Is A 10x Bitcoin Multiplier Realistic? Wall Street's Perspective.

Table of Contents

Bitcoin's volatility has always captivated investors. But is a 10x Bitcoin multiplier – a price increase of tenfold – a realistic expectation? This article delves into the perspectives of Wall Street analysts and market experts to evaluate the feasibility of such a dramatic price movement, exploring both the bullish and bearish arguments surrounding a potential Bitcoin price explosion.

Historical Bitcoin Price Performance and Volatility

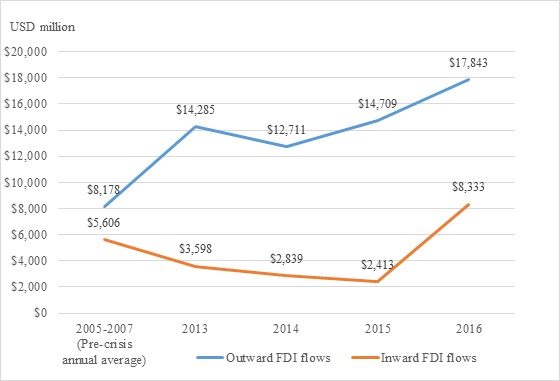

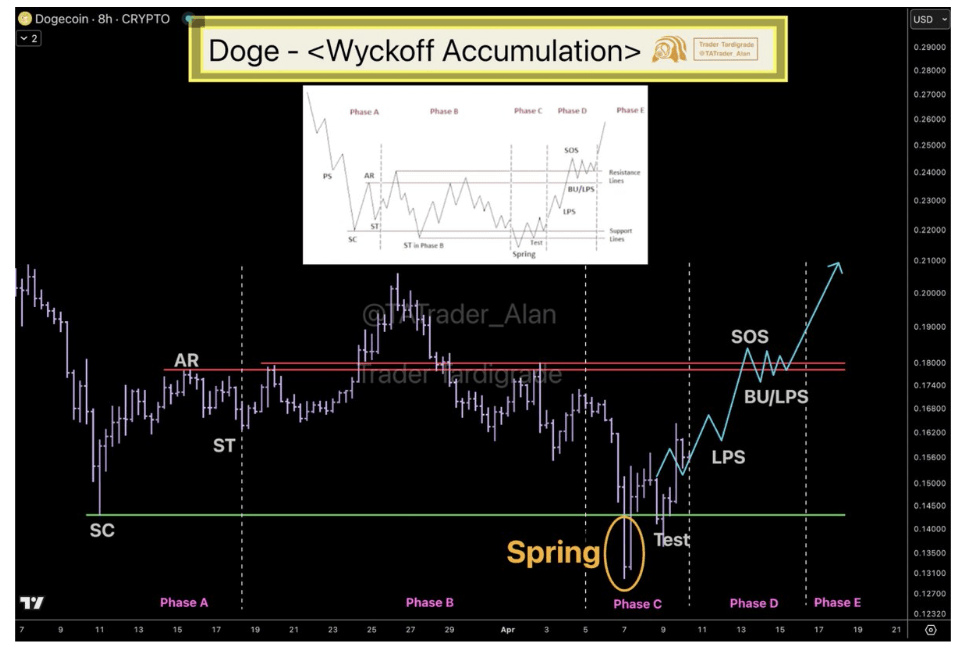

Bitcoin's history is marked by periods of explosive growth punctuated by sharp corrections. Analyzing past performance is crucial to understanding the potential for a 10x multiplier. The 2017 bull run, which saw Bitcoin's price increase exponentially, serves as a prime example of its volatile nature. However, this was followed by a significant bear market. Understanding the drivers behind these fluctuations is key.

- Past instances of significant price increases: The 2017 bull run, early 2021 surge.

- Factors contributing to past volatility: Regulatory announcements, technological upgrades, macroeconomic events (e.g., inflation), and overall market sentiment (FOMO and fear).

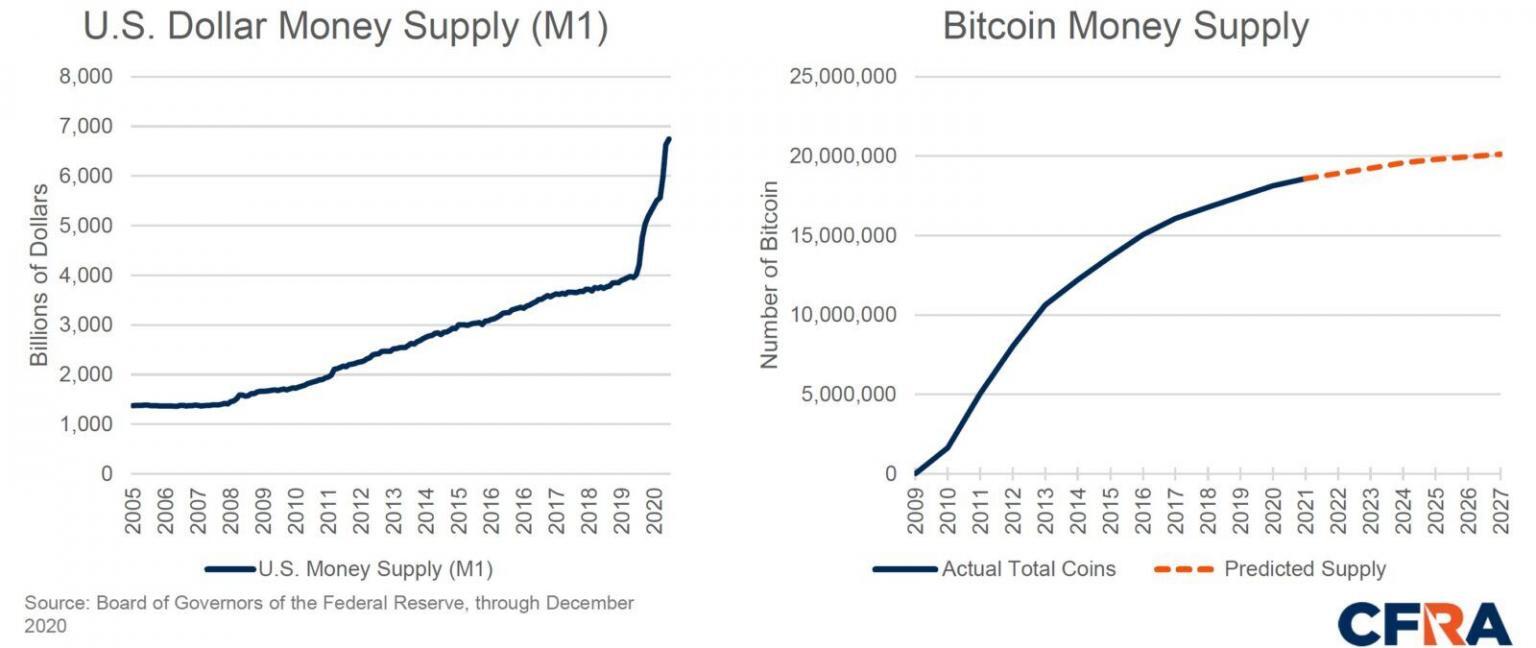

- Comparison of Bitcoin's historical volatility with other asset classes: Bitcoin's volatility significantly surpasses that of traditional assets like gold or stocks, highlighting its high-risk, high-reward profile. This inherent volatility makes predicting a 10x multiplier particularly challenging. Charts and graphs illustrating these price swings would further strengthen this point.

Wall Street's Current Stance on Bitcoin

Wall Street's stance on Bitcoin is evolving, albeit cautiously. While some institutional investors have embraced Bitcoin as a potential hedge against inflation or a part of a diversified portfolio, others remain skeptical due to its volatility and regulatory uncertainty. The opinions range from cautiously optimistic to outright bearish.

- Quotes from prominent analysts and institutional investors: Including quotes from well-known analysts and firms will lend credibility and provide diverse viewpoints.

- Summary of bullish and bearish predictions for Bitcoin's price: A balanced presentation of both sides is essential for a comprehensive analysis. Bullish predictions often cite increasing institutional adoption and macroeconomic factors. Bearish predictions emphasize regulatory risks and the potential for market corrections.

- Analysis of recent investment trends in Bitcoin by institutional players: Examining the investment strategies of major financial institutions provides valuable insights into the prevailing sentiment among sophisticated investors.

Factors that Could Contribute to a 10x Bitcoin Multiplier

Several factors could potentially contribute to a 10x Bitcoin price increase, although their combined effect and timing remain uncertain.

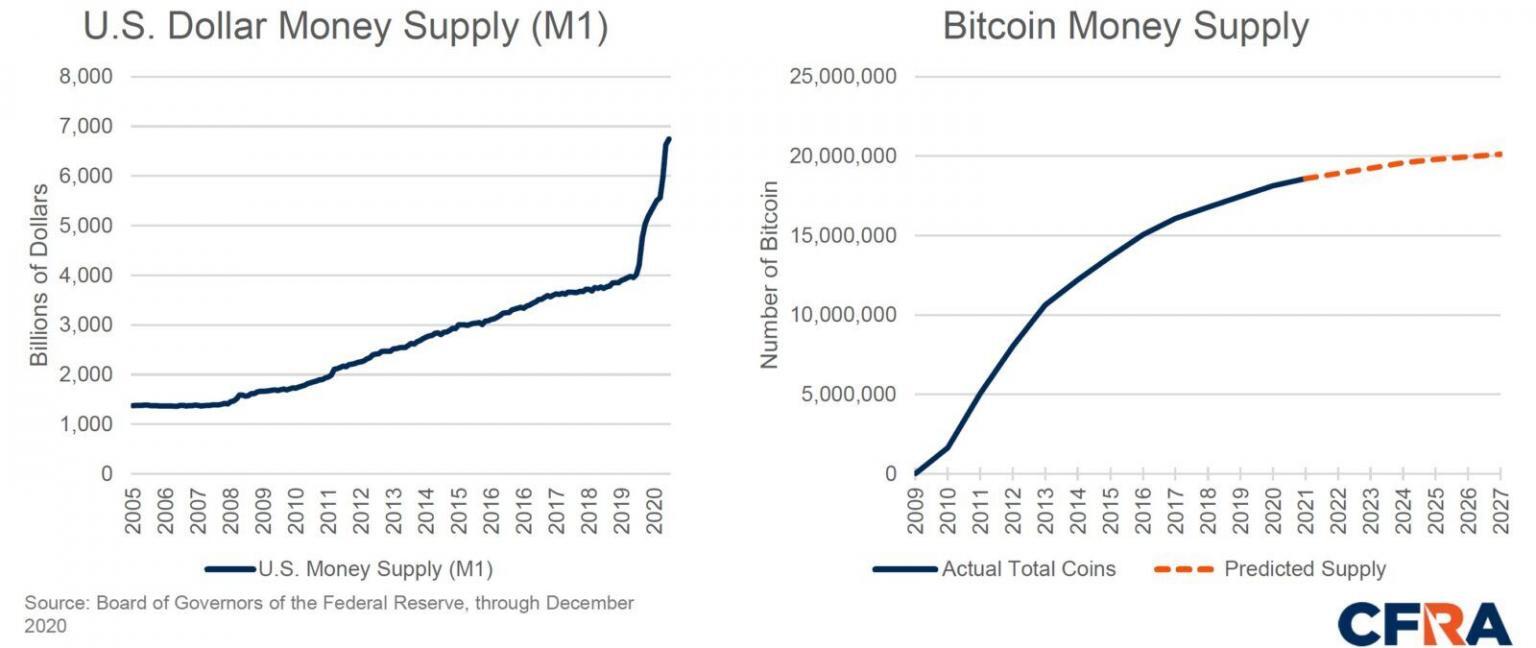

- Macroeconomic factors: High inflation, geopolitical instability, and a potential loss of confidence in fiat currencies could drive investors towards Bitcoin as a store of value.

- Wider cryptocurrency adoption: Increasing adoption by businesses and individuals could increase demand and drive the price higher.

- Technological advancements: Improvements such as the Lightning Network, which enhances Bitcoin's scalability and transaction speed, could contribute to broader adoption and increased utility.

Potential catalysts for a 10x increase: A major global economic crisis, widespread institutional adoption, and positive regulatory developments could all act as significant catalysts. However, the probability of these events occurring simultaneously is low.

Factors that Could Inhibit a 10x Bitcoin Multiplier

Despite the potential bullish factors, several obstacles could prevent a 10x Bitcoin multiplier.

- Regulatory hurdles: Increased government regulation, particularly stringent rules or outright bans, could severely dampen Bitcoin's price.

- Inherent volatility: Bitcoin's inherent volatility makes it susceptible to sharp price corrections. A sudden market downturn could erase gains and negate any potential for a 10x increase.

- Competition from other cryptocurrencies: The emergence of competing cryptocurrencies with superior technology or features could divert investment away from Bitcoin.

Potential for significant price corrections: The risk of substantial price drops should not be underestimated. Investors need to be prepared for significant market volatility.

Conclusion

This article examined the plausibility of a 10x Bitcoin multiplier from a Wall Street perspective, considering historical data, current market sentiment, and the opinions of key players. While a tenfold increase presents significant challenges, several factors could contribute to substantial price appreciation. However, considerable risks and uncertainties remain, emphasizing the highly speculative nature of such a prediction. The potential for a 10x Bitcoin multiplier remains a complex and debated topic.

Call to Action: The question of whether a 10x Bitcoin multiplier is realistic remains open to debate. Continue researching and staying informed about market trends and expert opinions to make your own informed decisions about Bitcoin investment. Keep following our analyses to stay updated on the latest developments concerning the potential of a 10x Bitcoin multiplier and other cryptocurrency market predictions. Remember to conduct thorough due diligence before investing in any cryptocurrency, including Bitcoin. A 10x Bitcoin multiplier represents a significant and unlikely event, fraught with both potential rewards and substantial risk.

Featured Posts

-

Us Bond Etf Outflows Taiwan Investors Reverse Course

May 08, 2025

Us Bond Etf Outflows Taiwan Investors Reverse Course

May 08, 2025 -

Counting Crows Snl Performance A Turning Point

May 08, 2025

Counting Crows Snl Performance A Turning Point

May 08, 2025 -

The Bitcoin Rebound What Investors Need To Know

May 08, 2025

The Bitcoin Rebound What Investors Need To Know

May 08, 2025 -

Dogecoin Shiba Inu And Sui Understanding This Weeks Market Gains

May 08, 2025

Dogecoin Shiba Inu And Sui Understanding This Weeks Market Gains

May 08, 2025 -

Arsenal Psg Mac Yayini Saat Bilgisi Ve Izleme Secenekleri

May 08, 2025

Arsenal Psg Mac Yayini Saat Bilgisi Ve Izleme Secenekleri

May 08, 2025

Latest Posts

-

1 500 Ethereum Price Target Is The Crucial Support Level About To Break

May 08, 2025

1 500 Ethereum Price Target Is The Crucial Support Level About To Break

May 08, 2025 -

Ethereum Price Holds Above Key Support Could A Drop To 1 500 Be Next

May 08, 2025

Ethereum Price Holds Above Key Support Could A Drop To 1 500 Be Next

May 08, 2025 -

Ethereums Price Action Suggests 2 700 Is Achievable Wyckoff Accumulation Explained

May 08, 2025

Ethereums Price Action Suggests 2 700 Is Achievable Wyckoff Accumulation Explained

May 08, 2025 -

Technical Analysis Ethereums Potential 2 700 Surge Based On Wyckoff

May 08, 2025

Technical Analysis Ethereums Potential 2 700 Surge Based On Wyckoff

May 08, 2025 -

Ethereum Price Analysis 2 700 On The Horizon Wyckoff Accumulation Hints At Rally

May 08, 2025

Ethereum Price Analysis 2 700 On The Horizon Wyckoff Accumulation Hints At Rally

May 08, 2025