Bitcoin's Sudden Rise: Analysis From Trump's Crypto Advisor

Table of Contents

The Trump Advisor's Perspective on Bitcoin's Recent Surge

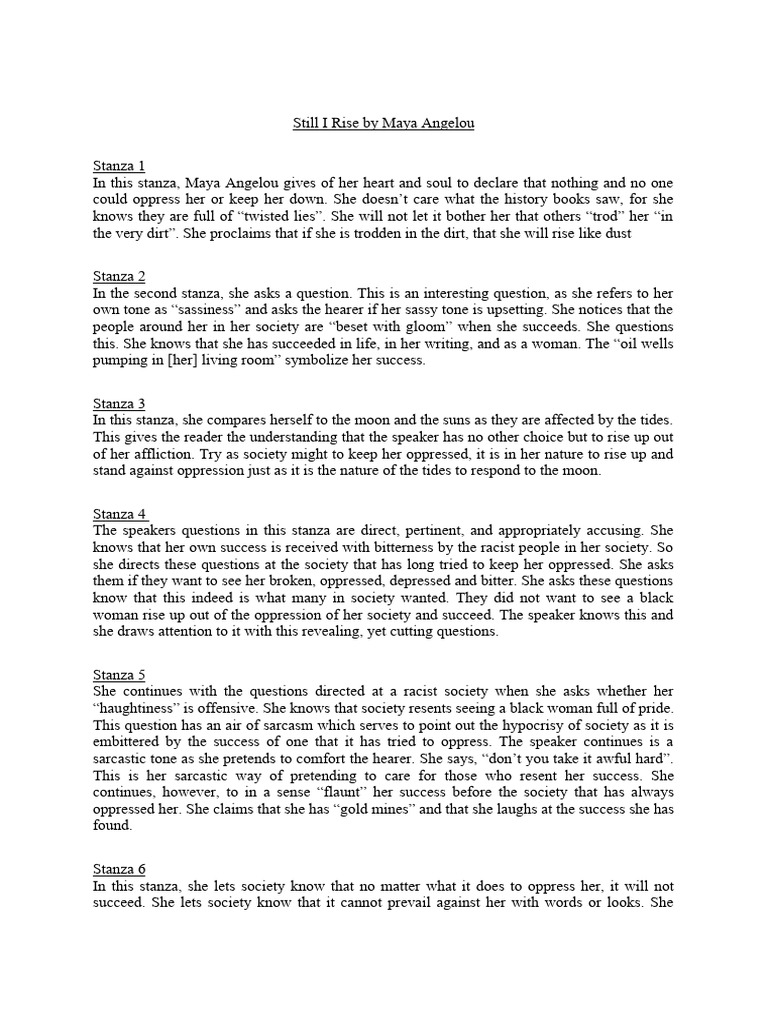

Anthony Scaramucci, a former White House Communications Director under President Trump and founder of SkyBridge Capital, has been a vocal commentator on the cryptocurrency market. His extensive experience in finance and his past association with the Trump administration provide a unique lens through which to examine Bitcoin's recent price action.

Scaramucci's arguments for the recent Bitcoin surge often center on a confluence of factors:

- Growing Institutional Acceptance: He highlights the increasing adoption of Bitcoin by major financial institutions as a key driver.

- Inflation Hedge: Scaramucci frequently emphasizes Bitcoin's potential as a hedge against inflation, particularly in times of economic uncertainty.

- Technological Advancement: He points to ongoing developments in Bitcoin's underlying technology, such as the Lightning Network, as enhancing its usability and appeal.

"According to Anthony Scaramucci, the recent Bitcoin rally is primarily driven by a combination of factors, including increased institutional adoption, its role as an inflation hedge, and continuous technological improvements," he stated in a recent interview. This perspective aligns with many analysts' observations.

Macroeconomic Factors Influencing Bitcoin's Price

Macroeconomic conditions significantly influence Bitcoin's price. High inflation, for example, can drive investors towards alternative assets like Bitcoin, which is often perceived as a store of value.

- Inflation as a Catalyst: Periods of high inflation erode the purchasing power of fiat currencies, making Bitcoin, with its fixed supply, an attractive alternative.

- Interest Rate Hikes: Increased interest rates can impact Bitcoin's price, as investors may shift funds from riskier assets to higher-yielding bonds. However, high inflation may offset this effect.

- Economic Uncertainty: Geopolitical instability and economic downturns can lead to increased demand for Bitcoin as a safe haven asset.

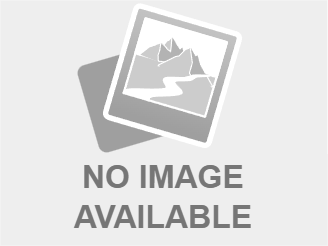

The following chart illustrates the correlation between inflation rates and Bitcoin's price over the past few years (Illustrative chart would be included here).

Institutional Adoption and its Impact on Bitcoin's Market

The growing acceptance of Bitcoin by institutional investors is a pivotal factor driving its price. Large corporations and financial institutions are increasingly allocating capital to Bitcoin, contributing to its price appreciation.

- Bitcoin ETFs: The potential approval of Bitcoin exchange-traded funds (ETFs) could significantly increase accessibility and liquidity, leading to further price increases.

- Corporate Investments: Companies like MicroStrategy and Tesla have made substantial investments in Bitcoin, signaling a growing belief in its long-term value.

- Pension Funds and Endowments: Some institutional investors are exploring Bitcoin as part of their diversified portfolios, increasing overall demand.

Institutional trading strategies, such as accumulation and strategic allocation, can also significantly influence Bitcoin's price action and volatility.

Regulatory Landscape and its Influence on Bitcoin's Future

The regulatory landscape surrounding cryptocurrencies is constantly evolving, and this has a considerable impact on Bitcoin's price.

- Varying Regulatory Approaches: Different countries are adopting different regulatory approaches, creating uncertainty and potentially impacting investor sentiment.

- Increased Scrutiny: Increased regulatory scrutiny can lead to both positive and negative impacts, depending on the nature and implementation of the regulations.

- Taxation: Clearer tax policies and regulations around Bitcoin could encourage greater institutional investment.

Clarity and consistency in regulatory frameworks are crucial for the sustained growth and stability of the Bitcoin market.

Conclusion

Understanding Bitcoin's sudden rise requires a comprehensive analysis of various factors. The insights provided by Anthony Scaramucci, coupled with an understanding of macroeconomic conditions, institutional adoption, and the regulatory landscape, offer a more complete picture. While Bitcoin's price remains volatile, understanding these key influences is critical for navigating its unpredictable nature. Stay updated on the latest developments in the cryptocurrency market to effectively navigate the complexities of Bitcoin's future and its sudden rises. Learn more about investing in Bitcoin and other cryptocurrencies by [link to further resources].

Featured Posts

-

1

May 08, 2025

1

May 08, 2025 -

Sony Ps 5 Pro Unveiling The Next Gen Console Upgrade

May 08, 2025

Sony Ps 5 Pro Unveiling The Next Gen Console Upgrade

May 08, 2025 -

Is Artetas Time At Arsenal Up Collymore Weighs In

May 08, 2025

Is Artetas Time At Arsenal Up Collymore Weighs In

May 08, 2025 -

Ousmane Dembele Injury Arsenals Transfer Plans In Jeopardy

May 08, 2025

Ousmane Dembele Injury Arsenals Transfer Plans In Jeopardy

May 08, 2025 -

Psg Vs Arsenal Gary Nevilles Prediction And Analysis

May 08, 2025

Psg Vs Arsenal Gary Nevilles Prediction And Analysis

May 08, 2025

Latest Posts

-

Understanding Ethereums Price A Comprehensive Analysis Of Market Factors And Future Trends

May 08, 2025

Understanding Ethereums Price A Comprehensive Analysis Of Market Factors And Future Trends

May 08, 2025 -

Ethereums Price Trajectory A Deep Dive Into Market Dynamics And Future Predictions

May 08, 2025

Ethereums Price Trajectory A Deep Dive Into Market Dynamics And Future Predictions

May 08, 2025 -

Predicting The Future Of Ethereum A Comprehensive Price Forecast

May 08, 2025

Predicting The Future Of Ethereum A Comprehensive Price Forecast

May 08, 2025 -

Ethereum Price Prediction 2024 And Beyond A Comprehensive Analysis

May 08, 2025

Ethereum Price Prediction 2024 And Beyond A Comprehensive Analysis

May 08, 2025 -

Comprehensive Ethereum Price Prediction Analyzing Future Trends And Market Dynamics

May 08, 2025

Comprehensive Ethereum Price Prediction Analyzing Future Trends And Market Dynamics

May 08, 2025