BlackRock ETF: A Billionaire Investment Poised For Explosive Growth?

Table of Contents

Exchange-Traded Funds (ETFs) are investment funds traded on stock exchanges, offering diversification and typically lower expense ratios than mutual funds. BlackRock, through its iShares platform, is the undisputed leader in the ETF market, holding a dominant global market share. This article will explore whether this dominance translates to explosive growth potential for investors, especially those with significant capital.

BlackRock's ETF Market Leadership and Diversification

BlackRock's dominance stems from its extensive range of ETF offerings. From the broadly diversified iShares Core series targeting core portfolio holdings to thematic ETFs focusing on specific sectors or trends (e.g., technology, renewable energy), BlackRock caters to a wide spectrum of investor profiles. This scale provides significant advantages:

- Lower Expense Ratios: BlackRock's massive asset under management allows for economies of scale, resulting in lower expense ratios compared to many competitors. This translates to greater returns for investors.

- High Liquidity: The sheer volume of BlackRock ETFs traded ensures high liquidity, meaning investors can easily buy and sell shares without significantly impacting the price.

Examples of top-performing BlackRock ETFs include:

- iShares CORE S&P 500 (IVV): A broadly diversified ETF tracking the S&P 500 index. (Past performance is not indicative of future results.)

- iShares iBonds Aggregate Bond ETF (AGG): A popular choice for fixed-income exposure. (Past performance is not indicative of future results.)

- iShares Global Clean Energy ETF (ICLN): An example of a thematic ETF focused on a growing sector. (Past performance is not indicative of future results.)

These ETFs, and many others in the BlackRock family, represent various asset classes, offering investors comprehensive diversification options.

Factors Contributing to Potential Explosive Growth

Several factors point towards the potential for explosive growth in BlackRock ETFs:

Rising Demand for Passive Investing

The investment landscape is shifting towards passive investment strategies. Investors are increasingly embracing index funds and ETFs, recognizing the potential for lower costs and improved diversification compared to actively managed funds. BlackRock ETFs are perfectly positioned to benefit from this trend.

Technological Advancements and Accessibility

Online brokerage platforms and mobile trading apps have democratized investing, making ETFs more accessible than ever before. This increased accessibility fuels the demand for easy-to-understand and easily-traded investment products like BlackRock ETFs.

Global Market Expansion and Emerging Markets

BlackRock maintains a strong presence in international markets, capitalizing on growth opportunities in emerging economies. Exposure to these markets through BlackRock ETFs adds diversification and potential for higher returns, but also carries increased risk.

Innovative ETF Product Development

BlackRock continues to innovate, introducing ETFs focused on Environmental, Social, and Governance (ESG) factors, thematic investments, and other specialized strategies. These innovative products attract a growing segment of investors seeking specific investment objectives.

Potential Risks and Challenges for BlackRock ETFs

While the outlook for BlackRock ETFs appears positive, several risks warrant consideration:

- Market Volatility: Like all investments, BlackRock ETFs are subject to market volatility. Economic downturns can significantly impact their performance.

- Competition: BlackRock faces competition from other major ETF providers, potentially impacting market share and growth.

- Regulatory Changes: Changes in regulations can influence the ETF industry, impacting costs, fees, and product offerings.

- Geopolitical Risks: Global events and geopolitical instability can negatively impact investment markets and ETF performance.

BlackRock ETFs and the Billionaire Investor Profile

BlackRock ETFs are well-suited for sophisticated investors, including high-net-worth individuals. Their diversification, cost-efficiency, and accessibility make them valuable tools in portfolio construction. Billionaire investors may use BlackRock ETFs for:

- Strategic Asset Allocation: Allocating capital across various asset classes to optimize risk and return.

- Tax Optimization: Employing tax-efficient strategies using ETFs within their overall investment plan.

Conclusion: Is a BlackRock ETF Right for You? A Final Verdict

BlackRock ETFs offer compelling advantages, including diversification, liquidity, and low expense ratios. Their market leadership and innovative product development suggest significant growth potential. However, investors must acknowledge the inherent risks associated with market volatility, competition, and regulatory changes. Thorough research and a well-defined investment strategy are crucial before investing in any ETF.

Ready to explore the potential of BlackRock ETFs for your investment portfolio? Start your research today and discover how these powerful investment vehicles could help you achieve your financial goals. [Link to BlackRock's website] [Link to reputable financial information site]

Featured Posts

-

Pese Yjet E Psg Se Qe Luis Enrique Do T I Largoje

May 08, 2025

Pese Yjet E Psg Se Qe Luis Enrique Do T I Largoje

May 08, 2025 -

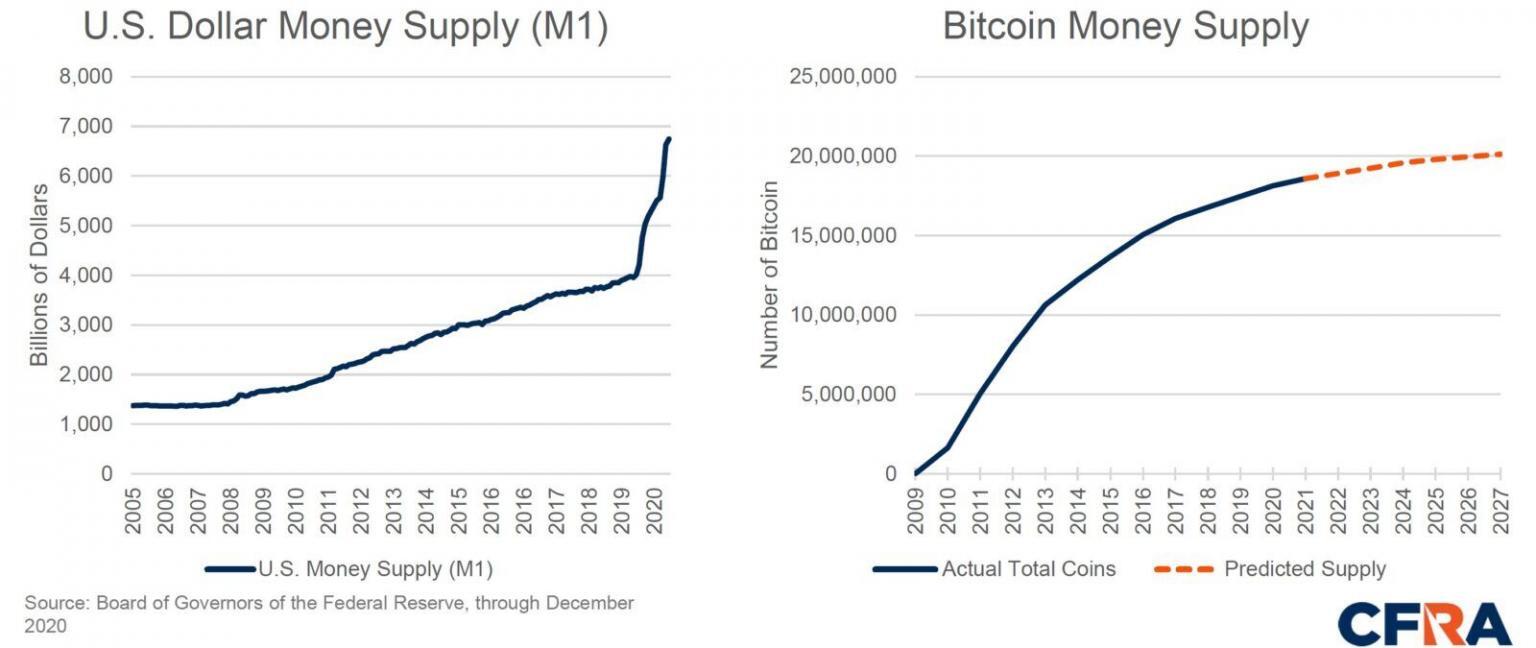

Is A 10x Bitcoin Multiplier Realistic Wall Streets Perspective

May 08, 2025

Is A 10x Bitcoin Multiplier Realistic Wall Streets Perspective

May 08, 2025 -

Xrp Etf Hopes Sec Shakeups And A Ripple Of Change

May 08, 2025

Xrp Etf Hopes Sec Shakeups And A Ripple Of Change

May 08, 2025 -

Lahwr Myn 5 Ahtsab Edaltyn Khtm Kya Yh Fyslh Drst He

May 08, 2025

Lahwr Myn 5 Ahtsab Edaltyn Khtm Kya Yh Fyslh Drst He

May 08, 2025 -

The End Of An Era Sonos And Ikea Part Ways On Smart Home Speakers

May 08, 2025

The End Of An Era Sonos And Ikea Part Ways On Smart Home Speakers

May 08, 2025

Latest Posts

-

Gjranwalh Wlyme Ke Dn Dl Ka Dwrh Dlha Ky Almnak Mwt

May 08, 2025

Gjranwalh Wlyme Ke Dn Dl Ka Dwrh Dlha Ky Almnak Mwt

May 08, 2025 -

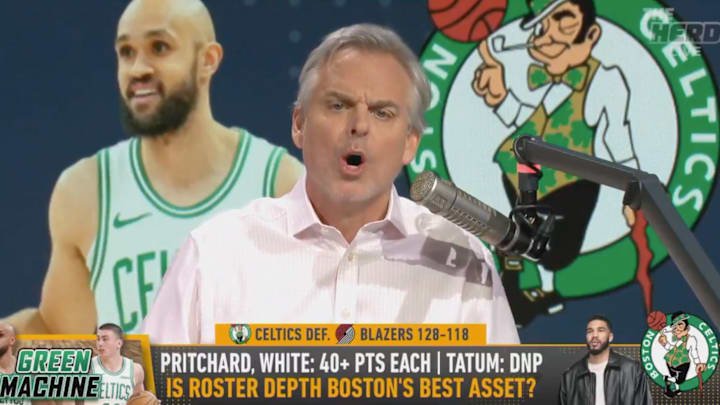

Analyzing Colin Cowherds Criticism Of Jayson Tatums Basketball Skills

May 08, 2025

Analyzing Colin Cowherds Criticism Of Jayson Tatums Basketball Skills

May 08, 2025 -

Wlyme Ky Sham Ghm Myn Bdl Gyy Gjranwalh Myn Dlha Ka Antqal

May 08, 2025

Wlyme Ky Sham Ghm Myn Bdl Gyy Gjranwalh Myn Dlha Ka Antqal

May 08, 2025 -

Colin Cowherd And Jayson Tatum A Persistent Point Of Contention

May 08, 2025

Colin Cowherd And Jayson Tatum A Persistent Point Of Contention

May 08, 2025 -

Dl Ka Dwrh Gjranwalh Myn Wlyme Ke Mwqe Pr Dlha Ky Mwt

May 08, 2025

Dl Ka Dwrh Gjranwalh Myn Wlyme Ke Mwqe Pr Dlha Ky Mwt

May 08, 2025