Analyzing Recent Developments In CoreWeave Stock

Table of Contents

CoreWeave, a rapidly growing player in the cloud computing market, has experienced significant volatility in its stock price recently. This article aims to analyze these recent developments in CoreWeave stock, examining its financial performance, the impact of industry trends, analyst predictions, and potential risks, to provide investors with a comprehensive overview and inform their investment decisions. Our analysis suggests a cautiously optimistic outlook for CoreWeave stock, but careful consideration of several factors is crucial.

2. Main Points:

H2: CoreWeave's Financial Performance and Key Metrics

Understanding CoreWeave's financial health is crucial for assessing its stock performance. While specific financial data requires access to recent quarterly reports and SEC filings, we can analyze key performance indicators (KPIs) to gauge its trajectory. Analyzing metrics such as revenue growth, customer acquisition cost (CAC), churn rate, and average revenue per user (ARPU) provides valuable insights. Comparing these figures to competitors like AWS, Google Cloud, and Azure allows for a comparative market analysis of CoreWeave's performance within the industry.

- Specific financial figures (with sources): (This section would require insertion of real-time data from reliable sources like CoreWeave's investor relations page, financial news websites, and SEC filings. Examples: Q[Quarter] Revenue: $[Amount], Year-over-Year Growth: [%], Net Income: $[Amount]).

- Comparison charts and graphs visualizing key metrics: (This section would ideally include visually compelling charts comparing CoreWeave's KPIs against its major competitors. Data visualization tools like Tableau or Google Charts could be used).

- Analysis of any significant deviations from previous performance: (This requires contextualizing the numerical data and explaining any notable upward or downward trends). For instance, a sudden increase in CAC might indicate increased competition or a shift in marketing strategy.

H2: Impact of Recent Industry Trends on CoreWeave Stock

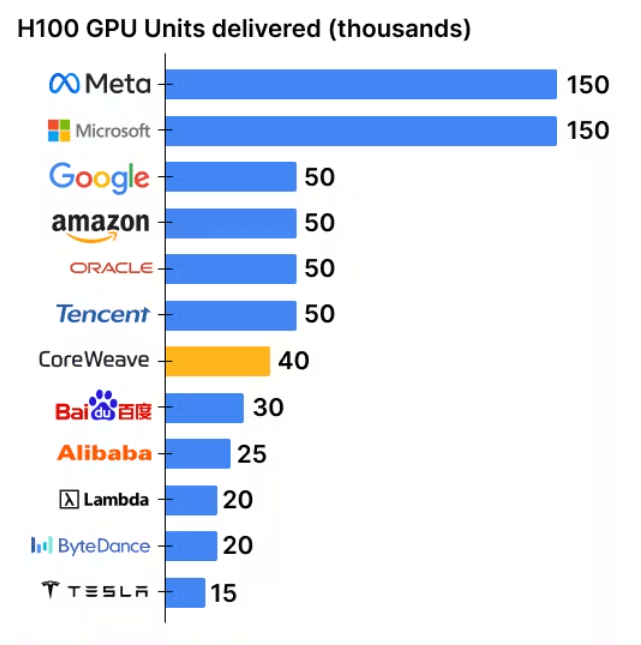

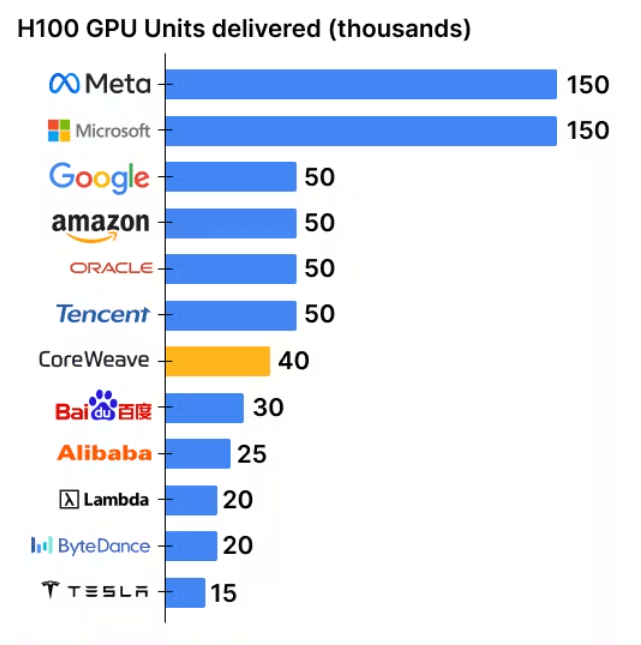

The cloud computing industry is dynamic, influenced by several key trends impacting CoreWeave stock. The burgeoning adoption of Artificial Intelligence (AI) and the increasing demand for GPU computing power are particularly significant. CoreWeave's focus on providing GPU-accelerated cloud services positions it well to capitalize on these trends. However, increased competition and potential regulatory changes are also factors to consider.

- Specific examples of industry trends: The rise of generative AI models, requiring immense computational power, directly benefits companies like CoreWeave. Increased demand for high-performance computing in fields like scientific research and financial modeling also creates significant opportunities.

- Analysis of how these trends create opportunities or challenges for CoreWeave: The high demand for GPU computing presents a huge growth opportunity, but maintaining sufficient capacity and staying ahead of the competition in terms of innovation are crucial challenges.

- Discussion of the competitive landscape and CoreWeave's strategic response: Analyzing CoreWeave's competitive advantages, such as specialized infrastructure or unique partnerships, helps gauge its ability to withstand competition from established giants and new entrants.

H2: Analyst Ratings and Predictions for CoreWeave Stock

Analyst ratings provide valuable insights into market sentiment towards CoreWeave stock. Examining recent ratings from reputable financial institutions, including their price targets and rationale, offers a broader perspective. However, it's crucial to remember that these are predictions, not guarantees.

- List of major financial institutions and their ratings: (This section would list major investment banks and their respective ratings – Buy, Hold, Sell – along with the date of the rating).

- Price target ranges and their respective time horizons: (Include the range of price targets given by analysts, including the time frame for these predictions).

- Summary of the key arguments supporting each rating: (Summarize the key factors driving each rating, whether it’s positive growth projections, concerns about competition, or other relevant factors).

H2: Risk Factors and Potential Challenges for CoreWeave

Despite its potential, CoreWeave faces several challenges that could impact its stock price. These include intense competition from established players, potential regulatory hurdles in data privacy and security, and the ever-present risk of an economic downturn affecting cloud computing spending.

- Specific risks and challenges with detailed explanations: The competitive landscape is fierce. Maintaining a competitive edge requires continuous innovation and efficient cost management. Regulatory compliance adds another layer of complexity and potential expense. Economic downturns can reduce enterprise spending on cloud services.

- Potential impact on financial performance and stock valuation: These risks could negatively affect CoreWeave's revenue growth, profitability, and ultimately, its stock valuation.

- Proposed mitigation strategies and their effectiveness: CoreWeave's response to these challenges, such as strategic partnerships, investment in R&D, or cost-cutting measures, will be critical to its future success.

3. Conclusion: Investing in CoreWeave Stock – A Final Assessment

Our analysis of recent developments in CoreWeave stock reveals a company with significant growth potential in a rapidly expanding market. While the positive trends in AI adoption and GPU computing present opportunities, investors must carefully consider the competitive pressures and potential economic headwinds. The overall trend remains cautiously optimistic, but further due diligence is necessary. Therefore, further research into CoreWeave stock is advised before making any investment decisions. Stay informed on CoreWeave stock developments and consult with a financial advisor before committing capital.

Featured Posts

-

Understanding Cassis Blackcurrant From Berry To Bottle

May 22, 2025

Understanding Cassis Blackcurrant From Berry To Bottle

May 22, 2025 -

How Original Sins Ending Highlights Dexters Failure With Debra Morgan

May 22, 2025

How Original Sins Ending Highlights Dexters Failure With Debra Morgan

May 22, 2025 -

The Enduring Appeal Of Little Britain To Gen Z

May 22, 2025

The Enduring Appeal Of Little Britain To Gen Z

May 22, 2025 -

Discover The Ultimate Hot Weather Drink

May 22, 2025

Discover The Ultimate Hot Weather Drink

May 22, 2025 -

Trans Australia Run A New Record On The Horizon

May 22, 2025

Trans Australia Run A New Record On The Horizon

May 22, 2025

Latest Posts

-

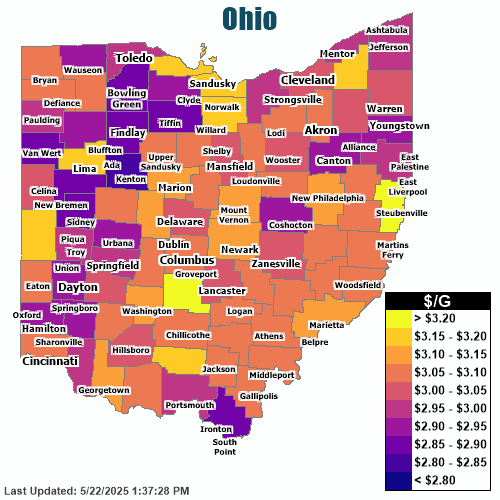

Wide Gas Price Range In Columbus 2 83 3 31 Gallon

May 22, 2025

Wide Gas Price Range In Columbus 2 83 3 31 Gallon

May 22, 2025 -

Solve Nyt Wordle 1368 March 18 Hints And The Answer

May 22, 2025

Solve Nyt Wordle 1368 March 18 Hints And The Answer

May 22, 2025 -

Columbus Gas Station Prices Vary By 48 Cents

May 22, 2025

Columbus Gas Station Prices Vary By 48 Cents

May 22, 2025 -

Wordle 367 March 17th Hints Clues And Answer

May 22, 2025

Wordle 367 March 17th Hints Clues And Answer

May 22, 2025 -

Columbus Gas Prices 2 83 To 3 31 Per Gallon

May 22, 2025

Columbus Gas Prices 2 83 To 3 31 Per Gallon

May 22, 2025