Increased NYSE Trading Activity Propels ICE's Q1 Profit Above Forecasts

Table of Contents

Record NYSE Trading Volume Drives Revenue Growth

Record-high daily trading volumes on the New York Stock Exchange (NYSE) were a major contributor to ICE's increased revenue in Q1 2024. This surge in NYSE trading volume directly translated into higher commission revenue for ICE, showcasing the direct link between market activity and the company's financial performance.

-

Record-Breaking Volumes: Daily trading volumes on the NYSE surpassed previous records, contributing significantly to ICE's overall revenue growth. Specific figures comparing Q1 2024 to Q1 2023 and Q4 2023 will be crucial in showcasing the scale of this increase. For example, a statement like, "Daily average trading volume increased by X% compared to Q1 2023 and Y% compared to Q4 2023," would provide concrete evidence of this growth.

-

Market Volatility's Influence: Increased market volatility, potentially stemming from macroeconomic factors or geopolitical events, likely played a key role in boosting trading activity. Investors engaging in more frequent trades to manage risk or capitalize on short-term opportunities significantly impact ICE's revenue streams tied to NYSE trading volume.

-

Securities Breakdown: Analyzing the types of securities that experienced the most substantial increases in trading volume is also essential. Did equities dominate the increase, or did derivatives trading see a particularly strong surge? Understanding this breakdown offers valuable insight into the drivers of increased NYSE trading activity and its impact on specific ICE revenue streams.

ICE Data Services Performance Contributed to Overall Success

Beyond the direct impact of increased NYSE trading volume, the strong performance of ICE's data services division further strengthened the company's Q1 results. This segment's success underscores the growing demand for high-quality financial data and advanced analytics within the financial industry.

-

Increased Demand for Market Data: The rising need for real-time market data and sophisticated analytics fueled revenue growth within ICE Data Services. Investors and financial institutions are increasingly relying on comprehensive data solutions to make informed decisions in today's complex market environment.

-

New Products and Partnerships: Any new product launches or strategic partnerships within the data services division should be highlighted. These initiatives can directly contribute to revenue growth by expanding the reach and capabilities of ICE's data offerings. For instance, a new data analytics platform or a collaboration with a leading financial technology firm would be significant factors.

Exceeding Forecasts: A Detailed Look at ICE's Q1 Financial Performance

ICE's Q1 2024 financial performance significantly outperformed analyst expectations, demonstrating the strength of its business model and its ability to capitalize on increased NYSE trading activity.

-

Key Financial Metrics: Presenting concrete figures regarding ICE's Q1 earnings is vital. This includes specifying the revenue generated, the net income achieved, and the earnings per share (EPS) reported. Clear comparisons to analyst consensus estimates and the corresponding figures from Q1 2023 are necessary to showcase the magnitude of the earnings beat.

-

Variance Analysis: Highlighting any significant differences between the actual results and the initial forecasts is important. Explaining the reasons behind these variances—attributing them to increased NYSE trading activity or other contributing factors—adds context and further solidifies the analysis.

Future Outlook and Implications for Investors

ICE's strong Q1 results have sent positive signals to the market, impacting investor sentiment and influencing future investment strategies.

-

Market Reaction and Stock Price: The market's immediate reaction to ICE's Q1 earnings announcement, specifically the movement of its stock price, reflects investor confidence. Analyzing this reaction provides crucial insight into how the market perceives the company's future prospects.

-

Investor Sentiment and Strategies: The positive performance is likely to enhance investor sentiment towards ICE, potentially leading to increased investment in the company. This section should discuss how investors might adjust their strategies based on ICE's strong Q1 showing and the implications of continued increased NYSE trading activity.

-

Challenges and Risks: While the outlook is positive, it's important to address potential challenges or risks that might impact ICE's future performance. Factors such as increased competition, regulatory changes, or shifts in market sentiment should be considered to provide a balanced perspective.

Conclusion

ICE's Q1 2024 earnings significantly exceeded expectations, primarily driven by increased NYSE trading activity and the strong performance across its diverse business segments. This robust financial performance showcases the company's resilience and adaptability in a dynamic market environment. The positive impact of increased NYSE trading activity on ICE's profitability is undeniable.

Call to Action: Stay informed about the impact of increased NYSE trading activity on market performance and ICE's continued growth. Monitor ICE's future financial reports and relevant market analyses to make informed investment decisions related to NYSE trading and the broader financial markets. Understanding the interplay between NYSE trading volume and ICE's financial success is crucial for navigating the evolving landscape of the financial industry.

Featured Posts

-

George Straits Drive Thru Selfie A Fans Unforgettable Encounter

May 14, 2025

George Straits Drive Thru Selfie A Fans Unforgettable Encounter

May 14, 2025 -

000 Neue Baeume Im Nationalpark Saechsische Schweiz Gepflanzt

May 14, 2025

000 Neue Baeume Im Nationalpark Saechsische Schweiz Gepflanzt

May 14, 2025 -

E Toro Aims For 500 Million In New Ipo Funding Round

May 14, 2025

E Toro Aims For 500 Million In New Ipo Funding Round

May 14, 2025 -

T Mobiles 16 Million Data Breach Fine Three Years Of Violations

May 14, 2025

T Mobiles 16 Million Data Breach Fine Three Years Of Violations

May 14, 2025 -

Nonna Trailer Vince Vaughns New Netflix Comedy Gets First Look

May 14, 2025

Nonna Trailer Vince Vaughns New Netflix Comedy Gets First Look

May 14, 2025

Latest Posts

-

Netflixs New Charming Movie Your Weekend Escape

May 14, 2025

Netflixs New Charming Movie Your Weekend Escape

May 14, 2025 -

New Release A Charming Netflix Film For Your Weekend

May 14, 2025

New Release A Charming Netflix Film For Your Weekend

May 14, 2025 -

Charming Film On Netflix A Must See Weekend Movie

May 14, 2025

Charming Film On Netflix A Must See Weekend Movie

May 14, 2025 -

Netflixs Heartfelt Film Your Perfect Weekend Movie

May 14, 2025

Netflixs Heartfelt Film Your Perfect Weekend Movie

May 14, 2025 -

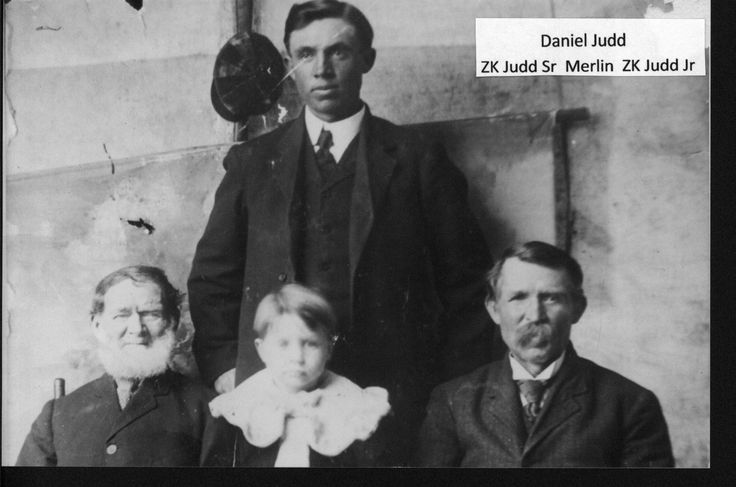

Untold Judd Family Stories Explored In New Docuseries Featuring Wynonna And Ashley

May 14, 2025

Untold Judd Family Stories Explored In New Docuseries Featuring Wynonna And Ashley

May 14, 2025