Singapore's DBS Bank: A Breathing Space For Top Polluters?

Table of Contents

DBS Bank's Financing of Fossil Fuel Projects

DBS Bank's substantial investments in fossil fuel projects raise significant concerns regarding its commitment to environmental sustainability. The scale of this investment is considerable, directly contributing to carbon emissions and climate change.

Scale of Investment

While precise figures are not always publicly available, various reports and analyses indicate significant investment by DBS Bank in fossil fuel companies involved in oil, gas, and coal extraction and processing. [Insert links to credible sources detailing DBS Bank's fossil fuel investments here]. This financing directly underpins the continued operation and expansion of high-emission industries.

- Specific examples: [Insert specific examples of high-emission projects financed by DBS Bank, including project names and locations. Link to verifiable sources].

- Quantifying the carbon footprint: [Insert data quantifying the carbon emissions associated with these projects, if available. If not, explain the challenges in obtaining this data and suggest alternative methods of assessment.]

- Comparison with renewable energy: [Compare the bank's investments in fossil fuels to its investments in renewable energy sources. Highlight the disparity if one exists]. This comparison is critical for assessing the bank's true commitment to a low-carbon future. The keyword "fossil fuel financing" accurately reflects this section's critical focus.

The sheer scale of DBS Bank's fossil fuel financing casts a long shadow over its professed commitment to ESG investing and combating climate change.

DBS Bank's Commitment to Sustainability (Greenwashing Concerns)

DBS Bank has publicly declared its commitment to environmental sustainability and published ESG (Environmental, Social, and Governance) reports outlining its sustainability goals. However, concerns remain regarding the transparency and actual impact of these initiatives, raising the spectre of greenwashing.

Public Statements and ESG Initiatives

The bank has set targets for reducing its carbon footprint and promoting sustainable finance. [Insert specific examples of DBS Bank's public statements and ESG targets here, linking to their official reports].

- Targets for carbon emission reduction: [Analyze the specific targets set by DBS Bank for reducing carbon emissions. Are these targets ambitious enough considering the urgency of the climate crisis? Are they aligned with the Paris Agreement goals?]

- Transparency and verifiability of ESG reports: [Critically assess the transparency and verifiability of DBS Bank's ESG reports. Are the methodologies used clear and auditable? Are third-party verification processes in place?]

- Potential greenwashing: [Discuss any instances where DBS Bank's actions might be perceived as greenwashing – i.e., making misleading or exaggerated claims about its environmental performance to create a positive public image without substantial action.] This section critically examines the bank's "ESG reporting" and its potential inconsistencies.

The Role of Regulatory Frameworks and International Pressure

DBS Bank's actions are influenced by both Singapore's national climate policies and international pressure from NGOs and climate activists. The effectiveness of these frameworks in curbing financing of polluting industries is a key consideration.

Singapore's Climate Policies

Singapore's climate policies [briefly describe Singapore’s current climate policies and their potential influence on DBS Bank's actions. Link to relevant government documents].

International Pressure and Activist Campaigns

International pressure, including activist campaigns targeting DBS Bank's environmental record, plays a vital role. [Detail notable campaigns and their impact. Include links to relevant news articles and reports].

- Effectiveness of existing regulations: [Analyze the effectiveness of existing regulations in Singapore and internationally in curbing financing of polluting industries. Are they stringent enough? Are they effectively enforced?]

- Notable activist campaigns: [Detail specific activist campaigns targeting DBS Bank's environmental record and their influence on the bank's policies.]

- Influence of international agreements: [Discuss the influence of international agreements like the Paris Agreement on DBS Bank's sustainability efforts.] This section utilizes the keywords "climate regulations" and "environmental activism."

Alternative Financing Models and Opportunities for DBS Bank

DBS Bank has opportunities to significantly shift its financing portfolio towards sustainable alternatives.

Investment in Renewable Energy

While DBS Bank invests in renewable energy projects, the scale of these investments needs further expansion. [Quantify the bank's investments in renewable energy and compare them to investments in fossil fuels. Provide examples of renewable energy projects financed by DBS Bank].

Sustainable Finance Products and Services

DBS Bank offers various sustainable finance products and services. [Provide examples of these products and services and evaluate their impact].

- Quantifying renewable energy investment: [Provide quantitative data comparing renewable energy investments to fossil fuel investments. This helps to illustrate the disparity and highlight the need for greater investment in renewable energy.]

- Examples of sustainable finance products: [List examples of innovative sustainable finance products offered by DBS Bank, such as green bonds or loans for renewable energy projects.]

- Leadership potential in green finance: [Discuss the potential for DBS Bank to take a leadership role in green finance in Southeast Asia and globally. This section focuses on "renewable energy financing" and "sustainable development goals".]

Conclusion

This article highlights a significant discrepancy between DBS Bank's public commitment to environmental sustainability and its continued substantial investment in high-emission industries. While the bank has made some progress in sustainable finance, the scale of its fossil fuel financing raises serious concerns about its contribution to climate change. We need greater transparency and accountability from DBS Bank and other financial institutions regarding their environmental impact. Demand responsible banking practices, support sustainable financial practices, and hold DBS Bank accountable for its environmental impact. Let's pressure financial institutions to prioritize genuine environmental sustainability over short-term profits and truly embrace a future powered by sustainable financial practices.

Featured Posts

-

Dwp Increases Home Visits For Benefit Claimants What You Need To Know

May 08, 2025

Dwp Increases Home Visits For Benefit Claimants What You Need To Know

May 08, 2025 -

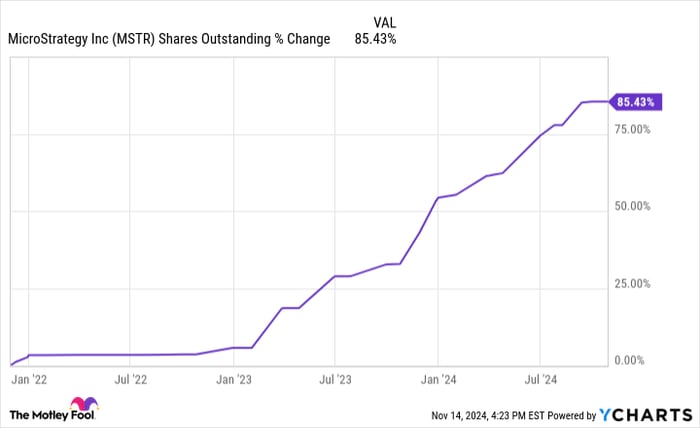

Is This Hot New Spac Stock The Next Micro Strategy Investor Analysis

May 08, 2025

Is This Hot New Spac Stock The Next Micro Strategy Investor Analysis

May 08, 2025 -

Bitcoin Madenciligi Nin Sonu Mu Analiz Ve Tahminler

May 08, 2025

Bitcoin Madenciligi Nin Sonu Mu Analiz Ve Tahminler

May 08, 2025 -

Bitcoin At A Critical Juncture Key Price Levels To Watch

May 08, 2025

Bitcoin At A Critical Juncture Key Price Levels To Watch

May 08, 2025 -

Raphaels Departure A Blow To Nc State Football

May 08, 2025

Raphaels Departure A Blow To Nc State Football

May 08, 2025

Latest Posts

-

Boston Celtics Head Coachs Statement On Jayson Tatums Wrist

May 08, 2025

Boston Celtics Head Coachs Statement On Jayson Tatums Wrist

May 08, 2025 -

Update On Jayson Tatums Wrist Boston Celtics Head Coach Weighs In

May 08, 2025

Update On Jayson Tatums Wrist Boston Celtics Head Coach Weighs In

May 08, 2025 -

Jayson Tatums Wrist Injury Boston Celtics Coach Gives Update

May 08, 2025

Jayson Tatums Wrist Injury Boston Celtics Coach Gives Update

May 08, 2025 -

Nba All Star Game Tatums Candid Opinion Of Steph Curry

May 08, 2025

Nba All Star Game Tatums Candid Opinion Of Steph Curry

May 08, 2025 -

Tatums Post All Star Game Remarks On Steph Currys Performance

May 08, 2025

Tatums Post All Star Game Remarks On Steph Currys Performance

May 08, 2025