Market Update: Why Scholar Rock Stock Experienced A Setback On Monday

Table of Contents

Negative Clinical Trial Results or News

Impact of Disappointing Data

The most significant factor influencing Monday's Scholar Rock stock price decline could be linked to the release of disappointing data from a clinical trial or news hinting at potential delays or complications. While specific details might not be publicly available immediately following the market close, several possibilities exist.

- Unmet Primary Endpoint: A failure to meet the primary endpoint in a crucial Phase II or III trial would significantly impact investor confidence. This would cast doubt on the drug's efficacy and future market potential.

- Safety Concerns: The emergence of unexpected safety concerns or adverse events in a clinical trial could halt the drug's development, leading to significant losses for investors.

- Regulatory Setbacks: Delays or rejection of a New Drug Application (NDA) by regulatory bodies like the FDA could also contribute to a drop in Scholar Rock stock.

Analyst reactions following such news would likely include downward revisions to price targets and a reassessment of the company's overall value. This negative sentiment would ripple through the market, impacting the Scholar Rock stock price.

Comparison to Competitors

A comparison of Scholar Rock's performance to its competitors within the biotechnology sector is crucial. Did competing companies experience similar setbacks? Or did positive news for competitors highlight Scholar Rock's relative underperformance?

- Positive Competitor News: Positive clinical trial results or regulatory approvals for competitor drugs could indirectly contribute to the decline in Scholar Rock stock, as investors may shift their focus to more promising alternatives. For example, if Company X (ticker symbol: COMPX) announced positive Phase III data for a similar drug, it could lead to investors selling their Scholar Rock shares.

- Negative Competitor News: Conversely, if competitors faced setbacks, the impact on Scholar Rock's stock might be less severe. However, a general negative sentiment within the sector could still influence the market.

Broader Market Influences

Overall Market Sentiment

Monday's setback in Scholar Rock stock might not be solely attributable to company-specific factors. The overall market sentiment plays a crucial role in influencing individual stock prices.

- Biotech Sector Sell-off: A general sell-off within the biotechnology sector, perhaps triggered by broader economic concerns or regulatory changes, could drag down even healthy companies like Scholar Rock. We would need to examine the performance of the Nasdaq Biotech Index on Monday to assess this possibility.

- Overall Market Downturn: A significant decline in the S&P 500 or other major market indices could indicate a broader market correction affecting all sectors, including biotechnology.

Sector-Specific Downturns

Negative trends within the pharmaceutical or biotechnology industry could also influence Scholar Rock's stock performance.

- Regulatory Changes: New regulations or policy shifts impacting drug development and approval processes could create uncertainty and negatively affect investor confidence.

- Industry Challenges: Challenges such as increasing manufacturing costs, pricing pressures, or patent expirations could further contribute to a negative market sentiment.

Company-Specific Factors

Internal Company Announcements

Internal announcements from Scholar Rock itself could have caused the drop in stock price.

- Management Changes: Unexpected changes in senior management, especially the departure of key personnel, could trigger concerns about the company's future direction and stability.

- Financial Updates: Disappointing financial reports, a lowered earnings forecast, or news of a significant capital raise could also contribute to investor anxiety.

Analyst Ratings and Price Target Adjustments

Changes in analyst ratings and price target adjustments significantly impact a company's stock performance.

- Downgraded Ratings: If several prominent analysts downgraded their rating on Scholar Rock stock, it would likely result in selling pressure.

- Lowered Price Targets: Similarly, a reduction in price targets by leading analysts signals a diminished outlook for the company, prompting investors to re-evaluate their holdings.

Conclusion

Monday's setback in Scholar Rock stock price can be attributed to a combination of factors. Disappointing clinical trial data, broader market influences such as a general downturn in the biotech sector, and company-specific announcements all likely played a role. While this market update sheds light on potential reasons for Monday's setback in Scholar Rock stock, remember to always conduct thorough research and consult with a financial advisor before making investment decisions concerning Scholar Rock stock or any other investment. Stay informed about future developments regarding Scholar Rock stock and its clinical trials to make informed investment choices.

Featured Posts

-

Superman Sneak Peek Kryptos Assault Revealed

May 08, 2025

Superman Sneak Peek Kryptos Assault Revealed

May 08, 2025 -

Ethereum Price Outlook Analyzing The Latest Weekly Chart Buy Signal

May 08, 2025

Ethereum Price Outlook Analyzing The Latest Weekly Chart Buy Signal

May 08, 2025 -

Rogues Legacy Gambits Emotional New Weapon

May 08, 2025

Rogues Legacy Gambits Emotional New Weapon

May 08, 2025 -

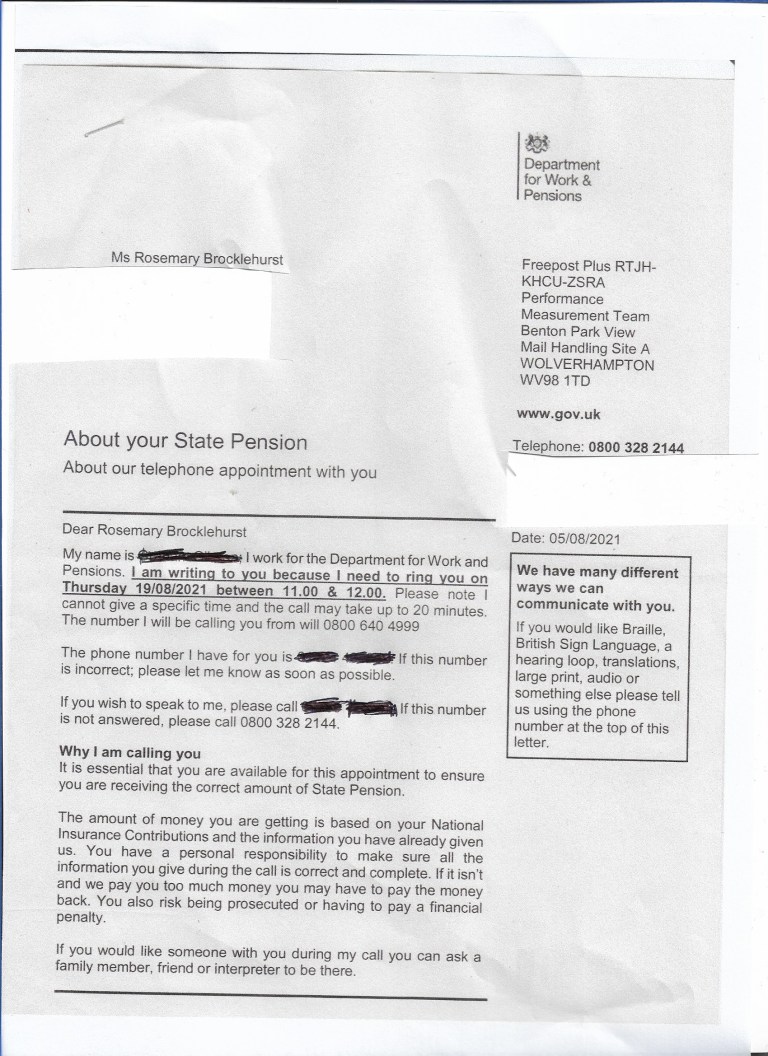

Dwp Letter Not On Doormat Potential 6 828 Loss Explained

May 08, 2025

Dwp Letter Not On Doormat Potential 6 828 Loss Explained

May 08, 2025 -

Golazo De Arrascaeta Flamengo Golea Y Se Corona En La Taca Guanabara

May 08, 2025

Golazo De Arrascaeta Flamengo Golea Y Se Corona En La Taca Guanabara

May 08, 2025

Latest Posts

-

Honest Remarks Jayson Tatums Post All Star Game Thoughts On Steph Curry

May 09, 2025

Honest Remarks Jayson Tatums Post All Star Game Thoughts On Steph Curry

May 09, 2025 -

Celtics Forward Jayson Tatum Suffers Apparent Ankle Injury

May 09, 2025

Celtics Forward Jayson Tatum Suffers Apparent Ankle Injury

May 09, 2025 -

Tatum Praises Curry An Honest Take Following The Nba All Star Game

May 09, 2025

Tatum Praises Curry An Honest Take Following The Nba All Star Game

May 09, 2025 -

Jayson Tatums Ankle Injury Update And Potential Absence For Celtics

May 09, 2025

Jayson Tatums Ankle Injury Update And Potential Absence For Celtics

May 09, 2025 -

Jayson Tatum Ankle Injury Pain Visible Celtics Face Uncertainty

May 09, 2025

Jayson Tatum Ankle Injury Pain Visible Celtics Face Uncertainty

May 09, 2025