Stock Market Valuations: BofA's Case For Investor Calm

Table of Contents

BofA's Valuation Metrics and Their Implications

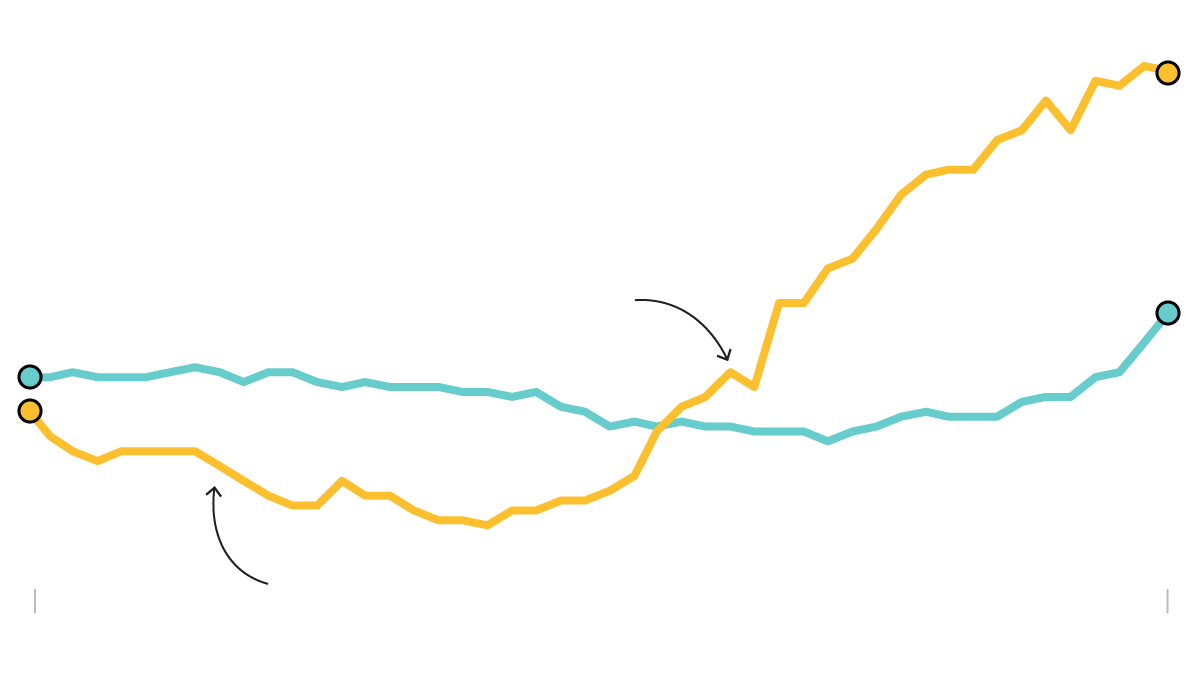

BofA employs a multi-faceted approach to assess stock market valuations, utilizing a range of established metrics to paint a comprehensive picture. Their methodology incorporates both short-term and long-term perspectives, aiming to provide a balanced view of the current market landscape.

-

Specific Metrics and Current Readings: BofA analysts consider various factors, including:

- Price-to-Earnings (P/E) ratio: This compares a company's stock price to its earnings per share. A high P/E ratio might suggest overvaluation, while a low ratio could indicate undervaluation. BofA's recent analysis might show the current P/E ratio for the S&P 500 is slightly above its historical average, but not alarmingly so.

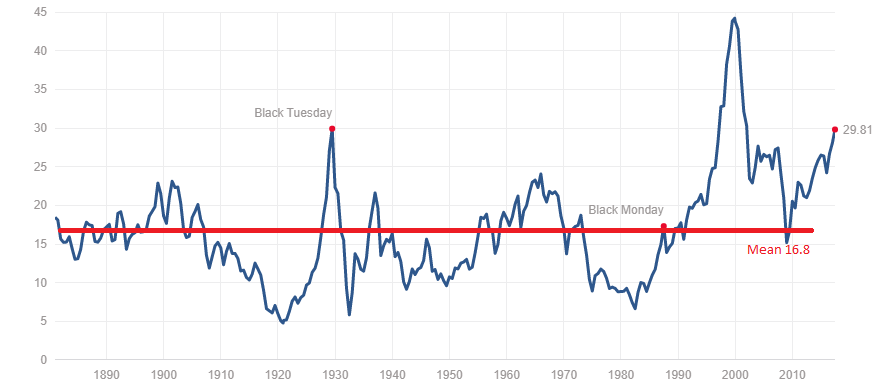

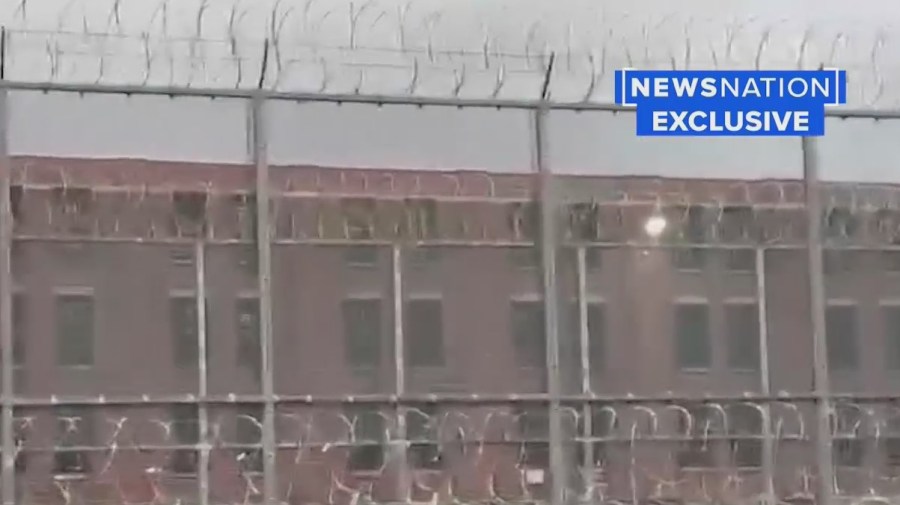

- Cyclically Adjusted Price-to-Earnings (CAPE) ratio: This metric smooths out short-term earnings fluctuations to provide a longer-term perspective on valuation. The CAPE ratio can offer insights into whether the market is historically overvalued or undervalued. BofA's analysis might indicate that, while the CAPE ratio is elevated, it's within the range of historical occurrences and doesn't necessarily signal an imminent crash.

- Comparison to other major market indices: BofA's analysis likely includes a comparative assessment of the S&P 500 valuation against other major global indices like the FTSE 100 or the Nikkei 225, providing context within the broader global economic picture.

-

Supporting BofA's Case for Calm: By considering these metrics in tandem, BofA argues that while valuations aren't necessarily "cheap," they are not at levels historically associated with major market crashes. The nuances within their data suggest that while certain sectors might be overvalued, others present attractive opportunities. They emphasize the importance of a diversified portfolio and selective investment strategies.

Addressing Key Market Concerns

Investor anxieties currently center on several key areas:

-

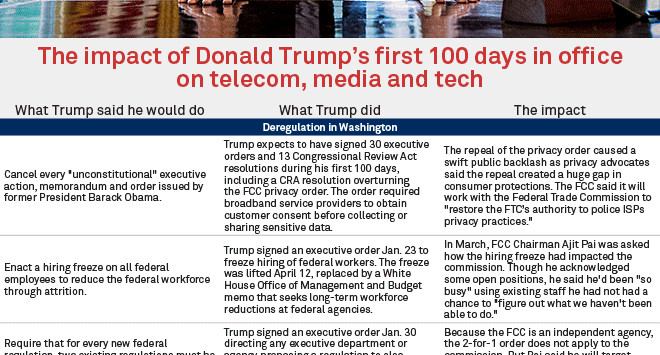

Inflation: High inflation erodes purchasing power and can impact corporate earnings. BofA's analysis likely accounts for the anticipated trajectory of inflation, assessing its potential impact on corporate earnings growth and predicting its eventual moderation. They might suggest that current inflation concerns are already priced into the market to some degree.

-

Interest Rates: The Federal Reserve's interest rate hikes aim to curb inflation but can also slow economic growth. BofA's analysts likely model different interest rate scenarios and assess their potential impact on stock market valuations and corporate profitability. Their analysis might indicate that, while rate hikes present a challenge, they're a necessary measure to maintain long-term economic stability.

-

Recessionary Fears: Concerns about a potential recession weigh heavily on investor sentiment. BofA's economists probably provide forecasts regarding the likelihood and severity of a potential recession, assessing its impact on corporate earnings and subsequently on stock prices. They might emphasize the difference between a mild correction and a significant recessionary downturn.

BofA's integrated analysis aims to mitigate these concerns by demonstrating that the market has priced in much of the negative news already, and that long-term growth prospects remain positive, albeit with increased uncertainty.

The Role of Long-Term Investing

Navigating market fluctuations requires a robust, long-term investment strategy. BofA's analysis underscores the importance of patience and perspective:

-

Benefits of Long-Term Investing:

- Historically, market corrections are temporary. Long-term trends tend to prevail.

- Long-term investors benefit from the power of compounding returns.

- Short-term volatility should not dictate long-term investment decisions.

-

Weathering Market Volatility: A well-diversified portfolio, regular rebalancing, and a disciplined approach to investing can help mitigate the impact of market downturns. Staying the course and avoiding impulsive decisions based on short-term market fluctuations is crucial for long-term success.

Investment Strategies Based on BofA's Analysis

Based on their assessment of stock market valuations, BofA might suggest several strategic approaches:

- Actionable Steps for Investors:

- Rebalancing portfolios to align with long-term goals, potentially shifting allocations based on current valuations.

- Considering investments in sectors less susceptible to economic downturns (e.g., consumer staples, healthcare).

- Seeking professional financial advice tailored to individual circumstances and risk tolerance.

It's crucial to remember that investing always involves risk. Avoid impulsive reactions driven by fear or greed. Instead, make informed decisions based on thorough research and a well-defined investment plan.

Conclusion:

BofA's analysis of current stock market valuations provides a measured perspective amidst market uncertainty. By examining key metrics and addressing prevailing investor concerns, BofA suggests that a calm, long-term approach remains prudent. While acknowledging potential risks, their analysis emphasizes the resilience of the market and the benefits of strategic long-term investing. Understanding these valuations and incorporating BofA's insights can help investors make informed decisions and navigate the current market landscape effectively. Don't let short-term volatility derail your long-term goals; carefully consider your own risk tolerance and investment strategy in light of these current stock market valuations.

Featured Posts

-

Chat Gpt Developer Open Ai Investigated By The Ftc

Apr 28, 2025

Chat Gpt Developer Open Ai Investigated By The Ftc

Apr 28, 2025 -

16 Million Penalty For T Mobile A Three Year Data Breach Investigation

Apr 28, 2025

16 Million Penalty For T Mobile A Three Year Data Breach Investigation

Apr 28, 2025 -

From Scatological Documents To Podcast Success The Power Of Ai

Apr 28, 2025

From Scatological Documents To Podcast Success The Power Of Ai

Apr 28, 2025 -

A Deep Dive Into The Motivations Of Luigi Mangiones Supporters

Apr 28, 2025

A Deep Dive Into The Motivations Of Luigi Mangiones Supporters

Apr 28, 2025 -

High Stock Market Valuations Why Bof A Remains Optimistic

Apr 28, 2025

High Stock Market Valuations Why Bof A Remains Optimistic

Apr 28, 2025

Latest Posts

-

The U S Dollar And Presidential Economic Policy A Case Study Of The Nixon Administration And Beyond

Apr 28, 2025

The U S Dollar And Presidential Economic Policy A Case Study Of The Nixon Administration And Beyond

Apr 28, 2025 -

Could The U S Dollar Experience Its Worst Start Since Nixon An Economic Assessment

Apr 28, 2025

Could The U S Dollar Experience Its Worst Start Since Nixon An Economic Assessment

Apr 28, 2025 -

U S Dollars First 100 Days A Historical Perspective And Economic Forecast

Apr 28, 2025

U S Dollars First 100 Days A Historical Perspective And Economic Forecast

Apr 28, 2025 -

Analyzing The U S Dollars Performance A Comparison To The Nixon Presidency

Apr 28, 2025

Analyzing The U S Dollars Performance A Comparison To The Nixon Presidency

Apr 28, 2025 -

The U S Dollar A Troubled First 100 Days Under The Current Presidency

Apr 28, 2025

The U S Dollar A Troubled First 100 Days Under The Current Presidency

Apr 28, 2025