Market Uncertainty And The Freeze On IPO Activity

Table of Contents

The Impact of Market Uncertainty on Investor Sentiment and IPO Pricing

Market uncertainty creates a climate of risk aversion among investors. When the future looks unpredictable, investors become hesitant to commit capital to new ventures, leading to lower demand for IPOs. This reduced investor appetite directly impacts IPO pricing. Accurately pricing an IPO in a volatile market is incredibly challenging. Companies aiming for an IPO must carefully consider the current market climate and its impact on valuation. Securing sufficient investor commitments becomes significantly more difficult, often requiring significant concessions from the issuing company.

- Reduced investor appetite for risk: Uncertainty breeds caution, leading investors to favor safer, more established investments.

- Difficulty in predicting long-term value: Volatile markets make it hard to project a company's future performance and therefore its long-term value.

- Increased pricing volatility: IPO prices become more susceptible to market swings, increasing the risk of underpricing or overpricing.

- Higher risk of underperformance post-IPO: Companies going public during periods of uncertainty are more likely to face headwinds and underperform market expectations.

Key Factors Driving the Freeze in IPO Activity

Several interconnected factors contribute to the current market uncertainty and the resulting freeze in IPO activity. High inflation erodes investor confidence, as it reduces purchasing power and increases the cost of goods and services. Rising interest rates, a common tool used to combat inflation, further dampen investor enthusiasm by increasing borrowing costs for both businesses and consumers. Geopolitical instability, whether stemming from wars, trade disputes, or other international conflicts, significantly impacts market confidence. Finally, regulatory changes and potential legal challenges can create uncertainty and deter companies from pursuing IPOs.

- High inflation eroding investor confidence: Inflation reduces the real return on investments, making investors more cautious.

- Rising interest rates increasing borrowing costs: Higher rates make it more expensive to finance growth, making IPOs less attractive.

- Geopolitical instability creating market volatility: Uncertainty about global events impacts investor sentiment and market stability.

- Regulatory uncertainty impacting IPO readiness: Changes in regulations can increase the costs and complexity of going public.

The Ripple Effect: Consequences for Investment Banks and Businesses

The freeze in IPO activity has significant consequences for investment banks and the businesses relying on IPOs for capital. Investment banks see a substantial decline in revenue streams and deal pipelines. The fees associated with underwriting and managing IPOs represent a significant portion of their revenue, and a reduction in IPO activity directly impacts their bottom line. Companies planning IPOs are forced to delay or even abandon their plans, impacting their growth strategies and access to capital. This lack of access to capital has broader consequences for the economy, potentially hindering innovation and economic growth. Many companies are now exploring alternative financing options, such as private equity funding or debt financing.

- Reduced fees for investment banks: Fewer IPOs mean less revenue for investment banking firms.

- Delayed expansion plans for businesses: Companies postpone growth initiatives due to difficulties securing capital through IPOs.

- Limited access to capital for growth: The lack of IPOs restricts businesses' ability to access funds for expansion and innovation.

- Increased reliance on private funding: Businesses are increasingly turning to private equity and venture capital for funding.

Looking Ahead: Potential Scenarios for IPO Market Recovery

A resurgence in IPO activity hinges on several key conditions. Inflation needs to be brought under control, leading to stable interest rates. Improved geopolitical stability and a reduction in global uncertainty are crucial for restoring investor confidence. Stronger corporate earnings and a positive economic outlook are essential for making IPOs attractive again. Finally, innovative IPO structures and offerings can help attract investors in a challenging market. The recovery might be gradual, as investors slowly regain confidence, or it could be rapid if favorable economic conditions develop quickly. The future of IPOs will likely see an evolution towards more flexible and adaptable structures to accommodate the demands of a changing market.

- Inflation reduction and stable interest rates: A stable macroeconomic environment is vital for restoring investor confidence.

- Improved geopolitical stability and reduced uncertainty: A more predictable global landscape will encourage investment.

- Stronger corporate earnings and positive economic outlook: Positive economic signals are key drivers of IPO activity.

- Innovative IPO structures and offerings: New approaches to IPOs can attract investors in a risk-averse market.

Conclusion: Navigating the IPO Freeze and the Path to Recovery

The current freeze in IPO activity is a direct result of significant market uncertainty fueled by high inflation, rising interest rates, and geopolitical instability. This creates substantial challenges for businesses seeking capital, investment banks facing reduced revenue, and investors navigating a volatile market. While the path to recovery is uncertain, a combination of macroeconomic stability, improved investor sentiment, and innovative IPO structures could pave the way for a resurgence in IPO activity. Stay informed about market trends and consult with financial experts to navigate the complexities of the current IPO landscape and prepare for future opportunities in this ever-evolving market. Understanding market uncertainty and its impact on IPO activity is crucial for making informed investment decisions and navigating the current climate.

Featured Posts

-

Sabalenka Defeats Mertens In Madrid Open Top Ranked Players Victory

May 14, 2025

Sabalenka Defeats Mertens In Madrid Open Top Ranked Players Victory

May 14, 2025 -

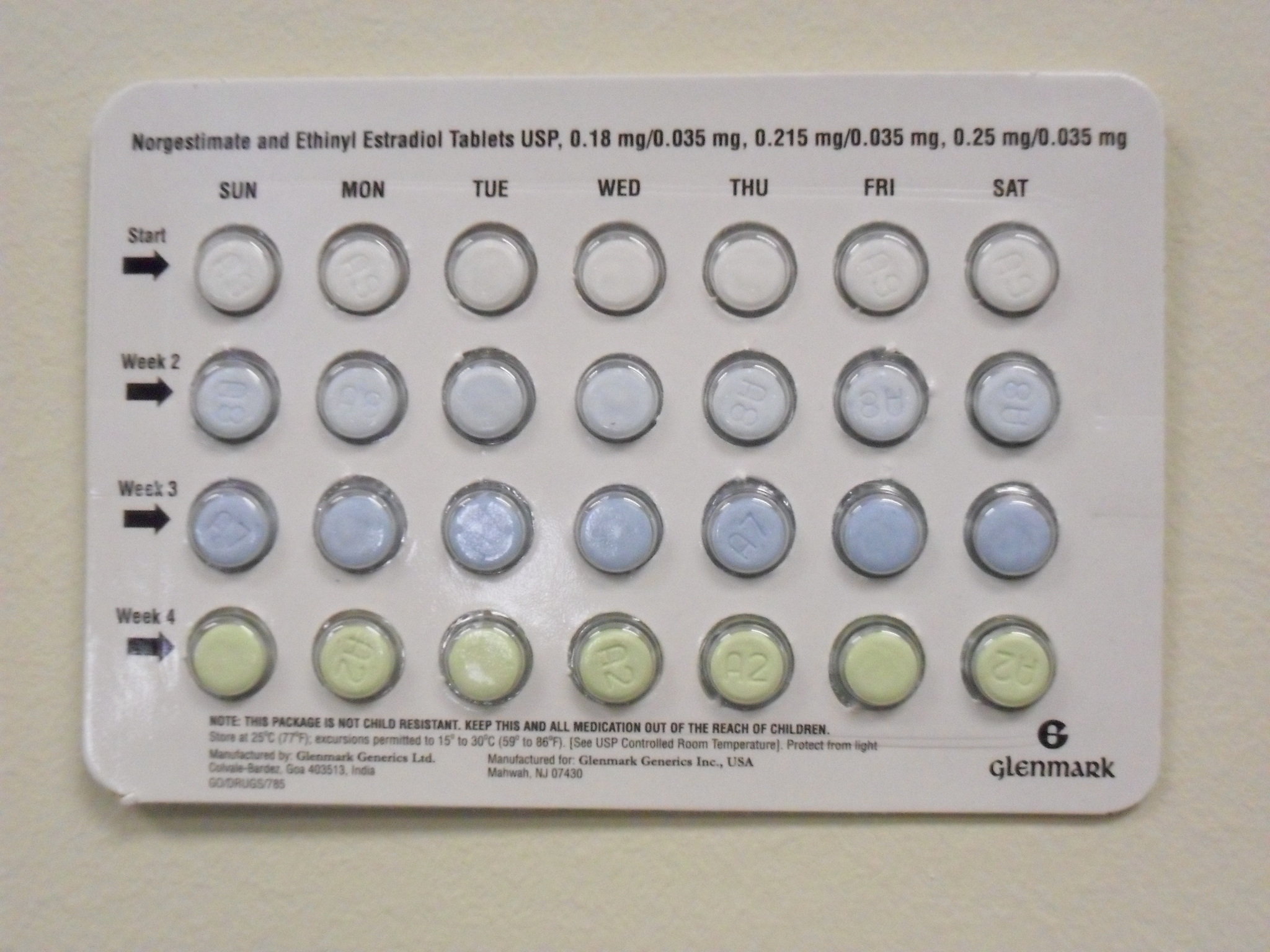

Recall Alert Affected Dressings And Birth Control Pills In Ontario And Canada

May 14, 2025

Recall Alert Affected Dressings And Birth Control Pills In Ontario And Canada

May 14, 2025 -

Fuenf Neue Partner Unterstuetzen Den Nationalpark Saechsische Schweiz

May 14, 2025

Fuenf Neue Partner Unterstuetzen Den Nationalpark Saechsische Schweiz

May 14, 2025 -

Nationalpark Saechsische Schweiz Kooperation Mit Fuenf Neuen Partnern

May 14, 2025

Nationalpark Saechsische Schweiz Kooperation Mit Fuenf Neuen Partnern

May 14, 2025 -

Sabalenkas Dubai Defeat Paolinis Reign Ends

May 14, 2025

Sabalenkas Dubai Defeat Paolinis Reign Ends

May 14, 2025

Latest Posts

-

Wynonna And Ashley Judd Share Intimate Family Details In New Documentary

May 14, 2025

Wynonna And Ashley Judd Share Intimate Family Details In New Documentary

May 14, 2025 -

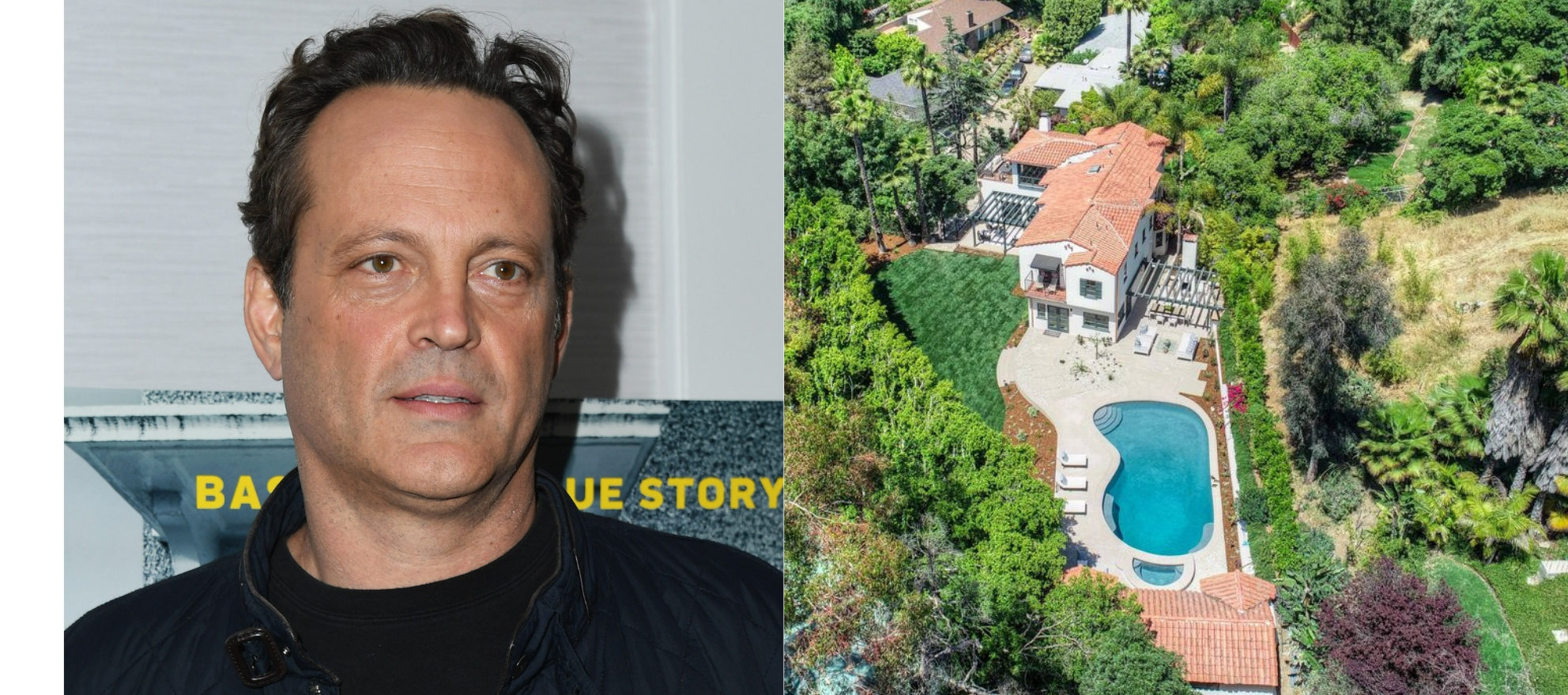

The Reality Of Vince Vaughns Italian Ancestry

May 14, 2025

The Reality Of Vince Vaughns Italian Ancestry

May 14, 2025 -

Judd Sisters Docuseries Uncovering Family History And Challenges

May 14, 2025

Judd Sisters Docuseries Uncovering Family History And Challenges

May 14, 2025 -

Exploring Vince Vaughns Family Roots And Ethnicity

May 14, 2025

Exploring Vince Vaughns Family Roots And Ethnicity

May 14, 2025 -

Untold Judd Family Stories Wynonna And Ashleys Docuseries

May 14, 2025

Untold Judd Family Stories Wynonna And Ashleys Docuseries

May 14, 2025