Is Betting On Wildfires The New Normal? The Los Angeles Case

Table of Contents

The Rising Cost of Wildfires in Los Angeles

The escalating cost of wildfires in Los Angeles is undeniable. Over the past decade, the financial toll has skyrocketed, leaving a trail of destruction in its wake. The economic impact of wildfires extends far beyond the immediate damage to property.

-

Escalating Damage Costs: The cost of wildfire damage in Los Angeles has increased exponentially, with billions of dollars in losses reported in recent years. Major fires like the Woolsey Fire (2018) and the Getty Fire (2019) resulted in widespread property destruction, infrastructure damage, and significant displacement of residents.

-

Impact on Property Values: The threat of wildfires significantly impacts property values in affected areas. Homes in high-risk zones experience a devaluation, making it difficult for residents to sell or refinance their properties. This devaluation ripples through the entire Los Angeles real estate market.

-

Soaring Insurance Premiums: As wildfire risk increases, so do insurance premiums. Homeowners in high-risk areas face drastically increased costs for wildfire insurance, making it unaffordable for some. This creates a significant financial burden on residents and exacerbates existing inequalities.

-

Economic Ripple Effects: The economic consequences extend beyond individual homeowners. Wildfires disrupt businesses, damage infrastructure, and lead to job losses, impacting the overall economic health of Los Angeles. The cost of firefighting, recovery, and rebuilding places a substantial strain on city resources and budgets.

The Role of Climate Change in Increasing Wildfire Risk

The link between climate change, increasingly frequent and intense wildfires, and the growing risk in Los Angeles is irrefutable. Global warming is creating a perfect storm of conditions conducive to devastating wildfires.

-

Drought and Extreme Weather: Rising global temperatures contribute to prolonged drought conditions in California, turning vegetation into tinder. Extreme weather events, such as heatwaves and Santa Ana winds, further increase wildfire risk.

-

Increased Ignition and Spread: Drier conditions and higher temperatures create ideal conditions for wildfire ignition and rapid spread. Smaller fires can quickly grow into uncontrollable infernos, fueled by abundant dry brush and strong winds.

-

Wildfire Prediction Models and Their Limitations: While wildfire prediction models are improving, they still have limitations. Accurately forecasting the precise location, timing, and intensity of wildfires remains a challenge, highlighting the unpredictable nature of these events.

-

Long-Term Implications: The long-term implications of climate change on wildfire risk in Los Angeles are deeply concerning. Without significant mitigation efforts, the frequency and intensity of wildfires are expected to increase dramatically in the coming decades.

Insurance Companies and the Wildfire Crisis

Insurance companies are facing an unprecedented challenge in insuring properties in high-risk wildfire zones in Los Angeles. The sheer number of claims and the magnitude of the payouts are pushing many insurers to their limits.

-

Challenges in Risk Assessment: Accurately assessing wildfire risk and pricing insurance accordingly is a complex task. Factors such as topography, vegetation density, and wind patterns need to be considered, making it difficult to establish fair and affordable premiums.

-

Increasing Wildfire Insurance Claims: The number of wildfire insurance claims is steadily rising, putting a huge strain on insurance companies' financial resources. Large-scale wildfires lead to a significant increase in payouts, potentially impacting the financial stability of insurers.

-

Mitigation Strategies from Insurers: To mitigate risk, insurance companies are employing various strategies. This includes adjusting premiums based on risk assessment, implementing stricter building codes in high-risk areas, and potentially limiting the availability of insurance in certain zones.

-

Affordability and Availability of Wildfire Insurance: The increasing cost and reduced availability of wildfire insurance are creating significant challenges for Los Angeles residents. Many homeowners struggle to find affordable coverage, leaving them vulnerable in the face of wildfire risk.

The "Bet" on Mitigation and Prevention

While the focus often lies on reacting to wildfires, the real "bet" lies in our ability to mitigate and prevent them. Proactive measures are crucial to reducing the devastating impact of these events.

-

Wildfire Prevention Strategies: Creating defensible space around homes, implementing community-based fire prevention programs, and actively managing vegetation are critical for reducing wildfire risk. This involves clearing brush, using fire-resistant landscaping, and creating firebreaks.

-

Government and Community Roles: Government agencies and local communities play a crucial role in wildfire mitigation efforts. This includes funding prevention programs, enforcing building codes, and educating residents about wildfire safety.

-

Effectiveness of Prevention Methods: The effectiveness of different prevention methods varies depending on various factors, including the specific location, vegetation type, and weather conditions. A multi-faceted approach that combines various strategies is crucial for maximum impact.

Conclusion

The escalating costs of wildfires in Los Angeles, exacerbated by climate change, pose a significant threat to the city's financial stability and the well-being of its residents. Insurance companies are struggling to keep pace with the rising number of claims, leading to increased premiums and reduced availability of coverage. The metaphorical "betting on wildfires" highlights the inherent risk we're taking. We are, in effect, betting on our ability to mitigate the risks effectively. This requires a comprehensive approach that combines proactive wildfire prevention strategies, robust community engagement, and a concerted effort to address climate change.

Don't gamble with your future; take action to mitigate wildfire risk in Los Angeles. Learn more about wildfire risk in your area, create defensible space around your property, and advocate for policies that prioritize climate change mitigation and wildfire prevention. Visit your local fire department's website ([insert link here]) and your insurance provider ([insert link here]) to learn more about protecting yourself and your community.

Featured Posts

-

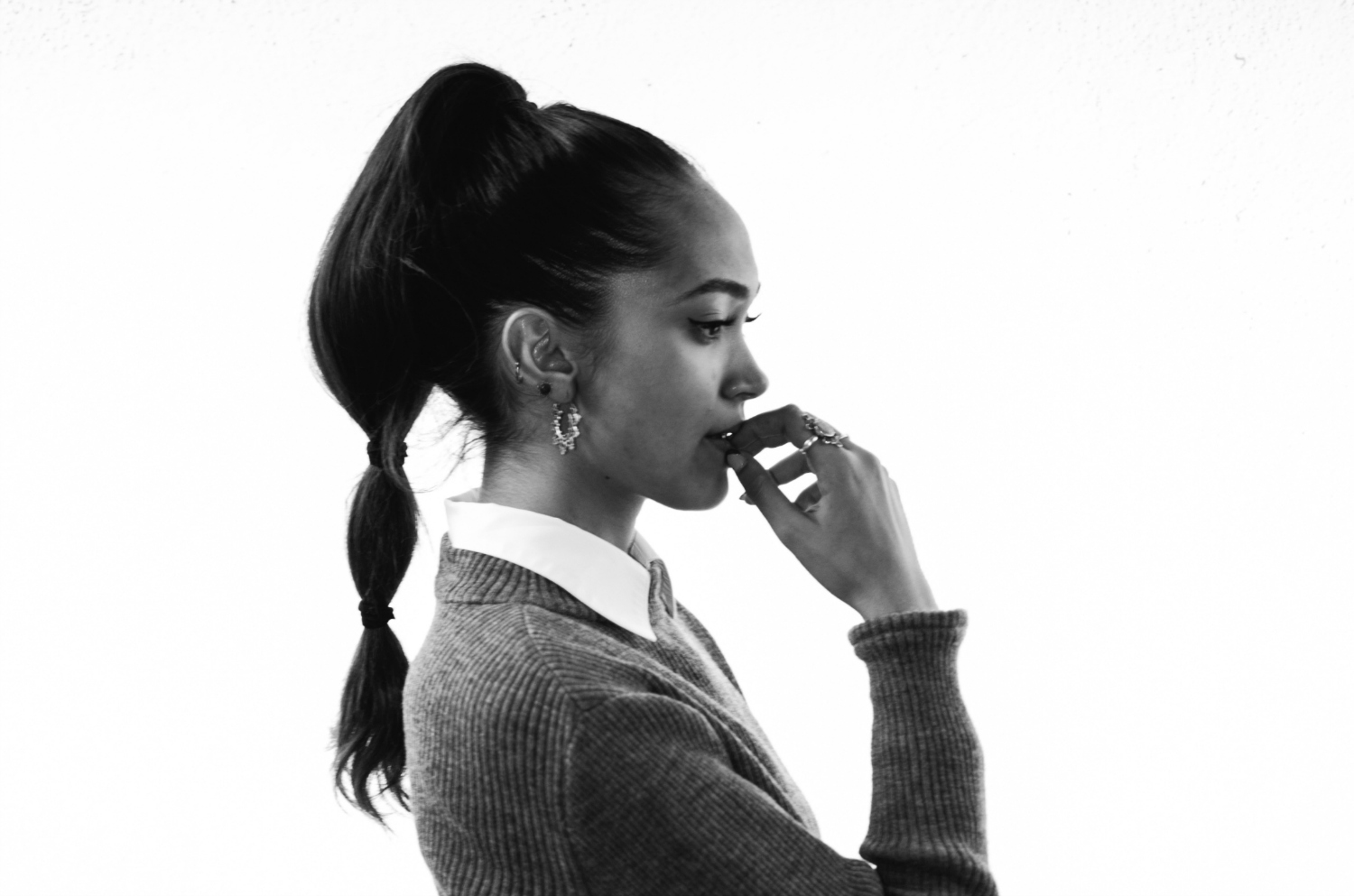

Joy Crookes New Single Carmen Is Out Now

May 25, 2025

Joy Crookes New Single Carmen Is Out Now

May 25, 2025 -

Prognoz Konchiti Vurst Potentsiyni Peremozhtsi Yevrobachennya 2025 Unian

May 25, 2025

Prognoz Konchiti Vurst Potentsiyni Peremozhtsi Yevrobachennya 2025 Unian

May 25, 2025 -

Mia Farrow Demands Trumps Imprisonment For Deporting Venezuelan Gang Members

May 25, 2025

Mia Farrow Demands Trumps Imprisonment For Deporting Venezuelan Gang Members

May 25, 2025 -

Is Elon Musk Selling His Dogecoin

May 25, 2025

Is Elon Musk Selling His Dogecoin

May 25, 2025 -

Mamma Mia Unboxing The New Ferrari Hot Wheels Collection

May 25, 2025

Mamma Mia Unboxing The New Ferrari Hot Wheels Collection

May 25, 2025

Latest Posts

-

George L Russell Jr Maryland Legal Giant And Progressive Icon Passes Away

May 25, 2025

George L Russell Jr Maryland Legal Giant And Progressive Icon Passes Away

May 25, 2025 -

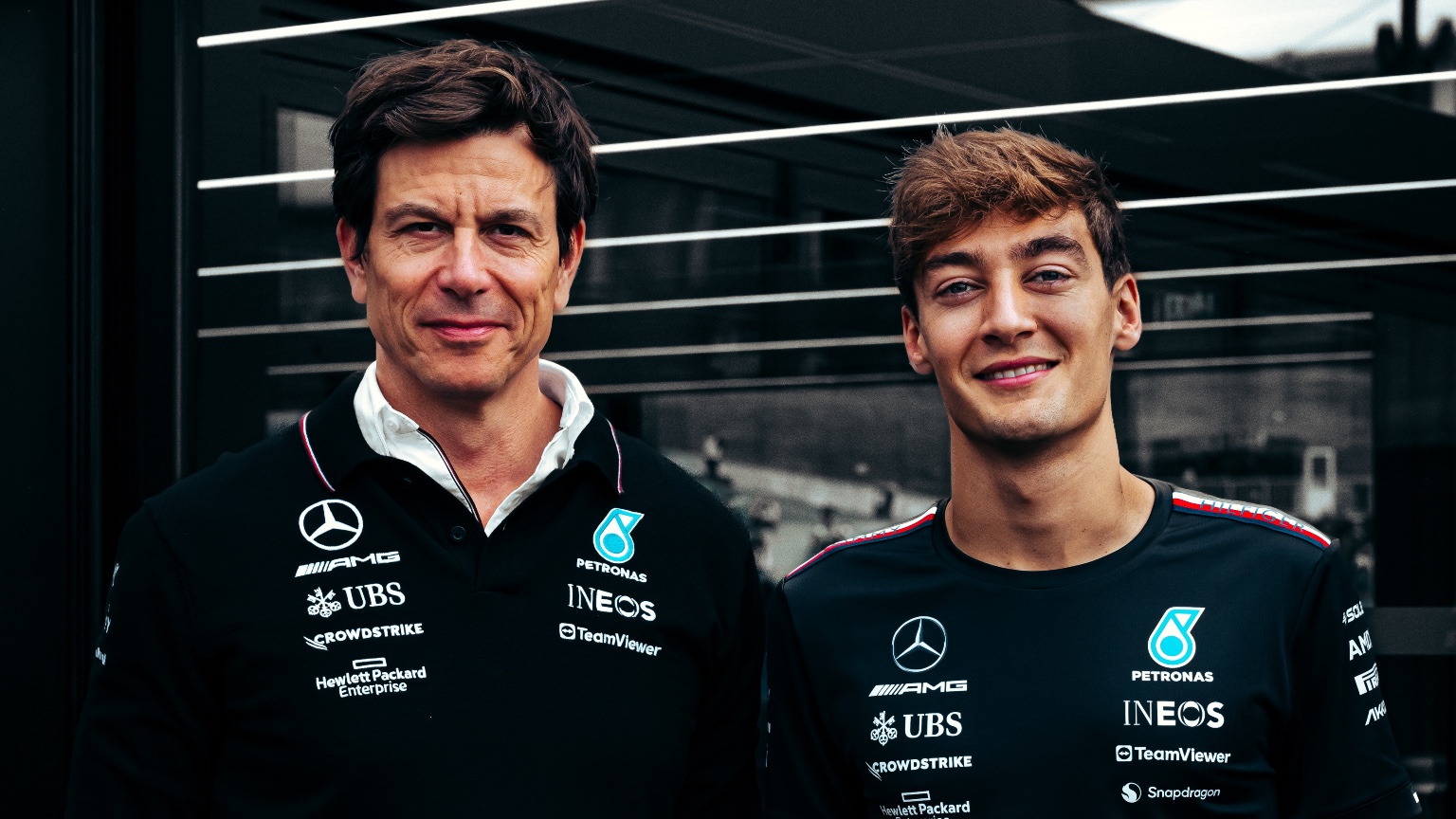

Mercedes F1 Wolffs New Hints On Russells Contract Status

May 25, 2025

Mercedes F1 Wolffs New Hints On Russells Contract Status

May 25, 2025 -

The George Russell Contract Why Mercedes Must Act

May 25, 2025

The George Russell Contract Why Mercedes Must Act

May 25, 2025 -

Will Mercedes Re Sign George Russell The Key Factor

May 25, 2025

Will Mercedes Re Sign George Russell The Key Factor

May 25, 2025 -

Toto Wolffs Latest Comments On George Russells Mercedes Contract

May 25, 2025

Toto Wolffs Latest Comments On George Russells Mercedes Contract

May 25, 2025