Stock Market Uncertainty: Strategies For Long-Term Investment Success

Table of Contents

Understanding Stock Market Volatility

The Nature of Market Fluctuations

The stock market is inherently cyclical, swinging between periods of growth (bull markets) and decline (bear markets). These fluctuations are influenced by a complex interplay of economic cycles, geopolitical events, and investor sentiment. Understanding this inherent volatility is crucial for long-term success.

- Inflation: Rising inflation erodes purchasing power and can lead to interest rate hikes, impacting stock valuations.

- Interest Rate Hikes: Increased interest rates make borrowing more expensive, potentially slowing economic growth and impacting corporate profits.

- Global Crises: Geopolitical instability, wars, or pandemics can trigger significant market downturns.

- Unexpected Economic Data: The release of unexpectedly poor economic data can trigger sell-offs, increasing stock market uncertainty.

Understanding your own risk tolerance is paramount. Are you comfortable with potential short-term losses in pursuit of long-term gains? This self-assessment is key to developing a suitable investment strategy.

Identifying Market Trends

While predicting short-term market movements is notoriously unreliable, analyzing market trends using technical and fundamental analysis can inform long-term investment decisions.

- Technical Analysis: This involves studying price charts and trading volume to identify patterns and predict future price movements. Common tools include moving averages, relative strength index (RSI), and chart patterns. However, remember that technical analysis alone is insufficient for sound investment decisions.

- Fundamental Analysis: This focuses on evaluating the intrinsic value of a company by examining its financial statements, management quality, competitive landscape, and industry trends. Fundamental analysis provides a more long-term perspective.

Focusing on the long-term health and prospects of companies, rather than daily price fluctuations, is a crucial aspect of mitigating stock market uncertainty.

Diversification: Spreading Your Risk

Asset Allocation

Diversification is a cornerstone of successful long-term investing. It involves spreading your investments across different asset classes to reduce the impact of any single asset's poor performance.

- Stocks: Offer the potential for high returns but also carry higher risk.

- Bonds: Generally less volatile than stocks, offering a more stable income stream.

- Real Estate: Can provide diversification and inflation hedge, but requires significant capital and active management.

- Commodities: Offer diversification but can be highly volatile.

A well-diversified portfolio might include a mix of stocks, bonds, and possibly real estate or other asset classes, tailored to your risk tolerance and financial goals. Mutual funds and exchange-traded funds (ETFs) offer convenient ways to achieve diversification.

Geographic Diversification

Don't put all your eggs in one basket – geographically speaking! Investing in international markets reduces your dependence on a single economy.

- Reduced Country-Specific Risk: Events impacting one country may not affect others in the same way. Global diversification helps mitigate this risk.

- Access to Higher Growth Potential: Emerging markets often offer higher growth potential, albeit with increased risk.

International diversification provides exposure to a wider range of investment opportunities and can enhance the overall return of your portfolio while mitigating stock market uncertainty.

Long-Term Investing Strategies

Dollar-Cost Averaging (DCA)

Dollar-cost averaging (DCA) involves investing a fixed amount of money at regular intervals, regardless of market fluctuations.

- Mitigates Market Timing Risk: You avoid the difficulty of trying to time the market perfectly.

- Reduces Emotional Decision-Making: DCA takes the emotion out of investing.

For example, investing $100 per month consistently buys more shares when prices are low and fewer shares when prices are high, averaging out the cost over time.

Value Investing

Value investing focuses on identifying undervalued companies and purchasing their shares at a price below their intrinsic value.

- Thorough Research is Crucial: This requires patience and diligent research to uncover hidden gems.

- Long-Term Perspective: Value investing is a long-term strategy that requires patience to reap the rewards.

Identifying undervalued companies involves examining their financial statements, competitive advantages, and future growth prospects.

Ignoring Short-Term Noise

Short-term market fluctuations are inevitable. Focus on your long-term goals and avoid emotional reactions to daily price changes.

- Avoid Panic Selling: Market downturns are opportunities to buy more shares at lower prices if your investment thesis remains sound.

- Stay Disciplined: Stick to your investment plan, even during periods of market uncertainty.

Seeking Professional Advice

Financial Advisors

A qualified financial advisor can provide personalized guidance and support to navigate stock market uncertainty.

- Tailored Investment Strategies: Advisors create portfolios aligned with your specific financial goals, risk tolerance, and time horizon.

- Objective Perspective: They offer an objective viewpoint, helping you make rational investment decisions.

Choosing a qualified and reputable financial advisor is crucial for building a strong financial future.

Conclusion

Stock market uncertainty is a constant, but by understanding market dynamics, diversifying your investments, and adopting a long-term perspective, you can significantly improve your chances of achieving long-term investment success. Remember to consider your risk tolerance, utilize strategies like dollar-cost averaging and value investing, and don't hesitate to seek professional advice. By proactively managing your investments and maintaining a disciplined approach, you can navigate stock market uncertainty and build a strong financial future. Start planning your long-term investment strategy today and overcome stock market uncertainty.

Featured Posts

-

Our Great Yorkshire Life A Comprehensive Guide

Apr 25, 2025

Our Great Yorkshire Life A Comprehensive Guide

Apr 25, 2025 -

Ftc Challenges Court Ruling On Microsofts Activision Acquisition

Apr 25, 2025

Ftc Challenges Court Ruling On Microsofts Activision Acquisition

Apr 25, 2025 -

Eurovision 2025 Early Predictions And Top Contenders

Apr 25, 2025

Eurovision 2025 Early Predictions And Top Contenders

Apr 25, 2025 -

Hudsons Bays Liquidation What The Court Documents Show

Apr 25, 2025

Hudsons Bays Liquidation What The Court Documents Show

Apr 25, 2025 -

War Heros Anzac Day Outrage School Snub And National Future Concerns

Apr 25, 2025

War Heros Anzac Day Outrage School Snub And National Future Concerns

Apr 25, 2025

Latest Posts

-

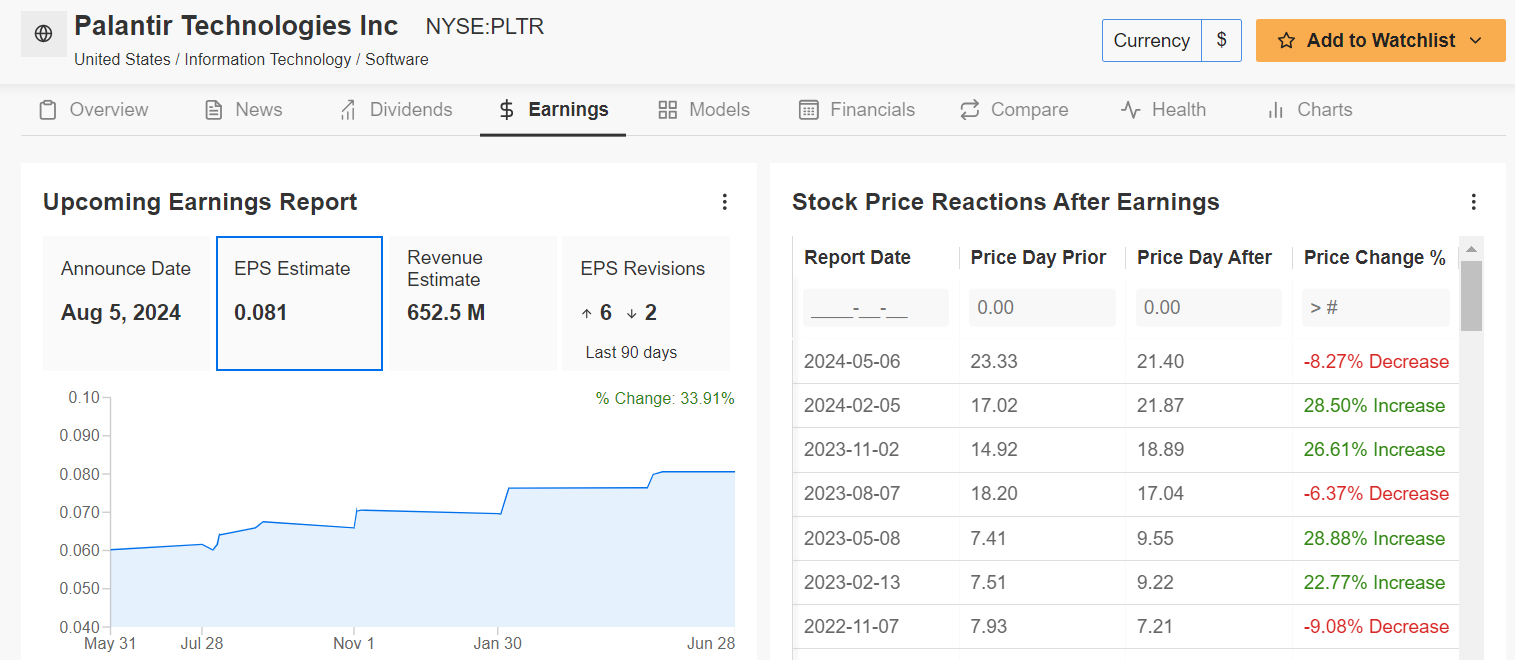

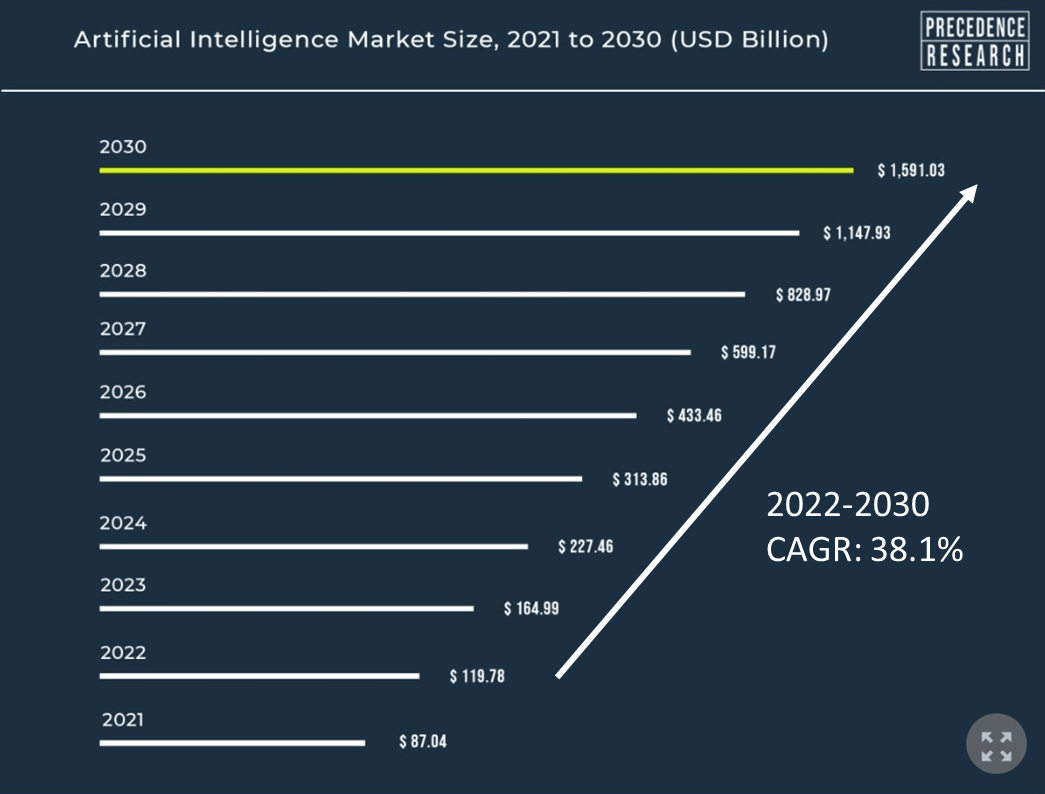

Should You Buy Palantir Stock Before May 5 A Pre Earnings Analysis

May 10, 2025

Should You Buy Palantir Stock Before May 5 A Pre Earnings Analysis

May 10, 2025 -

Should You Buy Palantir Before May 5th A Data Driven Approach

May 10, 2025

Should You Buy Palantir Before May 5th A Data Driven Approach

May 10, 2025 -

Investing In Palantir Stock A Look Ahead To May 5th

May 10, 2025

Investing In Palantir Stock A Look Ahead To May 5th

May 10, 2025 -

Pre May 5th Palantir Stock Evaluation Is It A Good Buy

May 10, 2025

Pre May 5th Palantir Stock Evaluation Is It A Good Buy

May 10, 2025 -

Analyzing Palantir Stock Should You Invest Before May 5th

May 10, 2025

Analyzing Palantir Stock Should You Invest Before May 5th

May 10, 2025