US Bond ETF Outflows: Taiwan Investors Reverse Course

Table of Contents

The Initial Outflows: Understanding the Previous Trend

For a considerable period, Taiwanese investment in US bond ETFs experienced a notable outflow. Several factors contributed to this trend:

-

Rising US interest rates impacting bond yields: The Federal Reserve's aggressive interest rate hikes to combat inflation directly impacted bond yields. Higher interest rates generally lead to lower bond prices, making existing holdings less attractive to investors seeking higher returns. This prompted many investors, including those from Taiwan, to reconsider their positions in US bond ETFs.

-

Strengthening US dollar affecting currency exchange rates: The strengthening US dollar presented another challenge. For Taiwanese investors, the appreciation of the US dollar against the Taiwanese dollar meant that returns, when converted back to their home currency, were reduced. This currency risk added to the pressure to divest from US dollar-denominated assets.

-

Geopolitical uncertainties creating risk aversion: Global geopolitical uncertainties, including the ongoing war in Ukraine and escalating trade tensions, contributed to a general increase in risk aversion among investors worldwide. This led many, including Taiwanese investors, to seek safer havens or less volatile investment options.

-

Search for higher yields in other markets: The relatively lower yields offered by US bonds, compared to potential yields in other emerging markets, further fueled the outflow. Taiwanese investors may have sought higher returns by shifting their investments towards other asset classes or geographical regions.

The Recent Reversal: Why are Taiwan Investors Returning?

Despite the previous outflow, recent data reveals a surprising reversal, with Taiwanese investors returning to US bond ETFs. Several factors explain this shift:

-

Attractive valuations of US Treasury bonds: After a period of aggressive rate hikes, US Treasury bond valuations have become more attractive. The expectation of eventual interest rate decreases or stabilization has made these bonds a more appealing investment opportunity. This represents a significant shift in sentiment among Taiwanese investors.

-

Increased appetite for US dollar-denominated assets: While the US dollar's strength previously presented a headwind, some investors now view it as a safe-haven currency, particularly amid global economic uncertainty. This increased demand for US dollar-denominated assets, including US bond ETFs, has driven the return of Taiwanese investment.

-

Diversification needs in a volatile global market: The current volatile global economic landscape has highlighted the importance of diversification. US Treasury bonds, often considered a relatively safe haven asset, can provide a valuable component in a well-diversified portfolio, thereby attracting Taiwanese investors seeking to mitigate risk.

-

Expectations of future interest rate decreases: Market forecasts suggesting future interest rate decreases by the Federal Reserve have further boosted the attractiveness of US bond ETFs. The expectation of rising bond prices as interest rates fall makes them a potentially lucrative investment for Taiwanese investors with a longer-term horizon.

-

Potential for capital gains as interest rates stabilize: As interest rates stabilize, investors anticipate potential capital gains on their bond holdings. This prospect, coupled with the relatively attractive yields compared to other markets, further incentivizes Taiwanese investment in US bond ETFs.

Implications for the US Bond Market

The renewed interest from Taiwan investors significantly impacts the US bond market:

-

Increased demand pushing up bond prices: The influx of Taiwanese capital increases demand for US Treasury bonds, leading to a potential increase in bond prices.

-

Potential for lower yields as demand increases: As bond prices rise, yields generally fall. This can impact the returns for existing bondholders but also attracts new investors seeking relatively safer investments.

-

Impact on overall market liquidity: The increased trading volume associated with this renewed interest contributes to improved market liquidity, making it easier for buyers and sellers to transact.

-

Comparison to other foreign investor activity in US bond ETFs: It's important to compare this trend to the activities of other foreign investors to understand the broader context of global capital flows into US bond markets. Analyzing these trends helps to paint a clearer picture of investor sentiment towards the US bond market as a whole.

Potential Risks and Future Outlook

Despite the positive aspects of this investment trend, potential risks remain:

-

Continued inflation risks: Persistently high inflation could force the Federal Reserve to maintain or even increase interest rates, thereby negatively impacting bond prices.

-

Unexpected interest rate hikes: Any unforeseen economic developments could lead to unexpected interest rate hikes, impacting bond yields and prices negatively.

-

Geopolitical instability: Continued geopolitical instability could trigger another wave of risk aversion, potentially leading to capital outflows from the US bond market.

-

Potential for currency fluctuations: Fluctuations in the US dollar against the Taiwanese dollar could affect the returns for Taiwanese investors, underscoring the need for careful currency risk management.

Conclusion

The reversal of Taiwan investors' outflows from US bond ETFs marks a significant shift in the market. The factors driving this change include attractive valuations, diversification needs, and a potential reassessment of risk. While this influx benefits US bond markets, investors should remain aware of potential future risks. Stay informed about the evolving dynamics of Taiwan investors and US bond ETFs. Understanding these trends is crucial for making informed investment decisions. Continue researching Taiwan investors US bond ETFs for up-to-date analysis.

Featured Posts

-

Re Examining The Thunder Bulls Offseason Trade A Look At The Real Story

May 08, 2025

Re Examining The Thunder Bulls Offseason Trade A Look At The Real Story

May 08, 2025 -

Lahwr Myn Gwsht Ky Qymtwn Myn Mslsl Adafh Chkn Mtn Awr Byf Pr Qabw Kywn Nhyn Paya Ja Ska

May 08, 2025

Lahwr Myn Gwsht Ky Qymtwn Myn Mslsl Adafh Chkn Mtn Awr Byf Pr Qabw Kywn Nhyn Paya Ja Ska

May 08, 2025 -

Rogues Costume In X Men A Look At Its Transformation

May 08, 2025

Rogues Costume In X Men A Look At Its Transformation

May 08, 2025 -

6 Million Awarded To Ex Assistant In Soulja Boy Sexual Assault Lawsuit

May 08, 2025

6 Million Awarded To Ex Assistant In Soulja Boy Sexual Assault Lawsuit

May 08, 2025 -

Bitcoin Conference Seoul 2025 A Global Gathering

May 08, 2025

Bitcoin Conference Seoul 2025 A Global Gathering

May 08, 2025

Latest Posts

-

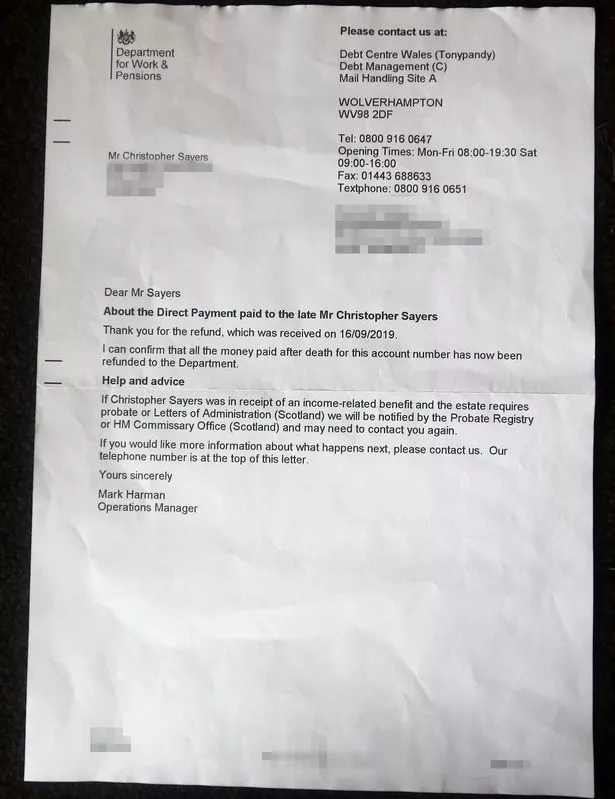

Dwp Warning Benefit Cuts Imminent For Uk Households

May 08, 2025

Dwp Warning Benefit Cuts Imminent For Uk Households

May 08, 2025 -

Uk Households Receive Dwp Letters Benefits At Risk

May 08, 2025

Uk Households Receive Dwp Letters Benefits At Risk

May 08, 2025 -

Dwp Benefit Cuts Final Payment Dates Announced

May 08, 2025

Dwp Benefit Cuts Final Payment Dates Announced

May 08, 2025 -

Dwp Benefit Stoppage Four Word Letters To Uk Households

May 08, 2025

Dwp Benefit Stoppage Four Word Letters To Uk Households

May 08, 2025 -

Imminent Benefit Cuts Dwps Planned Changes Explained

May 08, 2025

Imminent Benefit Cuts Dwps Planned Changes Explained

May 08, 2025