G-7 To Discuss De Minimis Tariff Thresholds For Chinese Goods

Table of Contents

Current De Minimis Thresholds and Their Impact

Currently, de minimis thresholds for goods imported from China vary significantly across G7 countries. These thresholds determine the value of goods that can be imported without incurring tariffs or duties. A low threshold encourages smaller imports and online shopping from China, boosting e-commerce but potentially straining customs processes.

- United States: The US currently has a de minimis threshold of $800 for most goods, a relatively low threshold compared to other nations. This has led to a surge in small-scale imports from China, particularly via e-commerce platforms.

- European Union: The EU’s threshold varies among member states, but generally sits higher than the US threshold, resulting in a different dynamic for import volumes and customs procedures.

- Japan, Canada, UK, Italy, France, Germany: Each of these G7 members has its own unique de minimis threshold, leading to an inconsistent landscape for importers and exporters dealing with Chinese goods.

The impact of these varied thresholds is considerable. Lower thresholds lead to increased import volumes, often overwhelming customs and regulatory bodies. They also create an uneven playing field for businesses, particularly those located in countries with higher thresholds, who face a competitive disadvantage. The ease of importing cheaper goods also raises concerns regarding intellectual property rights protection.

Arguments for Raising De Minimis Thresholds

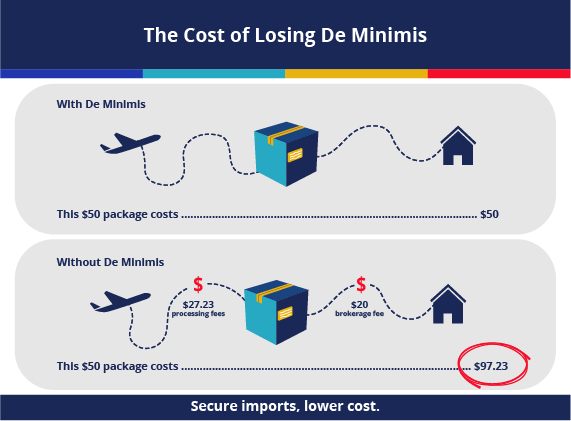

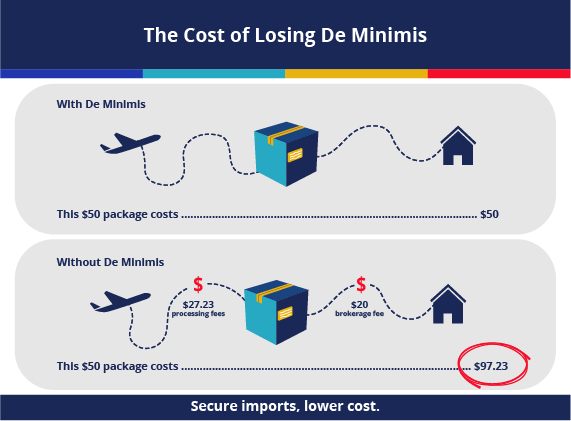

Proponents of raising de minimis thresholds argue that it would streamline import processes, reduce administrative burdens for importers, and benefit consumers through lower costs. This is particularly beneficial for small and medium-sized enterprises (SMEs) engaged in e-commerce.

- Reduced Administrative Burden: Raising the threshold reduces the paperwork and compliance costs associated with importing smaller shipments. This simplifies the process, especially for SMEs that lack the resources for complex customs procedures.

- Lower Import Costs for Consumers: Consumers would benefit from lower prices on goods, as tariffs and duties would only apply to larger, higher-value shipments.

- Enhanced Competitiveness for Smaller Businesses: SMEs would be able to compete more effectively with larger companies due to reduced import costs.

- Potential for Increased Trade: A higher threshold could stimulate trade between the G7 and China, leading to economic growth for both sides.

Arguments Against Raising De Minimis Thresholds

Opponents of raising thresholds raise several crucial concerns, including revenue loss for governments, potential damage to domestic industries, and challenges in controlling counterfeit goods.

- Loss of Revenue: Raising the threshold would result in a reduction in import duties and tariffs collected by governments, impacting public revenue.

- Increased Competition for Domestic Industries: Domestic industries could face increased competition from cheaper imports, potentially leading to job losses and business closures.

- Difficulty in Controlling Counterfeit Products: A higher threshold might make it easier for counterfeit goods to enter the market, undermining intellectual property rights and harming legitimate businesses.

- Potential for Increased Smuggling: A simplified import process could inadvertently facilitate smuggling activities, making it more difficult for authorities to monitor and regulate the flow of goods.

Potential Outcomes and Geopolitical Implications

The G7 discussions on de minimis thresholds could result in several outcomes: no change, a small increase, or a significant increase. Each scenario has far-reaching implications.

- No Change: Maintaining the status quo would preserve the current system, but fail to address concerns around administrative burdens and competitiveness for SMEs.

- Small Increase: A modest increase might offer some relief to small importers while mitigating many of the concerns around revenue loss and counterfeit goods.

- Significant Increase: A substantial increase could dramatically reshape the import landscape, leading to significant changes in trade volumes and potentially sparking retaliatory measures from China.

The decision will undoubtedly impact US-China trade relations and global supply chains. It could influence future trade negotiations and reshape the geopolitical dynamics between the G7 and China. Different sectors, from technology to manufacturing, will experience varying impacts depending on the final decision. The potential for retaliatory tariffs from China adds another layer of complexity to the situation.

Conclusion

The G7's deliberation on de minimis tariff thresholds for Chinese goods is a critical juncture in shaping global trade. The decision will impact businesses, consumers, and international relations. The arguments for and against change highlight the delicate balance between promoting trade and protecting domestic interests.

Call to Action: Stay informed about the G7's final decision on de minimis tariff thresholds for Chinese goods. Understanding these changes and their impact is essential for businesses involved in import/export with China. Further research into the outcomes and their ramifications is crucial for informed decision-making in international trade and e-commerce. Follow reputable news sources for updates on de minimis tariff threshold adjustments and their effect on the global economy.

Featured Posts

-

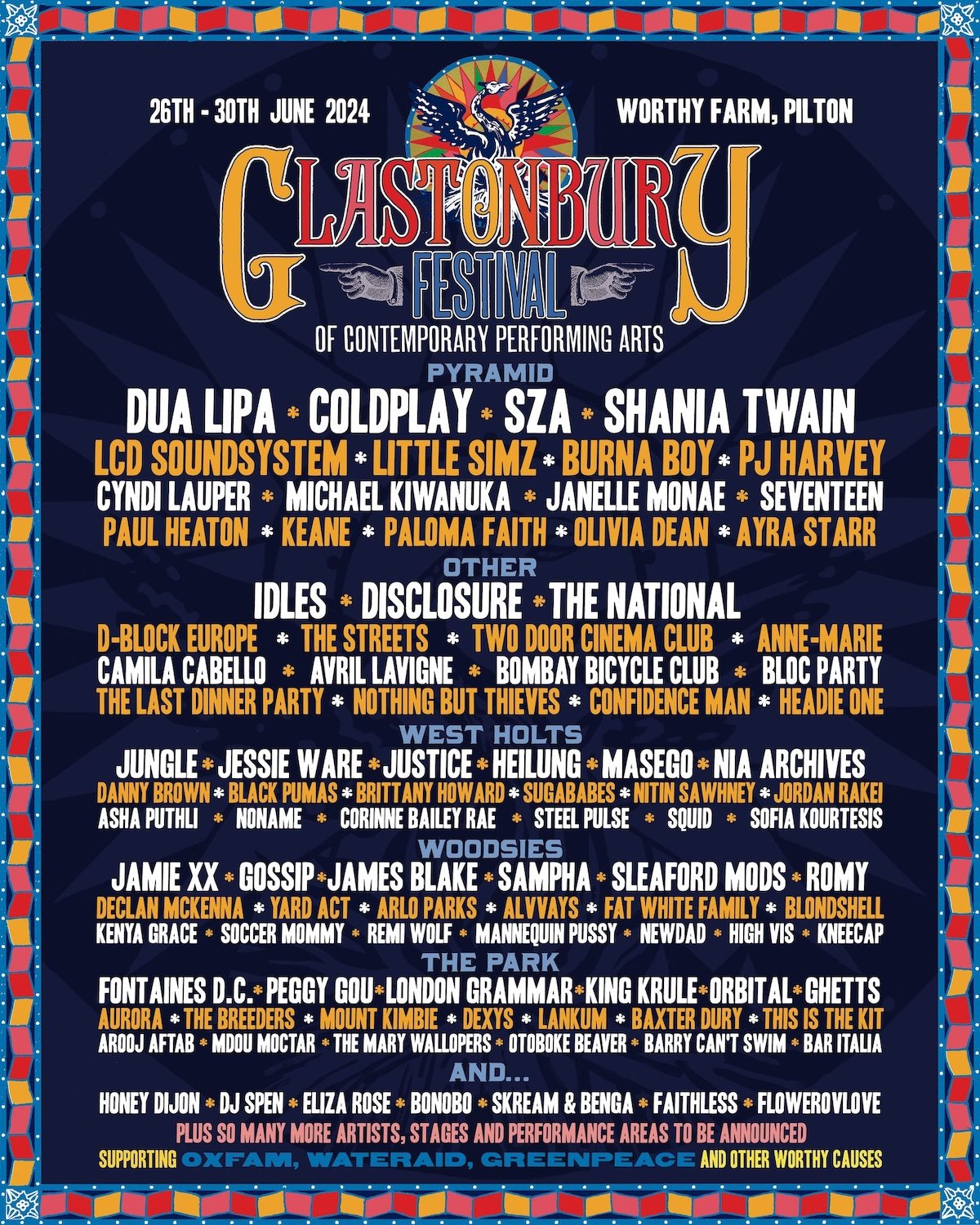

Leaked Glastonbury 2025 Lineup Confirmed Acts And How To Buy Tickets

May 25, 2025

Leaked Glastonbury 2025 Lineup Confirmed Acts And How To Buy Tickets

May 25, 2025 -

Anchor Brewing Companys Closure Reflecting On 127 Years Of Impact

May 25, 2025

Anchor Brewing Companys Closure Reflecting On 127 Years Of Impact

May 25, 2025 -

Southern Vacation Hotspot Rebuts Negative Safety Rating After Shooting Incident

May 25, 2025

Southern Vacation Hotspot Rebuts Negative Safety Rating After Shooting Incident

May 25, 2025 -

West Ham United Bid For Kyle Walker Peters Transfer Offer Details

May 25, 2025

West Ham United Bid For Kyle Walker Peters Transfer Offer Details

May 25, 2025 -

Nvidia Rtx 5060 Review Controversy A Wake Up Call For Gamers

May 25, 2025

Nvidia Rtx 5060 Review Controversy A Wake Up Call For Gamers

May 25, 2025

Latest Posts

-

Vozachi Na Mertsedes Kazneti Pred Gran Pri Na Bakhrein

May 25, 2025

Vozachi Na Mertsedes Kazneti Pred Gran Pri Na Bakhrein

May 25, 2025 -

Popular Southern Vacation Area Fights Back Against Negative Safety Report Post Shooting

May 25, 2025

Popular Southern Vacation Area Fights Back Against Negative Safety Report Post Shooting

May 25, 2025 -

Southern Resort Addresses Safety Concerns Following Recent Shooting

May 25, 2025

Southern Resort Addresses Safety Concerns Following Recent Shooting

May 25, 2025 -

Arrest In Deadly Myrtle Beach Hit And Run Case

May 25, 2025

Arrest In Deadly Myrtle Beach Hit And Run Case

May 25, 2025 -

Shooting Incident Prompts Safety Review At Popular Southern Vacation Spot

May 25, 2025

Shooting Incident Prompts Safety Review At Popular Southern Vacation Spot

May 25, 2025