CoreWeave Stock: A Deep Dive Into Current Market Activity

Table of Contents

CoreWeave's Business Model and Competitive Advantage

CoreWeave's success hinges on its innovative approach to cloud computing.

GPU-as-a-Service and the AI Boom

CoreWeave's core offering is GPU-as-a-Service (GPUaaS). This model provides on-demand access to high-performance graphics processing units (GPUs), crucial for computationally intensive tasks like AI model training and rendering. The explosive growth of AI directly benefits CoreWeave, as companies increasingly need powerful GPUs to process vast datasets. Key clients include leading AI research institutions and companies developing cutting-edge AI applications. CoreWeave boasts strategic partnerships that further strengthen its market position.

- Scalability: Businesses can easily scale their GPU resources up or down based on their needs, avoiding costly upfront investments in hardware.

- Cost-effectiveness: Paying only for what you use makes GPUaaS a more economical solution compared to owning and maintaining your own infrastructure.

- Accessibility: GPUaaS democratizes access to powerful computing resources, enabling even smaller companies to leverage the benefits of AI.

Competitors in the GPUaaS market include AWS, Google Cloud, and Azure, but CoreWeave differentiates itself through its specialized focus on high-performance computing and its commitment to sustainability.

Sustainable Infrastructure and Environmental Impact

CoreWeave is committed to sustainable practices, a significant factor for Environment, Social, and Governance (ESG) investors. This commitment sets them apart in a market increasingly focused on responsible technology.

- Renewable Energy Usage: CoreWeave actively utilizes renewable energy sources to power its data centers, reducing its carbon footprint.

- Efficient Cooling Systems: The company employs innovative cooling technologies to minimize energy consumption and environmental impact.

This positive ESG profile can attract investors seeking companies with strong environmental and social responsibility records, potentially boosting investor sentiment and CoreWeave share price.

Analyzing Current Market Sentiment and CoreWeave's Stock Performance

Understanding the current market sentiment surrounding CoreWeave stock is crucial for any potential investor.

Recent Share Price Fluctuations

CoreWeave's share price, like many tech stocks, has experienced fluctuations. Recent price movements can often be attributed to various factors:

- News: Positive news, such as new partnerships or successful product launches, tends to drive the price up. Conversely, negative news can lead to price drops.

- Economic Conditions: Broader economic trends and investor sentiment toward the technology sector as a whole significantly impact CoreWeave's stock performance.

- Competitor Actions: Actions by competitors, including new product announcements or price changes, can influence CoreWeave's stock price.

(Insert chart or graph visualizing recent CoreWeave share price fluctuations here)

Investor Confidence and Analyst Ratings

Investor confidence in CoreWeave is reflected in analyst ratings and overall market sentiment. While tracking the precise numbers is beyond the scope of this overview, it’s important to stay updated on major investment firm ratings, seeking out reputable financial news sources.

- Positive Ratings: Positive ratings from reputable investment firms indicate strong investor confidence and a bullish outlook on CoreWeave's future.

- Concerns: Analysts may express concerns about competition, market saturation, or potential regulatory hurdles, which could affect investor sentiment.

Future Growth Potential and Investment Outlook for CoreWeave Stock

CoreWeave's future growth potential is tied to several key factors.

Market Expansion and Potential Partnerships

CoreWeave has significant opportunities for expansion.

- Geographic Expansion: Expanding into new geographic markets can unlock significant growth potential.

- New Service Offerings: Diversifying its service offerings beyond GPUaaS could attract new customers and expand revenue streams.

- Strategic Partnerships: Strategic partnerships with leading technology companies can enhance CoreWeave's market reach and accelerate its growth.

Long-Term Growth Projections and Risks

While CoreWeave's prospects look promising, potential investors must acknowledge inherent risks.

- Intense Competition: The cloud computing market is highly competitive, and CoreWeave faces challenges from established players.

- Market Saturation: As the market matures, growth rates may slow down.

- Regulatory Hurdles: Changes in regulations or policies could impact CoreWeave's operations.

- Economic Headwinds: Broad economic downturns can significantly affect demand for cloud computing services.

Conclusion:

Investing in CoreWeave stock requires a thorough understanding of its business model, competitive landscape, and future growth prospects. The company's focus on GPUaaS positions it well to benefit from the AI boom, but potential investors must also consider the risks involved, including competition and market volatility. Conducting comprehensive due diligence, including reviewing CoreWeave's financial reports and industry analysis, is crucial before making any investment decision regarding CoreWeave stock. Remember to carefully assess your personal risk tolerance and investment goals before committing any capital to CoreWeave or any other cloud computing stock.

Featured Posts

-

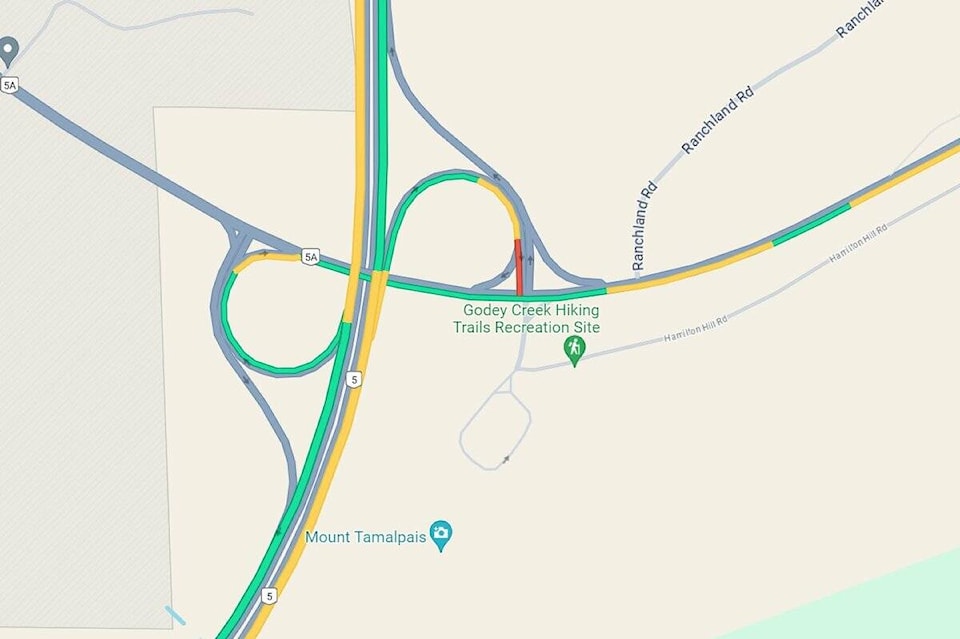

Updated Route 15 On Ramp Remains Closed After Crash

May 22, 2025

Updated Route 15 On Ramp Remains Closed After Crash

May 22, 2025 -

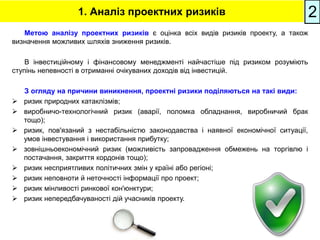

Vstup Ukrayini V Nato Otsinka Rizikiv Vid Yevrokomisara

May 22, 2025

Vstup Ukrayini V Nato Otsinka Rizikiv Vid Yevrokomisara

May 22, 2025 -

Fastest Australian Crossing Man Achieves Unprecedented Foot Race Record

May 22, 2025

Fastest Australian Crossing Man Achieves Unprecedented Foot Race Record

May 22, 2025 -

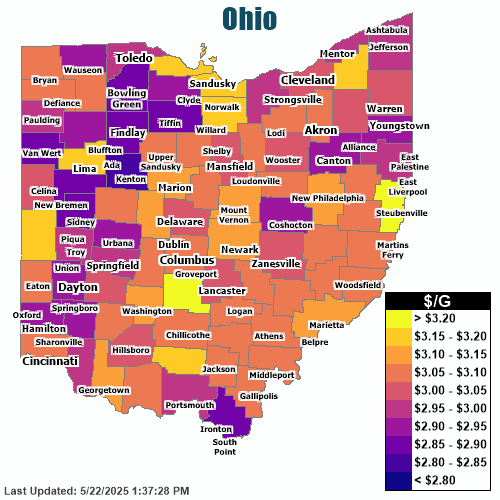

Significant Gas Price Hike Up Almost 20 Cents Gallon

May 22, 2025

Significant Gas Price Hike Up Almost 20 Cents Gallon

May 22, 2025 -

The 20 Cent Gas Price Rise Causes And Consequences

May 22, 2025

The 20 Cent Gas Price Rise Causes And Consequences

May 22, 2025

Latest Posts

-

Wide Gas Price Range In Columbus 2 83 3 31 Gallon

May 22, 2025

Wide Gas Price Range In Columbus 2 83 3 31 Gallon

May 22, 2025 -

Solve Nyt Wordle 1368 March 18 Hints And The Answer

May 22, 2025

Solve Nyt Wordle 1368 March 18 Hints And The Answer

May 22, 2025 -

Columbus Gas Station Prices Vary By 48 Cents

May 22, 2025

Columbus Gas Station Prices Vary By 48 Cents

May 22, 2025 -

Wordle 367 March 17th Hints Clues And Answer

May 22, 2025

Wordle 367 March 17th Hints Clues And Answer

May 22, 2025 -

Columbus Gas Prices 2 83 To 3 31 Per Gallon

May 22, 2025

Columbus Gas Prices 2 83 To 3 31 Per Gallon

May 22, 2025