Ontario Budget 2024: Key Changes To Manufacturing Tax Credits

Table of Contents

Enhanced Manufacturing Tax Credit Rates in Ontario Budget 2024

The Ontario Budget 2024 introduces increased tax credit rates for eligible manufacturing activities, offering substantial incentives for businesses to invest and grow. These enhanced manufacturing tax credits aim to boost innovation and competitiveness within the Ontario manufacturing sector.

- Increased Rates: The specific rate increases vary depending on the type of manufacturing activity. For example, investment in advanced manufacturing technologies may now qualify for a higher percentage tax credit than previously offered.

- Eligible Expenses: While the general categories of eligible expenses remain largely consistent, there may be clarifications or expansions under the Ontario Budget 2024. These could include specific software purchases, research and development expenditures, or investments in automation equipment. It's essential to review the official government documentation for precise details.

- Example: A manufacturer investing in new automation equipment, such as robotic welding systems, could now claim a significantly higher tax credit under the Ontario Budget 2024 changes, potentially offsetting a considerable portion of the investment cost. This increased incentive directly translates to greater profitability and accelerated growth.

- Keyword Integration: The Ontario Budget 2024 tax incentives for enhanced manufacturing tax credits and increased tax credit rates represent a significant boost to the sector.

Expansion of Eligible Activities under Ontario Budget 2024 Manufacturing Tax Credits

The Ontario Budget 2024 significantly expands the scope of eligible activities for manufacturing tax credits. This expanded eligibility opens doors for businesses previously excluded, fostering innovation and diversification within the sector.

- New Eligible Activities: The Ontario Budget 2024 now includes advanced manufacturing processes such as 3D printing, additive manufacturing, robotics, and artificial intelligence (AI) integration in the eligible activities list. This signals a government commitment to supporting cutting-edge technologies.

- Implications for Previously Excluded Businesses: Businesses previously ineligible due to the nature of their manufacturing processes may now qualify for Ontario Budget 2024 manufacturing incentives, providing a considerable competitive advantage.

- Examples: Businesses specializing in customized 3D-printed components or AI-driven quality control systems are now explicitly eligible for these expanded Ontario Budget 2024 manufacturing tax credits.

Simplified Application Process for Ontario Budget 2024 Manufacturing Tax Credits

The Ontario government has made efforts to streamline the application process for Ontario Budget 2024 manufacturing tax credits. This simplified process aims to reduce administrative burdens on businesses, allowing them to focus on growth and innovation.

- Streamlined Application: The exact nature of the simplifications may involve improved online portals, clearer application forms, or reduced documentation requirements. Checking the official government website for details on these changes is critical.

- Online Tools and Resources: The government likely offers updated online tools and resources to guide businesses through the application process. These resources can significantly reduce the time and effort required to claim the tax credits.

- Reduced Administrative Burden: The aim is to make claiming these Ontario Budget 2024 tax credit applications significantly less cumbersome than in previous years, freeing up valuable time and resources for businesses.

Impact on Small and Medium-Sized Enterprises (SMEs) in Ontario's Manufacturing Sector

The changes introduced in the Ontario Budget 2024 have a particularly significant impact on SMEs in the manufacturing sector. The streamlined application process and potentially increased credit amounts provide crucial support for these businesses.

- Targeted Support for SMEs: The Ontario government might have introduced specific measures or programs to further assist SMEs in accessing and benefiting from these small business tax credits.

- Examples: A smaller manufacturer investing in energy-efficient equipment could see a substantial return on investment thanks to these Ontario Budget 2024 support for manufacturers. This could significantly enhance their competitiveness.

Potential Challenges and Considerations for Ontario Manufacturers

While the Ontario Budget 2024 Manufacturing Tax Credits offer significant benefits, businesses might encounter certain challenges in accessing or utilizing them effectively.

- Complex Requirements: Understanding the specific eligibility criteria and navigating the application process may still pose a challenge for some businesses.

- Limited Resources: Smaller manufacturers may lack the internal resources to fully understand and maximize the benefits of the new tax credits.

- Strategies to Overcome Challenges: Seeking professional advice from tax advisors or consultants specializing in manufacturing tax credits can prove invaluable in overcoming these hurdles. Understanding the Ontario Budget 2024 complexities is crucial.

Conclusion: Leveraging the Ontario Budget 2024 Manufacturing Tax Credits for Growth

The Ontario Budget 2024 introduces significant enhancements to manufacturing tax credits, including increased rates, expanded eligibility, and a simplified application process. These changes represent a considerable opportunity for businesses of all sizes, particularly SMEs, to accelerate growth and enhance competitiveness. By carefully navigating the potential challenges and seeking professional advice, Ontario manufacturers can maximize their returns from the updated Ontario Budget 2024 Manufacturing Tax Credits. Don't miss out on these opportunities! Contact a tax professional today to optimize your business’s eligibility and maximize your returns from the Ontario Budget 2024 Manufacturing Tax Credits.

Featured Posts

-

Albwlysaryw Tetql Tyara Ajnbya

May 07, 2025

Albwlysaryw Tetql Tyara Ajnbya

May 07, 2025 -

The Julius Randle Phenomenon A Case Study In Shifting Fan Opinion Timberwolves

May 07, 2025

The Julius Randle Phenomenon A Case Study In Shifting Fan Opinion Timberwolves

May 07, 2025 -

Julius Randles Resurgence A Timberwolves Triumph

May 07, 2025

Julius Randles Resurgence A Timberwolves Triumph

May 07, 2025 -

March 27th Cavaliers Spurs Game Key Player Injury News

May 07, 2025

March 27th Cavaliers Spurs Game Key Player Injury News

May 07, 2025 -

Nhl A Svetovy Pohar 2028 Boj O Ucast Slovenska

May 07, 2025

Nhl A Svetovy Pohar 2028 Boj O Ucast Slovenska

May 07, 2025

Latest Posts

-

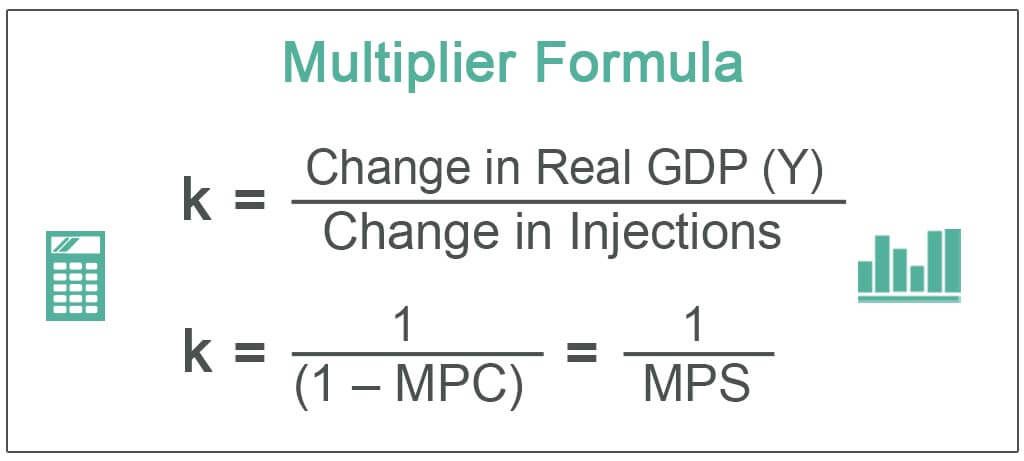

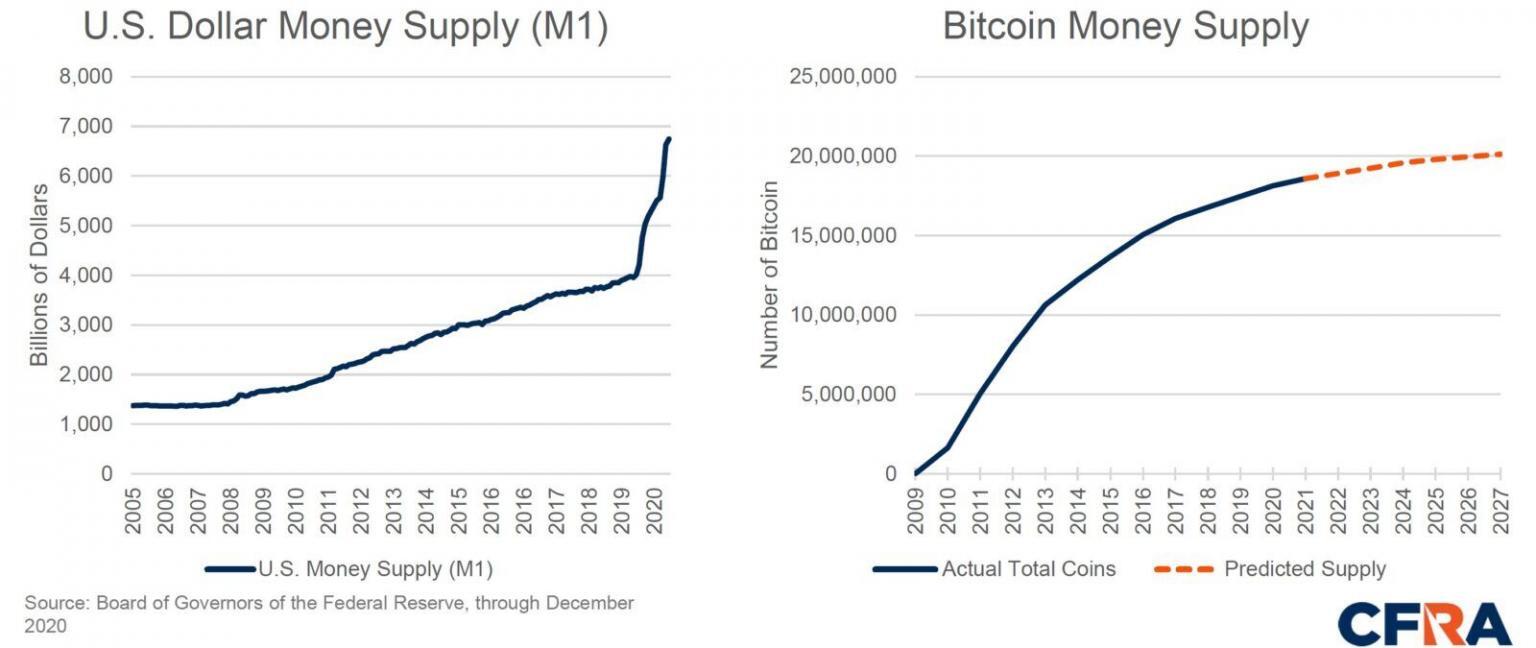

The 10x Bitcoin Multiplier Impact On Wall Street And Beyond

May 08, 2025

The 10x Bitcoin Multiplier Impact On Wall Street And Beyond

May 08, 2025 -

Bitcoins Sudden Rise Analysis From Trumps Crypto Advisor

May 08, 2025

Bitcoins Sudden Rise Analysis From Trumps Crypto Advisor

May 08, 2025 -

Is A 10x Bitcoin Multiplier Realistic Wall Streets Perspective

May 08, 2025

Is A 10x Bitcoin Multiplier Realistic Wall Streets Perspective

May 08, 2025 -

Bitcoin Price Rebound Long Term Outlook And Predictions

May 08, 2025

Bitcoin Price Rebound Long Term Outlook And Predictions

May 08, 2025 -

Unexpected Bitcoin Surge Trumps Crypto Chief Offers Prediction

May 08, 2025

Unexpected Bitcoin Surge Trumps Crypto Chief Offers Prediction

May 08, 2025