Understanding High Stock Market Valuations: A BofA Viewpoint

Table of Contents

Key Metrics for Assessing Stock Market Valuation

Several key metrics help assess whether current stock prices reflect intrinsic value. Understanding these metrics is crucial for evaluating high stock market valuations.

Price-to-Earnings Ratio (P/E)

The Price-to-Earnings ratio (P/E) is a fundamental valuation metric, calculated by dividing a company's stock price by its earnings per share (EPS). A high P/E ratio suggests investors are willing to pay more for each dollar of earnings, potentially indicating optimism about future growth. Conversely, a low P/E ratio might signal undervaluation or concerns about profitability.

- Examples: A P/E ratio of 15 is generally considered average, while a ratio of 30 or higher might be deemed high, depending on the industry and economic conditions. Conversely, a P/E ratio below 10 could suggest undervaluation, though this needs further investigation.

- Industry Variations: P/E ratios vary significantly across industries. High-growth technology companies often command higher P/E ratios than mature, cyclical industries.

- Cyclicality Impact: During economic downturns, P/E ratios tend to compress as earnings decline, while during periods of expansion, they tend to expand.

- BofA's Approach: BofA incorporates a thorough industry analysis and comparison to historical P/E ratios and peer group analysis to interpret P/E ratios, particularly within the context of high overall market valuations. We assess the sustainability of current earnings and future growth prospects.

Price-to-Sales Ratio (P/S)

The Price-to-Sales ratio (P/S) is another useful metric, especially for valuing companies with high growth potential but limited or negative earnings. It is calculated by dividing the market capitalization by the company's revenue.

- Examples: A P/S ratio of 1 indicates that the market is valuing the company at its annual revenue, while a higher ratio suggests a premium valuation based on growth expectations. Low P/S ratios can be indicative of value opportunities or concerns about future revenue growth.

- Comparison with P/E: P/S is often used in conjunction with P/E, providing a more comprehensive picture. It's particularly valuable for companies in early stages of development or those experiencing temporary losses.

- Suitability for Different Sectors: P/S ratios are particularly useful in industries where profitability is volatile, such as technology or biotechnology.

- BofA's Perspective: BofA considers P/S ratios alongside other metrics, particularly during periods of high market valuations, to assess the relationship between revenue growth and market expectations. We also consider the company's competitive landscape and long-term revenue potential.

Other Valuation Metrics

Several other metrics provide additional insights into stock market valuations.

- PEG Ratio: The Price/Earnings to Growth ratio (PEG) accounts for the company's growth rate, providing a more nuanced view than the P/E ratio alone.

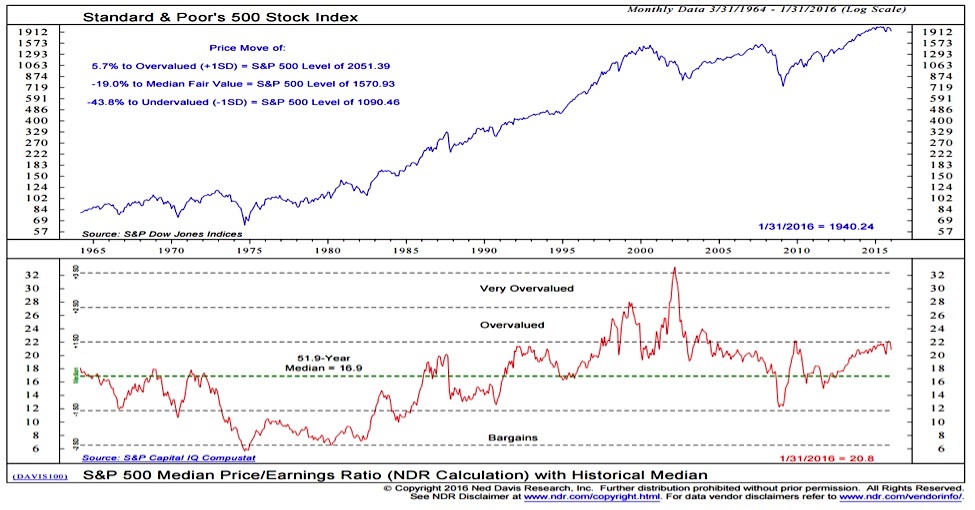

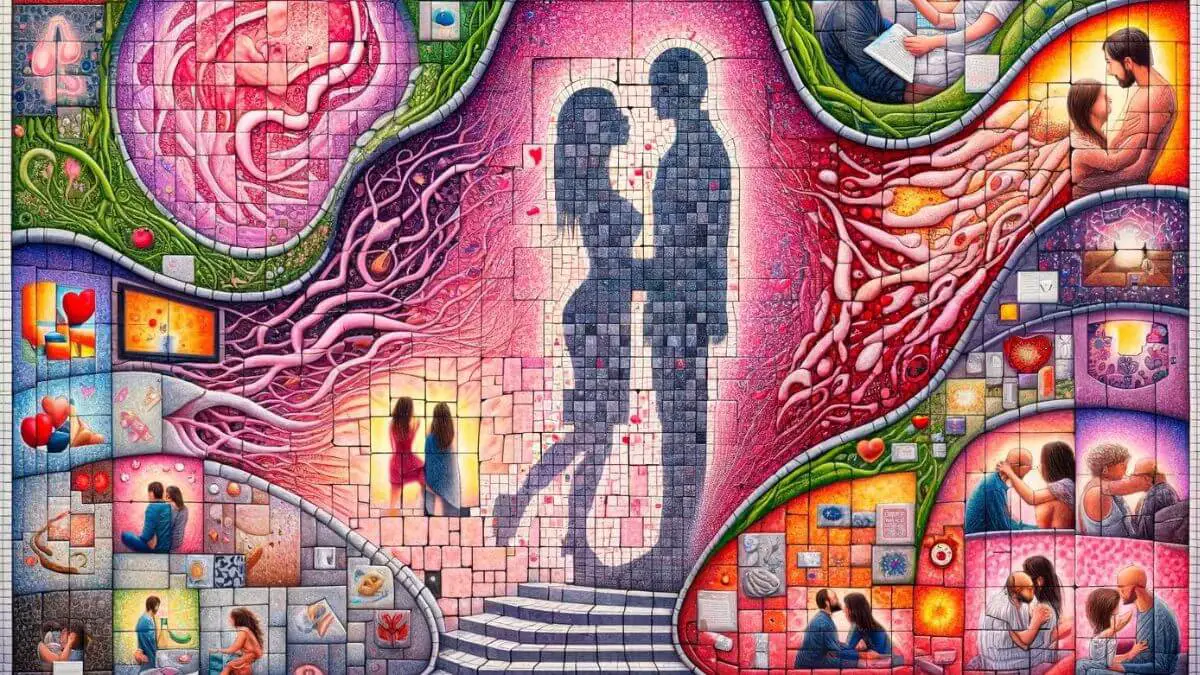

- Shiller PE (CAPE): The Cyclically Adjusted Price-to-Earnings ratio (CAPE) smoothes out earnings fluctuations, offering a longer-term perspective on valuations.

- Market Capitalization to GDP: This metric compares the total market capitalization of all publicly traded companies to a country's gross domestic product (GDP). An unusually high ratio might suggest overvaluation.

- BofA's Holistic Approach: BofA utilizes a combination of these metrics, considering their strengths and weaknesses in the context of the overall market environment and specific company circumstances, to arrive at a holistic valuation assessment.

Factors Contributing to High Stock Market Valuations

Several factors contribute to the current environment of high stock market valuations.

Low Interest Rates

Low interest rates significantly impact stock valuations. Lower borrowing costs reduce the cost of capital for companies, supporting higher investment and earnings growth. Simultaneously, lower returns on bonds make equities a more attractive investment, increasing demand and pushing up prices.

- Impact on Investor Behavior: Low interest rates can lead to increased risk-taking by investors, as they search for higher returns. This can further inflate stock prices.

- BofA's Analysis: BofA closely monitors interest rate movements and their effect on investor sentiment and corporate investment decisions. We analyze the implications of potential interest rate increases on stock valuations.

Strong Corporate Earnings

Robust corporate earnings are a cornerstone of high stock market valuations. Strong profits provide a justification for higher stock prices.

- Recent Earnings Reports: Recent earnings reports reveal strong performance across various sectors.

- Growth Projections: Analysts’ forecasts suggest continued earnings growth in the coming quarters.

- BofA's Outlook: BofA believes that, while strong, the sustainability of current earnings growth should be carefully considered given macro-economic uncertainties.

Technological Innovation and Growth Sectors

Technological innovation fuels growth in specific sectors, driving investor enthusiasm and higher valuations.

- High-Growth Sectors: Technology, biotechnology, and renewable energy are among the sectors experiencing significant growth and attracting considerable investment.

- Contribution to Market Performance: These high-growth sectors often disproportionately contribute to overall market performance.

- Related Risks: Rapid technological change can also bring significant risks, including obsolescence and intense competition.

- BofA's Insights: BofA recognizes the transformative power of technology but cautions against overestimating the long-term prospects of specific sectors and companies, emphasizing the need for careful due diligence.

Quantitative Easing and Monetary Policy

Central bank policies, such as quantitative easing (QE), have played a significant role in supporting asset prices, including stocks.

- Impact on Stock Market Valuations: QE increases the money supply, lowering interest rates and potentially increasing inflation, which can fuel stock market gains.

- BofA's Analysis: BofA analyzes the long-term effects of these policies on inflation and potential market corrections. We closely monitor central bank communications for any shifts in monetary policy.

BofA's Outlook on High Stock Market Valuations and Investment Strategies

BofA acknowledges the elevated nature of current stock market valuations and recognizes the need for a cautious approach.

Potential Risks

High valuations inherently carry risks.

- Market Corrections: The possibility of a market correction, or even a more significant downturn, cannot be ignored.

- Inflation: Rising inflation can erode corporate profits and investor returns.

- Interest Rate Hikes: Future interest rate increases could negatively impact stock valuations.

- BofA's Risk Assessment: BofA assesses these risks carefully and develops strategies to mitigate potential losses.

Investment Recommendations

BofA recommends a diversified portfolio approach to manage risks associated with high valuations.

- Diversification: Diversification across asset classes, sectors, and geographies is crucial.

- Sector Allocation: Careful sector allocation, considering both growth potential and risk, is vital.

- Risk Management: Employing appropriate risk management techniques, including stop-loss orders, is essential.

- BofA's Investment Advice: BofA advises investors to consult with a financial advisor to develop a personalized investment strategy that aligns with their risk tolerance and financial goals.

Conclusion

High stock market valuations are a complex issue influenced by a confluence of factors including low interest rates, strong corporate earnings, technological innovation, and central bank policies. While strong earnings and growth in specific sectors offer opportunities, BofA emphasizes the importance of using multiple valuation metrics (like P/E, P/S, PEG, CAPE, and Market Cap to GDP ratios) and carefully considering potential risks such as market corrections and inflation. A diversified investment strategy and sound risk management are crucial for navigating this market environment. Contact your BofA advisor today to discuss your investment strategy in light of these high stock market valuations and to develop a personalized plan to help you achieve your financial goals.

Featured Posts

-

Nine Revelations From Times Trump Interview Annexing Canada Xis Calls And More

Apr 28, 2025

Nine Revelations From Times Trump Interview Annexing Canada Xis Calls And More

Apr 28, 2025 -

Silent Divorce Understanding The Telltale Signs Of Marital Breakdown

Apr 28, 2025

Silent Divorce Understanding The Telltale Signs Of Marital Breakdown

Apr 28, 2025 -

Lab Owner Admits To Faking Covid 19 Test Results

Apr 28, 2025

Lab Owner Admits To Faking Covid 19 Test Results

Apr 28, 2025 -

Stock Market Valuations And Investor Concerns Bof As Reassurance

Apr 28, 2025

Stock Market Valuations And Investor Concerns Bof As Reassurance

Apr 28, 2025 -

Hollywood Production Halts Joint Writers And Actors Strike Impacts Entertainment

Apr 28, 2025

Hollywood Production Halts Joint Writers And Actors Strike Impacts Entertainment

Apr 28, 2025

Latest Posts

-

Starbucks Union Vote Rejects Companys Pay Raise Plan

Apr 28, 2025

Starbucks Union Vote Rejects Companys Pay Raise Plan

Apr 28, 2025 -

Starbucks Union Spurns Companys Guaranteed Raise Proposal

Apr 28, 2025

Starbucks Union Spurns Companys Guaranteed Raise Proposal

Apr 28, 2025 -

Unionized Starbucks Stores Reject Companys Wage Guarantee

Apr 28, 2025

Unionized Starbucks Stores Reject Companys Wage Guarantee

Apr 28, 2025 -

Starbucks Workers Reject Companys Pay Raise Offer

Apr 28, 2025

Starbucks Workers Reject Companys Pay Raise Offer

Apr 28, 2025 -

Starbucks Union Rejects Companys Proposed Wage Increase

Apr 28, 2025

Starbucks Union Rejects Companys Proposed Wage Increase

Apr 28, 2025