Analyzing Palantir Stock: Should You Invest Before May 5th?

Table of Contents

Palantir's Recent Financial Performance and Future Projections

Palantir's financial health is a crucial factor in determining whether to invest in Palantir stock. Analyzing recent quarterly reports provides insights into its growth trajectory and profitability.

Revenue Growth and Profitability

Palantir's revenue growth has been a key focus for investors. Recent quarters have shown [Insert specific data on revenue growth from recent reports, citing sources]. This translates to [Calculate and state the growth percentage]. Key financial metrics like [mention specific metrics, e.g., operating margin, net income] also reveal [explain the trend and significance of those metrics]. Compared to competitors like [mention competitors, e.g., Snowflake, Databricks], Palantir's performance [compare and contrast, highlighting strengths and weaknesses].

- Q1 2023 Revenue: [Insert Data]

- Q2 2023 Revenue: [Insert Data]

- Year-over-Year Revenue Growth: [Insert Data]

- Operating Margin: [Insert Data]

This data suggests [summarize the overall trend in revenue growth and profitability].

Government Contracts and Commercial Growth

Palantir's revenue stream is diverse, relying on both government contracts and commercial clients. The balance between these two sectors is essential for long-term growth. [Insert details about significant government contracts recently won, citing sources]. On the commercial side, Palantir has secured deals with [mention key commercial clients and the nature of their contracts]. The potential for future growth in both sectors is [assess the growth potential, supporting your claims with data or projections].

- Percentage of revenue from government contracts: [Insert Data]

- Percentage of revenue from commercial clients: [Insert Data]

- Key government clients: [List examples]

- Key commercial clients: [List examples]

The diversification of Palantir's revenue streams mitigates the risk associated with over-reliance on a single sector.

Market Sentiment and Analyst Ratings for Palantir Stock

Understanding market sentiment and analyst opinions is crucial for evaluating Palantir stock.

Current Stock Price and Volatility

The Palantir stock price has experienced [describe the recent price fluctuations, e.g., significant volatility, upward trend, downward trend]. [Mention specific dates and price points, linking to reliable financial news sources]. Factors contributing to this volatility include [discuss factors like market conditions, news events, earnings reports]. Technical analysis [if applicable, briefly mention key indicators and their implications].

- Current Palantir stock price: [Insert current price and date]

- 52-week high: [Insert data]

- 52-week low: [Insert data]

Analyst Ratings and Price Targets

Analyst ratings for Palantir stock vary. A summary of several analysts' ratings is presented below:

| Analyst Firm | Rating | Price Target |

|---|---|---|

| [Analyst Firm 1] | [Rating] | [Price Target] |

| [Analyst Firm 2] | [Rating] | [Price Target] |

| [Analyst Firm 3] | [Rating] | [Price Target] |

The range of price targets suggests a degree of uncertainty in the market's outlook for Palantir share price.

Risks and Potential Downsides of Investing in Palantir Stock Before May 5th

While Palantir offers growth potential, investors should consider the inherent risks.

Market Risks and Geopolitical Factors

Macroeconomic factors can significantly impact Palantir's stock price. [Discuss potential risks like inflation, interest rate hikes, and geopolitical instability]. These factors can affect investor sentiment and lead to market corrections, potentially impacting Palantir share price.

- Inflationary pressures: [Explain impact]

- Interest rate hikes: [Explain impact]

- Geopolitical risks: [Explain impact]

Competition and Technological Disruption

Palantir faces competition from established players and emerging startups in the data analytics and software markets. [Mention key competitors and their strengths]. The risk of technological disruption is also present, as new technologies could potentially render Palantir's solutions obsolete. However, Palantir's competitive advantage lies in [discuss Palantir's unique strengths, such as its strong government relationships or proprietary technology].

Conclusion: Should You Invest in Palantir Stock Before May 5th?

Investing in Palantir stock before May 5th presents both opportunities and risks. While Palantir shows promising revenue growth and diversification, market volatility and competition remain significant concerns. The mixed analyst ratings further highlight the uncertainty surrounding Palantir's future performance. Therefore, a thorough due diligence is necessary before making an investment decision. Consider your own risk tolerance and investment goals. Do not rely solely on this analysis. Start your Palantir stock analysis today! Learn more about investing in Palantir stock and consult with a financial advisor before making any investment decisions.

Featured Posts

-

Elisabeth Borne Et La Fusion Renaissance Modem Une Ligne Politique Plus Claire

May 10, 2025

Elisabeth Borne Et La Fusion Renaissance Modem Une Ligne Politique Plus Claire

May 10, 2025 -

Stephen King And His 5 Most Notorious Celebrity Disputes

May 10, 2025

Stephen King And His 5 Most Notorious Celebrity Disputes

May 10, 2025 -

Trumps Surgeon General Nominee Casey Means And The Maha Movement

May 10, 2025

Trumps Surgeon General Nominee Casey Means And The Maha Movement

May 10, 2025 -

Navigating The Elizabeth Line A Wheelchair Users Perspective

May 10, 2025

Navigating The Elizabeth Line A Wheelchair Users Perspective

May 10, 2025 -

The Snl Impression That Left Harry Styles Devastated

May 10, 2025

The Snl Impression That Left Harry Styles Devastated

May 10, 2025

Latest Posts

-

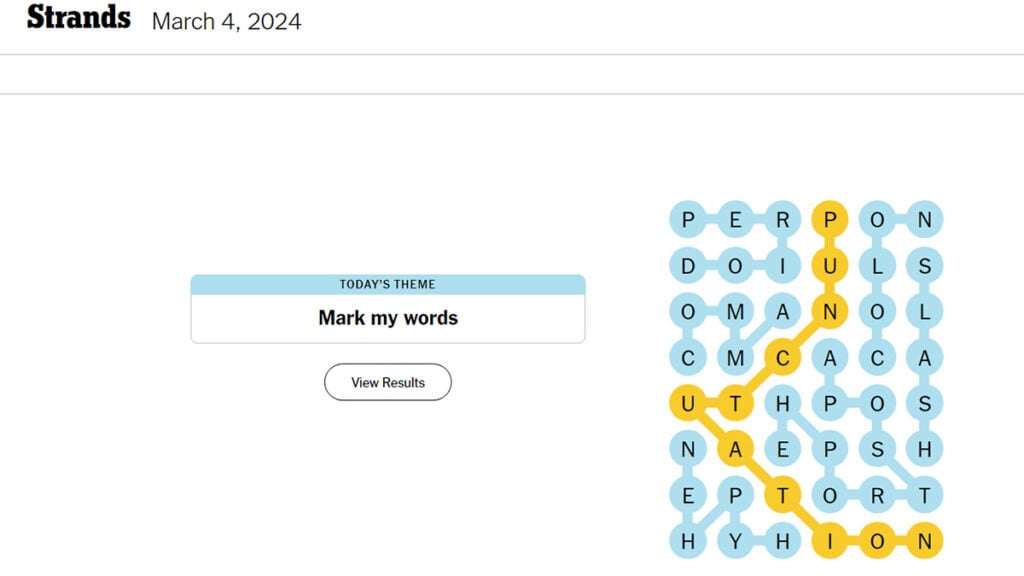

Nyt Strands Thursday April 10 Game 403 Find The Solutions Here

May 10, 2025

Nyt Strands Thursday April 10 Game 403 Find The Solutions Here

May 10, 2025 -

Nyt Strands April 9 2025 Complete Guide To Solving Todays Crossword

May 10, 2025

Nyt Strands April 9 2025 Complete Guide To Solving Todays Crossword

May 10, 2025 -

Solve Nyt Strands Game 403 Hints And Answers For Thursday April 10

May 10, 2025

Solve Nyt Strands Game 403 Hints And Answers For Thursday April 10

May 10, 2025 -

Strands Nyt April 10 2024 Complete Hints And Answers Game 403

May 10, 2025

Strands Nyt April 10 2024 Complete Hints And Answers Game 403

May 10, 2025 -

April 12th Nyt Strands Solutions Game 405 Complete Guide

May 10, 2025

April 12th Nyt Strands Solutions Game 405 Complete Guide

May 10, 2025