Weak Q1 Figures Trigger 6% Drop In Kering Share Price

Table of Contents

Disappointing Q1 Performance: A Detailed Look at the Numbers

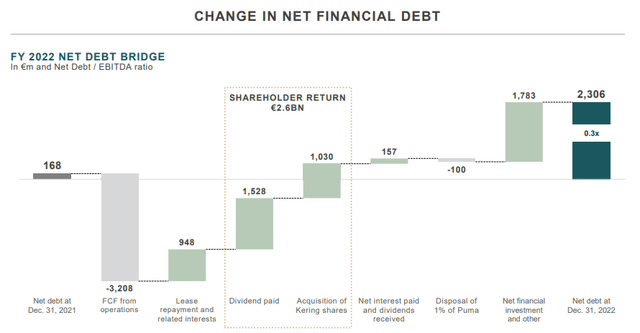

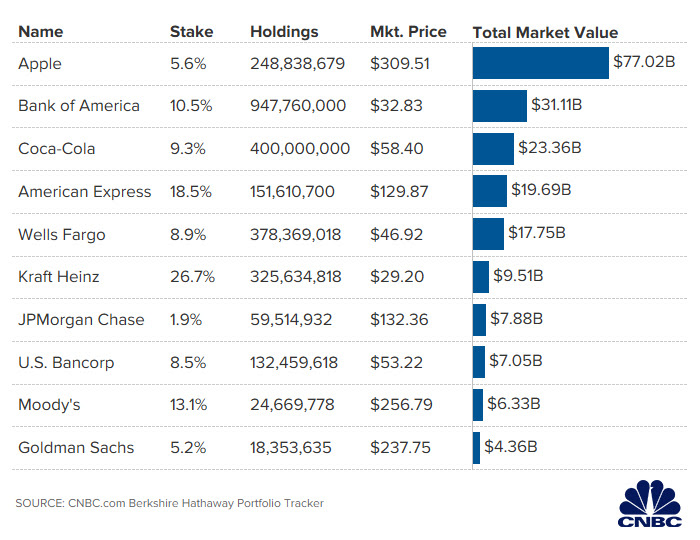

Kering's Q1 2024 earnings report revealed a concerning picture. The financial performance fell short of both internal projections and analyst expectations, leading to the significant share price drop. Let's examine the key figures:

- Revenue Decline: Kering reported a [insert percentage]% decline in revenue compared to Q1 2023, a significant deviation from the [insert percentage]% growth predicted by analysts. This represents a considerable setback for the company.

- Brand Performance Breakdown: While some brands within the Kering portfolio showed marginal growth, flagship brands like Gucci experienced a [insert percentage]% decrease in sales, significantly impacting overall performance. Saint Laurent, while performing better, also showed a slowdown compared to the previous year's Q1. Bottega Veneta's performance was [insert description - positive, negative, or neutral].

- Profit Margin Squeeze: The decline in revenue directly impacted profit margins, falling to [insert percentage] compared to [insert percentage] in Q1 2023. This reduced profitability further eroded investor confidence.

- Geographical Underperformance: Key markets like [insert region(s)] showed particularly weak performance, highlighting the impact of regional economic factors on Kering's sales.

- Unexpected Expenses: The report also cited [insert brief description of any unexpected costs or expenses, e.g., increased raw material costs, supply chain disruptions] which added to the pressure on profitability.

This detailed analysis of the Kering Q1 2024 financial report clearly demonstrates the severity of the underperformance and provides context for the subsequent market reaction.

Underlying Factors Contributing to the Share Price Drop

The weak Q1 performance wasn't solely due to internal factors. Several external pressures significantly contributed to the decline in Kering's share price.

- Macroeconomic Headwinds: The global economic slowdown, fueled by persistent inflation and rising interest rates, significantly impacted consumer spending, particularly in the luxury sector. High inflation reduces purchasing power, affecting demand for luxury goods.

- Supply Chain Disruptions: Ongoing supply chain issues, including [insert specifics, e.g., transportation delays, raw material shortages], continued to impact production and distribution, further constraining revenue.

- Intense Competition: Kering faces stiff competition from other luxury conglomerates like LVMH and Richemont, as well as emerging luxury brands. The competitive landscape is becoming increasingly challenging.

- Brand Strategy Effectiveness: Questions have arisen regarding the effectiveness of Kering's current brand strategies. Analysts are scrutinizing the marketing and product development initiatives of key brands like Gucci to determine if they resonate with the current consumer landscape.

- Internal Challenges: [Insert any potential internal challenges mentioned in the financial report or news articles, e.g., management changes, internal restructuring].

These external and internal pressures combined to create a perfect storm that resulted in the disappointing Q1 results and subsequent share price drop.

Investor Reaction and Market Sentiment

The market reacted swiftly and negatively to Kering's Q1 results.

- Immediate Market Reaction: The announcement immediately triggered a 6% drop in Kering's share price, reflecting investor concern. Trading volume spiked significantly as investors reacted to the news.

- Analyst Downgrades: Several analysts downgraded their ratings and price targets for Kering stock, further contributing to the negative sentiment. Concerns about future performance led to a reassessment of the company's value.

- Trading Volume and Volatility: Trading volume in Kering shares increased dramatically in the days following the release of the Q1 results, indicating heightened market activity and uncertainty.

- Investor Sentiment: Overall investor sentiment towards Kering shifted from positive to cautious, with many questioning the company's ability to navigate the current economic challenges. The luxury goods sector, as a whole, experienced a downturn in investor confidence.

Long-Term Implications and Potential Recovery Strategies

The weak Q1 performance poses significant challenges for Kering's long-term growth trajectory. However, the company has several avenues to pursue for recovery:

- Potential Long-Term Impacts: Continued underperformance could erode Kering's market share and brand value, impacting its ability to attract and retain talent and investment.

- Recovery Strategies: Kering might consider strategic investments in areas like digital marketing, sustainable practices, and innovative product development to regain lost ground. Brand repositioning for key brands is also a likely area of focus.

- Future Growth Potential: Despite the current challenges, the luxury goods market is expected to experience long-term growth. Kering's success will depend on its ability to adapt its strategies and capitalize on future opportunities.

Conclusion:

Kering's disappointing Q1 2024 results and the subsequent 6% drop in its share price highlight the challenges facing the luxury goods sector in the current economic climate. The reasons are multifaceted, ranging from macroeconomic headwinds to competitive pressures and internal challenges. While the short-term outlook remains uncertain, Kering's strategic response and the overall health of the luxury market will determine its ability to recover. Understanding the interplay of factors influencing the Kering share price is crucial.

Call to Action: Stay informed about the evolving situation surrounding Kering's share price and the luxury goods market by regularly checking for updates and analysis on Kering's Q1 figures and future performance. Analyzing Kering's performance, and the broader luxury market's response, is crucial for informed investment decisions.

Featured Posts

-

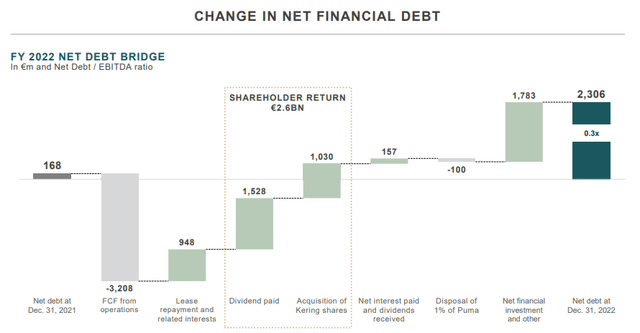

Nyt Mini Crossword April 18 2025 Answers And Clue Help

May 24, 2025

Nyt Mini Crossword April 18 2025 Answers And Clue Help

May 24, 2025 -

90mph Refuel The Incredible Police Chase Story

May 24, 2025

90mph Refuel The Incredible Police Chase Story

May 24, 2025 -

Porsche Elektromobiliu Ikrovimo Tinklo Augimas Europoje

May 24, 2025

Porsche Elektromobiliu Ikrovimo Tinklo Augimas Europoje

May 24, 2025 -

Porsche Atidare Nauja Elektromobiliu Ikrovimo Stoti Europoje

May 24, 2025

Porsche Atidare Nauja Elektromobiliu Ikrovimo Stoti Europoje

May 24, 2025 -

Kyle Walker Peters Transfer Leeds Initiate Talks

May 24, 2025

Kyle Walker Peters Transfer Leeds Initiate Talks

May 24, 2025

Latest Posts

-

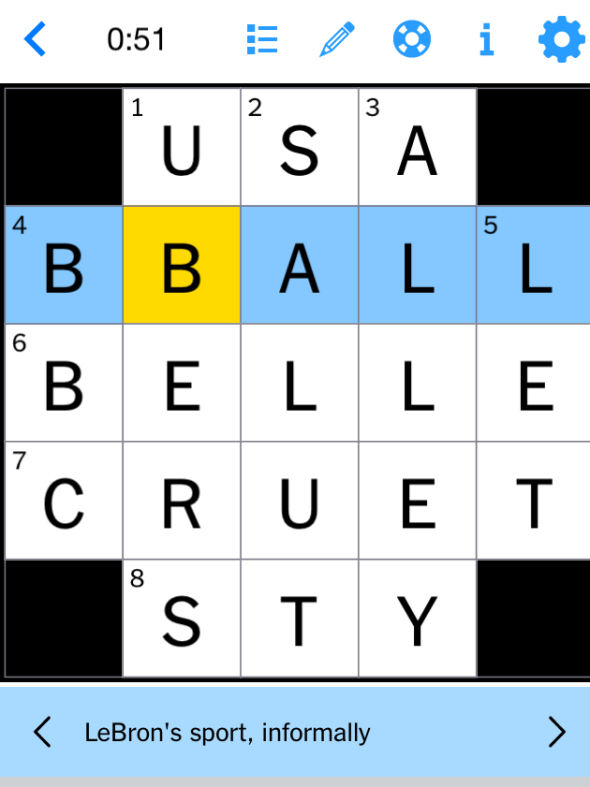

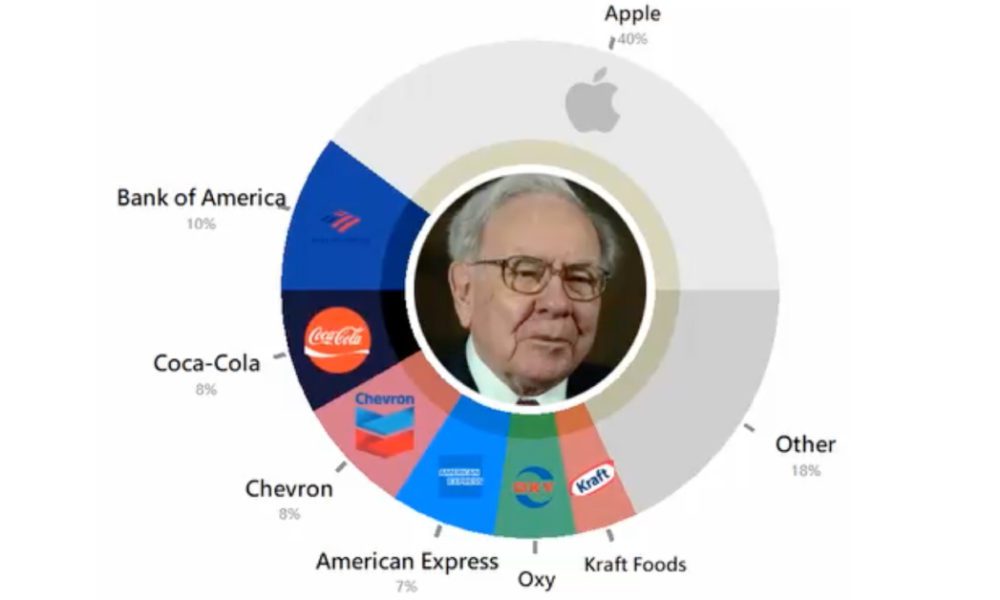

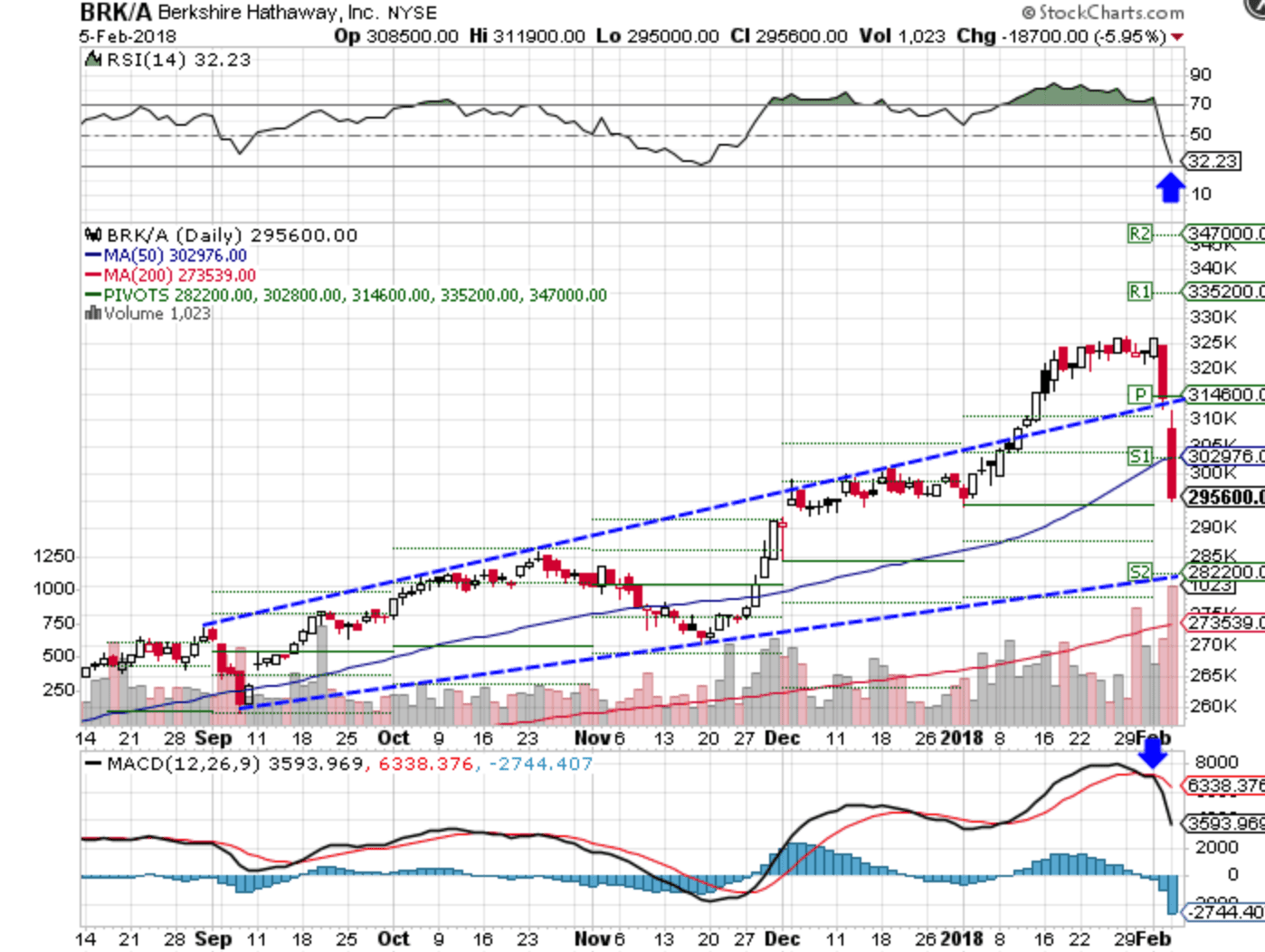

The Future Of Berkshire Hathaways Apple Holdings A Post Buffett Analysis

May 24, 2025

The Future Of Berkshire Hathaways Apple Holdings A Post Buffett Analysis

May 24, 2025 -

Buffetts Succession At Berkshire Hathaway Impact On Apple Investment

May 24, 2025

Buffetts Succession At Berkshire Hathaway Impact On Apple Investment

May 24, 2025 -

Berkshire Hathaway And Apple What Happens After Buffett Steps Down

May 24, 2025

Berkshire Hathaway And Apple What Happens After Buffett Steps Down

May 24, 2025 -

Will Berkshire Hathaway Sell Apple Stock After Buffetts Departure

May 24, 2025

Will Berkshire Hathaway Sell Apple Stock After Buffetts Departure

May 24, 2025 -

Ai I Phone

May 24, 2025

Ai I Phone

May 24, 2025