Shopify Shares Rocket: Nasdaq 100 Inclusion Drives 14% Increase

Table of Contents

Nasdaq 100 Inclusion: A Catalyst for Growth

Being included in the Nasdaq 100 is a significant milestone for any company, and for Shopify, it served as a powerful catalyst for growth. The Nasdaq 100 is a widely followed technology-heavy index, comprising 100 of the largest non-financial companies listed on the Nasdaq Stock Market. Inclusion signifies a level of market maturity, financial stability, and significant market capitalization, attracting the attention of a broader range of investors.

This increased exposure translates into several key advantages:

-

Increased institutional investment: Inclusion in the Nasdaq 100 automatically places Shopify on the radar of numerous institutional investors, such as mutual funds, pension funds, and hedge funds, who track the index and often invest heavily in its constituent companies. This influx of capital directly contributes to increased demand for Shopify shares, driving up the share price.

-

Enhanced market visibility and credibility: Being part of the Nasdaq 100 significantly enhances Shopify's market visibility and credibility. It provides a powerful signal to potential investors and stakeholders that Shopify is a robust, well-established company with a strong track record. This increased visibility can also attract new merchants to the Shopify platform.

-

Inclusion in major index funds tracking the Nasdaq 100: Many index funds passively track the Nasdaq 100, meaning they are obligated to buy Shopify shares to mirror the index's composition. This creates consistent demand, contributing to price stability and growth.

-

Potential for higher trading volume: Inclusion in the Nasdaq 100 generally leads to increased trading volume, improving liquidity and making it easier for investors to buy and sell Shopify shares.

Shopify's Strong Financial Performance: A Foundation for Success

Shopify's inclusion in the Nasdaq 100 wasn't a fluke; it's a testament to the company's consistently strong financial performance. Recent financial reports showcase impressive growth across key performance indicators (KPIs).

-

Strong year-over-year revenue growth: Shopify has consistently demonstrated robust year-over-year revenue growth, reflecting the increasing adoption of its e-commerce platform by merchants of all sizes. This sustained growth demonstrates the platform's appeal and its ability to adapt to evolving market trends.

-

Expanding merchant base and increasing customer acquisition: Shopify's merchant base continues to expand significantly, indicating strong customer acquisition and retention rates. This expansion underscores the platform's versatility and its ability to cater to diverse business needs.

-

Successful product launches and platform improvements: Shopify's continuous investment in research and development has resulted in a series of successful product launches and platform improvements, enhancing the platform's functionality and user experience. These ongoing updates keep Shopify competitive and attract new merchants.

-

Positive earnings and strong profit margins: The company's positive earnings and healthy profit margins demonstrate its financial health and efficiency, further bolstering investor confidence.

Shopify's Expanding Ecosystem and Future Outlook

Shopify’s success isn't solely dependent on its core platform; it stems from a thriving ecosystem. The Shopify app store offers a vast array of third-party integrations, providing merchants with tools to customize and optimize their stores. Shopify Payments offers streamlined payment processing, and the company's logistics network facilitates efficient order fulfillment. Future strategies include:

-

Continued investment in research and development: Shopify continues to invest heavily in R&D, ensuring its platform remains at the forefront of e-commerce innovation.

-

Expansion into new markets and geographic regions: Shopify is actively expanding its reach into new markets and geographic regions, tapping into new growth opportunities.

-

Strategic partnerships and acquisitions: Strategic partnerships and acquisitions further strengthen Shopify's ecosystem and capabilities, expanding its offerings and reach.

-

Focus on enhancing merchant services and functionalities: Shopify is committed to enhancing its merchant services and functionalities, providing businesses with even more tools and resources to succeed online.

Market Reaction and Investor Sentiment

The market responded enthusiastically to Shopify's Nasdaq 100 inclusion announcement. Investor sentiment was overwhelmingly positive, reflected in several key indicators:

-

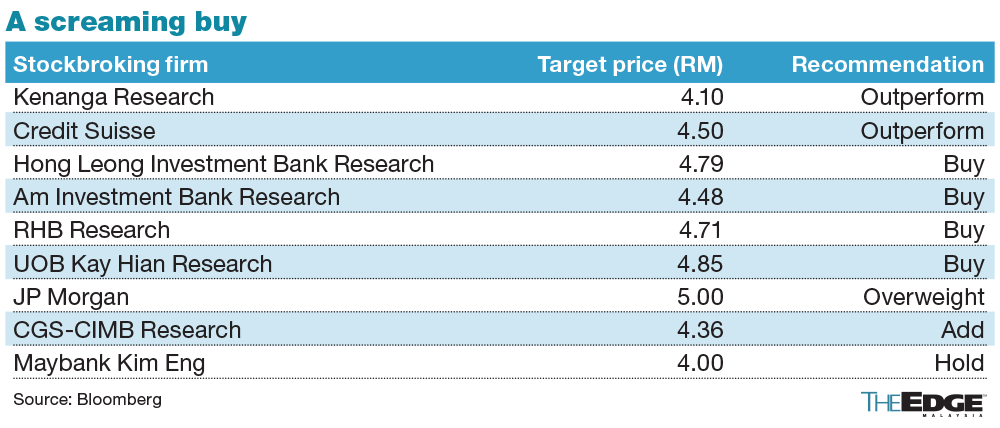

Analyst upgrades and price target increases: Following the announcement, numerous financial analysts upgraded their ratings on Shopify stock and increased their price targets, reflecting their bullish outlook on the company's future performance.

-

Positive media coverage and increased public interest: The inclusion generated significant positive media coverage, attracting broader public interest in Shopify and its stock.

-

Strong trading volume following the announcement: Trading volume in Shopify shares spiked significantly after the announcement, indicating increased investor activity and enthusiasm.

-

Comparison to other e-commerce stocks' performance: Compared to other major e-commerce stocks, Shopify's performance following the Nasdaq 100 inclusion stood out, signifying the market's strong belief in its future prospects.

Conclusion

Shopify's inclusion in the Nasdaq 100 has undeniably acted as a significant catalyst, driving a substantial 14% increase in its share price. This surge reflects not only the prestige of the index but also Shopify's strong financial performance and promising future prospects. The company's robust ecosystem and ongoing investments position it for continued growth in the competitive e-commerce landscape.

Call to Action: Are you looking to capitalize on the potential of Shopify stock? Stay informed about the latest developments in Shopify shares and the e-commerce market to make informed investment decisions. Research thoroughly before investing and consider consulting a financial advisor. Don't miss out on the opportunity to explore the world of Shopify stock and its potential for future growth.

Featured Posts

-

Arkansass New Queen Of Power Hitting Surpassing Bonds

May 14, 2025

Arkansass New Queen Of Power Hitting Surpassing Bonds

May 14, 2025 -

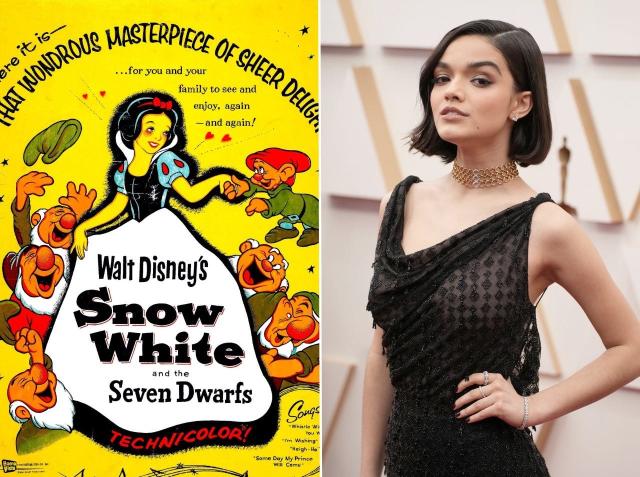

Disneys Snow White Remake A Hilariously Abysmal Failure According To Im Db

May 14, 2025

Disneys Snow White Remake A Hilariously Abysmal Failure According To Im Db

May 14, 2025 -

Man Utd Transfers Will Amorim Repeat Solskjaers Mistake With Top Young Talent

May 14, 2025

Man Utd Transfers Will Amorim Repeat Solskjaers Mistake With Top Young Talent

May 14, 2025 -

Disney Streaming Release Captain America Brave New World

May 14, 2025

Disney Streaming Release Captain America Brave New World

May 14, 2025 -

Ohtanis 3 Run Homer Leads Dodgers To 14 11 Victory

May 14, 2025

Ohtanis 3 Run Homer Leads Dodgers To 14 11 Victory

May 14, 2025

Latest Posts

-

Increased Nyse Trading Activity Propels Ices Q1 Profit Above Forecasts

May 14, 2025

Increased Nyse Trading Activity Propels Ices Q1 Profit Above Forecasts

May 14, 2025 -

Ipo Market Slowdown The Role Of Trade Tensions

May 14, 2025

Ipo Market Slowdown The Role Of Trade Tensions

May 14, 2025 -

The Impact Of Tariffs On Initial Public Offerings Ipos

May 14, 2025

The Impact Of Tariffs On Initial Public Offerings Ipos

May 14, 2025 -

Market Uncertainty And The Freeze On Ipo Activity

May 14, 2025

Market Uncertainty And The Freeze On Ipo Activity

May 14, 2025 -

Tariff Wars Freeze Ipo Market Examining The Economic Fallout

May 14, 2025

Tariff Wars Freeze Ipo Market Examining The Economic Fallout

May 14, 2025