Amundi Dow Jones Industrial Average UCITS ETF: A Guide To Net Asset Value

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

Net Asset Value (NAV) represents the value of an ETF's underlying assets minus its liabilities, per share. For the Amundi Dow Jones Industrial Average UCITS ETF, this means calculating the total value of its holdings and subtracting any outstanding liabilities. Understanding this calculation is key to grasping your investment's true worth.

- Calculating NAV: The basic formula is: Assets (market value of holdings) - Liabilities = NAV.

- Components of Assets: The Amundi Dow Jones Industrial Average UCITS ETF primarily holds shares of the 30 companies that comprise the Dow Jones Industrial Average. The market value of these holdings fluctuates constantly, directly affecting the ETF's NAV.

- Types of Liabilities: Liabilities for an ETF are generally low and may include management fees accrued but not yet paid, and other operational expenses.

- Frequency of NAV Calculation: The NAV of the Amundi Dow Jones Industrial Average UCITS ETF is typically calculated daily, reflecting the closing prices of the underlying stocks.

Understanding the NAV calculation for the Amundi Dow Jones Industrial Average UCITS ETF Holdings allows you to track the intrinsic value of your investment separate from market fluctuations in the ETF's share price.

Factors Affecting the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Several factors influence the daily NAV fluctuations of the Amundi Dow Jones Industrial Average UCITS ETF. Keeping these in mind is vital for managing your investment effectively.

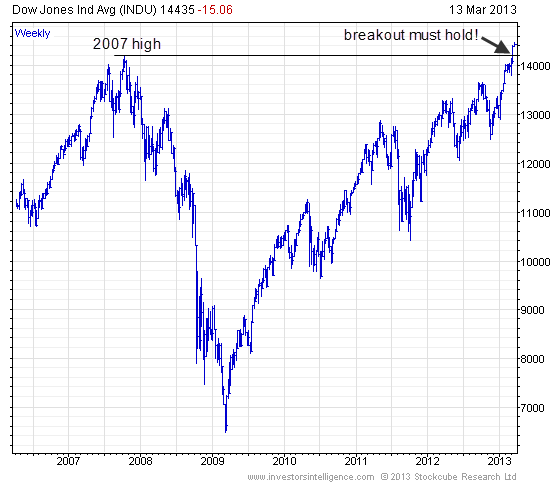

- Market Fluctuations: The primary driver of NAV changes is the performance of the Dow Jones Industrial Average. If the Dow rises, the NAV of the ETF generally rises as well, and vice versa. Market volatility directly impacts the NAV.

- Currency Fluctuations: While the Dow Jones Industrial Average is a US-based index, any currency exchange rate differences between the ETF's base currency and the currencies of any underlying assets held, though minimal, could slightly impact the NAV calculation.

- Dividend Income: Dividends paid by the companies in the Dow Jones Industrial Average are usually reinvested into the ETF, increasing its total assets and consequently, its NAV.

- Expenses: Management fees and other operating expenses reduce the ETF's overall assets, leading to a slightly lower NAV. These expenses are typically reflected in the NAV calculation. Understanding ETF expenses is important for comparing investment options.

How to Find the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Accessing the NAV for the Amundi Dow Jones Industrial Average UCITS ETF is straightforward. Several reliable sources provide this crucial data.

- Official Sources: The most accurate and up-to-date NAV information can be found on Amundi's official website. Many financial news websites and brokerage platforms also publish daily NAV data for this ETF.

- Interpreting NAV Data: Pay close attention to the date and time the NAV is calculated, as well as the currency in which it's expressed.

- Comparing NAV to Market Price: The market price of the ETF may slightly differ from the NAV due to factors like supply and demand (bid-ask spread). While generally close, these discrepancies are normal in the ETF marketplace.

Finding and interpreting ETF NAV data is a crucial skill for actively managing your investment.

The Importance of NAV for Investment Decisions

Monitoring the NAV of the Amundi Dow Jones Industrial Average UCITS ETF is essential for informed investment decision-making.

- Performance Tracking: Tracking the NAV over time allows you to assess the performance of your investment, enabling comparison with other assets and benchmarks.

- Buy and Sell Decisions: While not the sole factor, understanding the NAV can help you identify potentially undervalued or overvalued opportunities when considering buying or selling the ETF.

- Risk Management: By regularly monitoring NAV, you can better understand the risks associated with your investment and adjust your strategy accordingly. This is vital for long-term investment strategies.

Conclusion: Mastering the Net Asset Value of your Amundi Dow Jones Industrial Average UCITS ETF

Understanding the Net Asset Value (NAV) of your Amundi Dow Jones Industrial Average UCITS ETF is paramount for successful investing. By regularly checking the NAV on reliable sources like Amundi's website and comparing it to the market price, you can gain a clearer picture of your investment's performance and make more informed decisions. Actively monitoring your Amundi Dow Jones Industrial Average UCITS ETF NAV and continuing to learn about ETF investing will enhance your investment strategy and help you achieve your financial goals. Remember to regularly review the Amundi Dow Jones Industrial Average UCITS ETF NAV to stay informed and in control of your investment.

Featured Posts

-

Crystal Palace Eye Free Transfer For Kyle Walker Peters

May 25, 2025

Crystal Palace Eye Free Transfer For Kyle Walker Peters

May 25, 2025 -

Aex Stijgt Na Trump Uitstel Analyse Van De Marktwinsten

May 25, 2025

Aex Stijgt Na Trump Uitstel Analyse Van De Marktwinsten

May 25, 2025 -

Find Housing Finance Solutions And Family Fun At The Iam Expat Fair

May 25, 2025

Find Housing Finance Solutions And Family Fun At The Iam Expat Fair

May 25, 2025 -

Inside The New Ferrari Service Centre Bengaluru

May 25, 2025

Inside The New Ferrari Service Centre Bengaluru

May 25, 2025 -

Wall Street Comeback Threatens Germanys Dax Rally

May 25, 2025

Wall Street Comeback Threatens Germanys Dax Rally

May 25, 2025

Latest Posts

-

Find Housing Finance Solutions And Family Fun At The Iam Expat Fair

May 25, 2025

Find Housing Finance Solutions And Family Fun At The Iam Expat Fair

May 25, 2025 -

2024 Philips Annual General Meeting Financial Results And Future Plans

May 25, 2025

2024 Philips Annual General Meeting Financial Results And Future Plans

May 25, 2025 -

Report Philips Holds Annual General Meeting For Shareholders

May 25, 2025

Report Philips Holds Annual General Meeting For Shareholders

May 25, 2025 -

Philips Convenes Annual General Meeting Review And Outlook

May 25, 2025

Philips Convenes Annual General Meeting Review And Outlook

May 25, 2025 -

Royal Philips Details On The 2025 Shareholders Annual General Meeting

May 25, 2025

Royal Philips Details On The 2025 Shareholders Annual General Meeting

May 25, 2025