BlackRock ETF: Billionaire Investment Strategy For 2025 And Beyond

Table of Contents

Understanding BlackRock's Dominance in the ETF Market

BlackRock, through its iShares brand, holds a commanding market share in the exchange-traded fund (ETF) industry. This dominance stems from decades of experience, a robust product lineup, and a reputation for innovation.

Key Advantages of Investing in BlackRock ETFs

Investing in BlackRock ETFs offers several compelling advantages:

- Low Expense Ratios: BlackRock ETFs generally boast significantly lower expense ratios compared to actively managed mutual funds, meaning more of your investment stays working for you. This is a crucial factor in maximizing long-term returns.

- Diversification Opportunities: Access to a diverse range of asset classes is readily available through iShares. For example, the iShares Core US Aggregate Bond ETF (AGG) provides broad exposure to the U.S. investment-grade bond market, while the iShares Core S&P 500 ETF (IVV) tracks the performance of the S&P 500 index. This diversification is key to mitigating risk.

- Transparency and Ease of Access: BlackRock ETFs offer transparency regarding their holdings and trading is straightforward, making them accessible to both novice and experienced investors.

- Specific BlackRock ETFs and Underlying Assets:

- iShares MSCI Emerging Markets ETF (EEM): Provides exposure to a broad range of emerging market equities.

- iShares Core U.S. REIT ETF (USRT): Offers exposure to the U.S. real estate investment trust (REIT) sector.

- iShares Global Clean Energy ETF (ICLN): Invests in companies involved in clean energy technologies.

Analyzing BlackRock's Investment Philosophy

BlackRock's investment philosophy is largely built on passive investment strategies and index tracking. This means their ETFs aim to mirror the performance of a specific market index, rather than actively picking individual stocks. This approach aligns perfectly with long-term investment goals, emphasizing consistent, steady growth over speculative, short-term gains.

Billionaire Investment Strategies and ETF Utilization

Many billionaires employ sophisticated investment strategies, but several core principles consistently emerge. BlackRock ETFs can be effectively utilized to implement these strategies.

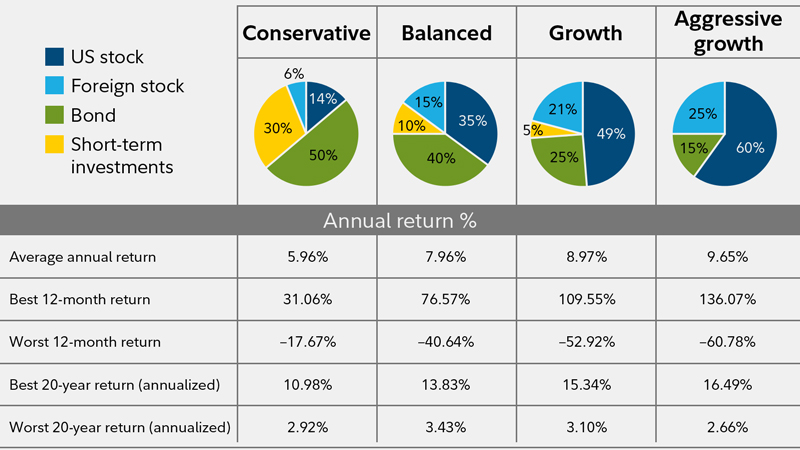

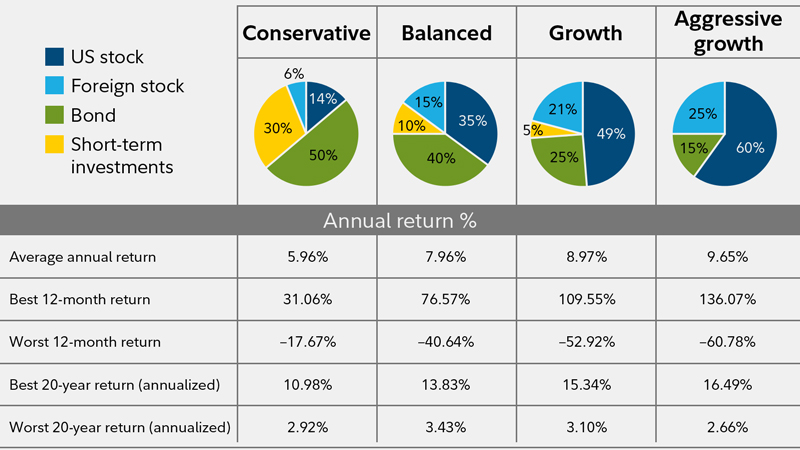

Diversification: A Cornerstone of Billionaire Portfolios

Diversification is paramount in mitigating risk. By spreading investments across various asset classes and geographies, billionaires reduce the impact of any single market downturn. BlackRock ETFs make diversification incredibly efficient:

- Example Diversified Portfolio: A combination of AGG (bonds), IVV (U.S. equities), EEM (emerging markets), and USRT (real estate) provides a diversified portfolio across various asset classes and geographies.

- Diverse BlackRock ETFs:

- iShares MSCI EAFE ETF (EFA): Offers exposure to developed international markets outside of North America.

- iShares Core Total USD Bond Market ETF (IUSG): Provides broad exposure to the U.S. investment-grade bond market.

- iShares Global Infrastructure ETF (IGF): Invests in global infrastructure companies.

Long-Term Investing: The Billionaire's Approach

Billionaires understand the power of long-term investing. BlackRock ETFs, with their low expense ratios and focus on index tracking, are ideally suited for long-term strategies. The potential for compounding returns over decades is significant.

Passive Investing vs. Active Management

Many billionaires favor passive investing strategies over active management. The lower costs and often superior long-term performance of passive index funds, like those offered by BlackRock, are compelling reasons for this preference.

BlackRock ETF Strategies for 2025 and Beyond

Adapting to market changes and identifying emerging opportunities are key to long-term success.

Adapting to Market Volatility

Market volatility is inevitable. BlackRock ETFs can be strategically used to manage risk:

- Sector Rotation: Shifting investments between different BlackRock ETFs based on market performance (e.g., moving from technology ETFs to consumer staples ETFs during market downturns).

- Bond ETFs for Risk Mitigation: Using bond ETFs like AGG to reduce overall portfolio volatility during periods of equity market uncertainty.

Identifying Emerging Market Opportunities

Emerging markets often present higher growth potential. BlackRock ETFs offer convenient exposure to these markets, allowing investors to participate in their growth.

ESG Investing with BlackRock ETFs

Environmental, Social, and Governance (ESG) factors are increasingly important. BlackRock offers several ETFs aligned with ESG principles, enabling investors to align their portfolios with their values.

Conclusion

Utilizing BlackRock ETFs offers a compelling path to building a robust and diversified investment portfolio, mimicking strategies employed by successful long-term investors. Key takeaways include leveraging diversification across various asset classes, embracing a long-term investment horizon, adopting passive investment strategies, and adapting to changing market conditions. Explore BlackRock ETF options today to build a strong foundation for your financial future. Invest in BlackRock ETFs and begin building your portfolio for 2025 and beyond. [Link to BlackRock's website]

Featured Posts

-

The Life Of Chuck Movie Trailer Stephen Kings Positive Review

May 08, 2025

The Life Of Chuck Movie Trailer Stephen Kings Positive Review

May 08, 2025 -

Tnts Hilarious Commentary Tatum Takes The Heat In Lakers Celtics Promo

May 08, 2025

Tnts Hilarious Commentary Tatum Takes The Heat In Lakers Celtics Promo

May 08, 2025 -

Wednesday April 2nd 2025 Official Lotto And Lotto Plus Results

May 08, 2025

Wednesday April 2nd 2025 Official Lotto And Lotto Plus Results

May 08, 2025 -

Bobi Marjanovic I Neobican Obicaj Zasto Se Dzordan I Jokic Ljube Tri Puta

May 08, 2025

Bobi Marjanovic I Neobican Obicaj Zasto Se Dzordan I Jokic Ljube Tri Puta

May 08, 2025 -

11 Million Eth Accumulated Implications For Ethereums Price

May 08, 2025

11 Million Eth Accumulated Implications For Ethereums Price

May 08, 2025

Latest Posts

-

Kuzmas Comments On Tatums Viral Instagram Photo

May 08, 2025

Kuzmas Comments On Tatums Viral Instagram Photo

May 08, 2025 -

Understanding Partly Cloudy Weather Patterns

May 08, 2025

Understanding Partly Cloudy Weather Patterns

May 08, 2025 -

Rebels In Andor Season 2 Examining The Timeline For Connections

May 08, 2025

Rebels In Andor Season 2 Examining The Timeline For Connections

May 08, 2025 -

Andor Season 2 Release Date Trailer And Everything We Know

May 08, 2025

Andor Season 2 Release Date Trailer And Everything We Know

May 08, 2025 -

Prepare For Partly Cloudy Conditions A Weather Guide

May 08, 2025

Prepare For Partly Cloudy Conditions A Weather Guide

May 08, 2025