Hudson's Bay's Liquidation: What The Court Documents Show

Table of Contents

Key Financial Struggles Leading to Potential Liquidation

Hudson's Bay Company (HBC) has been grappling with significant financial troubles for several years, ultimately leading to the current threat of liquidation. The company's declining performance is evident in several key financial indicators, pointing towards a perfect storm of challenges within the broader context of the retail industry decline. These Hudson's Bay financial troubles are not isolated incidents but rather the culmination of various interconnected factors.

- Decreased sales figures over the past five years: Consistent year-on-year declines in sales revenue demonstrate a struggle to compete in an evolving retail market.

- Rising debt levels and difficulty securing further financing: HBC's mounting debt has severely limited its financial flexibility, making it increasingly difficult to secure necessary funding for operations and expansion. This high HBC debt burden has constricted its ability to invest in modernization and innovation.

- Impact of e-commerce competition on brick-and-mortar stores: The rise of online retailers has significantly impacted brick-and-mortar stores like Hudson's Bay, forcing a necessary but often costly transition to a multi-channel approach.

- Failure of previous restructuring efforts: Previous attempts to restructure the business have proven insufficient to address the underlying financial challenges, highlighting the gravity of the situation.

Analysis of Court Documents: What They Reveal

The Hudson's Bay court filings provide a stark picture of the company's financial position. These documents offer insights into HBC's assets, liabilities, and the ongoing efforts to secure a future for the company. Analyzing the Hudson's Bay court filings reveals crucial details for understanding the potential outcomes.

- Overview of the company's total assets and liabilities: Court documents detail a significant disparity between assets and liabilities, exposing the extent of the company's debt burden. Precise figures on the HBC asset valuation are crucial to assessing the feasibility of various restructuring or sale options.

- Details on any potential bids from interested parties: The court filings may contain information on potential potential buyers HBC, their proposed offers, and the terms of acquisition. This information is crucial in predicting the likely outcome of the proceedings.

- Information about secured and unsecured creditors: Understanding the claims of various creditor claims is critical in determining how assets will be distributed in a potential liquidation scenario. The hierarchy of creditor claims is a key factor shaping the negotiation process.

- Timeline of upcoming court dates and hearings: The court documents provide a schedule of future hearings and deadlines, offering a roadmap for the ongoing legal proceedings. Following this timeline provides clarity on the speed and direction of the Hudson's Bay Liquidation process.

Impact on Stakeholders: Employees, Shareholders, and Consumers

The potential Hudson's Bay Liquidation carries significant consequences for various stakeholders. The implications extend far beyond the company's leadership and investors.

- Potential job losses for Hudson's Bay employees: A liquidation could lead to widespread Hudson's Bay employee layoffs, impacting the livelihoods of thousands of employees across the country.

- Impact on shareholder investments and stock prices: Shareholders face potential losses, with stock prices likely to continue declining in the face of a potential liquidation. This is a significant financial risk for investors.

- Potential store closures and disruption to consumer access: The closure of numerous stores would severely limit consumer access to Hudson's Bay products and services, particularly in regions where the company maintains a significant retail presence. This would have a considerable impact on consumer impact Hudson's Bay.

- Discussion of potential effects on the Canadian retail sector: The liquidation of such a prominent Canadian retailer could trigger a domino effect, impacting other retailers and potentially destabilizing the Canadian retail sector as a whole.

Future Outlook and Potential Scenarios

The future of HBC remains uncertain, with several possible outcomes emerging from the ongoing legal proceedings. The possibilities range from a complete Hudson's Bay Liquidation to a successful restructuring or sale.

- Probability of successful restructuring: The viability of a successful restructuring depends on several factors, including the willingness of creditors to negotiate and the availability of sufficient financing. The Hudson's Bay restructuring scenario requires significant creditor cooperation.

- Analysis of potential buyers and their offers: The emergence of potential buyers HBC and the nature of their offers will significantly impact the ultimate outcome of the legal proceedings. The attractiveness of the offers will influence the decision-making process.

- Long-term implications for the Hudson's Bay Company brand: Even if the company avoids liquidation, the long-term impact on the Hudson's Bay brand reputation is uncertain, depending on whether the company is able to successfully re-establish itself in the marketplace. A liquidation vs. sale HBC decision affects the future brand reputation significantly.

- Speculation on the future of the company's real estate portfolio: The value of Hudson's Bay's extensive real estate holdings is a significant factor in determining the company's future financial stability. The fate of these assets significantly influences HBC future plans.

Conclusion

The court documents surrounding the potential Hudson's Bay Liquidation paint a complex picture of a company grappling with significant financial challenges. The information revealed highlights the company's declining performance, the impact on stakeholders, and the various scenarios that may unfold. The potential outcomes—liquidation, sale, or restructuring—will significantly affect employees, shareholders, consumers, and the Canadian retail landscape. To stay informed about this evolving situation, it is recommended to follow the ongoing legal proceedings and consult reputable news sources for updates on the Hudson's Bay Liquidation. Regularly checking for updates and subscribing to relevant news sources and legal databases will provide valuable insights into the future of this iconic retailer.

Featured Posts

-

Increased Birth Control Access Examining The Post Roe Otc Landscape

Apr 25, 2025

Increased Birth Control Access Examining The Post Roe Otc Landscape

Apr 25, 2025 -

Dope Thief Trailer Brian Tyree Henry And Wagner Moura In Ridley Scotts Pulse Pounding New Series

Apr 25, 2025

Dope Thief Trailer Brian Tyree Henry And Wagner Moura In Ridley Scotts Pulse Pounding New Series

Apr 25, 2025 -

Linda Evangelista The Impact Of A Botched Cool Sculpting Procedure

Apr 25, 2025

Linda Evangelista The Impact Of A Botched Cool Sculpting Procedure

Apr 25, 2025 -

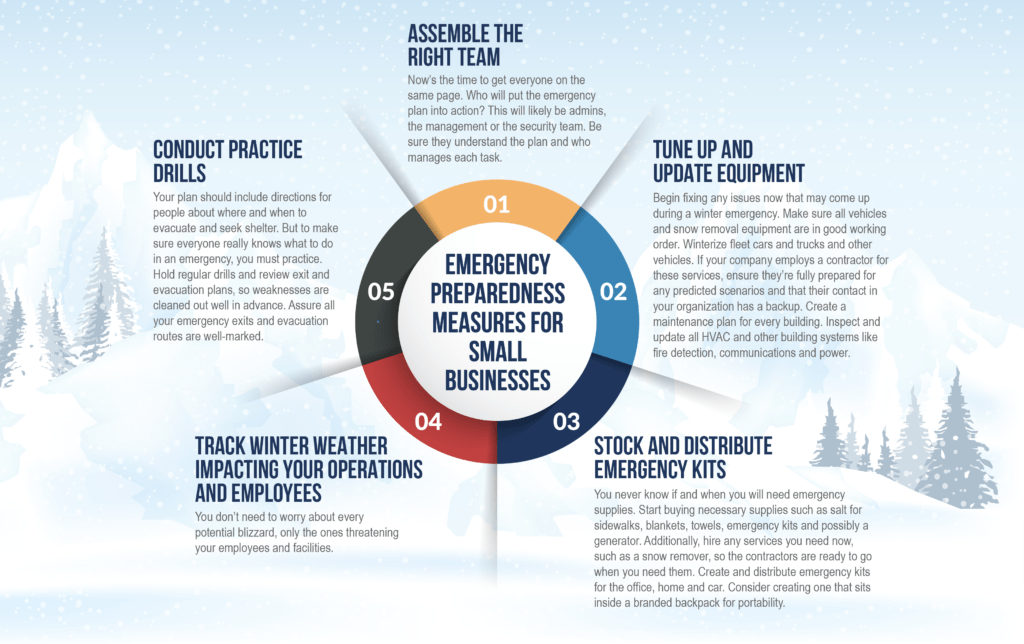

Effective Winter Weather Preparation A Timeline Strategy

Apr 25, 2025

Effective Winter Weather Preparation A Timeline Strategy

Apr 25, 2025 -

Jorge E Mateus E Felipe Amorim Sucesso No 1 Dia De Folia

Apr 25, 2025

Jorge E Mateus E Felipe Amorim Sucesso No 1 Dia De Folia

Apr 25, 2025

Latest Posts

-

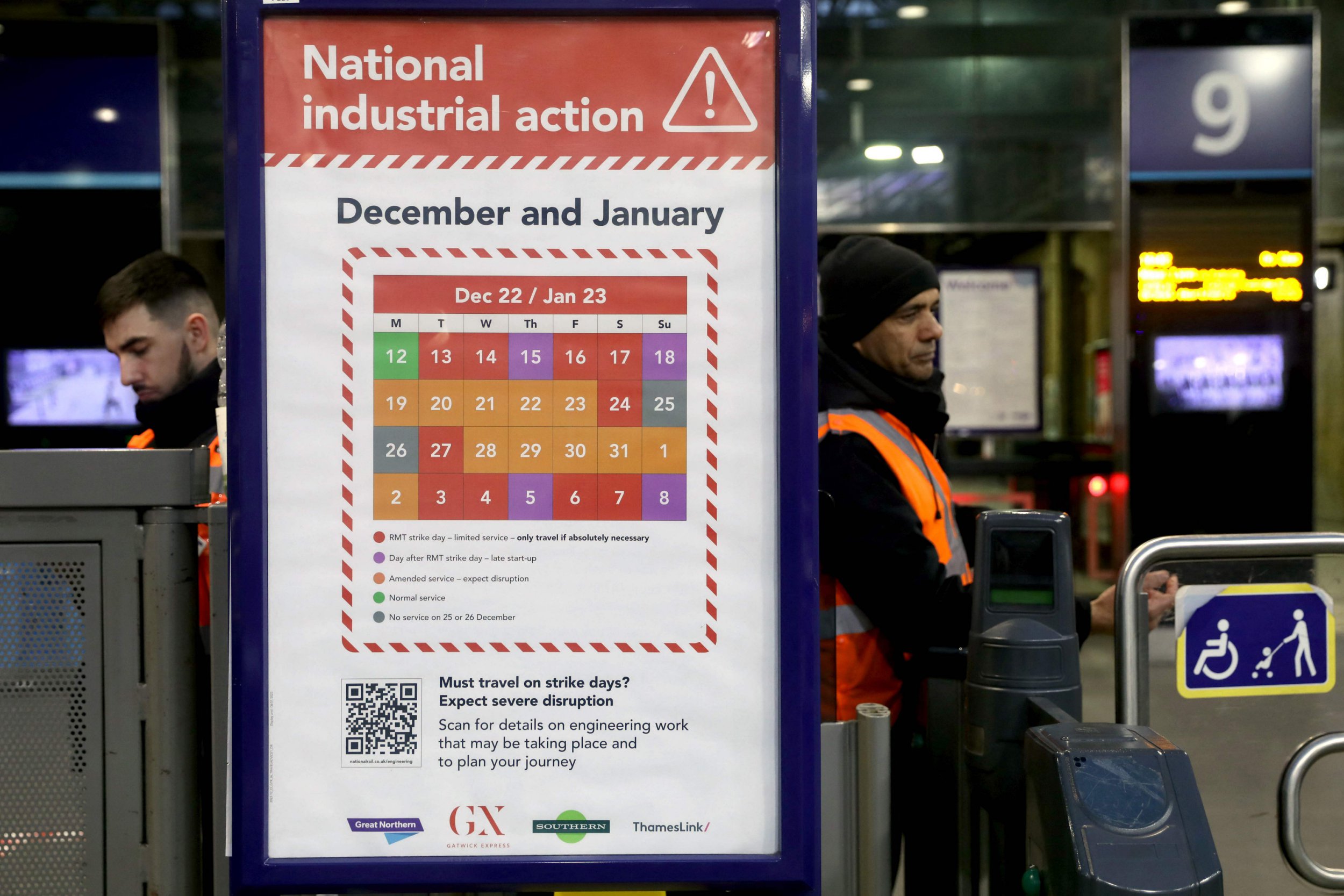

Elizabeth Line Strike Dates And Affected Routes February March

May 10, 2025

Elizabeth Line Strike Dates And Affected Routes February March

May 10, 2025 -

Elizabeth Line Strikes February And March Service Disruptions

May 10, 2025

Elizabeth Line Strikes February And March Service Disruptions

May 10, 2025 -

Palantir Stock Investment Opportunities And Potential Growth By 2025

May 10, 2025

Palantir Stock Investment Opportunities And Potential Growth By 2025

May 10, 2025 -

Is A 40 Return On Palantir Stock By 2025 Possible

May 10, 2025

Is A 40 Return On Palantir Stock By 2025 Possible

May 10, 2025 -

Stock Market Gains Sensex Nifty Performance And Top Movers

May 10, 2025

Stock Market Gains Sensex Nifty Performance And Top Movers

May 10, 2025