Investing In XRP: Weighing The Risks And Rewards After A 400% Rally

Table of Contents

XRP's Recent Price Surge and Market Analysis

The 400% rally in XRP's price is a noteworthy event in the cryptocurrency market. Several factors likely contributed to this surge. Positive legal developments in the ongoing SEC lawsuit against Ripple, coupled with increased adoption of RippleNet by financial institutions and a generally improving market sentiment towards cryptocurrencies, likely fueled the price increase.

[Insert chart showing XRP's price history, highlighting the recent surge]

-

Analysis of trading volume during the rally: The significant increase in trading volume during the rally suggests strong buying pressure and genuine market interest, rather than solely speculative activity. This high volume is a key indicator to consider.

-

Comparison to other cryptocurrencies' performance during the same period: While other cryptocurrencies also saw gains during this period, XRP's performance significantly outpaced many, highlighting its unique market dynamics and potential. Comparing XRP's performance against Bitcoin, Ethereum, and other major altcoins offers valuable context.

-

Identification of key price support and resistance levels: Identifying these levels using technical analysis tools is crucial for potential investors to assess potential entry and exit points and manage risk effectively. A thorough technical analysis should be a part of any XRP investment strategy.

Potential short-term price predictions are highly speculative and dependent on numerous factors. Similarly, long-term price predictions should be viewed with extreme caution, as the cryptocurrency market is notoriously volatile. Any projections should be treated as educated guesses, not guaranteed outcomes.

Understanding Ripple's Technology and Use Cases

RippleNet, Ripple's global payment network, utilizes XRP to facilitate faster and cheaper cross-border transactions for financial institutions. XRP acts as a bridge currency, enabling near-instantaneous transfers between different currencies and reducing the reliance on traditional correspondent banking networks. This efficiency is a key differentiator for Ripple in the financial technology space.

-

Explanation of XRP's consensus mechanism: XRP uses a unique consensus mechanism, different from proof-of-work or proof-of-stake, resulting in fast transaction speeds and low energy consumption. Understanding this mechanism is crucial for understanding XRP's technical advantages.

-

Comparison of XRP to other payment-focused cryptocurrencies (e.g., Stellar Lumens, Litecoin): While other cryptocurrencies aim to improve payment systems, XRP's integration with RippleNet and its focus on institutional adoption provide a distinct competitive advantage. Comparing its strengths and weaknesses against competitors provides a broader understanding of its market position.

-

Discussion of the potential for wider adoption of RippleNet by financial institutions: Increased adoption by major banks and financial institutions is crucial for XRP's long-term growth. Analyzing the ongoing partnerships and potential future collaborations provides insights into its future prospects.

Regulatory Landscape and Legal Challenges Facing XRP

The ongoing SEC lawsuit against Ripple Labs presents a significant challenge for XRP. The SEC alleges that XRP is an unregistered security, which could have substantial implications for its price and future adoption.

-

Summary of key developments in the SEC lawsuit: Keeping abreast of the legal proceedings is crucial for assessing the risks associated with XRP investment. Understanding the arguments presented by both sides is essential for informed decision-making.

-

Analysis of expert opinions on the legal battle's likely resolution: Experts hold differing opinions on the outcome of the case, and understanding the range of possibilities is vital. This analysis requires a careful review of legal analysis and expert commentary.

-

Discussion of potential regulatory implications for XRP in different jurisdictions: The regulatory landscape surrounding cryptocurrencies varies significantly across countries. Understanding the implications of different regulatory approaches is crucial for investors.

Diversification and Risk Management Strategies for XRP Investments

Investing in cryptocurrencies inherently carries a high degree of risk. Diversification is paramount. Never invest more than you can afford to lose.

-

Recommendations for allocating a portion of your investment portfolio to XRP: A prudent approach involves allocating only a small percentage of your overall portfolio to XRP, minimizing the potential impact of any significant price drops.

-

Strategies for mitigating risk, such as dollar-cost averaging: Dollar-cost averaging allows you to reduce the impact of volatility by investing smaller amounts regularly over time.

-

Importance of conducting thorough due diligence before investing in XRP or any cryptocurrency: Researching the technology, market conditions, and regulatory landscape is crucial before making any investment decisions.

Future Outlook and Potential for XRP Growth

Several factors could drive future growth for XRP. Increased institutional adoption of RippleNet, a favorable outcome in the SEC lawsuit, and further technological advancements within the Ripple ecosystem are all potential catalysts for price appreciation.

-

Potential partnerships and collaborations that could boost XRP's adoption: New collaborations and strategic partnerships could significantly impact XRP's growth trajectory.

-

Predictions for XRP's market capitalization and price in the coming years (with disclaimers): Any price prediction should be taken with caution, as the cryptocurrency market is highly volatile and unpredictable.

-

Assessment of XRP's competitive advantages in the cryptocurrency space: XRP's focus on cross-border payments and its integration with RippleNet give it a unique competitive edge within the cryptocurrency landscape.

Conclusion

Investing in XRP after its significant price increase requires careful consideration of both its potential rewards and inherent risks. The recent rally, while impressive, doesn't guarantee future success. Thorough research, understanding the regulatory landscape, and effective risk management strategies are crucial for navigating the complexities of the cryptocurrency market. Before investing in XRP, conduct thorough due diligence, weigh the risks, and diversify your portfolio. Only invest what you can afford to lose. Remember, this is not financial advice; making informed decisions about investing in XRP, or any cryptocurrency, remains your responsibility.

Featured Posts

-

Charles Barkleys Unexpected Cavaliers Commentary

May 07, 2025

Charles Barkleys Unexpected Cavaliers Commentary

May 07, 2025 -

Nhl Potvrdila Svetovy Pohar V Hokeji 2028

May 07, 2025

Nhl Potvrdila Svetovy Pohar V Hokeji 2028

May 07, 2025 -

Carney And Trump A Preview Of Tuesdays Crucial White House Meeting

May 07, 2025

Carney And Trump A Preview Of Tuesdays Crucial White House Meeting

May 07, 2025 -

High Profile Nhl 4 Nations Face Off Pei Bill Tops 500 000

May 07, 2025

High Profile Nhl 4 Nations Face Off Pei Bill Tops 500 000

May 07, 2025 -

Front Loading Strategies Mitigate Malaysian Ringgit Myr Risks For Exporters

May 07, 2025

Front Loading Strategies Mitigate Malaysian Ringgit Myr Risks For Exporters

May 07, 2025

Latest Posts

-

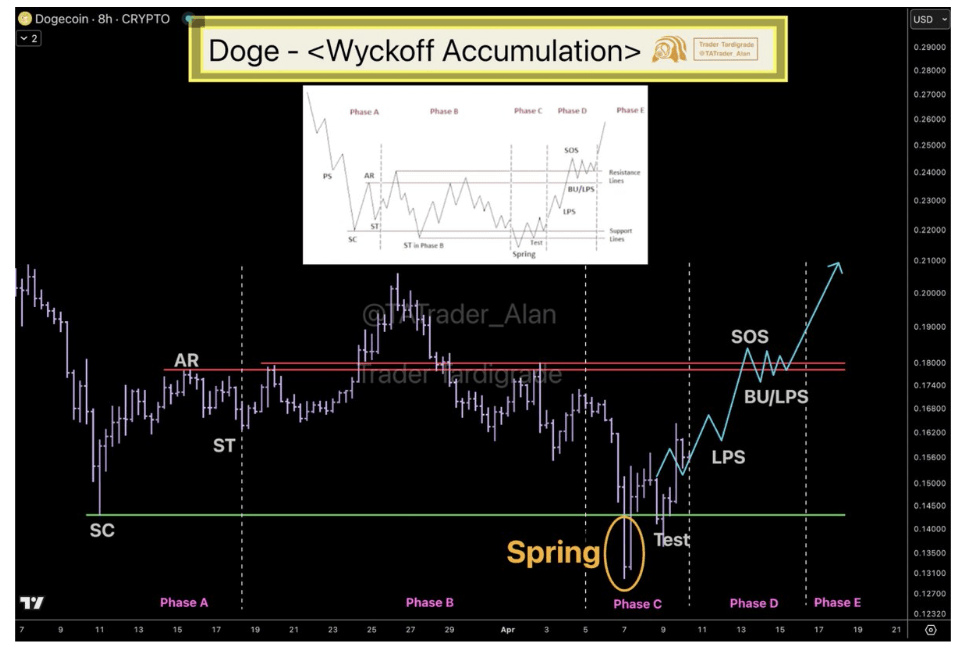

Ethereums Price Action Suggests 2 700 Is Achievable Wyckoff Accumulation Explained

May 08, 2025

Ethereums Price Action Suggests 2 700 Is Achievable Wyckoff Accumulation Explained

May 08, 2025 -

Technical Analysis Ethereums Potential 2 700 Surge Based On Wyckoff

May 08, 2025

Technical Analysis Ethereums Potential 2 700 Surge Based On Wyckoff

May 08, 2025 -

Ethereum Price Analysis 2 700 On The Horizon Wyckoff Accumulation Hints At Rally

May 08, 2025

Ethereum Price Analysis 2 700 On The Horizon Wyckoff Accumulation Hints At Rally

May 08, 2025 -

Ethereum Price To Hit 4 000 Cross X Indicators And Institutional Accumulation Suggest A Bullish Trend

May 08, 2025

Ethereum Price To Hit 4 000 Cross X Indicators And Institutional Accumulation Suggest A Bullish Trend

May 08, 2025 -

Wyckoff Accumulation In Ethereum Price Poised For 2 700 Breakout

May 08, 2025

Wyckoff Accumulation In Ethereum Price Poised For 2 700 Breakout

May 08, 2025