Should You Buy Palantir Stock Before May 5? A Pre-Earnings Analysis

Table of Contents

Keywords: Palantir stock, Palantir earnings, PLTR stock, Palantir investment, buy Palantir stock, Palantir stock price prediction, Palantir May 5 earnings, pre-earnings analysis Palantir, Palantir Technologies

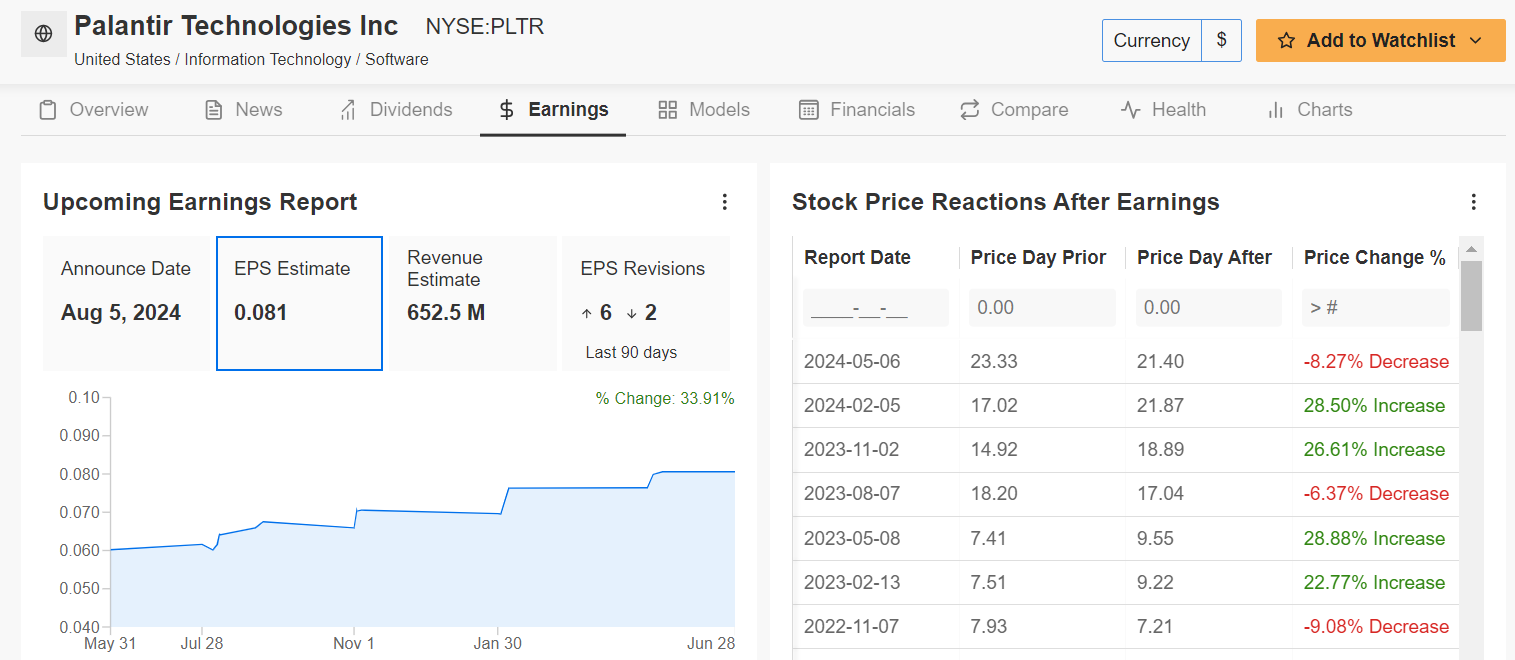

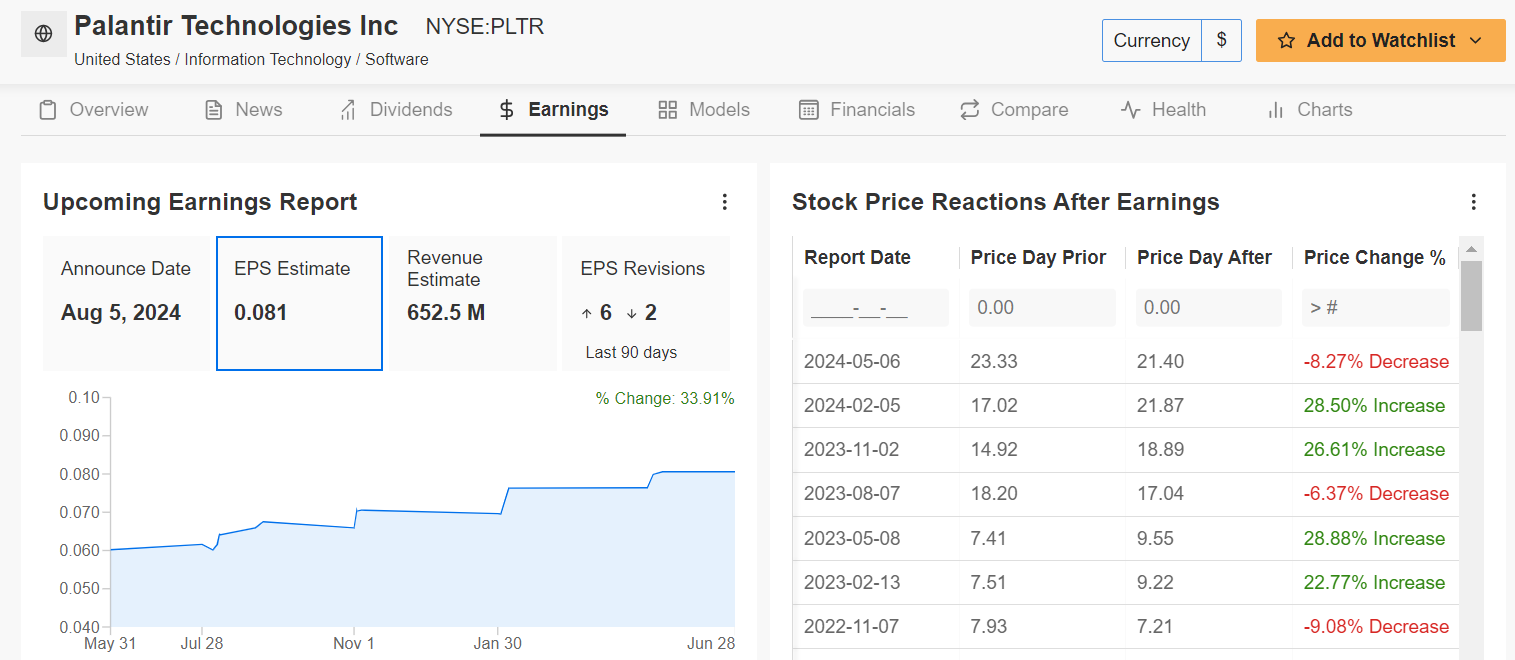

Palantir Technologies (PLTR) is a data analytics company known for its powerful software platforms. With its earnings announcement looming on May 5th, many investors are asking: should you buy Palantir stock before the big reveal? This pre-earnings analysis examines recent performance, future prospects, and inherent risks to help you make an informed decision about whether to invest in PLTR stock.

Palantir's Recent Performance and Key Metrics

Analyzing Palantir's recent performance is crucial before considering a purchase. We need to look beyond the headline numbers and dig into the details of their quarterly and annual reports. Key metrics such as revenue growth, net income (or loss), and operating margins paint a clearer picture.

- Government Contracts: Palantir’s government contracts have historically been a significant revenue driver. Analyzing the size and duration of these contracts, as well as any new wins or renewals, is vital for understanding future revenue streams. A decline in government spending could negatively impact PLTR stock price.

- Commercial Growth: Palantir's commercial business segment is a key area of focus for investors. Growth in this area demonstrates the broader applicability and market acceptance of its platforms beyond government clients. Examining the rate of customer acquisition and the average contract value provides insights into the health of this segment.

- Key Performance Indicators (KPIs): Beyond revenue, examining KPIs like operating margins, customer churn rate, and research and development spending will reveal Palantir's efficiency and future growth potential. Strong margins suggest profitability and sustainability.

- Competitor Comparison: Comparing Palantir's performance to its competitors in the data analytics and AI sectors is also essential. This helps assess its competitive positioning and market share. Are they outperforming or lagging behind rivals like Snowflake or Datadog?

Analyzing Palantir's Future Projections and Growth Potential

Palantir's future projections and growth potential are central to any investment decision. The company's guidance for the upcoming quarter and fiscal year, including projected revenue and earnings, will be closely scrutinized by investors.

- AI Integration: Palantir is aggressively pursuing opportunities in the rapidly expanding Artificial Intelligence market. The success of their AI-driven solutions will be a key determinant of future growth. Investors should analyze how effectively they're integrating AI into their existing platforms and developing new AI-focused products.

- Market Opportunity: The addressable market for data analytics and AI solutions is vast. Assessing Palantir's ability to capture a significant share of this market is crucial. Analyzing their market penetration and expansion strategies is vital.

- Growth Risks: Despite the potential, Palantir faces risks. Intense competition, economic downturns impacting customer spending, and the potential for delays in large contract implementations can all impact their trajectory. Understanding these risks is critical for informed investing.

Evaluating the Risks Associated with Investing in Palantir Stock Before Earnings

Investing in Palantir stock before earnings carries inherent risks. The stock is known for its volatility, meaning its price can fluctuate significantly in response to news and market sentiment.

- Earnings Miss: A disappointing earnings report could trigger a sharp decline in the Palantir stock price. Investors must consider the potential for a negative earnings surprise and its impact on their investment.

- Macroeconomic Factors: Broader economic conditions also influence Palantir's stock. A recession or economic slowdown could negatively impact customer spending and the demand for its services. Understanding macroeconomic trends is crucial.

- Government Contract Dependence: Palantir’s reliance on government contracts presents a specific risk. Changes in government policy or budget cuts could affect revenue streams. Diversification of revenue streams is something to consider.

- Portfolio Diversification: To mitigate risk, diversification is key. Don't put all your eggs in one basket. Spreading investments across different asset classes reduces overall risk.

Considering Alternative Investment Strategies

Before investing solely in Palantir, consider alternative options within the data analytics or technology sector. This provides a broader perspective and helps evaluate the risk/reward profile of PLTR stock.

- Competitor Stocks: Compare Palantir's growth prospects and valuation to those of its competitors, such as Snowflake (SNOW) or Datadog (DDOG). This comparative analysis allows for a more informed investment decision.

- Market Outlook: Consider the broader market outlook. Is the technology sector as a whole expected to grow or contract? This will influence the performance of Palantir and other tech stocks.

- Investment Horizons: Define your investment horizon. Are you a long-term investor or are you focused on short-term gains? This affects your tolerance for risk and volatility.

Conclusion

Deciding whether to buy Palantir stock before May 5th requires careful consideration of its recent performance, future projections, and associated risks. While Palantir operates in a high-growth sector with significant potential, its volatility and dependence on specific contracts warrant caution. This pre-earnings analysis highlights key factors to evaluate, but it's crucial to conduct your own thorough due diligence. Remember, this analysis is not financial advice. Before making a decision on whether to buy Palantir stock, conduct your own thorough research and consider consulting with a financial advisor. Remember to carefully analyze the Palantir earnings report on May 5th and adjust your investment strategy accordingly. Learn more about how to properly assess Palantir stock before investing.

Featured Posts

-

Stock Market Gains Sensex Nifty Performance And Top Movers

May 10, 2025

Stock Market Gains Sensex Nifty Performance And Top Movers

May 10, 2025 -

Jeanine Pirro And The Controversy Surrounding Her Us Attorney Nomination For Dc

May 10, 2025

Jeanine Pirro And The Controversy Surrounding Her Us Attorney Nomination For Dc

May 10, 2025 -

Elon Musks Net Worth Below 300 Billion After Tesla Slump And Tariff Issues

May 10, 2025

Elon Musks Net Worth Below 300 Billion After Tesla Slump And Tariff Issues

May 10, 2025 -

The Impact Of Trumps Executive Orders On The Transgender Community Personal Stories

May 10, 2025

The Impact Of Trumps Executive Orders On The Transgender Community Personal Stories

May 10, 2025 -

Njwm Krt Alqdm Waltbgh Drast Fy Altnaqd

May 10, 2025

Njwm Krt Alqdm Waltbgh Drast Fy Altnaqd

May 10, 2025