Scholar Rock Stock Price Plunge: A Monday Market Analysis

Table of Contents

Pre-Market News and its Impact on Scholar Rock Stock

Pre-market trading often sets the tone for the day's stock performance, and Monday was no exception for Scholar Rock. Negative news releases can significantly impact investor sentiment, leading to immediate sell-offs. Keywords: Pre-market trading, news impact, stock volatility, investor sentiment, negative news.

-

Delayed Clinical Trial Results: One potential factor contributing to the Scholar Rock stock price plunge could have been the delay or underwhelming release of clinical trial results for one of their key pipeline drugs. This type of news often triggers immediate negative reactions from investors concerned about the drug's efficacy and potential market approval. A delay in a crucial stage of development can cast doubt on the company's future profitability.

-

Regulatory Setbacks: Another possibility is a regulatory setback. The biotech industry is heavily regulated, and any negative interaction with regulatory bodies can significantly impact a company's stock price. News of a rejected application, a clinical hold, or a warning letter from regulatory agencies could all lead to investor panic and a subsequent stock price decline.

-

Analyst Downgrade: A negative analyst report could also have contributed to the plunge. Changes in analyst ratings reflect shifts in professional opinion, and a downgrade could trigger a wave of sell-offs.

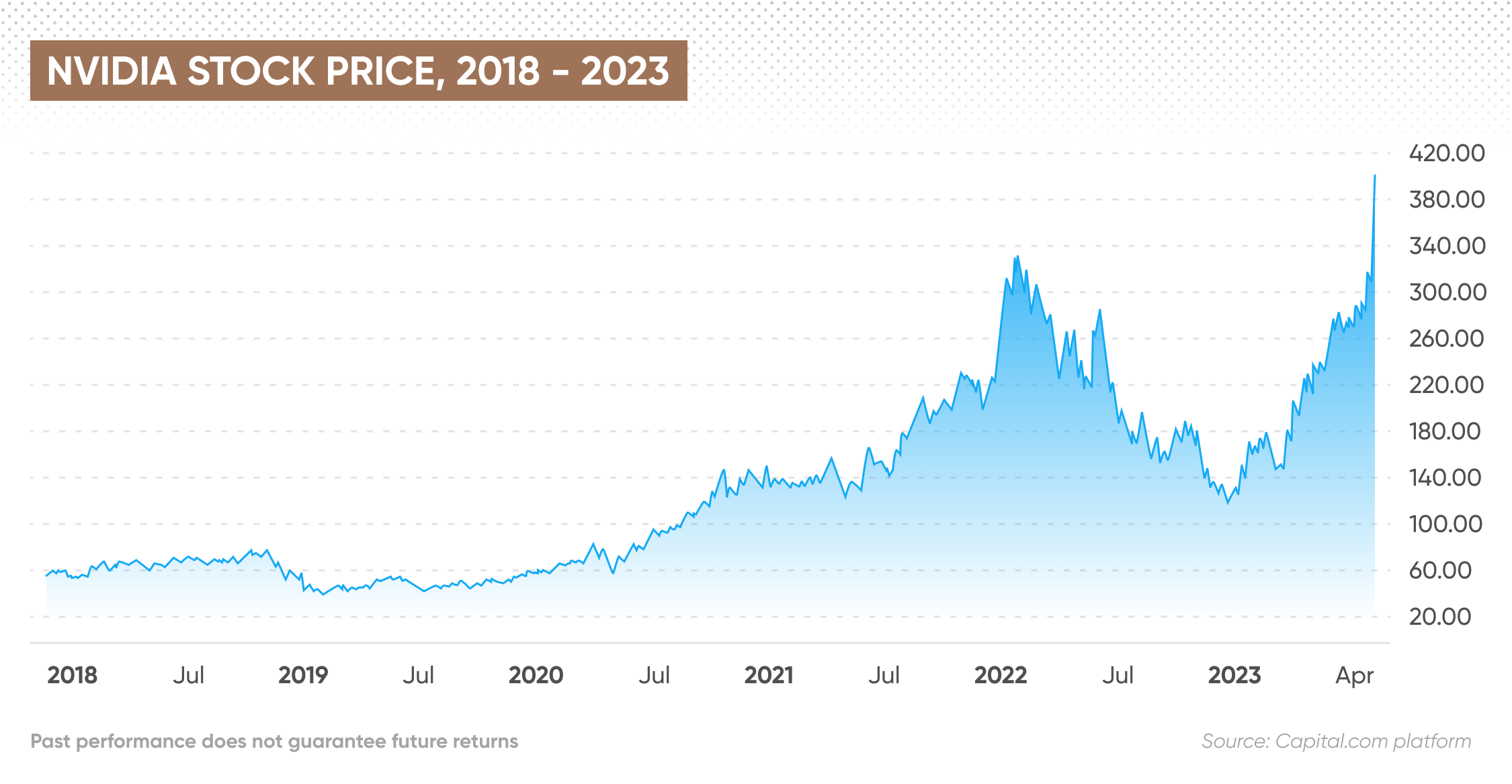

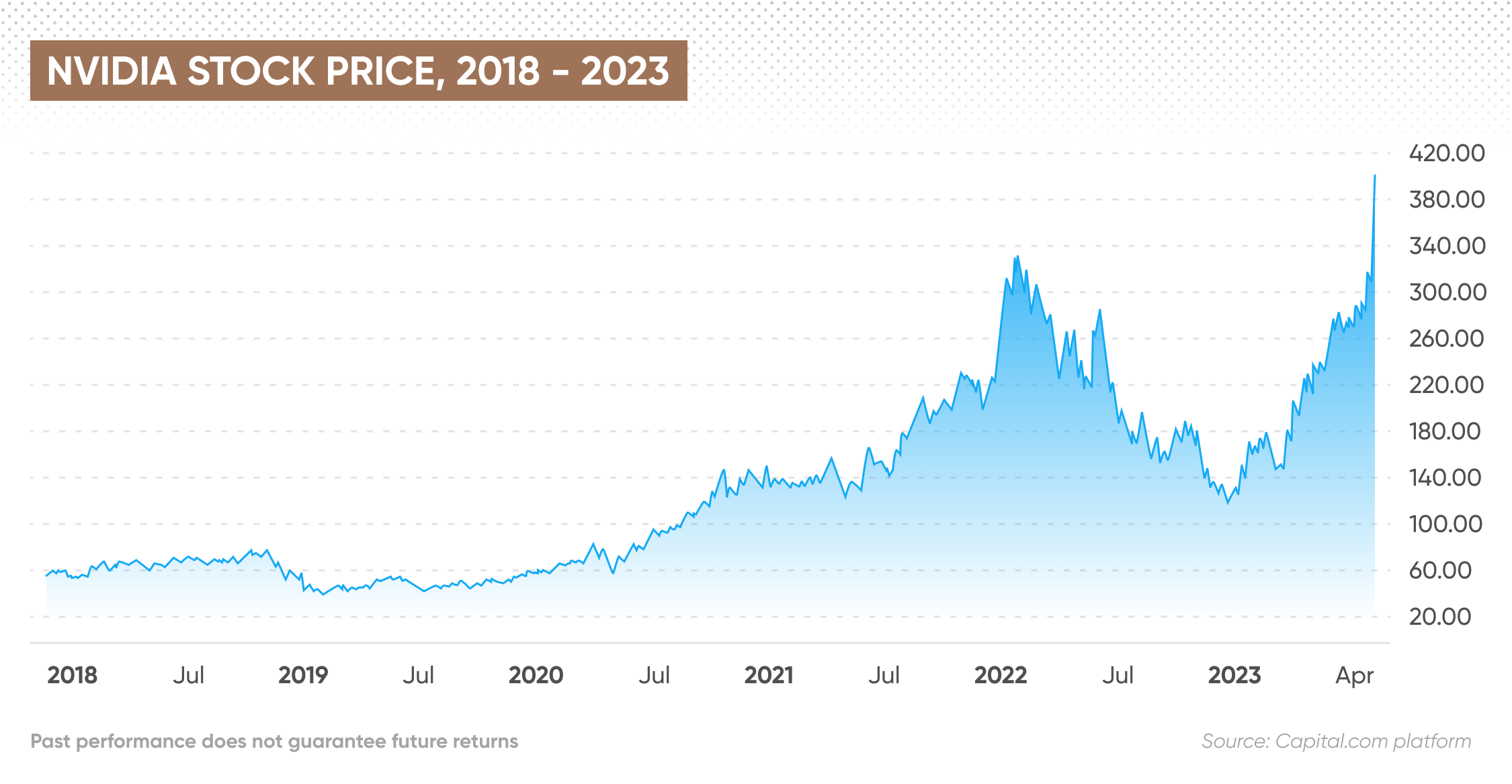

The impact of this pre-market news is reflected in the charts below, showcasing the sharp decline in SRRK's price before the market even opened. (Insert chart showing pre-market price movement) This early negative sentiment likely set the stage for the day's significant drop.

Analyzing Trading Volume and Short-Selling Activity

Understanding the trading volume and potential short-selling activity surrounding the Scholar Rock stock price plunge is crucial to a complete analysis. Keywords: Trading volume, short selling, stock price fluctuation, market manipulation, investor behavior.

-

High Trading Volume: A significantly higher than average trading volume on Monday compared to previous days would suggest a substantial shift in investor behavior. This heightened activity could be attributed to a large number of investors reacting to the pre-market news and selling their shares. (Insert chart comparing trading volume)

-

Increased Short-Selling Activity: Short selling, where investors borrow and sell shares hoping to buy them back later at a lower price, can contribute to downward pressure on a stock's price. An increase in short-selling activity on Monday could have exacerbated the decline.

-

Short Squeeze Potential: While increased short-selling contributed to the fall, the potential for a future short squeeze should be considered. If positive news emerges, short sellers may be forced to buy back shares to cover their positions, driving the price upwards.

The interplay between these factors created a volatile trading environment on Monday, driving the Scholar Rock stock price sharply lower.

Broader Market Trends and their Influence on Scholar Rock

To fully grasp the context of the Scholar Rock stock price plunge, it's essential to consider broader market trends and their influence on the biotech sector. Keywords: Market downturn, sector performance, overall market sentiment, biotech industry trends, economic factors.

-

Overall Market Sentiment: A general downturn in the overall stock market on Monday could have amplified the negative impact on Scholar Rock. Negative market sentiment often leads to widespread selling across sectors, regardless of individual company performance.

-

Biotech Sector Performance: It's vital to analyze the performance of other biotech stocks. Was Scholar Rock's drop an isolated event, or was it part of a broader sector-wide decline? A negative trend in the biotech sector indicates a more significant issue impacting the industry as a whole.

-

Economic Factors: Macroeconomic factors such as interest rate hikes, inflation concerns, or geopolitical instability can create negative market sentiment and affect investor confidence in riskier assets like biotech stocks.

Analyzing these broader trends provides crucial context for understanding the magnitude and implications of the Scholar Rock stock price decline.

Future Outlook and Investment Strategies for Scholar Rock

The significant drop in Scholar Rock's stock price leaves investors with important decisions to make. Keywords: Long-term investment, risk assessment, stock forecast, investment strategy, portfolio management.

-

Cautious Outlook: Given the recent events, a cautious outlook on Scholar Rock's short-term stock price is warranted. Further analysis is needed to assess the long-term implications of the negative news.

-

Long-Term Potential: Despite the recent downturn, Scholar Rock's long-term potential still depends on its pipeline and future prospects. Investors need to carefully assess the company's long-term viability and the potential for future success.

-

Investment Strategies: The appropriate investment strategy will vary depending on individual risk tolerance. Investors with a higher risk tolerance might consider buying the dip, while more risk-averse investors might choose to hold or even sell their shares. Diversification across different sectors is crucial to mitigate risk within an investment portfolio.

Careful consideration of these factors is vital for navigating the complexities of investing in biotech companies.

Conclusion

This analysis of the Scholar Rock stock price plunge on Monday emphasizes the impact of pre-market news, trading volume, broader market trends, and overall investor sentiment. Understanding these interacting factors is crucial for navigating the volatile world of biotech investments. The situation highlights the importance of thorough due diligence, risk assessment, and a well-diversified portfolio.

Call to Action: Stay informed about the ongoing developments concerning Scholar Rock and the broader biotech sector to make well-informed investment decisions. Continuously monitor the Scholar Rock stock price and conduct thorough research to navigate this dynamic market effectively. Further analysis and understanding of market trends will be essential for future success in your Scholar Rock investments and your overall investment portfolio.

Featured Posts

-

Most Intense War Films Streaming Now On Amazon Prime A Viewers Guide

May 08, 2025

Most Intense War Films Streaming Now On Amazon Prime A Viewers Guide

May 08, 2025 -

Jayson Tatum On Larry Bird Respect Inspiration And The Celtics Legacy

May 08, 2025

Jayson Tatum On Larry Bird Respect Inspiration And The Celtics Legacy

May 08, 2025 -

Pakstan Qwmy Hyrw Aym Aym Ealm Ky 12wyn Brsy Ky Tqrybat Ka Aneqad

May 08, 2025

Pakstan Qwmy Hyrw Aym Aym Ealm Ky 12wyn Brsy Ky Tqrybat Ka Aneqad

May 08, 2025 -

Dogecoin Shiba Inu And Sui Understanding This Weeks Market Gains

May 08, 2025

Dogecoin Shiba Inu And Sui Understanding This Weeks Market Gains

May 08, 2025 -

Papal Conclave Cardinals Weigh Candidate Dossiers

May 08, 2025

Papal Conclave Cardinals Weigh Candidate Dossiers

May 08, 2025

Latest Posts

-

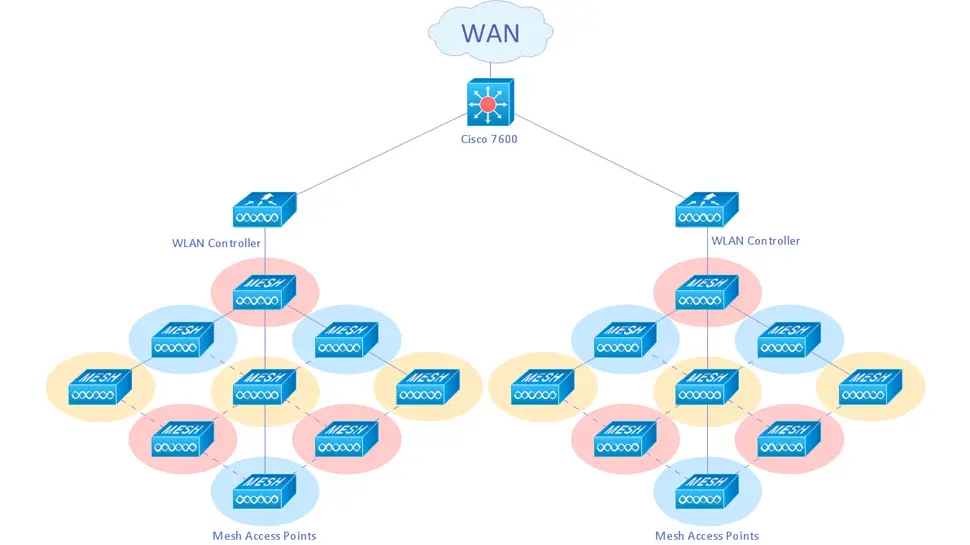

Wireless Mesh Networks Market 9 8 Cagr Projected Growth

May 09, 2025

Wireless Mesh Networks Market 9 8 Cagr Projected Growth

May 09, 2025 -

Anchorage Arts Scene A Standing Ovation For Local Coverage

May 09, 2025

Anchorage Arts Scene A Standing Ovation For Local Coverage

May 09, 2025 -

Support Grows For American Samoan Family Charged With Voter Fraud In Whittier Ahead Of Court Date

May 09, 2025

Support Grows For American Samoan Family Charged With Voter Fraud In Whittier Ahead Of Court Date

May 09, 2025 -

Community Rallies Behind American Samoan Family Accused Of Voter Fraud In Whittier

May 09, 2025

Community Rallies Behind American Samoan Family Accused Of Voter Fraud In Whittier

May 09, 2025 -

Warming Temperatures And Mud Obstacles In Anchorage Fin Whale Skeleton Salvage Operation

May 09, 2025

Warming Temperatures And Mud Obstacles In Anchorage Fin Whale Skeleton Salvage Operation

May 09, 2025