Succession Planning: A Growing Trend Among The Ultra-Wealthy

Table of Contents

The Unique Challenges Faced by Ultra-High-Net-Worth Families

The complexities of succession planning for UHNWIs far exceed those faced by individuals with more modest estates. Several unique hurdles require careful consideration and specialized expertise.

Complex Asset Structures: Ultra-high-net-worth families often possess a diverse portfolio of assets, including:

- International assets: Properties, businesses, and investments spanning multiple countries, each with its own legal and tax ramifications.

- Family trusts: Complex trust structures designed to manage and protect assets across generations, requiring intricate legal and financial planning.

- Private equity and other illiquid assets: These assets pose valuation and liquidity challenges in estate planning.

- Art collections and other valuable assets: Unique assets demanding specialized appraisal, insurance, and transfer strategies.

- Philanthropic foundations: Charitable organizations requiring ongoing management and strategic planning for future contributions.

- Generational differences in asset management preferences: Differing investment philosophies and risk tolerances across generations can lead to conflicts and require careful navigation.

Family Dynamics and Conflict: The concentration of significant wealth can exacerbate existing family tensions or create new ones. Potential sources of conflict include:

- Sibling rivalry: Disputes over inheritance shares and control of family businesses are common.

- Differing visions for the future: Generational differences in values and goals can lead to clashes over the management and distribution of wealth.

- Disputes over charitable giving: Divergent views on philanthropic priorities can strain family relationships.

- Lack of clear communication and transparency: Absence of open dialogue about family wealth and succession plans can fuel mistrust and conflict.

Tax Implications and Legal Considerations: Wealth transfer comes with substantial tax implications, requiring sophisticated strategies to minimize liabilities. These include:

- Estate taxes: Significant taxes levied on the transfer of assets upon death.

- Inheritance taxes: Taxes imposed on the recipient of an inheritance.

- Gift taxes: Taxes on gifts made during the donor's lifetime.

- International tax laws: Complex tax treaties and regulations governing the transfer of assets across borders.

- Trust structures for tax optimization: Sophisticated trust structures can help minimize tax liabilities, but require careful planning and legal expertise.

Key Components of Effective Succession Planning for the Ultra-Wealthy

Developing a robust succession plan for ultra-high-net-worth families requires a multifaceted approach encompassing various key components:

Comprehensive Financial Planning: A detailed financial plan is paramount, encompassing:

- Investment strategies: Long-term investment strategies aligned with the family's goals and risk tolerance.

- Risk management: Identifying and mitigating potential risks to the family's wealth.

- Debt management: Strategies to manage and reduce outstanding debts.

- Cash flow projections: Forecasting future cash flows to ensure sufficient liquidity.

Family Governance Structures: Formal structures are crucial for managing family wealth and resolving potential disputes:

- Family constitutions: Formal documents outlining family values, governance rules, and wealth management principles.

- Family councils: Regular meetings of family members to discuss family matters and make important decisions.

- Mediation processes: Formalized processes for resolving family disputes.

- Conflict resolution mechanisms: Clear procedures for addressing disagreements and conflicts.

Professional Advisory Teams: Assembling a team of experienced professionals is critical for success:

- Estate planning attorneys: Expertise in drafting wills, trusts, and other estate planning documents.

- Tax attorneys and accountants: Minimizing tax liabilities through sophisticated tax planning strategies.

- Investment managers and wealth advisors: Managing and growing the family's investments.

- Family office professionals: Providing comprehensive wealth management and family governance services. (discussed in more detail below)

- Philanthropic advisors: Guiding the family's philanthropic endeavors and establishing charitable foundations.

The Growing Role of Family Offices in Succession Planning

Family offices have become increasingly important in assisting ultra-high-net-worth families with their succession planning needs.

Specialized Expertise and Resources: Family offices offer a wide array of specialized services:

- Investment management: Sophisticated investment management strategies tailored to the family's unique needs.

- Tax optimization: Minimizing tax liabilities through sophisticated tax planning.

- Legal and compliance: Ensuring compliance with all relevant laws and regulations.

- Philanthropic advising: Guiding the family's philanthropic activities.

- Concierge services: Providing personalized services to meet the family's needs.

Long-Term Perspective and Continuity: Family offices provide a long-term perspective that is essential for preserving wealth across generations:

- Multi-generational wealth management: Developing strategies to manage and preserve wealth across multiple generations.

- Continuity of family values: Ensuring that the family's values and traditions are preserved.

- Preservation of family businesses: Developing strategies to ensure the long-term success of family businesses.

Conclusion:

Effective succession planning is no longer a luxury for the ultra-wealthy; it's a necessity. The complexities of managing vast and diverse assets, navigating intricate family dynamics, and complying with stringent legal and tax requirements demand proactive and comprehensive planning. By engaging a team of experienced professionals and leveraging the resources of a family office, ultra-high-net-worth families can secure their legacy, protect their assets, and ensure a smooth transition of wealth to future generations. Don't wait – contact a wealth management expert today to discuss your succession planning needs and develop your robust succession plan. Secure your family's legacy with effective succession planning.

Featured Posts

-

Public Anger Over Thames Water Executive Bonuses A Critical Review

May 22, 2025

Public Anger Over Thames Water Executive Bonuses A Critical Review

May 22, 2025 -

Everything You Need To Know About The Goldbergs Tv Series

May 22, 2025

Everything You Need To Know About The Goldbergs Tv Series

May 22, 2025 -

Musique Le Hellfest Au Noumatrouff De Mulhouse

May 22, 2025

Musique Le Hellfest Au Noumatrouff De Mulhouse

May 22, 2025 -

Bp Executive Compensation A Significant 31 Decrease

May 22, 2025

Bp Executive Compensation A Significant 31 Decrease

May 22, 2025 -

Impact Of Economic Slowdown Sse Cuts Spending By 3 Billion

May 22, 2025

Impact Of Economic Slowdown Sse Cuts Spending By 3 Billion

May 22, 2025

Latest Posts

-

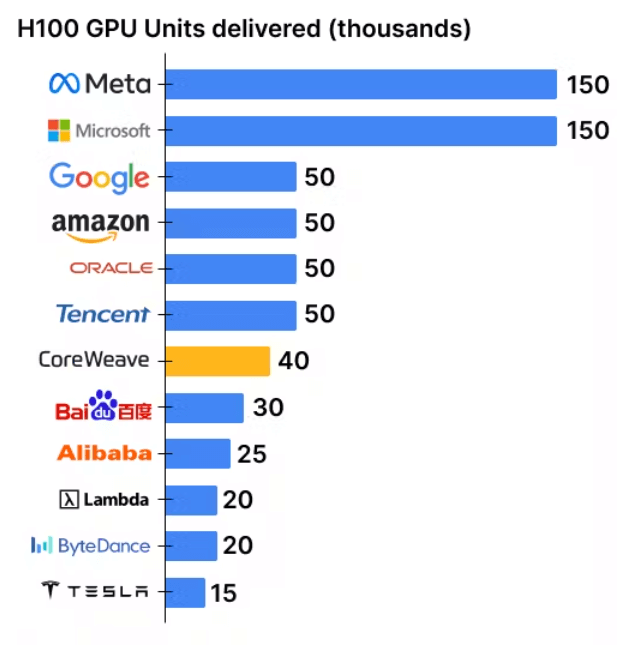

Core Weave Crwv Stock Market Movement On Tuesday Causes And Implications

May 22, 2025

Core Weave Crwv Stock Market Movement On Tuesday Causes And Implications

May 22, 2025 -

Core Weave Inc Crwv Analyzing The Stocks Tuesday Appreciation

May 22, 2025

Core Weave Inc Crwv Analyzing The Stocks Tuesday Appreciation

May 22, 2025 -

Core Weave Stock A Deep Dive Into Current Market Activity

May 22, 2025

Core Weave Stock A Deep Dive Into Current Market Activity

May 22, 2025 -

Analyzing Recent Developments In Core Weave Stock

May 22, 2025

Analyzing Recent Developments In Core Weave Stock

May 22, 2025 -

Understanding Core Weave Inc S Crwv Stock Increase On Tuesday

May 22, 2025

Understanding Core Weave Inc S Crwv Stock Increase On Tuesday

May 22, 2025