Sharp Decline In Amsterdam Stock Market: 7% Plunge On Trade War Worries

Table of Contents

Trade War Uncertainty: The Primary Catalyst for the Amsterdam Stock Market Crash

The primary catalyst for the recent Amsterdam stock market crash is the growing uncertainty surrounding global trade wars. The Netherlands, heavily reliant on international trade, is particularly vulnerable to these tensions. The ongoing EU-US trade disputes, coupled with broader geopolitical instability, have created a perfect storm impacting key Dutch export sectors.

Data from the Netherlands Bureau for Economic Policy Analysis (CPB) shows a significant decline in export volumes in several key sectors since the intensification of trade disputes. For example, agricultural exports, a cornerstone of the Dutch economy, experienced a 5% year-on-year drop in Q3 2023. The technology sector, another crucial part of the Amsterdam stock market, also witnessed a marked slowdown in export growth, contributing to the overall market decline.

- Impact on specific Dutch industries: Agriculture, technology, and manufacturing have been disproportionately affected.

- Analysis of the effect on investor confidence: The uncertainty surrounding future trade policies has severely eroded investor confidence, leading to widespread selling.

- Potential future trade war developments and their predicted impact: Any further escalation of trade disputes could lead to a more prolonged and severe downturn in the Amsterdam stock market.

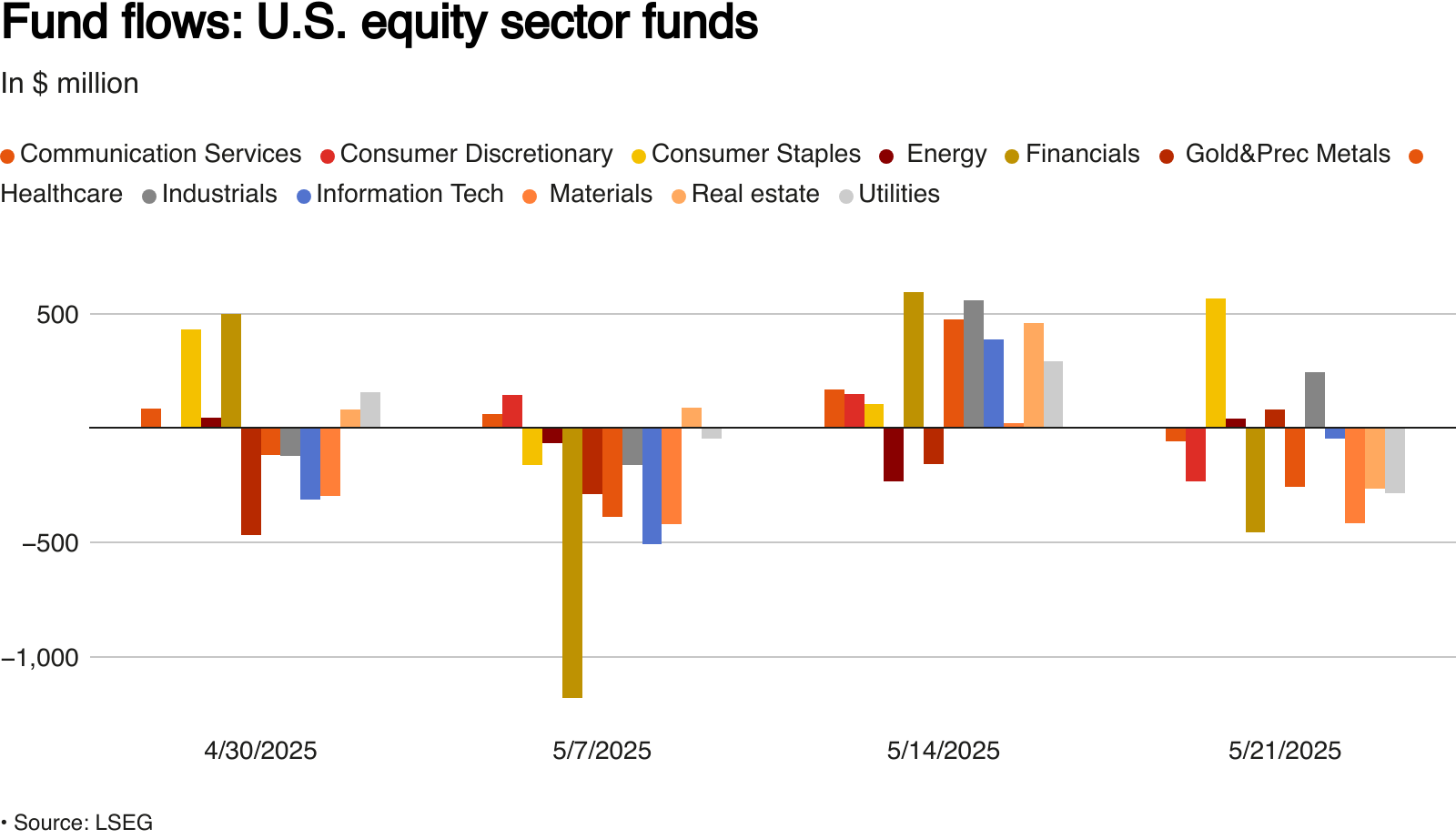

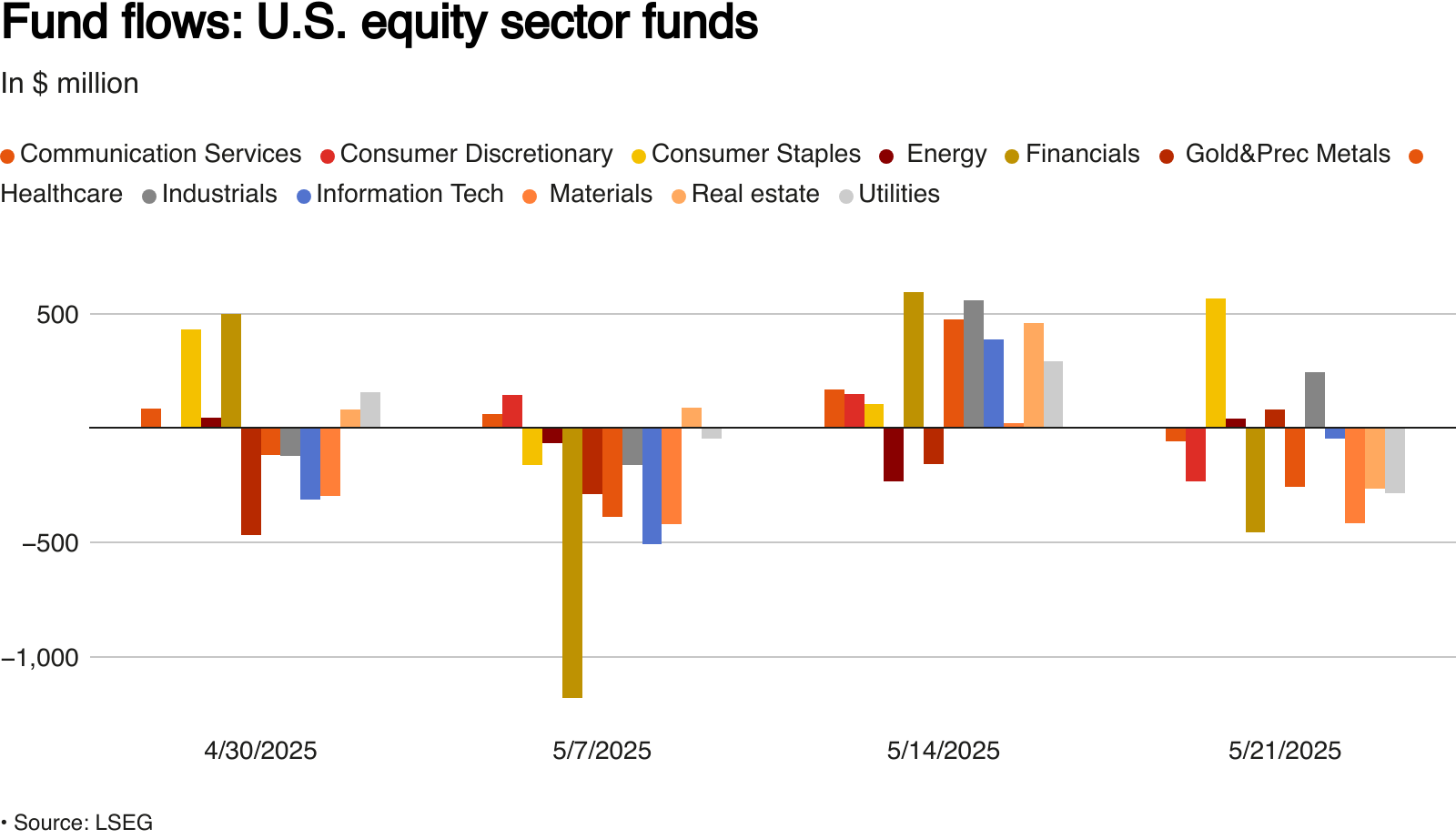

Impact on Key Amsterdam Stock Market Sectors

The 7% plunge wasn't evenly distributed across all sectors of the Amsterdam stock market. Technology, finance, and energy sectors bore the brunt of the decline. Companies heavily reliant on international trade experienced the steepest drops. For example, ASML Holding (ASML.AS), a leading semiconductor equipment manufacturer, saw its share price fall by over 8% in a single day. Similarly, several major financial institutions experienced significant losses, reflecting the overall market sentiment.

Charts illustrating the decline in specific sectors visually highlight the disparity. For instance, a comparison chart showing the performance of the AEX index (Amsterdam Exchange Index) against other major European indices underscores the severity of the Amsterdam-specific drop.

- Performance of leading Dutch companies: ASML (ASML.AS), ING Groep (INGA.AS), and Unilever (UNA.AS) all experienced significant share price declines.

- Comparison to other European stock markets: While other European markets also experienced declines, the drop in Amsterdam was considerably sharper, highlighting the Netherlands' unique vulnerability.

- Analysis of sector-specific vulnerabilities to trade war pressures: Sectors with high export dependence, such as technology and agriculture, were particularly vulnerable to the negative impact of trade uncertainties.

Investor Reactions and Market Sentiment Following the Amsterdam Stock Market Drop

Following the sharp decline, investors reacted swiftly, with many selling off stocks and moving towards safer assets like government bonds and gold. Market sentiment is characterized by widespread fear, uncertainty, and doubt (FUD). The rapid sell-off indicates a significant loss of confidence in the short-term outlook for the Amsterdam stock market.

While the Dutch government hasn't implemented drastic measures yet, the central bank, De Nederlandsche Bank (DNB), is closely monitoring the situation and is prepared to intervene if necessary to maintain financial stability.

- Analysis of trading volume and volatility: Trading volumes surged as investors reacted to the news, further indicating significant market instability.

- Quotes from financial analysts and experts: Many analysts predict a period of continued volatility, urging investors to exercise caution.

- Discussion of investor strategies in response to the crisis: Investors are increasingly diversifying their portfolios and adopting more conservative strategies.

Long-Term Implications for the Amsterdam Stock Market and the Dutch Economy

The long-term implications of this decline remain uncertain. A prolonged period of trade uncertainty could significantly hamper economic growth in the Netherlands. The recovery will depend on several factors, including the resolution of trade disputes, the overall global economic climate, and government policies aimed at stimulating economic activity.

- Projected economic growth (or decline) for the Netherlands: The CPB has revised its growth forecasts downward, reflecting the increased uncertainty.

- Potential government interventions and their effectiveness: Government initiatives aimed at supporting specific sectors could play a significant role in recovery.

- Long-term prospects for investor confidence in the Amsterdam stock market: Restoring investor confidence will be crucial for a sustained recovery.

Strategies for Navigating the Amsterdam Stock Market Volatility

Navigating the current volatility requires a cautious and well-informed approach. Investors should prioritize risk management and diversification strategies. Diversifying across different asset classes, including bonds, real estate, and commodities, can help mitigate potential losses. A long-term investment horizon remains crucial, allowing investors to weather short-term fluctuations.

- Recommendations for diversifying investments: Spread investments across different sectors and asset classes to minimize risk.

- Strategies for mitigating risk during market downturns: Consider hedging strategies and limiting exposure to volatile assets.

- Importance of long-term investment strategies: Maintain a long-term perspective and avoid making rash decisions based on short-term market fluctuations.

Conclusion: Understanding the Amsterdam Stock Market Decline and Preparing for the Future

The 7% plunge in the Amsterdam stock market underscores the significant impact of escalating trade war concerns on the Dutch economy. The decline has resulted in increased market volatility, impacting investor confidence and prompting diverse reactions. The long-term implications for the Amsterdam stock market and the Dutch economy are still unfolding, highlighting the need for careful monitoring and strategic planning. Understanding these factors is crucial for navigating the current volatile climate and making informed investment decisions. Stay informed about developments in the Amsterdam stock market and consider consulting financial advisors for personalized guidance. Continue to monitor reputable financial news sources for the latest updates on the Amsterdam stock market and global trade tensions.

Featured Posts

-

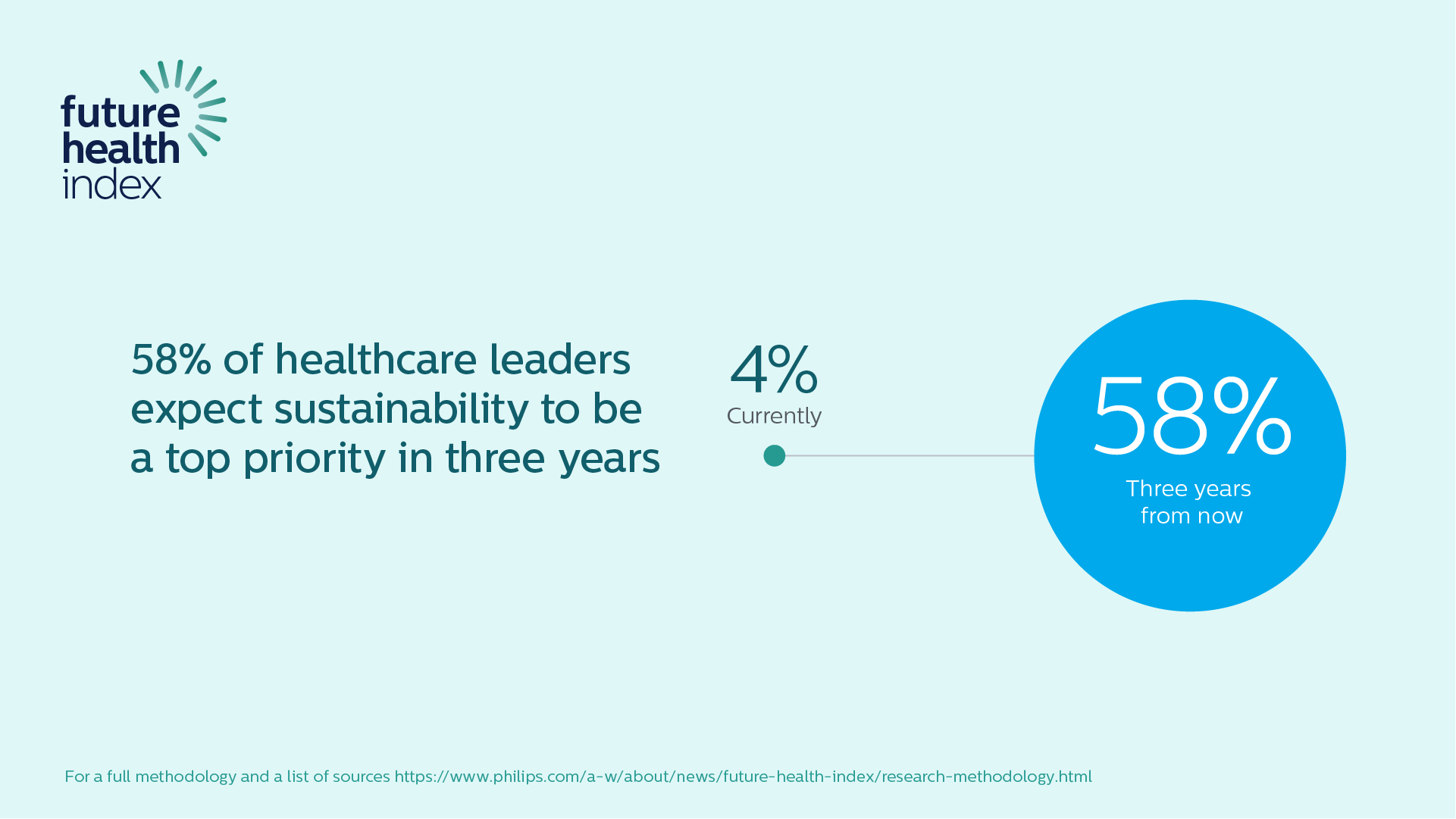

Philips Future Health Index 2025 Ais Transformative Potential In Global Healthcare

May 25, 2025

Philips Future Health Index 2025 Ais Transformative Potential In Global Healthcare

May 25, 2025 -

Amsterdam Stock Market 7 Opening Drop Fuels Trade War Anxiety

May 25, 2025

Amsterdam Stock Market 7 Opening Drop Fuels Trade War Anxiety

May 25, 2025 -

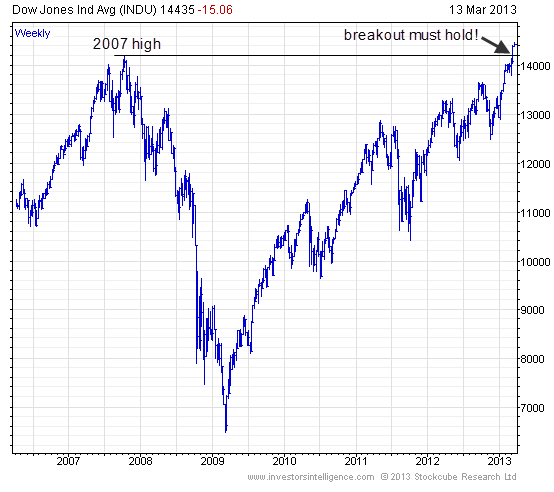

Amundi Dow Jones Industrial Average Ucits Etf A Guide To Net Asset Value

May 25, 2025

Amundi Dow Jones Industrial Average Ucits Etf A Guide To Net Asset Value

May 25, 2025 -

Pobediteli Evrovideniya Za Poslednee Desyatiletie Ikh Sudby I Karera

May 25, 2025

Pobediteli Evrovideniya Za Poslednee Desyatiletie Ikh Sudby I Karera

May 25, 2025 -

Long Delays On M6 After Van Crash

May 25, 2025

Long Delays On M6 After Van Crash

May 25, 2025

Latest Posts

-

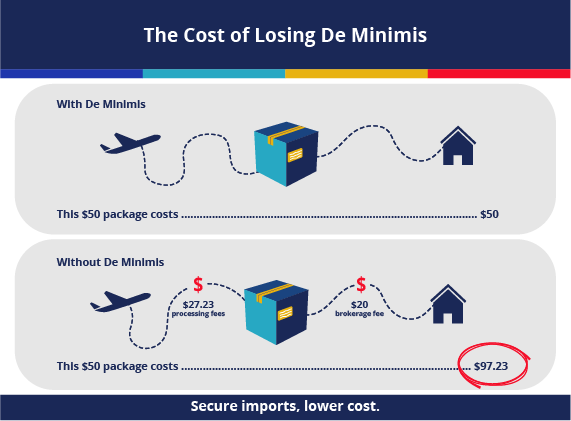

G 7 To Discuss De Minimis Tariff Thresholds For Chinese Goods

May 25, 2025

G 7 To Discuss De Minimis Tariff Thresholds For Chinese Goods

May 25, 2025 -

Increased Rent In La Sparks Price Gouging Debate After Recent Fires

May 25, 2025

Increased Rent In La Sparks Price Gouging Debate After Recent Fires

May 25, 2025 -

Is Betting On Wildfires The New Normal The Los Angeles Case

May 25, 2025

Is Betting On Wildfires The New Normal The Los Angeles Case

May 25, 2025 -

G 7 Nations Debate Lowering De Minimis Tariffs On Chinese Imports

May 25, 2025

G 7 Nations Debate Lowering De Minimis Tariffs On Chinese Imports

May 25, 2025 -

La Landlord Practices Under Scrutiny Following Recent Fires

May 25, 2025

La Landlord Practices Under Scrutiny Following Recent Fires

May 25, 2025