Recent $67 Million Ethereum Liquidation: A Sign Of Market Weakness?

Table of Contents

Understanding the $67 Million Ethereum Liquidation

The $67 million Ethereum liquidation, which occurred on [Insert Date of Liquidation], was a significant event highlighting the risks inherent in leveraged trading within the decentralized finance (DeFi) ecosystem. A liquidation, in the context of cryptocurrency trading, occurs when a trader's margin account falls below the required maintenance margin. This typically happens when the price of an asset moves against the trader's position, forcing the exchange or lending platform to sell the collateral to cover losses. In this case, a large number of Ethereum positions were liquidated simultaneously.

Key aspects of this event include:

- Total Value Liquidated: $67 million worth of ETH.

- Timeframe: The liquidation occurred over approximately [Insert timeframe, e.g., a few hours].

- Platforms Involved: [Insert names of platforms involved, if known. If unknown, state that information is currently unavailable].

- Position Types: Primarily [Insert whether long or short positions, or both, were liquidated].

The mechanics of these liquidations, particularly within DeFi protocols, involve smart contracts automatically triggering the sale of collateral when predefined thresholds are breached. This automated process, while efficient, can exacerbate market volatility during periods of rapid price swings. The high value of this particular ETH liquidation underscores the significant financial exposure some traders undertake in the pursuit of potentially high returns.

Analyzing Market Conditions Before and After the Liquidation

Before the $67 million ETH liquidation, the cryptocurrency market was experiencing [Describe the overall market conditions – bullish, bearish, sideways, etc.]. [Insert relevant charts and data illustrating market trends leading up to the event. Include links to sources]. The price of Ethereum itself was [Describe the price trend before the liquidation].

Factors influencing market conditions at the time included:

- Macroeconomic Factors: [Mention relevant macroeconomic factors such as inflation rates, interest rate hikes, etc., and their impact on crypto prices.]

- Regulatory News: [Mention any significant regulatory news or developments that could have affected the market].

- Community Sentiment: [Describe the overall sentiment within the crypto community – optimistic, pessimistic, neutral].

- DeFi Activity: [Discuss any significant events or trends within the DeFi space that might have contributed to the liquidation].

Following the $67 million ETH liquidation, the Ethereum price [Describe the price movement after the event]. The impact of this event on the broader market was [Analyze whether the liquidation amplified existing trends or triggered a significant shift]. A comparison of market behavior before and after reveals [State your conclusions based on the comparison].

Is this a Sign of Larger Market Weakness?

The question of whether the $67 million Ethereum liquidation signifies broader market weakness is complex and requires nuanced analysis.

Arguments suggesting it's a sign of weakness include:

- Low Trading Volume: [Explain how low trading volume could contribute to a larger market trend].

- Bearish Market Sentiment: [Explain how negative sentiment could influence the market].

- Increased Volatility: [Discuss the connection between increased volatility and a bearish market].

However, arguments suggesting it's a normal event include:

- Isolated Incident: [Explain why this could have been an isolated event not reflective of larger market trends].

- Healthy Market Correction: [Explain how the liquidation could be a healthy adjustment in a volatile market].

- Leveraged Trading Risks: [Highlight the inherent risks involved in leveraged trading within DeFi and how this liquidation showcases these risks].

The impact on investor confidence is debatable. Some investors might see it as a cause for concern, while others might view it as a buying opportunity. Ultimately, the interpretation depends on individual risk tolerance and market outlook. Expert opinions, like those from [Mention reputable crypto analysts or firms and their perspectives], will provide further insight into the situation.

What to Expect in the Future of Ethereum and the Crypto Market

Predicting the future of Ethereum and the broader cryptocurrency market is inherently challenging due to its volatility. However, based on the current analysis of the $67 million Ethereum liquidation and surrounding market conditions, we can offer some potential scenarios.

- Short-Term Predictions: [Offer cautious short-term predictions regarding Ethereum price and market trends.]

- Long-Term Predictions: [Present long-term predictions based on your analysis of the situation].

- Potential Risks and Opportunities: [Highlight potential risks and opportunities for investors in the Ethereum market].

The long-term trajectory of Ethereum and the crypto market will depend on several factors, including regulatory developments, technological advancements, and overall investor sentiment.

Conclusion: The $67 Million Ethereum Liquidation: Implications and Next Steps

The $67 million Ethereum liquidation serves as a potent reminder of the inherent risks associated with leveraged trading in the dynamic cryptocurrency market. While the event itself was significant, whether it indicates broader market weakness is still subject to ongoing interpretation. The analysis suggests that it's crucial to consider the broader context, including macroeconomic factors, regulatory developments, and overall market sentiment. While this ETH liquidation highlights the risks within DeFi, it's not necessarily a definitive predictor of future market trends.

To navigate this volatile landscape, effective risk management strategies are paramount. Stay informed about future Ethereum liquidations and market trends by following [Your Website/Platform]. Learn more about risk management strategies for Ethereum trading and sign up for our newsletter to receive updates on significant Ethereum liquidations and market analysis. Understanding the dynamics of events like this $67 million Ethereum liquidation is crucial for successful participation in the crypto market.

Featured Posts

-

Analysis The Unexpected Spike In Bitcoin Mining Activity

May 08, 2025

Analysis The Unexpected Spike In Bitcoin Mining Activity

May 08, 2025 -

Xrp Price Prediction 2025 Can Xrp Hit 5

May 08, 2025

Xrp Price Prediction 2025 Can Xrp Hit 5

May 08, 2025 -

Boosting Productivity David Dodges Advice For Governor Carney

May 08, 2025

Boosting Productivity David Dodges Advice For Governor Carney

May 08, 2025 -

Bitcoin Madenciliginde Yeni Bir Doenem Degisen Dinamikler

May 08, 2025

Bitcoin Madenciliginde Yeni Bir Doenem Degisen Dinamikler

May 08, 2025 -

Realistic Wwii Films Expert Opinions And Top Recommendations

May 08, 2025

Realistic Wwii Films Expert Opinions And Top Recommendations

May 08, 2025

Latest Posts

-

Black Rock Etf A Billionaire Investment Poised For Explosive Growth

May 08, 2025

Black Rock Etf A Billionaire Investment Poised For Explosive Growth

May 08, 2025 -

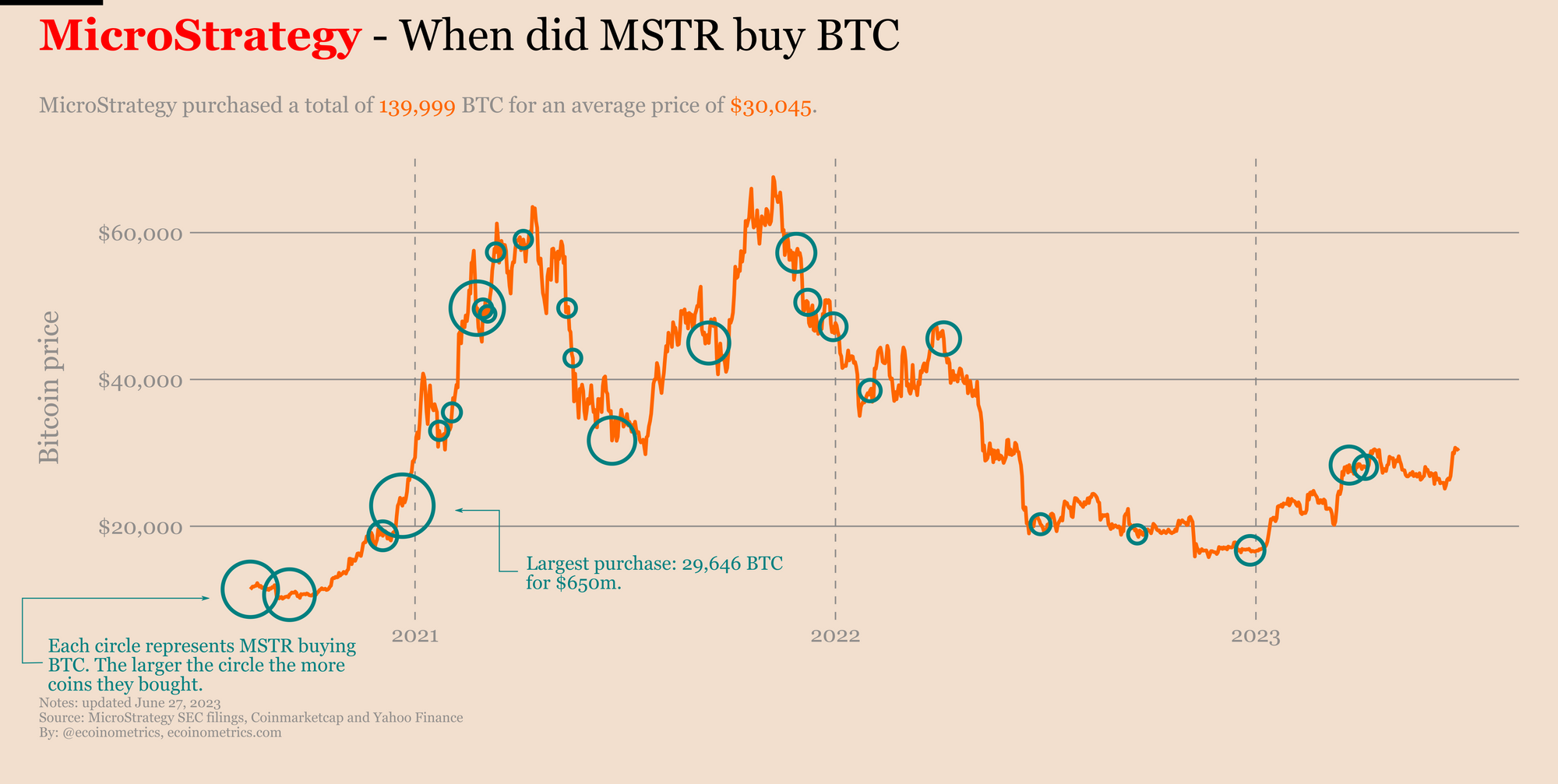

Analyzing Micro Strategy Stock And Bitcoin The Best Investment For 2025

May 08, 2025

Analyzing Micro Strategy Stock And Bitcoin The Best Investment For 2025

May 08, 2025 -

Black Rock Etf Billionaire Investment Strategy For 2025 And Beyond

May 08, 2025

Black Rock Etf Billionaire Investment Strategy For 2025 And Beyond

May 08, 2025 -

Micro Strategy Vs Bitcoin Investment A 2025 Perspective

May 08, 2025

Micro Strategy Vs Bitcoin Investment A 2025 Perspective

May 08, 2025 -

110 Potential Why Billionaires Are Investing In This Black Rock Etf

May 08, 2025

110 Potential Why Billionaires Are Investing In This Black Rock Etf

May 08, 2025