BP Executive Compensation: A Significant 31% Decrease

Table of Contents

Reasons Behind the 31% Decrease in BP Executive Compensation

Several interconnected factors contributed to the remarkable 31% reduction in BP executive compensation. Let's examine the key drivers:

Impact of the Global Energy Market Volatility

The global energy market has experienced unprecedented volatility in recent years. Fluctuating oil prices, driven by geopolitical instability and the accelerating renewable energy transition, have significantly impacted BP's profitability.

- Oil Price Volatility: Sharp drops in oil prices directly affect BP's revenue and profitability, impacting the overall compensation pool available for executives.

- Geopolitical Risk: Events such as the war in Ukraine have created significant uncertainty and disruption, influencing BP's operational efficiency and financial performance, thus affecting executive bonuses.

- Renewable Energy Transition: BP's strategic shift towards renewable energy sources, while crucial for long-term sustainability, involves significant upfront investments and may yield lower short-term returns, potentially influencing executive compensation tied to short-term financial metrics.

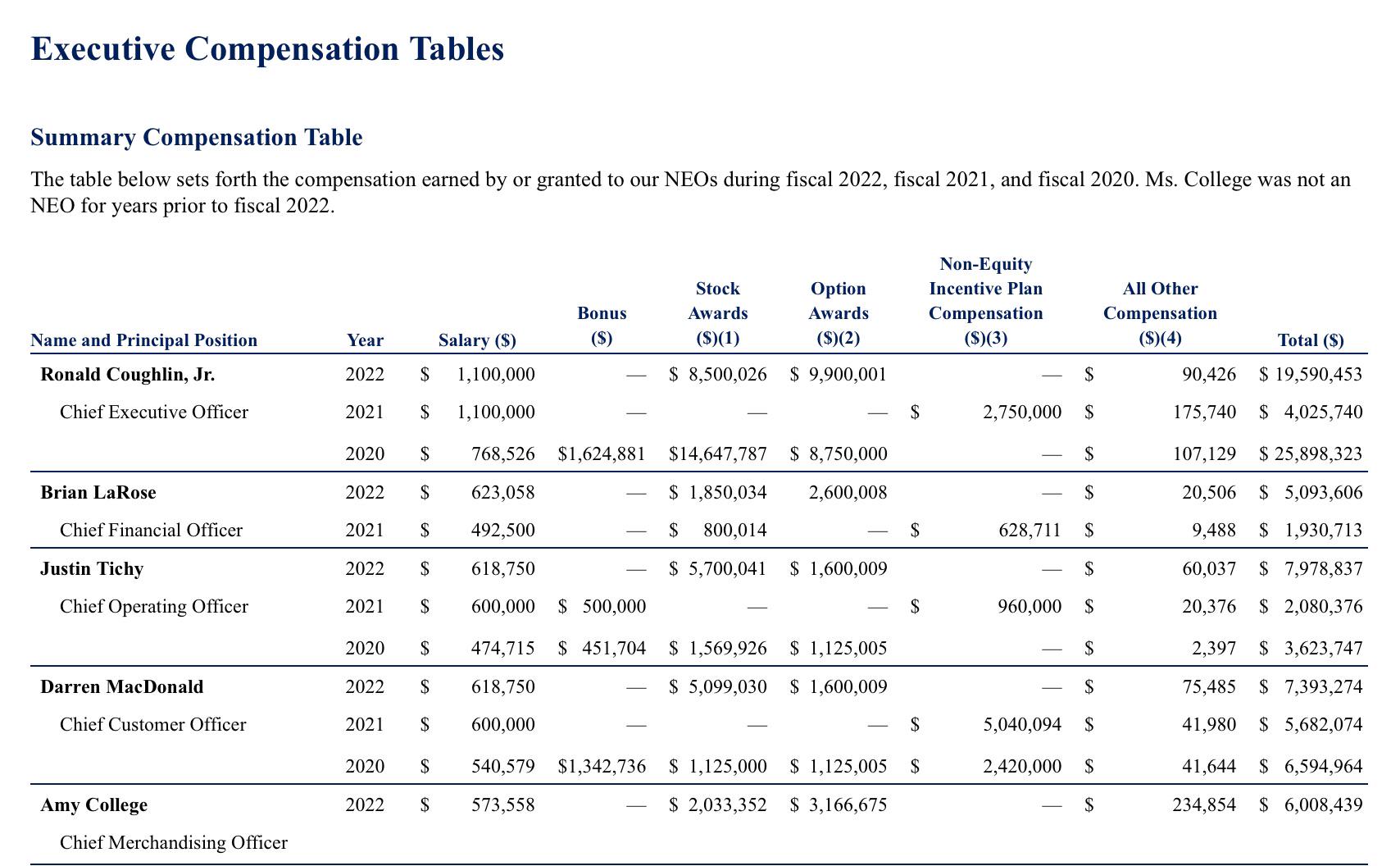

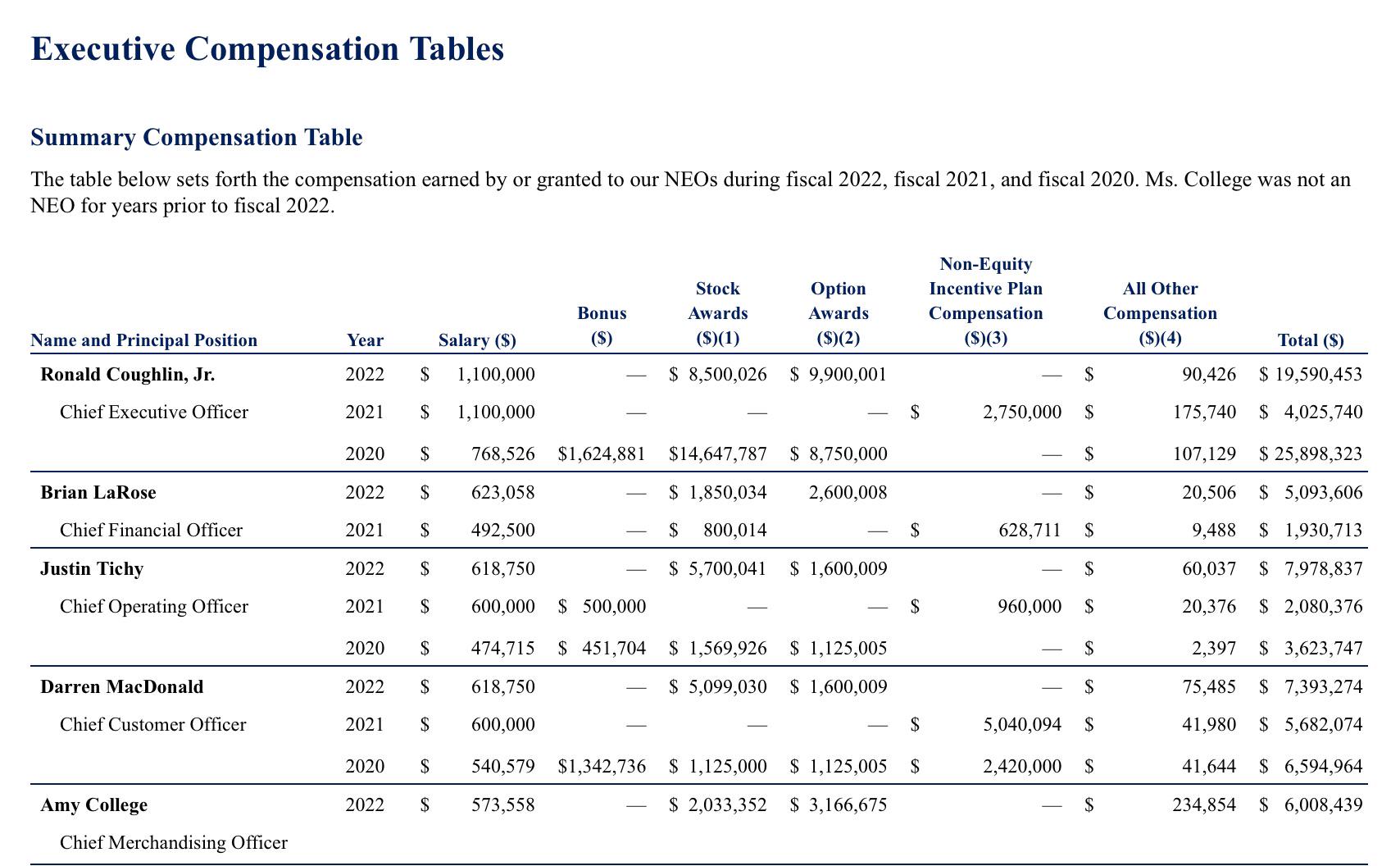

Data shows a strong correlation between oil price fluctuations and BP's annual profits. For example, [Insert data or a reference to a reliable source showing the correlation between oil prices and BP's financial performance]. This directly influenced the performance-based components of executive compensation packages.

BP's Performance and Strategic Goals

BP's financial performance in the relevant period played a significant role in the decrease in executive pay.

- BP Financial Performance: [Insert specific data on BP's financial performance, including revenue, profit margins, and return on equity, for the relevant period. Cite sources]. Lower-than-expected performance inevitably led to reduced bonuses and incentives for executives.

- Corporate Strategy: BP's strategic pivot towards renewable energy necessitates substantial investment and may have impacted short-term profitability, influencing decisions regarding executive compensation.

- Shareholder Activism: Shareholder pressure to reduce executive pay, especially in light of fluctuating market conditions and a focus on responsible investing (ESG factors), may have influenced the company's decisions.

- Cost-Cutting Measures: As part of a broader cost-cutting initiative, reductions in executive compensation may have been implemented to demonstrate a commitment to fiscal responsibility to stakeholders.

Key Performance Indicators (KPIs) such as revenue growth, operating margins, and return on capital employed likely fell short of targets, leading to a decrease in performance-based compensation.

Changes in BP's Compensation Structure

Beyond market factors and company performance, changes in BP's internal compensation structure also contributed to the reduction.

- Executive Bonus Schemes: The company likely adjusted its bonus schemes to be more closely tied to long-term, sustainable performance, rather than solely focusing on short-term financial results.

- Long-Term Incentives: Changes to long-term incentive plans, such as stock options and performance shares, might have reduced the overall payout to executives.

- Base Salary Adjustments: While less likely to be a significant factor, slight adjustments to base salaries might have played a minor role in the overall compensation reduction.

Implications of the Reduced BP Executive Compensation

The 31% decrease in BP executive compensation has wide-ranging implications:

Impact on Executive Retention and Talent Acquisition

Lower executive pay may pose challenges for BP.

- Executive Retention: The reduced compensation could impact BP's ability to retain high-performing executives, potentially leading to talent loss to competitors offering more lucrative packages.

- Talent Acquisition: Attracting top-tier talent in a competitive energy market could become more challenging with lower compensation packages, compared to industry benchmarks.

It's crucial to analyze whether this decrease aligns with compensation trends within the energy sector to determine the true impact on BP's ability to attract and retain talent.

Signaling to Investors and Stakeholders

This decrease sends a clear signal to investors and stakeholders.

- Investor Relations: The reduction might be seen as a sign of fiscal responsibility and a commitment to long-term value creation, potentially positively impacting investor sentiment.

- Corporate Governance: It may also reflect improvements in corporate governance, emphasizing alignment between executive compensation and company performance.

- Responsible Investing (ESG): The move could resonate positively with investors focused on Environmental, Social, and Governance (ESG) factors.

Broader Implications for the Energy Sector

This significant decrease in BP executive compensation might influence the wider energy industry.

- Energy Industry Trends: It may signal a broader shift towards more responsible executive compensation practices within the sector, influenced by market volatility and the need for long-term sustainability.

- Executive Pay Trends: The decision could potentially influence compensation strategies adopted by other energy companies, prompting a reevaluation of executive pay structures.

Conclusion: Understanding the Significance of the Reduced BP Executive Compensation

The 31% decrease in BP executive compensation is a multifaceted issue stemming from a confluence of global energy market volatility, BP's strategic shifts, and changes in its internal compensation structure. The implications are significant, affecting talent retention, investor relations, and potentially setting a precedent for the broader energy sector. Further research into BP executive compensation, including analysis of BP's annual reports and financial statements, is crucial for a more comprehensive understanding of this important development. Understanding the nuances of BP executive pay and its correlation with the company's overall performance is vital for investors and industry observers alike.

Featured Posts

-

Irish Actor Barry Ward An Interview On Roles And Perceptions

May 22, 2025

Irish Actor Barry Ward An Interview On Roles And Perceptions

May 22, 2025 -

Nederlandse Bankieren Vereenvoudigd Een Praktische Handleiding Voor Tikkie

May 22, 2025

Nederlandse Bankieren Vereenvoudigd Een Praktische Handleiding Voor Tikkie

May 22, 2025 -

Abn Amro Analyse Van De Stijgende Occasionmarkt

May 22, 2025

Abn Amro Analyse Van De Stijgende Occasionmarkt

May 22, 2025 -

Manchester Citys Next Manager Could An Arsenal Legend Replace Pep Guardiola

May 22, 2025

Manchester Citys Next Manager Could An Arsenal Legend Replace Pep Guardiola

May 22, 2025 -

National Treasure Trafficking Antiques Roadshow Episode Ends In Arrest

May 22, 2025

National Treasure Trafficking Antiques Roadshow Episode Ends In Arrest

May 22, 2025

Latest Posts

-

Antiques Roadshow Couples Appraisal Results In Serious Charges

May 22, 2025

Antiques Roadshow Couples Appraisal Results In Serious Charges

May 22, 2025 -

National Treasure Trafficking Antiques Roadshow Episode Ends In Arrest

May 22, 2025

National Treasure Trafficking Antiques Roadshow Episode Ends In Arrest

May 22, 2025 -

Antiques Roadshow Stolen Goods Discovery Leads To Arrests

May 22, 2025

Antiques Roadshow Stolen Goods Discovery Leads To Arrests

May 22, 2025 -

Antiques Roadshow Couple Arrested After National Treasure Appraisal

May 22, 2025

Antiques Roadshow Couple Arrested After National Treasure Appraisal

May 22, 2025 -

Appraisal On Antiques Roadshow Results In Jail Sentences

May 22, 2025

Appraisal On Antiques Roadshow Results In Jail Sentences

May 22, 2025