Tariff Wars Freeze IPO Market: Examining The Economic Fallout

Increased Uncertainty and Investor Hesitation

Unpredictable trade policies create a climate of fear and uncertainty among investors. This volatility makes it incredibly difficult to accurately assess the risk associated with investing in any new company, let alone those preparing for an IPO. This hesitation is a major factor contributing to the slowdown in the IPO market.

- Investors are hesitant to commit capital in volatile markets. The fear of further trade escalations and their potential impact on company performance makes investors cautious. They prefer to wait for clearer signals before committing significant capital.

- Risk assessments for IPOs become significantly harder to calculate. The introduction of new tariffs can dramatically alter a company's cost structure and future profitability, making traditional valuation methods unreliable.

- Long-term projections for company growth are jeopardized. Uncertainties around future trade policies make it nearly impossible to create accurate long-term financial forecasts, a crucial element in assessing the viability of an IPO.

- Difficult to value companies accurately in a fluctuating global trade environment. The unpredictable nature of tariff wars makes it challenging for investment banks and analysts to provide accurate valuations, further deterring investors.

This uncertainty impacts both domestic and international IPOs. Companies considering going public in the US or other major markets are delaying their plans, while international firms seeking US investment face additional hurdles due to the uncertainty.

Reduced Valuation and Lower IPO Proceeds

Tariff wars directly impact company valuations, leading to lower IPO proceeds. The increased costs and supply chain disruptions caused by tariffs squeeze profit margins and diminish investor confidence.

- Increased costs due to tariffs reduce profit margins. Companies that rely on imported materials or export a significant portion of their goods are directly affected by tariffs, leading to reduced profits and lower valuations.

- Supply chain disruptions impact revenue forecasts. Tariffs and trade restrictions can disrupt supply chains, causing delays and shortages, and ultimately impacting revenue.

- Investors demand lower valuations due to heightened risk. Given the increased uncertainty, investors are demanding lower valuations to compensate for the heightened risk associated with investing in companies affected by trade wars.

- Companies postpone IPOs to avoid undervalued offerings. Facing lower valuations, many companies are postponing their IPOs in the hope of more favorable market conditions.

Several companies have already delayed or cancelled their IPOs due to trade tensions. These examples highlight the real-world impact of tariff wars on the IPO market, underscoring the hesitation felt by both companies and investors.

Impact on Specific Sectors

Certain industries are disproportionately affected by tariff wars, significantly impacting their IPO prospects.

- Technology: The technology sector, reliant on global supply chains for components and markets, is vulnerable to disruptions. Tariffs on components increase production costs, impacting profitability and IPO valuations.

- Manufacturing: Manufacturing companies are heavily affected by tariffs on imported materials and exported goods. Increased costs and reduced demand directly impact their profitability and attractiveness to investors.

- Agriculture: The agricultural sector is particularly susceptible, with tariffs impacting both domestic and international trade, severely impacting farm incomes and investment.

These examples illustrate how specific sectors are experiencing a dramatic decrease in IPO activity. The vulnerability of these sectors underscores the significant impact of tariff wars on the broader economy.

Global Economic Slowdown and its Ripple Effect on IPOs

The wider economic consequences of tariff wars significantly impact IPO activity. A slowdown in global economic growth directly translates into reduced IPO activity.

- Explain the connection between global economic growth and IPO activity. A healthy economy generally fuels higher IPO activity as companies are more confident in their growth prospects and investors are more willing to take on risk.

- Discuss the reduced consumer and business confidence. Tariff wars and trade uncertainties dampen consumer and business confidence, leading to reduced spending and investment, thus decreasing the attractiveness of IPOs.

- Highlight the role of decreased global trade in hindering IPO market growth. Reduced global trade limits market access for companies and creates further uncertainty for investors, further slowing IPO activity.

- Show how a slowdown in one major economy affects other markets. The interconnectedness of the global economy means that a slowdown in one major market ripples throughout the world, impacting IPO markets across different regions.

Alternative Funding Sources and Their Implications

With the IPO market stalled, companies are increasingly resorting to alternative funding sources.

- Mention private equity, venture capital, and debt financing as alternatives. These options provide companies with capital, but often come with different terms and implications.

- Analyze the implications of these alternative routes on company growth and long-term strategy. Reliance on private equity or debt financing can limit a company's flexibility and potentially constrain its long-term growth.

- Explore the potential drawbacks of relying on alternative funding. High interest rates on debt or stringent conditions imposed by private equity investors can hinder the company's long-term prospects.

Conclusion

The ongoing tariff wars have created a significant chill in the IPO market. Increased uncertainty, reduced valuations, and a broader global economic slowdown have combined to significantly reduce the number of initial public offerings. Companies are facing increased difficulty in attracting investors and securing the necessary funding. The consequences extend beyond individual companies, impacting overall economic growth and investor confidence.

Understanding the impact of tariff wars on the IPO market is crucial for investors, entrepreneurs, and policymakers alike. Staying informed about global trade developments and the ongoing effects of these tariff wars is essential for navigating this complex economic landscape and making informed decisions regarding initial public offerings and stock market investments. Closely monitoring the economic fallout from these trade disputes is paramount for long-term financial planning.

Societe Generale Le Nouveau Role D Alexis Kohler

Societe Generale Le Nouveau Role D Alexis Kohler

Celac Summit 2024 A Push For Greater Regional Integration In Latin America And The Caribbean

Celac Summit 2024 A Push For Greater Regional Integration In Latin America And The Caribbean

Eramets Era Low A Breakthrough In Steel Decarbonization

Eramets Era Low A Breakthrough In Steel Decarbonization

Urgence Humanitaire En Haiti Crise Des Enfants Deplaces De Moins De 5 Ans

Urgence Humanitaire En Haiti Crise Des Enfants Deplaces De Moins De 5 Ans

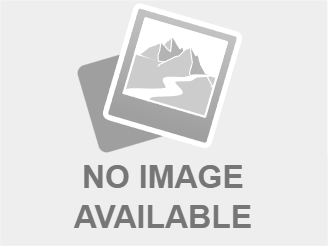

When Is The Eurovision 2025 Final Dates For Semi Finals And Grand Final

When Is The Eurovision 2025 Final Dates For Semi Finals And Grand Final