The Impact Of Tariffs On Initial Public Offerings (IPOs)

Table of Contents

Reduced Valuation Due to Tariff Uncertainty

The imposition of tariffs introduces significant uncertainty into a company's financial projections, directly impacting its valuation during the IPO process. This uncertainty stems from two primary sources: the impact on projected revenue and profitability, and the resulting shift in investor sentiment.

Impact on Projected Revenue and Profitability

Tariffs directly increase input costs for companies relying on imported goods or exporting their products. This translates to:

- Increased production costs due to imported materials: Higher import duties on raw materials, components, or finished goods increase the cost of production, squeezing profit margins.

- Reduced export opportunities due to retaliatory tariffs: If a company's exports are subject to retaliatory tariffs in other countries, its revenue streams are negatively affected, impacting its overall financial health.

- Difficulty in accurately predicting future earnings, impacting investor appetite: The unpredictable nature of tariff policies makes accurate financial forecasting challenging. This uncertainty makes it harder to project future earnings, a key factor for investors evaluating an IPO. Inaccurate projections can lead to a lower IPO valuation.

Investor Sentiment and Risk Aversion

Tariff uncertainty creates a climate of risk aversion amongst investors. This leads to:

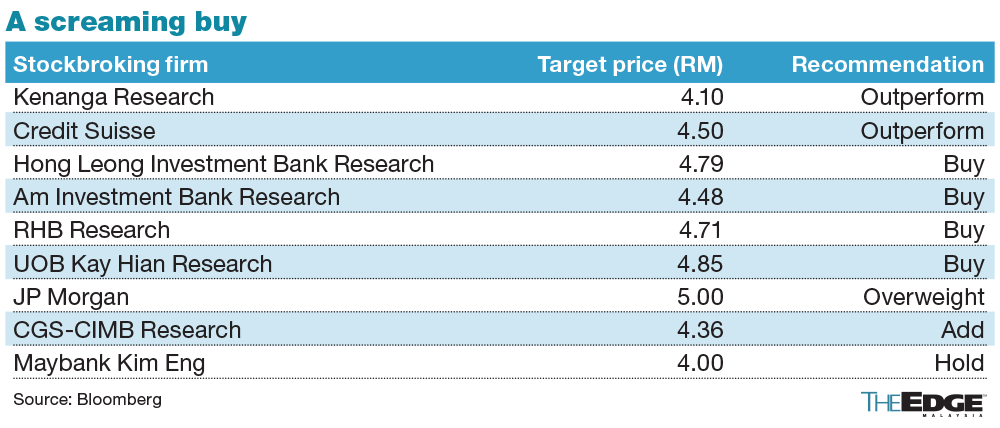

- Investors may demand a lower valuation to compensate for the increased risk: To offset the increased uncertainty and potential for lower future earnings, investors may demand a lower valuation for the company's shares during the IPO.

- Potential for delays in IPOs as companies wait for greater tariff clarity: Companies may postpone their IPOs until there is greater clarity on future tariff policies to improve their chances of achieving a favorable valuation.

- Increased scrutiny from investors regarding a company's tariff exposure: Investors will thoroughly scrutinize a company's supply chains and assess their exposure to tariffs before investing in the IPO. Companies with significant tariff-related risks may face increased scrutiny and potentially lower valuations.

Supply Chain Disruptions and Operational Challenges

Tariffs frequently disrupt established global supply chains, creating operational challenges that can significantly impact a company's IPO readiness. These disruptions are costly and time-consuming to resolve.

Impact on Global Supply Chains

The imposition of tariffs forces companies to re-evaluate and potentially restructure their entire supply chain. This process includes:

- Increased lead times for sourcing materials: Finding alternative suppliers outside of tariff-affected regions often involves longer lead times, potentially delaying production and negatively impacting the company's ability to meet projected demands.

- Higher transportation costs associated with sourcing from alternative locations: Sourcing from new locations can significantly increase transportation costs, further reducing profit margins.

- Potential for disruptions in production and delivery schedules: The transition to new suppliers can cause disruptions in production schedules and delivery times, impacting the company's operational efficiency and overall valuation.

Negotiating Tariff Impacts

Mitigating the negative impacts of tariffs requires proactive strategies, often involving significant investment:

- Diversification of sourcing to reduce reliance on tariff-affected regions: Companies may need to diversify their sourcing to reduce their dependence on specific regions affected by tariffs.

- Increased investment in domestic manufacturing or alternative sourcing locations: This involves significant capital expenditure that may impact the company's financial position and potentially affect IPO proceeds.

- Potential need for additional capital investments, impacting IPO proceeds: These investments to restructure supply chains can reduce the available capital for other crucial aspects of the business, impacting the IPO's overall success.

Geopolitical Risk and Market Volatility

The imposition of tariffs often exacerbates geopolitical uncertainty, creating volatility in global financial markets. This volatility significantly impacts the timing and success of IPOs.

Increased Market Uncertainty

Tariff-related uncertainty leads to:

- Fluctuations in currency exchange rates: Trade disputes and tariff policies can significantly impact currency exchange rates, increasing uncertainty for companies with international operations.

- Increased investor anxiety and risk aversion: The overall uncertainty in the global economic climate reduces investor confidence and increases risk aversion, making it harder to attract investors for an IPO.

- Potential for market corrections impacting IPO valuations: Geopolitical uncertainty and market volatility can lead to market corrections, which directly impact the valuation of companies going public.

Impact on International Trade Relations

Escalating trade disputes and retaliatory tariffs negatively affect the overall business environment, influencing companies' decisions to go public:

- Reduced global trade volumes impacting overall economic growth: Trade wars and tariffs can reduce global trade volumes, negatively impacting economic growth and reducing investor confidence.

- Uncertainty about future trade policies impacting long-term business planning: Uncertainty surrounding future trade policies makes long-term business planning more difficult, making it challenging for companies to accurately assess their future prospects.

- Potential for decreased foreign investment: Geopolitical uncertainty and trade disputes can discourage foreign investment, making it harder for companies to secure the capital necessary for expansion and growth.

Conclusion

The impact of tariffs on IPOs is multifaceted and significant. From reduced valuations and supply chain disruptions to increased market volatility, tariffs present considerable challenges for companies considering going public. Understanding these impacts is crucial for companies navigating the IPO process in a globalized and increasingly protectionist environment. By carefully assessing their tariff exposure and developing strategies to mitigate related risks, companies can increase their chances of a successful IPO. Thorough due diligence and a comprehensive understanding of the impact of tariffs and IPOs are essential for both companies and investors alike. Don't underestimate the influence of trade policy on your IPO strategy – plan accordingly to navigate this complex landscape.

Featured Posts

-

Arkansass New Queen Of Power Hitting Surpassing Bonds

May 14, 2025

Arkansass New Queen Of Power Hitting Surpassing Bonds

May 14, 2025 -

Neue Sensortechnologie Fuer Die Saechsische Schweiz Sachsenforst Verbessert Waldbrandschutz

May 14, 2025

Neue Sensortechnologie Fuer Die Saechsische Schweiz Sachsenforst Verbessert Waldbrandschutz

May 14, 2025 -

Caparros Regresa Al Sevilla Releva A Garcia Pimienta En El Banquillo

May 14, 2025

Caparros Regresa Al Sevilla Releva A Garcia Pimienta En El Banquillo

May 14, 2025 -

Switzerlands Eurovision 2025 Coverage Srf Announces Extensive Broadcast

May 14, 2025

Switzerlands Eurovision 2025 Coverage Srf Announces Extensive Broadcast

May 14, 2025 -

Dodgers Wild Comeback Fueled By Ohtanis 6 Run 9th

May 14, 2025

Dodgers Wild Comeback Fueled By Ohtanis 6 Run 9th

May 14, 2025

Latest Posts

-

Actividades En Sevilla Hoy Miercoles 7 De Mayo De 2025

May 14, 2025

Actividades En Sevilla Hoy Miercoles 7 De Mayo De 2025

May 14, 2025 -

Que Ver Y Hacer En Sevilla Miercoles 7 De Mayo De 2025

May 14, 2025

Que Ver Y Hacer En Sevilla Miercoles 7 De Mayo De 2025

May 14, 2025 -

Sevilla Miercoles 7 De Mayo Tu Plan Perfecto Para Hoy

May 14, 2025

Sevilla Miercoles 7 De Mayo Tu Plan Perfecto Para Hoy

May 14, 2025 -

Eventos De Hoy En Sevilla Miercoles 7 De Mayo De 2025

May 14, 2025

Eventos De Hoy En Sevilla Miercoles 7 De Mayo De 2025

May 14, 2025 -

Guia De Ocio Sevilla Miercoles 7 De Mayo De 2025

May 14, 2025

Guia De Ocio Sevilla Miercoles 7 De Mayo De 2025

May 14, 2025