Are High Stock Market Valuations A Concern? BofA's Analysis

Table of Contents

BofA's Valuation Metrics and Their Interpretation

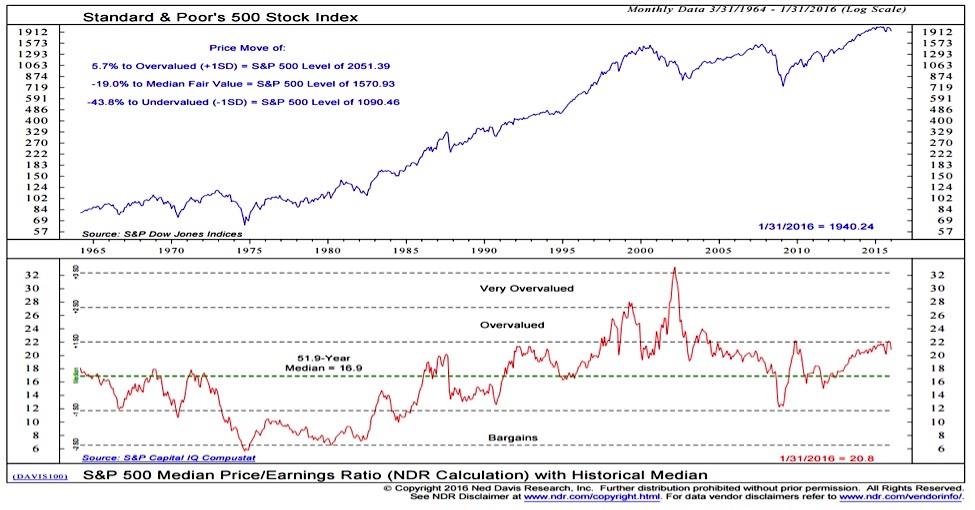

BofA employs a range of valuation metrics to assess the health of the stock market. These include traditional measures like the Price-to-Earnings ratio (P/E), forward P/E ratios (which look at future earnings estimates), and the cyclically adjusted price-to-earnings ratio (CAPE or Shiller PE), a longer-term valuation metric that smooths out short-term earnings fluctuations. BofA then compares these current readings to historical data, establishing benchmarks and identifying potential deviations from historical norms.

- BofA's Findings: BofA's recent analyses (specific reports should be cited here if available) might indicate whether current valuations are considered overvalued, fairly valued, or undervalued relative to historical averages and various predictive models. (Insert specific data points from BofA's reports here, citing the source).

- Implications: High P/E ratios, for example, could suggest the market is pricing in optimistic future earnings growth, while a high CAPE ratio might signal a potential bubble. BofA's interpretation of these metrics will inform their outlook on potential risks and opportunities.

- Sector-Specific Concerns: BofA's analysis may highlight specific sectors or market segments exhibiting particularly high or low valuations relative to their historical performance and growth prospects. These insights can be crucial for investors seeking to manage risk and identify potential investment opportunities. For example, they might flag technology stocks as overvalued compared to the broader market.

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors and market dynamics contribute to the current environment of high stock market valuations. Understanding these factors is essential for interpreting BofA's assessment and forming your own investment strategy.

-

Low Interest Rates and Quantitative Easing: Historically low interest rates and the implementation of quantitative easing policies by central banks have pushed investors into riskier assets, driving up stock prices. This increases demand for stocks without a commensurate increase in supply.

-

Strong Corporate Earnings: Robust corporate earnings, especially in certain sectors, can justify higher valuations. However, the sustainability of these earnings needs to be evaluated in the context of overall economic conditions.

-

Investor Sentiment and Market Psychology: Positive investor sentiment and a general sense of optimism can fuel a bull market, pushing valuations higher. This often involves speculation and a willingness to overlook potential risks.

-

Inflation and its Impact: High inflation can impact valuations both positively and negatively. While higher prices can boost corporate revenues, they can also erode the purchasing power of future earnings and potentially impact interest rate policies from central banks.

BofA's Predictions and Recommendations

BofA's analysts likely offer predictions regarding the future direction of stock market valuations and provide investment recommendations based on their assessment.

- Market Trajectory: BofA might forecast a bullish, bearish, or neutral market outlook, depending on their interpretation of the valuation metrics and contributing factors. (Insert BofA's predicted market trajectory here if available).

- Portfolio Adjustments: Based on their outlook, BofA might recommend specific portfolio adjustments for various risk tolerance levels. Investors with a higher risk tolerance might be advised to maintain their current equity exposure, while those with a lower risk tolerance might be advised to consider diversifying into less volatile assets.

- Alternative Investment Strategies: BofA might suggest exploring alternative investment strategies, such as bonds, real estate, or commodities, to diversify portfolios and mitigate risks associated with high stock market valuations.

Alternative Perspectives and Counterarguments

It's crucial to consider alternative perspectives and counterarguments to BofA's analysis of high stock market valuations. A balanced view acknowledges the inherent complexities and uncertainties involved in predicting market movements.

- Contrasting Opinions: Other financial institutions or analysts might offer differing views on the significance of current valuations. Some might argue that current valuations are justified by strong growth prospects or low interest rates, while others may express greater concerns about a potential market correction.

- Limitations of BofA's Methodology: Acknowledging potential limitations in BofA's methodology, such as reliance on specific models or assumptions about future economic conditions, is essential for a comprehensive understanding.

- Uncertainties and Risks: Market valuation is inherently uncertain, subject to unforeseen events and shifts in market sentiment. Acknowledging these limitations promotes a realistic and cautious approach to investing.

Conclusion: Addressing the Concern of High Stock Market Valuations – A BofA Perspective and Next Steps

BofA's analysis of high stock market valuations offers valuable insights but should be considered alongside other perspectives. The current valuation environment is influenced by a complex interplay of macroeconomic factors, investor sentiment, and corporate earnings. While BofA's predictions and recommendations are informative, it's crucial to remember that market behavior is inherently unpredictable. Therefore, a thorough understanding of multiple viewpoints and potential risks is critical for informed investment decisions. Conduct thorough research, consult with a financial advisor, and stay informed about updates from BofA and other market analysts to effectively navigate the complexities of high stock market valuations. Remember that understanding high stock market valuations is an ongoing process that requires continuous monitoring and adaptation to the evolving market conditions.

Featured Posts

-

Harvard Researchers Deportation Case Awaiting Louisiana Judges Decision

Apr 28, 2025

Harvard Researchers Deportation Case Awaiting Louisiana Judges Decision

Apr 28, 2025 -

Trumps Time Interview Canada Annexation Xi Jinping And Presidential Term Limits

Apr 28, 2025

Trumps Time Interview Canada Annexation Xi Jinping And Presidential Term Limits

Apr 28, 2025 -

Understanding High Stock Market Valuations A Bof A Viewpoint

Apr 28, 2025

Understanding High Stock Market Valuations A Bof A Viewpoint

Apr 28, 2025 -

New Developments In Us China Trade Relations Tariff Adjustments

Apr 28, 2025

New Developments In Us China Trade Relations Tariff Adjustments

Apr 28, 2025 -

Luigi Mangione A Look At His Supporters Key Messages

Apr 28, 2025

Luigi Mangione A Look At His Supporters Key Messages

Apr 28, 2025

Latest Posts

-

U S Stock Market Rally Driven By Tech Giants Tesla In The Lead

Apr 28, 2025

U S Stock Market Rally Driven By Tech Giants Tesla In The Lead

Apr 28, 2025 -

Tesla And Tech Stocks Power U S Market Surge

Apr 28, 2025

Tesla And Tech Stocks Power U S Market Surge

Apr 28, 2025 -

Starbucks Union Vote Rejects Companys Pay Raise Plan

Apr 28, 2025

Starbucks Union Vote Rejects Companys Pay Raise Plan

Apr 28, 2025 -

Starbucks Union Spurns Companys Guaranteed Raise Proposal

Apr 28, 2025

Starbucks Union Spurns Companys Guaranteed Raise Proposal

Apr 28, 2025 -

Unionized Starbucks Stores Reject Companys Wage Guarantee

Apr 28, 2025

Unionized Starbucks Stores Reject Companys Wage Guarantee

Apr 28, 2025