Should You Buy Palantir Before May 5th? A Data-Driven Approach

Table of Contents

- Palantir's Recent Financial Performance and Growth Trajectory

- Analyzing Key Performance Indicators (KPIs)

- Upcoming Catalysts and Potential Market Drivers for Palantir

- The Role of Artificial Intelligence in Palantir's Future Growth

- Evaluating the Risks Associated with Investing in Palantir

- Understanding Market Sentiment and Investor Expectations

- A Data-Driven Conclusion: Should You Buy Before May 5th?

- Conclusion

Palantir's Recent Financial Performance and Growth Trajectory

Analyzing Palantir's recent financial performance is crucial for any investment decision. Keywords like "Palantir financials," "PLTR revenue," and "Palantir earnings" are key to understanding its trajectory.

-

Analyzing Recent Quarterly Earnings Reports: Palantir's recent quarterly earnings reports reveal valuable insights into its financial health. We need to look beyond headline numbers and delve into the details: revenue growth, profitability (or lack thereof), and key performance indicators (KPIs). Consistent and substantial revenue growth is a positive signal, while improving profitability indicates efficient operations and a sustainable business model.

-

Expanding Customer Base and Market Penetration: Palantir's success depends on its ability to expand its customer base and penetrate key markets. Its focus on government and commercial sectors represents a diversified approach, mitigating reliance on a single market segment. Examining the growth rate of its customer base in both sectors, as well as the size and nature of new contracts, provides crucial information on the company's trajectory.

-

Progress Towards Profitability and Long-Term Growth Projections: Palantir's path to profitability is a crucial aspect of its investment profile. Examining its operating margin and its projected long-term growth is essential. Positive adjustments in operating margins suggest efficient cost management and a strengthening business model, bolstering its long-term sustainability.

Analyzing Key Performance Indicators (KPIs)

Key performance indicators like revenue growth rate, operating margin, and customer acquisition cost offer a more nuanced understanding of Palantir's performance. A consistently high revenue growth rate indicates strong market demand and successful execution of its business strategy. A rising operating margin suggests improvements in efficiency and cost control. Finally, a low customer acquisition cost indicates effective sales and marketing strategies. Analyzing trends in these KPIs provides a deeper insight into Palantir's financial health and future potential.

Upcoming Catalysts and Potential Market Drivers for Palantir

Several potential catalysts could significantly impact Palantir's stock price. Examining these factors – including keywords like "Palantir catalysts," "PLTR future," "AI," and "government contracts" – is essential for a comprehensive assessment.

-

Upcoming Product Launches and Partnerships: New product releases and strategic partnerships can inject fresh momentum into Palantir's growth. Any significant advancements in its AI capabilities or expansion into new markets through strategic collaborations can drive substantial stock appreciation.

-

Increased Government Spending on Defense and Intelligence: Palantir's strong presence in the government sector makes it particularly sensitive to fluctuations in government spending. Increased defense and intelligence budgets can translate directly into increased demand for Palantir's data analytics solutions.

-

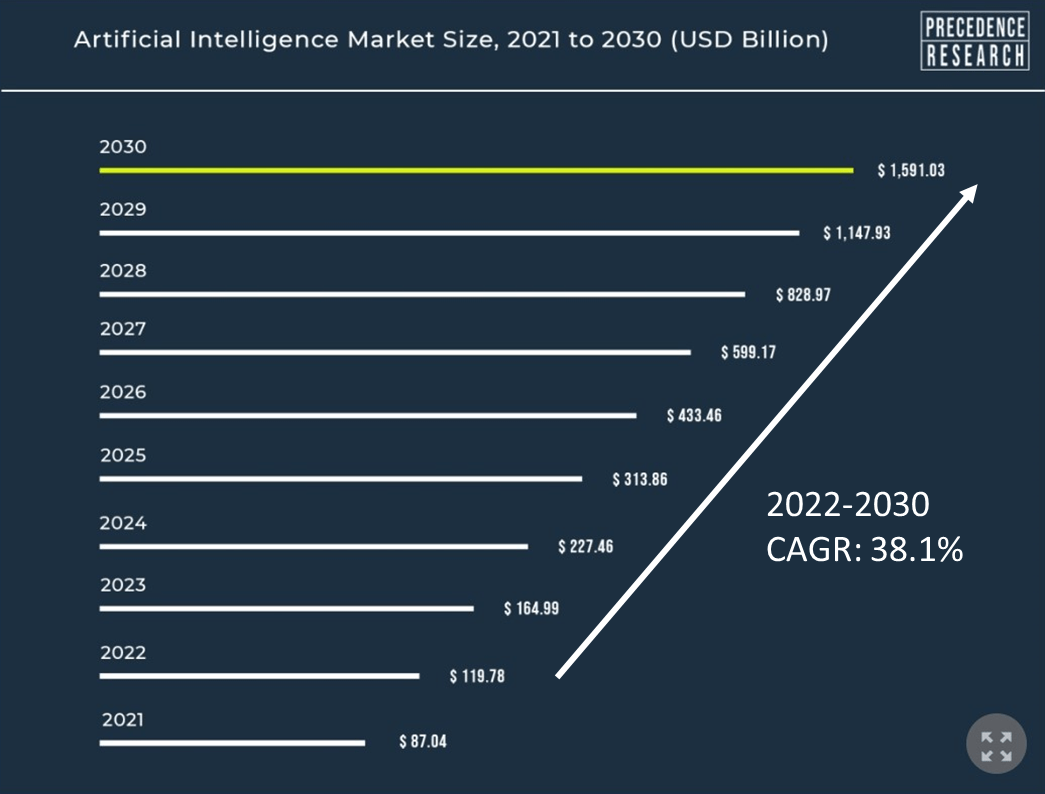

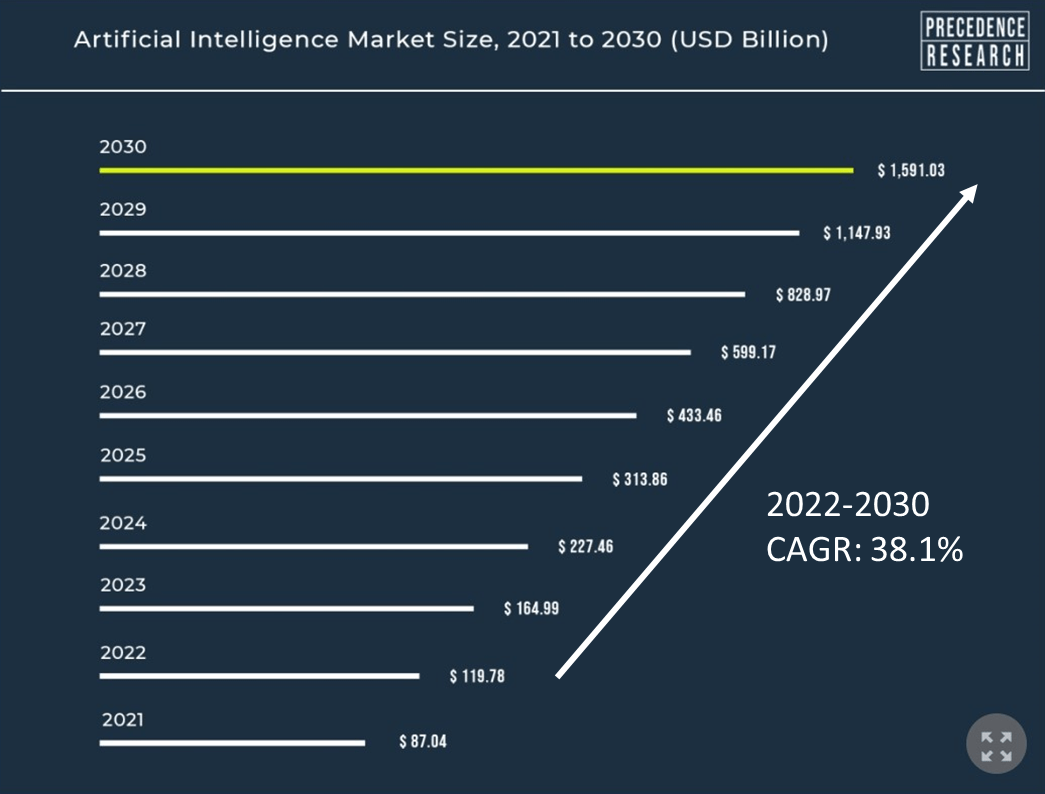

Growing Demand for AI and Data Analytics Solutions: The burgeoning demand for AI and data analytics across diverse industries presents significant growth opportunities for Palantir. Its ability to leverage these technologies to serve a wider range of clients will be a key determinant of its future success.

The Role of Artificial Intelligence in Palantir's Future Growth

Palantir's investment in artificial intelligence is a crucial factor influencing its long-term growth potential. Its AI capabilities offer a competitive advantage, allowing it to process vast amounts of data to extract valuable insights and deliver superior solutions to its clients. Analyzing its ongoing investments in AI research and development, and their integration into its existing products and services, is crucial.

Evaluating the Risks Associated with Investing in Palantir

Investing in Palantir carries inherent risks. Keywords such as "Palantir risks," "PLTR risks," and "investment risk" are central to understanding these potential downsides.

-

Competitive Landscape: The technology sector is highly competitive, and Palantir faces challenges from established tech giants and emerging startups. Analyzing the strength of its competitive advantages and potential disruptions from competitors is crucial.

-

Macroeconomic Factors: Broader economic conditions significantly influence investor sentiment and stock valuations. Economic downturns or uncertainties can lead to decreased demand for Palantir's services, impacting its revenue and profitability.

-

Regulatory Changes: Regulatory changes in the government and commercial sectors can significantly impact Palantir's operations and profitability. Any regulatory hurdles or changes in government policies could hinder its growth.

-

Volatility of the Technology Sector: The technology sector is known for its volatility. Investment in Palantir, as a growth stock, carries significant risk, and its price can fluctuate significantly based on market sentiment and company-specific news.

Understanding Market Sentiment and Investor Expectations

Gauging investor sentiment through news articles, analyst ratings, and social media sentiment can offer valuable insights into the market's perception of Palantir. Positive investor sentiment usually correlates with higher stock valuations, while negative sentiment can lead to price declines.

A Data-Driven Conclusion: Should You Buy Before May 5th?

Based on our analysis, determining whether to buy Palantir before May 5th requires a careful evaluation of the preceding points.

-

Summary of Key Findings: We've examined Palantir's recent financial performance, projected growth trajectory, potential catalysts, and inherent risks. The analysis considers various factors, including revenue growth, profitability, market competition, and regulatory landscape.

-

Recommendation: (This section requires an actual analysis of Palantir's current situation to provide a genuine recommendation - replace "Buy," "Hold," or "Sell" with the actual conclusion based on your research). Based on our analysis, the recommendation is to Hold. However, remember that market conditions can shift rapidly.

-

Caveats and Limitations: This analysis is based on publicly available information and current market conditions. Future performance cannot be guaranteed.

-

Independent Research: Always conduct your own thorough research and consider consulting a qualified financial advisor before making any investment decisions.

Conclusion

This data-driven analysis explored key factors influencing Palantir's stock price leading up to May 5th. We examined financial performance, upcoming catalysts, and potential risks, providing a comprehensive overview to help investors make informed decisions. Remember, this analysis is not financial advice.

Call to Action: Should you buy Palantir before May 5th? The decision ultimately rests on your individual risk tolerance and investment strategy. However, by utilizing this data-driven approach, you can make a more informed decision about investing in Palantir or other similar growth stocks. Conduct thorough research and consider consulting a financial advisor before making any investment in Palantir stock.

International Transgender Day Of Visibility 3 Ways To Be A Better Ally

International Transgender Day Of Visibility 3 Ways To Be A Better Ally

Tarykh Altdkhyn Byn Njwm Krt Alqdm

Tarykh Altdkhyn Byn Njwm Krt Alqdm

Attorney General Pam Bondis Amusement Over Epstein Files Controversy

Attorney General Pam Bondis Amusement Over Epstein Files Controversy

Hertls Injury A Potential Blow To The Vegas Golden Knights

Hertls Injury A Potential Blow To The Vegas Golden Knights

Technical Training Initiative For Transgender Community In Punjab

Technical Training Initiative For Transgender Community In Punjab