Ethereum CrossX Indicators Flash Buy Signal: Institutions Accumulate, $4,000 Price Predicted

Table of Contents

Decoding the Ethereum CrossX Indicators Flash Buy Signal

Understanding the CrossX Indicator

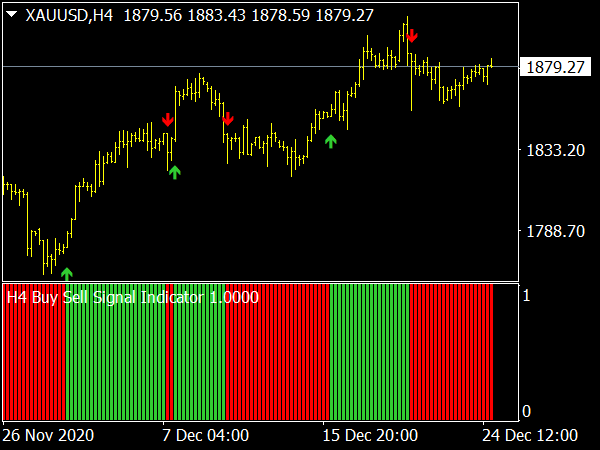

The CrossX indicator is a powerful technical analysis tool used to identify potential price reversals and momentum shifts in the cryptocurrency market. It combines several key metrics to generate buy and sell signals. Understanding its components is crucial for interpreting the recent flash buy signal. Key terms include:

- Bullish Crossover: Occurs when a fast-moving average crosses above a slow-moving average, suggesting a potential upward price trend.

- Bearish Crossover: The opposite of a bullish crossover, indicating a potential downward trend.

- Resistance Levels: Price points where the asset's price has historically struggled to break through, acting as a ceiling for price increases.

- Support Levels: Price points where the asset's price has historically found buying pressure, acting as a floor for price decreases.

The CrossX indicator itself is a proprietary algorithm that integrates these and other metrics to identify optimal buy and sell points. It is often represented visually on charts, making its interpretation relatively straightforward.

[Insert Chart/Graph illustrating a CrossX buy signal here]

The Recent Flash Buy Signal

On [Date], at approximately [Time], the Ethereum CrossX indicators flashed a powerful buy signal. This event was characterized by:

- A sharp bullish crossover of the fast and slow moving averages within the CrossX algorithm.

- A significant increase in trading volume accompanying the price surge.

- The price breaking through a key resistance level.

This particular signal aligns strongly with the $4,000 price prediction, as past instances of similar signals have often preceded substantial price increases. The intensity and confluence of indicators in this specific event make it particularly noteworthy.

Confirmation from Other Technical Indicators

The bullish signal from the Ethereum CrossX indicators is further reinforced by several other technical indicators:

- RSI (Relative Strength Index): Showing a reading of [RSI Value], suggesting the market is not overbought.

- MACD (Moving Average Convergence Divergence): Exhibiting a clear bullish crossover, confirming upward momentum.

- Moving Averages (e.g., 50-day, 200-day): The price is comfortably above both the 50-day and 200-day moving averages, a strong bullish signal.

The convergence of these indicators strengthens the confidence in the bullish outlook indicated by the CrossX signal.

Institutional Accumulation Fuels Ethereum's Price Potential

Evidence of Institutional Investment

Several pieces of evidence point towards significant institutional accumulation of Ethereum:

- Large ETH Transfers: Numerous large-scale Ethereum transfers have been observed on the blockchain, suggesting institutional-level buying activity. [Link to credible source].

- Grayscale Investments: Grayscale Investments, a major player in the crypto investment space, has significantly increased its ETH holdings. [Link to credible source].

- Increased Custody Solutions: The rise of institutional-grade custody solutions for Ethereum demonstrates growing comfort amongst large investors. [Link to credible source].

Why Institutions are Buying Ethereum

The reasons behind this institutional interest are multifaceted:

- DeFi Growth: The explosive growth of the Decentralized Finance (DeFi) ecosystem on Ethereum is a major draw for institutional investors.

- Ethereum 2.0 Upgrades: The ongoing upgrades to the Ethereum network, including the transition to Proof-of-Stake, enhance scalability and efficiency, boosting investor confidence.

- Enterprise Adoption: Growing adoption of Ethereum's blockchain technology by enterprises for various applications adds to its long-term value proposition.

The $4,000 Ethereum Price Prediction: Realistic or Overly Optimistic?

Factors Supporting the $4,000 Target

Several factors could propel Ethereum's price towards the $4,000 mark:

- Increasing Adoption: Widespread adoption of Ethereum in various sectors (DeFi, NFTs, Metaverse) fuels demand.

- Network Upgrades: Successful implementation of Ethereum 2.0 will improve efficiency and scalability.

- Positive Market Sentiment: Continued positive market sentiment towards cryptocurrencies in general could lead to further price increases.

- Analyst Predictions: Several reputable analysts have predicted price targets exceeding $4,000 based on fundamental and technical analysis.

Potential Risks and Challenges

It's crucial to acknowledge potential downsides:

- Regulatory Uncertainty: Changes in regulatory frameworks could negatively impact the market.

- Market Corrections: The cryptocurrency market is inherently volatile, and corrections are inevitable.

- Competition: Competition from other blockchain platforms could put downward pressure on Ethereum's price.

Careful risk management and diversification are essential when considering any investment in the cryptocurrency market.

Conclusion: Capitalize on the Ethereum CrossX Indicators Flash Buy Signal

The Ethereum CrossX indicators have flashed a strong buy signal, supported by evidence of institutional accumulation and positive market sentiment. While a $4,000 price target is ambitious, the confluence of factors suggests a significant upside potential. However, remember that the cryptocurrency market is highly volatile. Monitor Ethereum CrossX indicators closely, learn more about Ethereum investment strategies, and stay informed about the future of Ethereum. This information is for educational purposes only and should not be considered financial advice. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

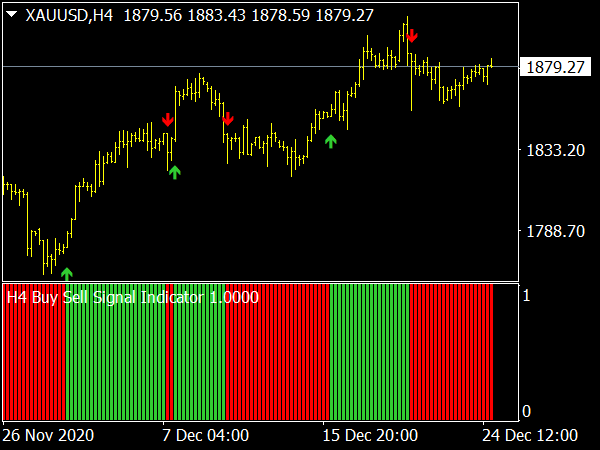

Fungal Infections A Growing Threat Of Antibiotic Resistance

May 08, 2025

Fungal Infections A Growing Threat Of Antibiotic Resistance

May 08, 2025 -

Inter Milan Beats Barcelona A Ticket To The Champions League Final

May 08, 2025

Inter Milan Beats Barcelona A Ticket To The Champions League Final

May 08, 2025 -

Counting Crows Las Vegas Strip Tour Date Revealed

May 08, 2025

Counting Crows Las Vegas Strip Tour Date Revealed

May 08, 2025 -

Trump On Cusma Positive Assessment But Termination Remains A Possibility

May 08, 2025

Trump On Cusma Positive Assessment But Termination Remains A Possibility

May 08, 2025 -

The Dembele Injury How It Affects Arsenals Premier League Campaign

May 08, 2025

The Dembele Injury How It Affects Arsenals Premier League Campaign

May 08, 2025

Latest Posts

-

Xrp Market Analysis Three Reasons Why Xrp May Be Ready To Explode

May 08, 2025

Xrp Market Analysis Three Reasons Why Xrp May Be Ready To Explode

May 08, 2025 -

3 Key Indicators Suggesting Xrp Could Be Poised For A Significant Rally

May 08, 2025

3 Key Indicators Suggesting Xrp Could Be Poised For A Significant Rally

May 08, 2025 -

Xrp Price Prediction 3 Factors Pointing To A Possible Parabolic Move In Xrp

May 08, 2025

Xrp Price Prediction 3 Factors Pointing To A Possible Parabolic Move In Xrp

May 08, 2025 -

Xrp News 3 Reasons For A Potential Xrp Price Surge

May 08, 2025

Xrp News 3 Reasons For A Potential Xrp Price Surge

May 08, 2025 -

Aktuelle Lotto 6aus49 Ergebnisse Ziehung Vom 12 April 2025

May 08, 2025

Aktuelle Lotto 6aus49 Ergebnisse Ziehung Vom 12 April 2025

May 08, 2025