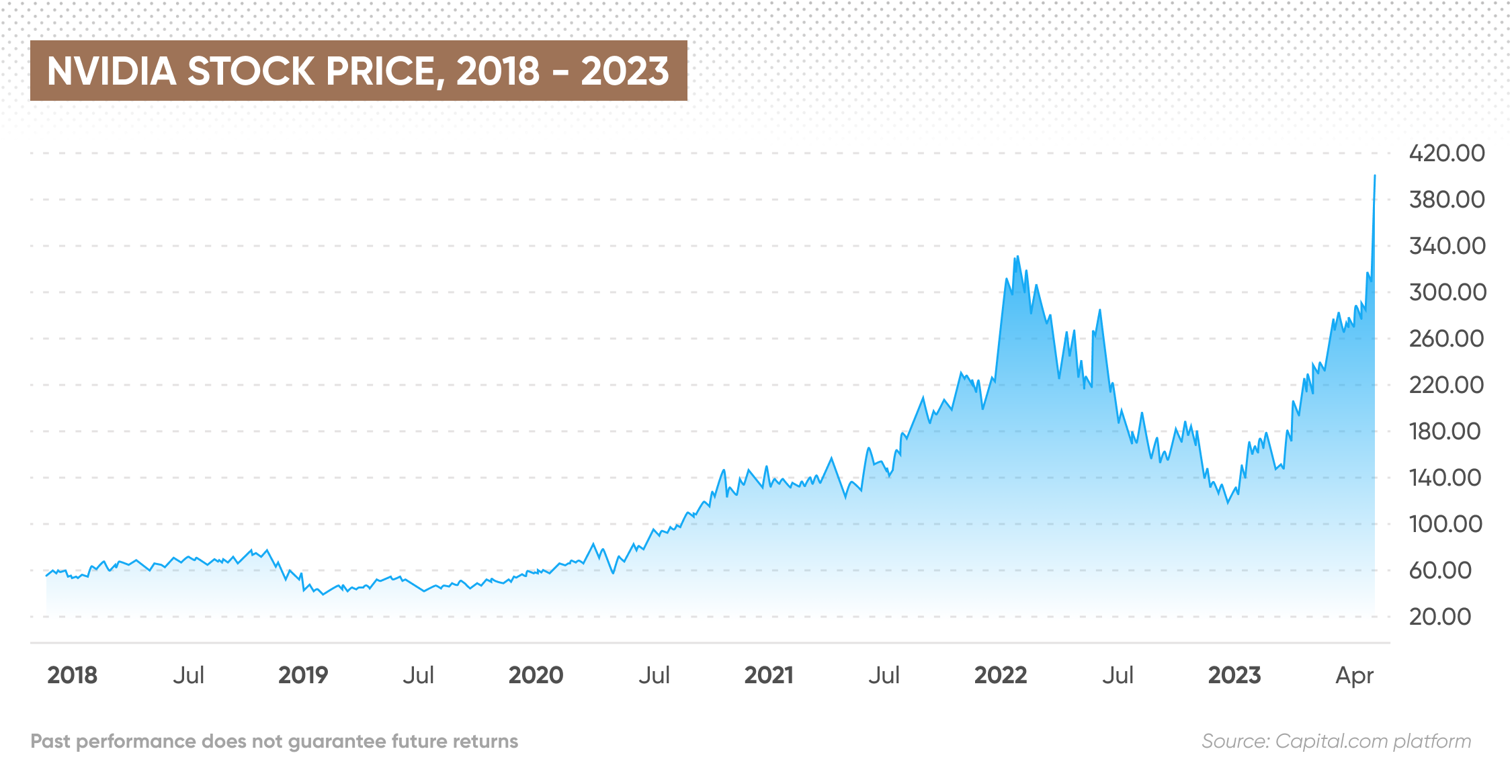

XRP's recent price surge has been nothing short of spectacular, significantly outperforming Bitcoin during the same period. While Bitcoin has seen moderate gains, XRP has experienced a far more dramatic increase.

-

Price Data and Percentage Changes: [Insert chart/graph comparing XRP and Bitcoin price movements over the relevant period. Include specific numerical data, e.g., "XRP experienced a X% increase, while Bitcoin saw a Y% increase"]. This visual representation will clearly showcase XRP's outperformance.

-

Factors Beyond SEC Acknowledgment: While the SEC acknowledgment is a primary driver, other factors contribute to XRP's outperformance. Technological advancements within the XRP Ledger, new partnerships, and increased adoption by businesses are all playing a role.

-

Correlation Analysis: An analysis of the correlation (or lack thereof) between XRP and Bitcoin price movements during this period is crucial. This will help determine whether XRP's surge is purely driven by the SEC news or influenced by broader market trends.

-

Market Sentiment Shift: The market's perception of XRP has clearly shifted. While Bitcoin remains the dominant cryptocurrency, the renewed confidence in XRP's potential is evidenced by its outperformance. Keywords: XRP price, Bitcoin price, price comparison, cryptocurrency market, market correlation, technical analysis

Potential Implications of an XRP ETF

The approval of an XRP ETF would have profound and far-reaching consequences for the cryptocurrency market.

-

Increased Accessibility and Institutional Investment: An ETF would make XRP far more accessible to institutional investors, such as hedge funds and pension funds, who often prefer regulated investment vehicles. This could lead to significant capital inflows.

-

Price Volatility and Stability: While an ETF could cause increased short-term price volatility due to increased trading volume, it may also lead to greater long-term price stability. The increased participation of institutional investors often brings a degree of market maturity.

-

Impact on Other Cryptocurrencies: The success of an XRP ETF could ripple through the entire cryptocurrency market, influencing the prices and adoption rates of other digital assets.

-

Regulatory Changes: The approval of an XRP ETF could set a precedent for the regulation of other cryptocurrencies, potentially leading to further regulatory clarity and a more mature market environment. Keywords: ETF impact, institutional investment, cryptocurrency adoption, market volatility, regulatory landscape

Risks and Considerations for XRP Investors

Despite the recent positive developments, investors must be aware of the inherent risks associated with XRP.

-

Ongoing Legal Battles: The ongoing legal battles facing Ripple, although seemingly less impactful now, still carry risk. While the SEC's recent actions are positive, the outcome remains uncertain.

-

Cryptocurrency Market Volatility: The cryptocurrency market is notoriously volatile. Price swings can be dramatic and unpredictable, even with positive news.

-

Thorough Research and Due Diligence: Before investing in XRP or any cryptocurrency, thorough research is paramount. Understand the technology, the risks, and the potential rewards.

-

Diversification: Never invest more than you can afford to lose, and always diversify your investment portfolio to mitigate risk. Keywords: Investment risk, cryptocurrency volatility, Ripple lawsuit, diversification, due diligence

Conclusion

XRP's recent surge, outperforming Bitcoin, is primarily attributed to the SEC's acknowledgment of Grayscale's XRP ETF application. This event signals a potential paradigm shift in regulatory sentiment, potentially leading to increased institutional adoption and long-term market stability. However, investors should maintain a cautious approach, conducting thorough due diligence before investing in XRP. The potential rewards are significant, but so are the risks. Stay informed about the latest developments surrounding the XRP ETF application and the ongoing Ripple lawsuit. Learn more about the potential opportunities and risks associated with investing in XRP and other cryptocurrencies by researching reputable sources. Understanding the dynamics of the XRP market is crucial for navigating this exciting and volatile landscape.

Featured Posts

-

Lahore Punjab Eid Ul Fitr Weather Prediction Next 48 Hours

May 08, 2025

Lahore Punjab Eid Ul Fitr Weather Prediction Next 48 Hours

May 08, 2025 -

Bitcoin Price Prediction Analyzing The Potential Impact Of Trumps Economic Plans

May 08, 2025

Bitcoin Price Prediction Analyzing The Potential Impact Of Trumps Economic Plans

May 08, 2025 -

Lahwr Ky Panch Ahtsab Edaltyn Khtm Ahm Pysh Rft

May 08, 2025

Lahwr Ky Panch Ahtsab Edaltyn Khtm Ahm Pysh Rft

May 08, 2025 -

The Running Man Glen Powells Fitness Regime And Method Acting

May 08, 2025

The Running Man Glen Powells Fitness Regime And Method Acting

May 08, 2025 -

Singapores Dbs Bank A Breathing Space For Top Polluters

May 08, 2025

Singapores Dbs Bank A Breathing Space For Top Polluters

May 08, 2025

Latest Posts

-

Market Update Why Scholar Rock Stock Experienced A Setback On Monday

May 08, 2025

Market Update Why Scholar Rock Stock Experienced A Setback On Monday

May 08, 2025 -

Scholar Rock Stock Factors Contributing To Mondays Price Decrease

May 08, 2025

Scholar Rock Stock Factors Contributing To Mondays Price Decrease

May 08, 2025 -

Understanding The Dwps New Universal Credit Verification System

May 08, 2025

Understanding The Dwps New Universal Credit Verification System

May 08, 2025 -

Scholar Rock Stock Price Plunge A Monday Market Analysis

May 08, 2025

Scholar Rock Stock Price Plunge A Monday Market Analysis

May 08, 2025 -

Dwp Benefit Changes What Claimants Need To Know About April 5th

May 08, 2025

Dwp Benefit Changes What Claimants Need To Know About April 5th

May 08, 2025