Amsterdam Stock Market: 7% Opening Drop Fuels Trade War Anxiety

Table of Contents

Causes of the Amsterdam Stock Market Drop

The sharp decline in the Amsterdam Stock Market is attributable to a confluence of factors, primarily stemming from escalating trade tensions and broader global market sentiment, further exacerbated by specific vulnerabilities within the Dutch economy.

Escalating Trade Tensions

- Increased tariffs between major economic powers: The ongoing trade dispute between the US and China, coupled with rising protectionist measures in other regions, creates significant uncertainty for international businesses. This uncertainty directly impacts Dutch companies heavily reliant on global trade.

- Uncertainty surrounding future trade agreements: The lack of clarity regarding future trade deals leaves businesses hesitant to invest and expand, impacting their stock valuations. This uncertainty is a key driver of market volatility.

- Negative impact on global supply chains: Trade wars disrupt established supply chains, increasing costs and leading to production delays. Dutch companies integrated into these global networks are particularly susceptible to these disruptions.

The impact of these trade disputes on Dutch businesses is significant. For instance, the agricultural sector, a cornerstone of the Dutch economy, has been particularly hard hit by retaliatory tariffs, impacting export volumes and profitability. Similarly, the technology sector, with its complex global supply chains, faces considerable challenges in navigating the shifting trade landscape. Economic analysts predict a further contraction in export-oriented sectors if the trade war intensifies.

Global Market Sentiment

- Contagion effect from other major market declines: Negative news and market drops in other major financial centers, such as Wall Street or the Shanghai Stock Exchange, often trigger a "contagion effect," impacting investor confidence globally. The interconnectedness of global markets means that a downturn in one region can quickly spread to others.

- Investor fear and risk aversion: The uncertainty surrounding trade wars and other geopolitical events leads to increased investor fear and a shift towards risk-averse investment strategies. Investors often pull their money from equities, contributing to market declines.

- Flight to safety in less volatile assets (e.g., gold, bonds): During periods of market uncertainty, investors often seek refuge in "safe haven" assets like gold and government bonds, perceived as less risky alternatives to equities. This further drives down stock prices.

The market psychology at play is crucial. Herd behavior, where investors react similarly based on the actions of others, amplifies the impact of negative news, creating a self-reinforcing downward spiral.

Specific Dutch Economic Factors

- Dependence on international trade: The Netherlands has a highly open economy, heavily reliant on international trade. This makes it particularly vulnerable to global economic slowdowns and trade disruptions.

- Vulnerability to global economic slowdowns: A global economic slowdown, often a consequence of trade wars, would disproportionately impact the Dutch economy, given its reliance on exports.

- Impact on specific Dutch companies listed on the Amsterdam exchange: Companies heavily reliant on exports or with significant international operations are more susceptible to the negative effects of trade wars, resulting in lower stock prices.

The Netherlands' strong dependence on specific sectors, such as logistics and international finance, increases its exposure to global economic fluctuations. Any significant disruption in these areas can trigger broader economic instability.

Impact of the Drop on the Netherlands Economy

The 7% drop in the Amsterdam Stock Market has significant implications for the Dutch economy, both in the short and long term.

Short-Term Consequences

- Reduced consumer confidence: Market volatility can erode consumer confidence, leading to reduced spending and investment.

- Potential job losses: Companies facing reduced profitability might resort to layoffs or hiring freezes, impacting employment levels.

- Decreased investment: Uncertainty in the market discourages investment, slowing economic growth.

- Negative impact on GDP growth: The combined effect of reduced consumer spending, investment, and potential job losses will negatively impact the Netherlands' GDP growth.

The immediate consequences are likely to be felt across various sectors, impacting businesses and individuals alike.

Long-Term Implications

- Potential for prolonged economic slowdown: If the trade war continues or escalates, the negative impact on the Dutch economy could be prolonged, leading to a sustained period of slow growth.

- Impact on government revenue: A weakened economy will reduce government tax revenue, potentially limiting the government's ability to implement stimulus measures.

- Need for economic stimulus measures: The government may need to intervene with fiscal or monetary policies to mitigate the negative effects of the market downturn and stimulate economic activity.

The long-term consequences will depend on the duration and intensity of the trade war and the effectiveness of any government intervention.

Investor Response and Strategies

Navigating the volatility in the Amsterdam Stock Market requires a well-defined investment strategy.

Defensive Investment Strategies

- Diversification of portfolios: Spreading investments across different asset classes and geographical regions reduces risk exposure.

- Shifting to less volatile assets: Moving a portion of investments into less volatile assets like government bonds or high-quality corporate bonds can help mitigate losses.

- Hedging strategies to mitigate risks: Employing hedging strategies, such as options or futures contracts, can help protect portfolios from further market declines.

Opportunities Amidst Volatility

- Potential for bargain hunting: The market downturn may present opportunities for seasoned investors to buy undervalued stocks at discounted prices.

- Long-term investment opportunities: Investors with a long-term horizon may view the current market volatility as a buying opportunity, particularly for fundamentally strong companies.

- Understanding market cycles: Recognizing that market cycles include periods of both growth and decline is crucial for making informed investment decisions.

Careful analysis and a long-term perspective are critical for identifying potential opportunities amidst the volatility.

Conclusion

The 7% drop in the Amsterdam Stock Market is a stark reminder of the fragility of global markets and the pervasive impact of trade wars on even strong economies. The volatility highlights the need for investors to adopt robust strategies to navigate economic uncertainty. Understanding the underlying causes and potential consequences is crucial for both individual investors and policymakers. Stay informed about developments in the Amsterdam Stock Market and adjust your investment strategy accordingly to mitigate risk and potentially capitalize on opportunities in this dynamic environment. Keep monitoring the European Stock Market and global trade relations for further updates on the impact of this significant market event.

Featured Posts

-

Menelusuri Sejarah Porsche 356 Dari Pabrik Zuffenhausen Jerman

May 25, 2025

Menelusuri Sejarah Porsche 356 Dari Pabrik Zuffenhausen Jerman

May 25, 2025 -

April 2025 Tornado And Flash Flood Summary April 4th Report

May 25, 2025

April 2025 Tornado And Flash Flood Summary April 4th Report

May 25, 2025 -

Unconfirmed Glastonbury Booking Us Bands Social Media Hints

May 25, 2025

Unconfirmed Glastonbury Booking Us Bands Social Media Hints

May 25, 2025 -

A Successful Escape To The Country Things To Consider Before You Go

May 25, 2025

A Successful Escape To The Country Things To Consider Before You Go

May 25, 2025 -

The Rtx 5060 A Case Study In Graphics Card Review Transparency

May 25, 2025

The Rtx 5060 A Case Study In Graphics Card Review Transparency

May 25, 2025

Latest Posts

-

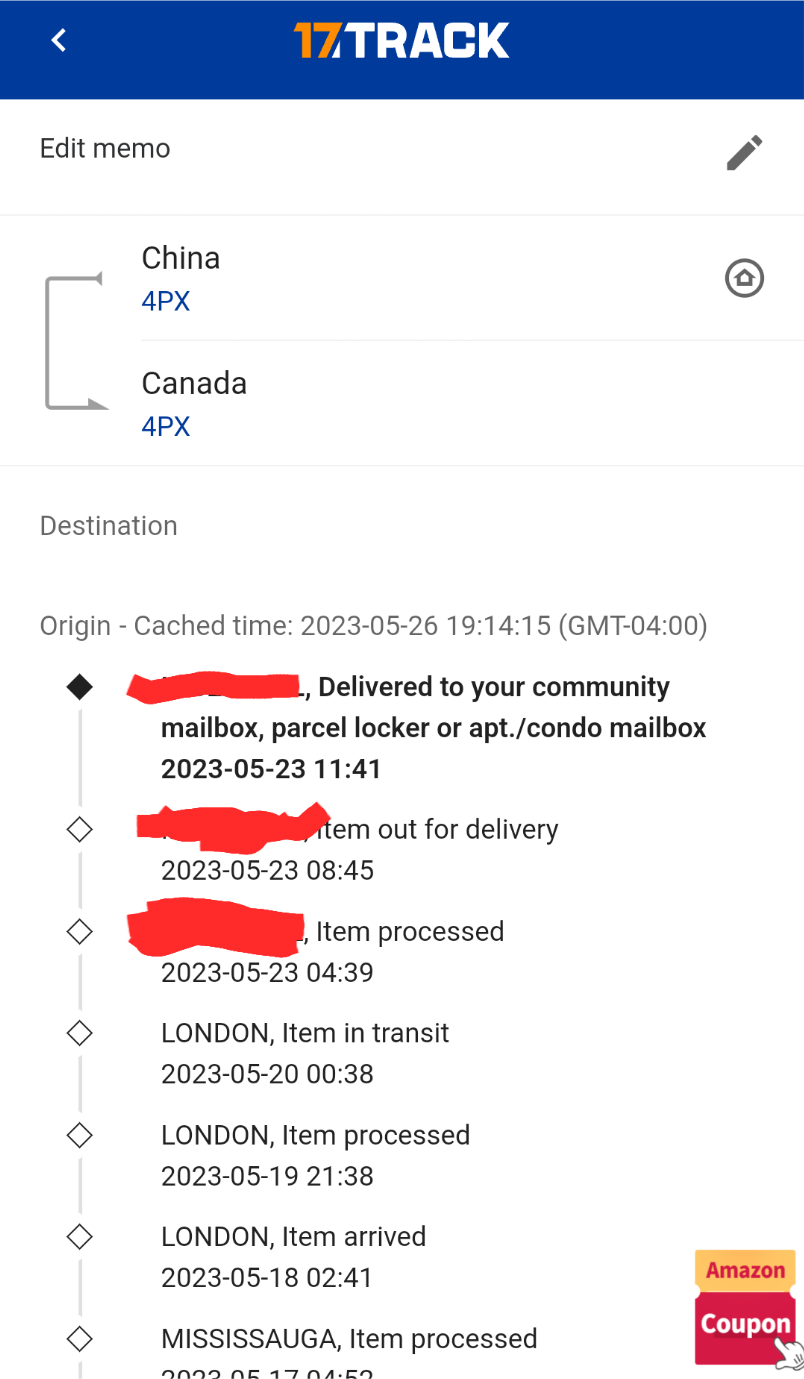

The Shifting Landscape Of Delivery Services Canada Post And The Competition

May 25, 2025

The Shifting Landscape Of Delivery Services Canada Post And The Competition

May 25, 2025 -

Is Canada Posts Decline Creating A Boom For Alternative Delivery Companies

May 25, 2025

Is Canada Posts Decline Creating A Boom For Alternative Delivery Companies

May 25, 2025 -

Analyzing The Growth Of Alternative Delivery Services In Relation To Canada Post

May 25, 2025

Analyzing The Growth Of Alternative Delivery Services In Relation To Canada Post

May 25, 2025 -

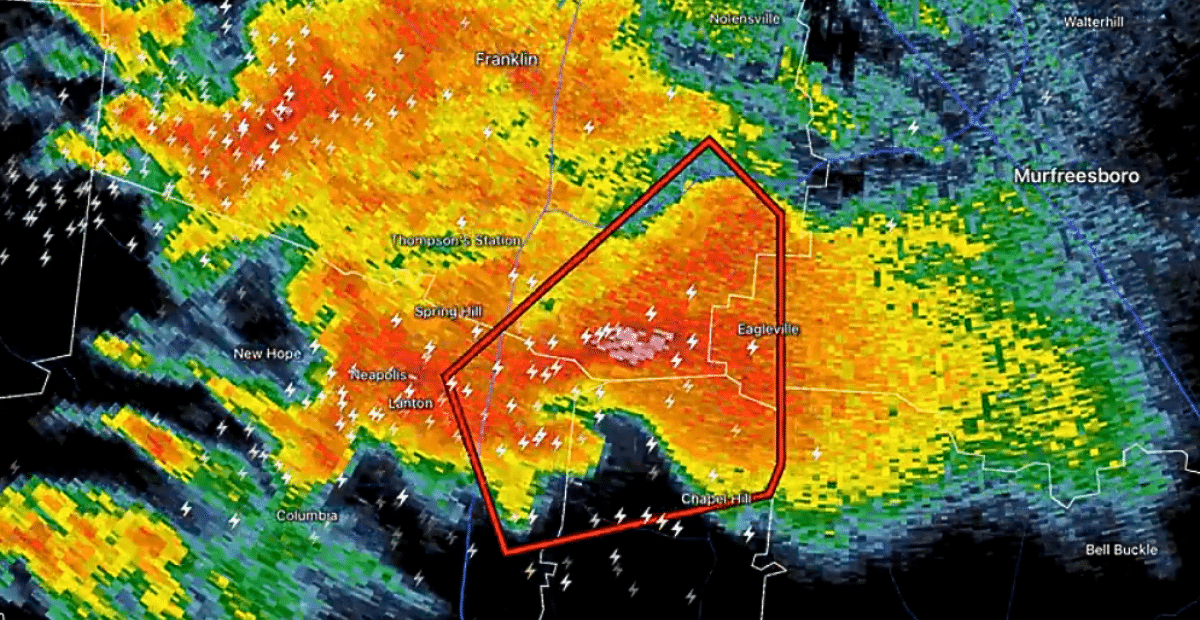

Severe Thunderstorms Bring Flash Flood Warning To Hampshire And Worcester

May 25, 2025

Severe Thunderstorms Bring Flash Flood Warning To Hampshire And Worcester

May 25, 2025 -

Increased Competition Canada Posts Challenges And The Growth Of Alternatives

May 25, 2025

Increased Competition Canada Posts Challenges And The Growth Of Alternatives

May 25, 2025