Impact Of Economic Slowdown: SSE Cuts Spending By £3 Billion

Table of Contents

Reasons Behind SSE's Spending Cuts

SSE's dramatic £3 billion spending cut is a direct response to a confluence of factors stemming from the ongoing economic slowdown.

Inflation and Increased Costs

Soaring inflation has significantly increased the cost of essential resources for SSE's operations. This includes:

- Rising interest rates: Higher borrowing costs make financing new projects considerably more expensive.

- Supply chain disruptions: Global supply chain issues lead to delays and increased prices for essential materials.

- Increased fuel prices: The volatile global energy market has driven up the cost of fuel needed for energy generation, impacting profitability and making renewable energy projects more challenging to finance.

These factors directly affect SSE's operational costs and profitability, squeezing margins and necessitating a reduction in expenditure. The impact is particularly acute for large-scale renewable energy projects, which often require significant upfront investment.

Reduced Consumer Demand

The economic slowdown has also led to decreased energy consumption by both households and businesses. This is primarily due to:

- Higher energy bills: The cost-of-living crisis has forced consumers to cut back on energy usage to manage household budgets.

- Cost-of-living crisis: Reduced disposable income limits consumer spending across the board, including energy consumption.

- Reduced industrial activity: Economic uncertainty leads to decreased industrial production, impacting energy demand from businesses.

Lower demand directly impacts SSE's revenue projections, further exacerbating the need for aggressive spending cuts. The company is clearly responding to a shrinking market and a need to maintain financial stability in a challenging environment.

Investor Sentiment and Market Uncertainty

The current economic slowdown has created significant uncertainty in the energy sector, impacting investor confidence. This includes:

- Volatile energy markets: Fluctuating energy prices create uncertainty about future profitability.

- Concerns about future profitability: Investors are hesitant to commit capital in a climate of economic uncertainty.

- Potential for further interest rate hikes: The anticipation of further interest rate increases adds to the financial risk for investors.

This uncertainty is a key factor influencing SSE's investment decisions. The need to conserve capital and maintain a strong financial position in the face of market volatility is driving the spending cuts.

Impact on SSE's Operations and Future Plans

The £3 billion spending cut will have a profound impact on SSE's operations and future plans.

Project Delays and Cancellations

SSE has already announced delays and cancellations of several key projects due to the spending cuts. These include:

- Renewable energy projects: Several planned wind and solar farms are likely to be delayed or scrapped, impacting the UK's renewable energy targets.

- Network upgrades: Essential infrastructure upgrades may be postponed, potentially affecting the reliability and resilience of the energy grid.

- Other significant investments: Other capital-intensive projects, crucial for long-term growth, are also likely to be impacted.

The estimated cost savings from these cancellations will provide short-term financial relief, but the long-term consequences for SSE's growth and sustainability goals are yet to be fully determined.

Job Security and Employment

The spending cuts raise concerns about job security within SSE and related industries. Potential consequences include:

- Potential job losses: Staff reductions are a likely consequence of reduced investment and project cancellations.

- Restructuring: The company might undergo a significant restructuring to streamline operations and reduce costs.

- Impact on contractors and subcontractors: Reduced investment will inevitably affect companies working with SSE, potentially resulting in job losses across the supply chain.

SSE has yet to release a full statement on the impact on its workforce, but the magnitude of the spending cuts suggests significant consequences are inevitable.

Long-Term Strategic Implications

The current short-term cost-cutting strategy may have significant long-term consequences for SSE's growth and sustainability:

- Impact on renewable energy targets: Delayed or canceled renewable energy projects hinder the UK's transition to cleaner energy sources.

- Ability to compete in the market: Reduced investment could impact SSE's ability to compete with other energy providers in the long run.

- Potential loss of market share: Delayed innovation and infrastructure upgrades might lead to a decline in market share.

The £3 billion spending cut may be a temporary measure to navigate the immediate challenges of the economic slowdown, but it also signals a potential shift in SSE's long-term strategy.

Wider Implications for the UK Economy

The impact of SSE's decision extends beyond the company itself, influencing the UK economy as a whole.

Impact on Energy Security

Reduced investment in energy infrastructure and renewable energy projects has serious implications for the UK's energy security:

- Increased reliance on fossil fuels: Delays in renewable energy development may lead to increased dependence on fossil fuels, impacting climate goals.

- Potential for energy shortages: Inadequate investment in grid infrastructure could increase vulnerability to energy shortages during peak demand periods.

- Vulnerability to global price fluctuations: Dependence on imported fossil fuels exposes the UK to global price volatility and potential supply disruptions.

The government's response to the situation and any potential policy adjustments will play a crucial role in mitigating these risks.

Ripple Effect on Related Industries

SSE's spending cuts create a ripple effect across various related industries:

- Impact on construction: Reduced investment in energy infrastructure projects will affect the construction sector, potentially leading to job losses and reduced economic activity.

- Impact on manufacturing: Decreased demand for equipment and materials from energy projects will impact manufacturing businesses.

- Impact on other sectors supplying SSE: The reduction in spending will affect numerous businesses along SSE's supply chain.

The consequences extend beyond job losses and directly impact economic activity across several related sectors.

Conclusion

SSE's £3 billion spending cut, a direct consequence of the ongoing economic slowdown, highlights the severe challenges facing the UK energy sector. Reduced consumer demand, soaring inflation, and investor uncertainty have forced the company to prioritize short-term financial stability, potentially at the expense of long-term growth and sustainability. The impact extends far beyond SSE, affecting the UK's energy security and creating a ripple effect across various related industries. The magnitude of this spending cut serves as a stark warning of the broader economic challenges facing the nation.

Call to Action: Stay informed about the evolving situation and the ongoing impact of the economic slowdown on energy providers and businesses across the UK. Follow our updates for further analysis on the effects of the economic slowdown on the energy sector and learn how companies like SSE are navigating this challenging period of spending cuts.

Featured Posts

-

Abn Amro Ziet Occasionverkoop Flink Toenemen Groeiend Autobezit Als Drijfveer

May 22, 2025

Abn Amro Ziet Occasionverkoop Flink Toenemen Groeiend Autobezit Als Drijfveer

May 22, 2025 -

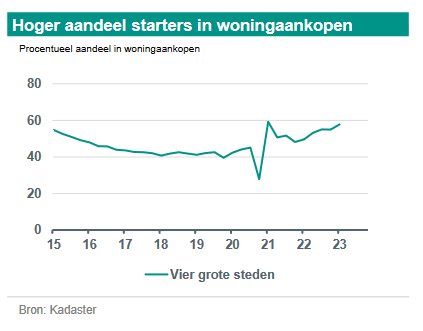

Abn Amro Huizenprijzen En Rente De Laatste Voorspellingen

May 22, 2025

Abn Amro Huizenprijzen En Rente De Laatste Voorspellingen

May 22, 2025 -

Tory Councillors Wife Loses Appeal After Migrant Rant Following Southport Attack

May 22, 2025

Tory Councillors Wife Loses Appeal After Migrant Rant Following Southport Attack

May 22, 2025 -

Peppa Pig Welcomes A Baby Sister Its A Girl

May 22, 2025

Peppa Pig Welcomes A Baby Sister Its A Girl

May 22, 2025 -

Dexter New Blood Blu Ray Steelbook Release Everything You Need To Know Before Dexter Resurrection

May 22, 2025

Dexter New Blood Blu Ray Steelbook Release Everything You Need To Know Before Dexter Resurrection

May 22, 2025

Latest Posts

-

Blake Lively And The Hadid Swift Feud Family Support In The Spotlight

May 22, 2025

Blake Lively And The Hadid Swift Feud Family Support In The Spotlight

May 22, 2025 -

Blake Lively Alleged Controversies And Speculations

May 22, 2025

Blake Lively Alleged Controversies And Speculations

May 22, 2025 -

The Blake Lively Alleged Incident A Comprehensive Overview Bored Panda

May 22, 2025

The Blake Lively Alleged Incident A Comprehensive Overview Bored Panda

May 22, 2025 -

Blake Lively Iced Out Sisters Rally Around Amidst A List Falling Out

May 22, 2025

Blake Lively Iced Out Sisters Rally Around Amidst A List Falling Out

May 22, 2025 -

Recent Allegations About Blake Lively What We Know Bored Panda

May 22, 2025

Recent Allegations About Blake Lively What We Know Bored Panda

May 22, 2025