How Bundestag Elections Influence The Dax Index

Table of Contents

Pre-Election Volatility and Uncertainty

The period leading up to a Bundestag election is often marked by increased market uncertainty. As the election draws closer, political rhetoric intensifies, and the potential outcomes become clearer (or more confusing, depending on the state of the polls). This uncertainty directly impacts investor sentiment, creating ripples throughout the German stock market.

- Polling data and its impact on investor sentiment: Fluctuations in poll numbers can trigger immediate market reactions. A significant shift in favor of a particular party, especially one with drastically different economic policies, can lead to volatility. Investors may react to perceived risks or opportunities presented by the shifting political landscape.

- Increased market volatility due to unpredictable outcomes: The inherent uncertainty of any election, especially in a multi-party system like Germany's, contributes to heightened market volatility. Investors become more cautious, potentially reducing their investments or hedging their positions against potential negative outcomes.

- Potential for capital flight before election results: In periods of heightened uncertainty, some investors might choose to withdraw their capital from the German market, seeking safer havens until the election results are known and the political landscape becomes clearer. This capital flight can exacerbate market volatility.

- Examples of past pre-election market fluctuations: Examining the DAX's behavior in the lead-up to previous Bundestag elections provides valuable insights. Analyzing these historical trends reveals patterns in investor behavior and market reactions to various pre-election scenarios. For example, periods with close races often saw increased volatility compared to elections with a clear frontrunner.

During this period, investors often employ hedging strategies to mitigate potential losses. These strategies include diversifying their portfolios, using options contracts, or investing in less volatile assets.

Post-Election Market Reactions

The immediate market response after the Bundestag election results are announced can be dramatic. The nature of the outcome significantly influences investor confidence and, consequently, the DAX’s trajectory.

- Positive market reactions to clear mandate governments: A decisive victory for a single party or a coalition with a clear majority generally leads to positive market reactions. A strong mandate suggests political stability and the potential for swift and decisive policy implementation, boosting investor confidence.

- Negative reactions to coalition negotiations and instability: Conversely, a fragmented election result requiring lengthy coalition negotiations often leads to negative market reactions. Uncertainty regarding the eventual government composition and its policy agenda creates an environment of apprehension.

- Impact of specific policy pledges on different sectors (e.g., energy, finance): The specific policy pledges of the winning party or coalition significantly influence the performance of different sectors. For example, policies favoring renewable energy might benefit related companies, while stricter financial regulations could impact the banking sector.

- Analysis of DAX performance following previous Bundestag elections: A historical analysis of the DAX's performance after previous Bundestag elections provides valuable data points. This allows for the identification of trends and patterns, helping investors anticipate potential future market movements.

The speed and magnitude of market adjustments after an election depend on various factors, including the clarity of the election result, the composition of the new government, and the perceived credibility of its economic policies.

The Influence of Coalition Governments on the DAX

The formation of coalition governments significantly impacts long-term economic policy and investor confidence. The stability and predictability offered by a well-functioning coalition are critical for attracting foreign investment and fostering economic growth.

- Analysis of the differing economic policies of various potential coalition partners: Different parties often hold contrasting economic viewpoints, impacting their policy proposals. Analyzing these differences helps to understand the potential range of outcomes following the election.

- The role of stability and predictability in attracting foreign investment: Political stability is crucial for attracting foreign investment. A stable government with a clear economic agenda provides investors with the confidence necessary for long-term commitments.

- The impact of coalition agreements on specific sectors (e.g., automotive, technology): The specific details of coalition agreements can have a significant impact on individual sectors. For instance, policies related to environmental regulations or industrial subsidies can directly influence the performance of the automotive and technology sectors.

- Examples of how past coalitions have influenced the DAX’s trajectory: Examining the historical performance of the DAX under different coalition governments provides crucial insights into the impact of various political alliances on the German stock market.

The potential for policy gridlock within a coalition government can negatively affect market performance. Disagreements and delays in policy implementation can create uncertainty and reduce investor confidence.

Economic Policy and the DAX

The economic policies proposed by different parties during a Bundestag election campaign directly impact the DAX. Specific policy proposals, such as tax reforms and fiscal spending plans, have far-reaching consequences for businesses and the overall economy.

- Impact of tax policies on corporate profitability: Changes to corporate tax rates can directly influence company profitability, affecting stock valuations and market sentiment.

- Effect of government spending on infrastructure or social programs on market sentiment: Increased government spending on infrastructure projects or social programs can stimulate economic growth, positively impacting market sentiment.

- Influence of regulatory changes on specific sectors: New regulations in sectors like energy or finance can significantly impact companies operating in those sectors, affecting their stock prices and market capitalization.

- Examples of past economic policies and their impact on the DAX: Historical examples of how different economic policies have influenced the DAX provide valuable insights into potential future scenarios.

The long-term consequences of different economic approaches can vary significantly, influencing the overall economic health and stability of Germany and consequently impacting the DAX.

Conclusion

Bundestag elections are a significant event influencing the German economy and, consequently, the DAX index. Pre-election uncertainty often leads to market volatility, while post-election results shape investor confidence based on the formed government and its proposed economic policies. The nature of the coalition government, and the stability and clarity of its economic plan, play crucial roles in the long-term performance of the DAX.

Understanding the interplay between Bundestag elections and the DAX is crucial for investors seeking to navigate the German market. Stay informed about the upcoming election and the platforms of participating parties to better understand potential impacts on your investments. Further research into the historical relationship between Bundestag elections and the DAX index will provide a more comprehensive understanding of this dynamic relationship.

Featured Posts

-

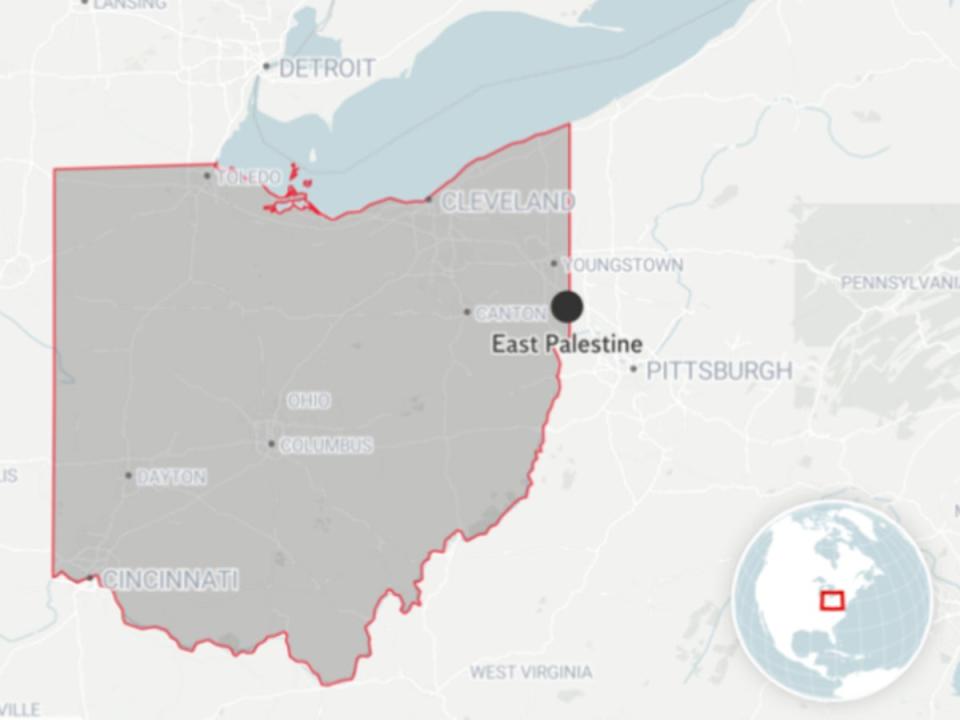

Toxic Chemical Persistence Ohio Train Derailments Lingering Impact On Buildings

Apr 27, 2025

Toxic Chemical Persistence Ohio Train Derailments Lingering Impact On Buildings

Apr 27, 2025 -

Motherhood And Victory Belinda Bencics Wta Return

Apr 27, 2025

Motherhood And Victory Belinda Bencics Wta Return

Apr 27, 2025 -

Cannes Film Festival 2025 Juliette Binoche To Lead Jury

Apr 27, 2025

Cannes Film Festival 2025 Juliette Binoche To Lead Jury

Apr 27, 2025 -

Pfcs Complaint To Eo W Gensol Engineering Accused Of Document Falsification

Apr 27, 2025

Pfcs Complaint To Eo W Gensol Engineering Accused Of Document Falsification

Apr 27, 2025 -

How Bundestag Elections Influence The Dax Index

Apr 27, 2025

How Bundestag Elections Influence The Dax Index

Apr 27, 2025

Latest Posts

-

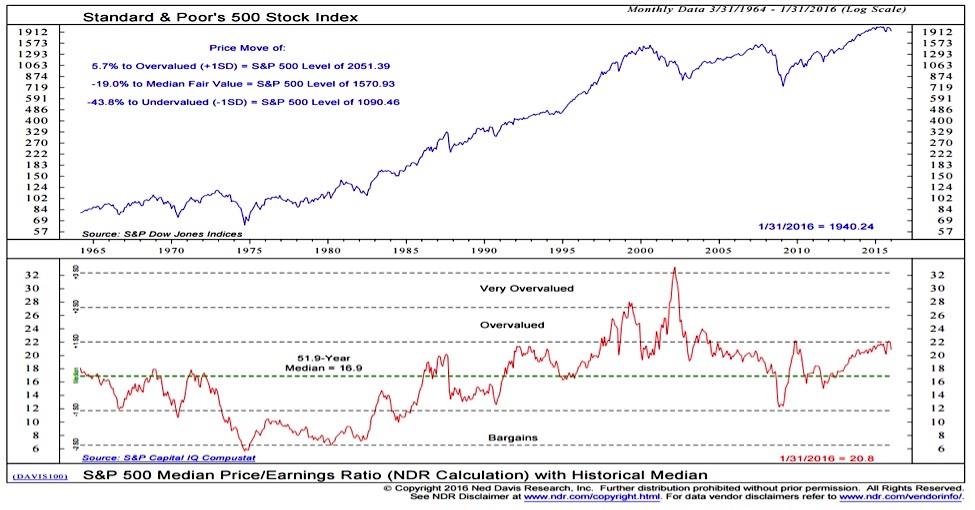

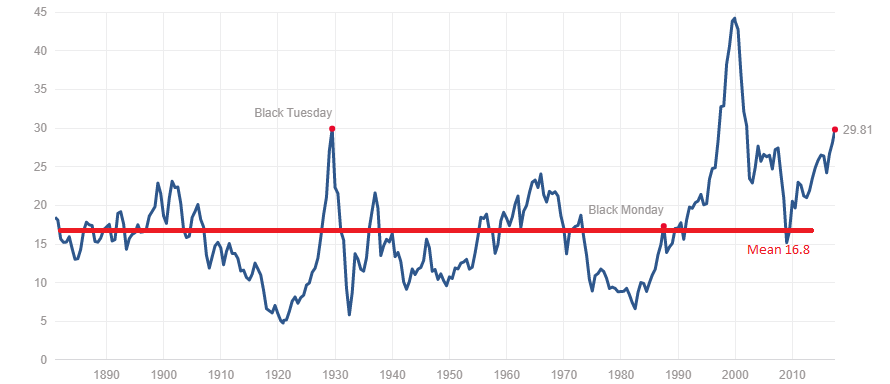

Understanding High Stock Market Valuations A Bof A Viewpoint

Apr 28, 2025

Understanding High Stock Market Valuations A Bof A Viewpoint

Apr 28, 2025 -

Are High Stock Market Valuations A Concern Bof As Analysis

Apr 28, 2025

Are High Stock Market Valuations A Concern Bof As Analysis

Apr 28, 2025 -

High Stock Market Valuations Why Bof A Remains Optimistic

Apr 28, 2025

High Stock Market Valuations Why Bof A Remains Optimistic

Apr 28, 2025 -

Stock Market Valuations Bof As Case For Investor Calm

Apr 28, 2025

Stock Market Valuations Bof As Case For Investor Calm

Apr 28, 2025 -

Navigating The Private Credit Boom 5 Key Dos And Don Ts

Apr 28, 2025

Navigating The Private Credit Boom 5 Key Dos And Don Ts

Apr 28, 2025