Unexpected Bitcoin Surge: Trump's Crypto Chief Offers Prediction

Table of Contents

The Prediction: What Did Trump's Crypto Chief Say?

Anthony Scaramucci, known for his outspoken views and experience in finance, has made a noteworthy prediction regarding Bitcoin's future price. While the exact wording and timeframe may vary depending on the source, the core of his prediction points towards a significant increase in Bitcoin's value. He's often cited (though specific quotes require verification from reputable financial news sources) as suggesting a potential price target within a specific timeframe, fueled by his belief in Bitcoin's long-term potential as a store of value and a hedge against inflation.

- Specific price target mentioned: While the precise target fluctuates across reports, many cite a potential price significantly higher than the current market value. This is often framed in the context of long-term growth.

- Timeframe for the predicted price increase: Scaramucci's predictions generally focus on a longer-term outlook rather than short-term gains, suggesting a period of several years for the predicted price increase to materialize.

- Rationale behind the prediction: Scaramucci's reasoning typically involves a combination of macroeconomic factors, including inflation concerns and growing institutional adoption of Bitcoin. He also often points to Bitcoin's inherent scarcity as a key driver of long-term value.

Factors Contributing to the Bitcoin Surge

Several factors have contributed to the recent Bitcoin price surge. Understanding these nuances is crucial for anyone considering a Bitcoin investment or navigating the broader cryptocurrency market.

- Inflation and its effect on Bitcoin as a hedge: Global inflation is a major factor. Investors often see Bitcoin as a hedge against inflation, driving demand during periods of economic uncertainty.

- Adoption by large corporations: Increased adoption by major corporations, including MicroStrategy and Tesla, lends credibility to Bitcoin as a legitimate asset class and boosts market confidence. This institutional investment is a significant driver of price increases.

- Regulatory developments affecting crypto markets: While regulatory clarity is still evolving, recent positive developments or the lack of overly restrictive measures in some jurisdictions can impact market sentiment and investor confidence, driving price movements.

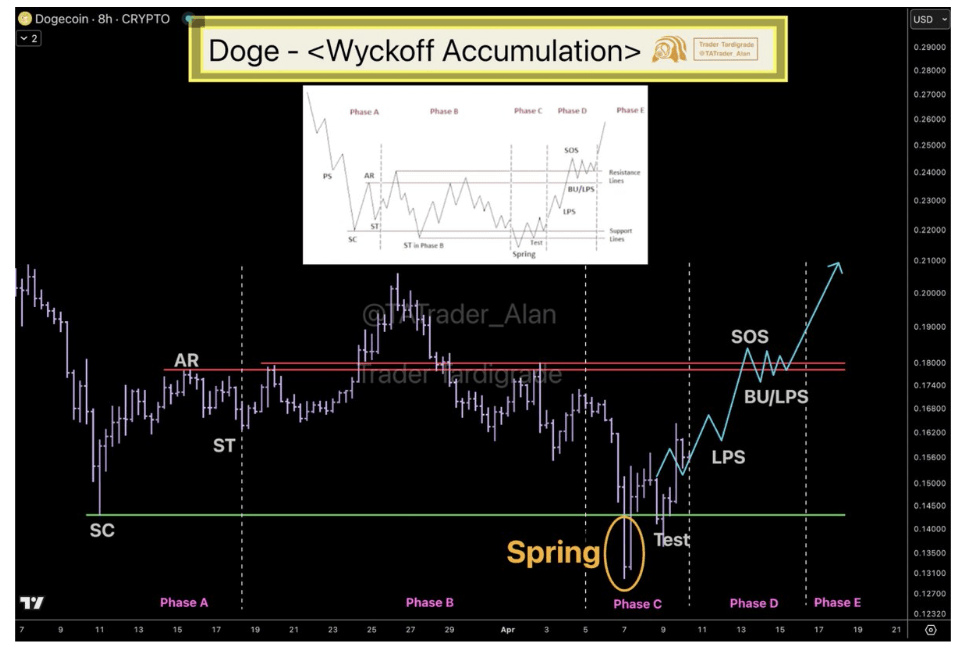

- Technical analysis of Bitcoin's chart: Technical analysis, which studies price charts and trading volume to predict future price movements, often reveals patterns that may contribute to explaining recent surges and future trends. However, it's important to remember that technical analysis is not foolproof.

Analyzing the Prediction's Accuracy and Implications

Evaluating the likelihood of Scaramucci's prediction requires a careful assessment of market trends and inherent risks.

- Strengths and weaknesses of the prediction's underlying assumptions: While the argument for Bitcoin as an inflation hedge is compelling, geopolitical instability, regulatory changes, and overall market sentiment can significantly impact its price.

- Potential challenges that could hinder Bitcoin's growth: Government regulations, technological disruptions, and the emergence of competing cryptocurrencies are among the potential challenges to Bitcoin's growth.

- Implications for altcoins and the overall crypto landscape: A Bitcoin surge often influences the prices of other cryptocurrencies (altcoins), creating ripple effects across the entire crypto landscape.

Is Now a Good Time to Invest in Bitcoin?

The question of whether now is a good time to invest in Bitcoin is complex and depends on individual risk tolerance and investment goals. Scaramucci's prediction, while intriguing, shouldn't be the sole basis for investment decisions.

- Risks of investing in volatile assets like Bitcoin: Bitcoin's price is notoriously volatile, meaning significant losses are possible.

- Importance of conducting thorough research before investing: Investing in Bitcoin requires a comprehensive understanding of the technology, market dynamics, and associated risks.

- Strategies for mitigating investment risk: Diversification, dollar-cost averaging (investing smaller amounts regularly), and careful risk assessment are key strategies to mitigate potential losses.

Conclusion: Unexpected Bitcoin Surge: Should You Heed Trump's Crypto Chief's Prediction?

Scaramucci's prediction, coupled with the recent Bitcoin surge, highlights the ongoing interest and volatility in the cryptocurrency market. While the factors contributing to the surge are multifaceted, it’s crucial to remember that the crypto market is inherently risky. Any investment decisions should be made after thorough research and consultation with a financial advisor. The potential for high returns comes with equally high potential for losses. Remember, invest only what you can afford to lose. Ready to delve deeper into the world of Bitcoin and understand its potential? Start your research today!

Featured Posts

-

Bakan Simsek In Kripto Varlik Kuruluslarina Uyarisi Riskler Ve Yeni Duezenlemeler

May 08, 2025

Bakan Simsek In Kripto Varlik Kuruluslarina Uyarisi Riskler Ve Yeni Duezenlemeler

May 08, 2025 -

New Movie The Life Of Chuck Gets Stephen Kings Seal Of Approval

May 08, 2025

New Movie The Life Of Chuck Gets Stephen Kings Seal Of Approval

May 08, 2025 -

Road Rage Incident Van Strikes Motorcycle Cnn Coverage

May 08, 2025

Road Rage Incident Van Strikes Motorcycle Cnn Coverage

May 08, 2025 -

Vesprem A Sobori Ps Zh Vo Ligata Na Shampionite

May 08, 2025

Vesprem A Sobori Ps Zh Vo Ligata Na Shampionite

May 08, 2025 -

Bobi Marjanovic I Neobican Obicaj Zasto Se Dzordan I Jokic Ljube Tri Puta

May 08, 2025

Bobi Marjanovic I Neobican Obicaj Zasto Se Dzordan I Jokic Ljube Tri Puta

May 08, 2025

Latest Posts

-

Ethereums Price Action Suggests 2 700 Is Achievable Wyckoff Accumulation Explained

May 08, 2025

Ethereums Price Action Suggests 2 700 Is Achievable Wyckoff Accumulation Explained

May 08, 2025 -

Technical Analysis Ethereums Potential 2 700 Surge Based On Wyckoff

May 08, 2025

Technical Analysis Ethereums Potential 2 700 Surge Based On Wyckoff

May 08, 2025 -

Ethereum Price Analysis 2 700 On The Horizon Wyckoff Accumulation Hints At Rally

May 08, 2025

Ethereum Price Analysis 2 700 On The Horizon Wyckoff Accumulation Hints At Rally

May 08, 2025 -

Ethereum Price To Hit 4 000 Cross X Indicators And Institutional Accumulation Suggest A Bullish Trend

May 08, 2025

Ethereum Price To Hit 4 000 Cross X Indicators And Institutional Accumulation Suggest A Bullish Trend

May 08, 2025 -

Wyckoff Accumulation In Ethereum Price Poised For 2 700 Breakout

May 08, 2025

Wyckoff Accumulation In Ethereum Price Poised For 2 700 Breakout

May 08, 2025