Could A 10x Bitcoin Multiplier Reshape Wall Street?

Table of Contents

The Potential for a 10x Bitcoin Price Increase

A 10x Bitcoin price surge, while seemingly dramatic, isn't entirely outside the realm of possibility. Several factors could contribute to such a significant increase:

-

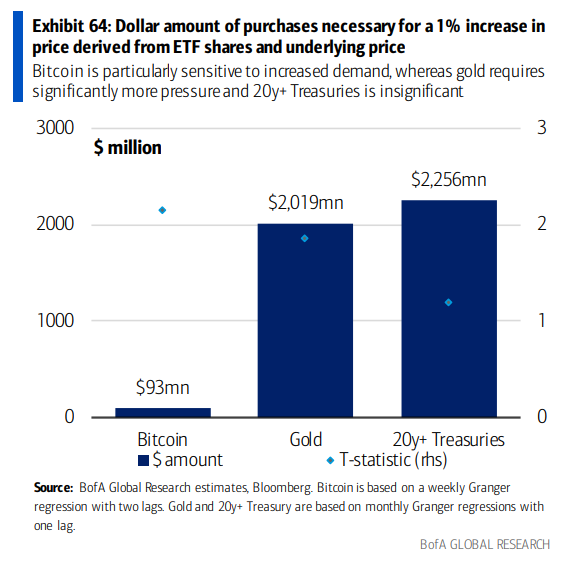

Increased Institutional Adoption: The entry of major institutional investors, like pension funds and endowments, into the Bitcoin market is a significant catalyst. The approval of more Bitcoin ETFs (Exchange-Traded Funds) would dramatically increase accessibility and liquidity, driving demand. This increased institutional participation could fuel a substantial price increase.

-

Growing Global Macroeconomic Uncertainty: In times of economic instability, Bitcoin's decentralized and deflationary nature positions it as an attractive safe-haven asset. Increased global uncertainty could push investors towards Bitcoin, boosting demand and driving up the price. This "flight to safety" effect is a crucial factor in predicting potential price surges.

-

Technological Advancements: Improvements in Bitcoin's underlying technology, such as the scalability enhancements offered by the Lightning Network, could significantly increase transaction speed and reduce fees. This improved efficiency could attract a wider range of users and businesses, boosting demand.

-

Regulation and Government Acceptance: Positive regulatory frameworks and government acceptance of Bitcoin as a legitimate asset class would legitimize its use and increase investor confidence. This would lead to broader adoption and, consequently, a higher price.

Analyzing historical price movements, although volatile, shows Bitcoin's capacity for exponential growth. While predicting the future is impossible, a confluence of the factors listed above could theoretically lead to a 10x price increase. However, counterarguments exist. Bitcoin's inherent volatility, potential regulatory crackdowns, and competition from other cryptocurrencies present significant obstacles to such a dramatic price rise.

Impact on Traditional Financial Institutions

A 10x Bitcoin multiplier would profoundly impact traditional financial institutions, forcing significant adaptations:

Investment Banks

- Increased Demand for Bitcoin-Related Financial Products: Investment banks would see a surge in demand for Bitcoin derivatives, ETFs, and other financial products.

- Potential for New Revenue Streams: This increased demand would unlock new revenue streams and opportunities for these institutions.

- Need for Adaptation and Integration: Investment banks would need to rapidly adapt and integrate cryptocurrency technologies into their existing infrastructure.

Asset Management Firms

- Portfolio Diversification: Asset management firms would need to reassess their investment strategies and incorporate Bitcoin allocation into their portfolios to remain competitive.

- Increased Competition: They would face intensified competition from cryptocurrency-focused funds that specialize in Bitcoin and other digital assets.

Hedge Funds

- Increased Trading Activity: Hedge funds would engage in increased trading activity in Bitcoin and related assets, seeking to capitalize on price fluctuations.

- Sophisticated Trading Strategies: The development of sophisticated trading strategies specifically for Bitcoin would become a key area of focus.

Implications for Regulatory Bodies

A 10x Bitcoin price surge would present significant challenges for regulatory bodies worldwide:

- Maintaining Financial Stability: Regulators would need to navigate the increased volatility in the market and maintain financial stability.

- Balancing Innovation and Risk Mitigation: Striking a balance between encouraging innovation in the cryptocurrency space and mitigating potential risks is crucial.

- Developing Effective Regulatory Frameworks: Creating effective and comprehensive regulatory frameworks for cryptocurrencies is a complex undertaking requiring international collaboration.

Potential regulatory responses could include increased scrutiny of Bitcoin exchanges and trading platforms, new regulations on Bitcoin derivatives, and increased international cooperation on cryptocurrency regulation.

The Broader Economic Effects of a 10x Bitcoin Multiplier

A 10x Bitcoin multiplier would have far-reaching economic consequences:

-

Impact on Global Markets: Significant capital flows into the cryptocurrency market could potentially impact global equity markets and fiat currencies, potentially causing inflation or deflation depending on the scale and speed of adoption.

-

Effects on Individual Investors: While offering substantial opportunities for wealth creation, a 10x Bitcoin multiplier would also increase the risk for individual investors. Responsible investing practices and robust risk management become paramount.

Will a 10x Bitcoin Multiplier Reshape Wall Street?

A 10x Bitcoin price increase holds the potential to significantly reshape Wall Street and the global financial landscape. Its impact on traditional financial institutions, regulatory bodies, and individual investors would be profound. The factors contributing to such a surge, while potentially powerful, are also subject to significant uncertainties. However, ignoring the potential of a 10x Bitcoin multiplier would be a significant oversight. Understanding the potential of a 10x Bitcoin multiplier is crucial for navigating the future of finance. Stay informed and learn more about Bitcoin's impact on Wall Street today!

Featured Posts

-

Prelazna Vlada Grbovic Psg Spreman Za Kompromis

May 08, 2025

Prelazna Vlada Grbovic Psg Spreman Za Kompromis

May 08, 2025 -

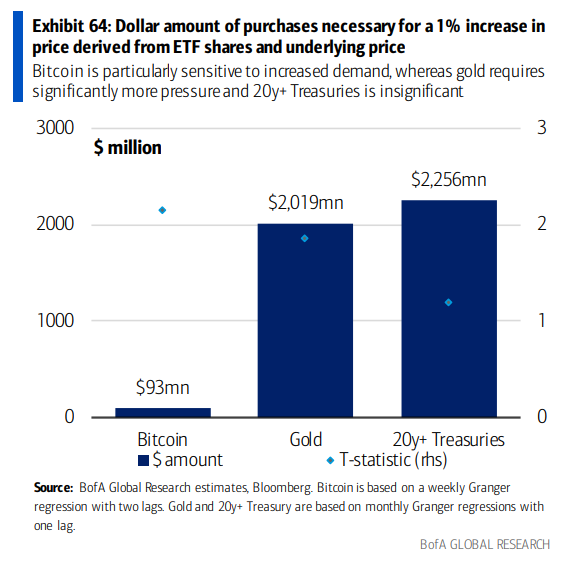

Unveiling The Past A Rogue One Heros Journey In The New Star Wars Series

May 08, 2025

Unveiling The Past A Rogue One Heros Journey In The New Star Wars Series

May 08, 2025 -

Nc State Recruiting Setback Loss Of Kendrick Raphael

May 08, 2025

Nc State Recruiting Setback Loss Of Kendrick Raphael

May 08, 2025 -

Thunder Vs Pacers Injury Report March 29th Game Status

May 08, 2025

Thunder Vs Pacers Injury Report March 29th Game Status

May 08, 2025 -

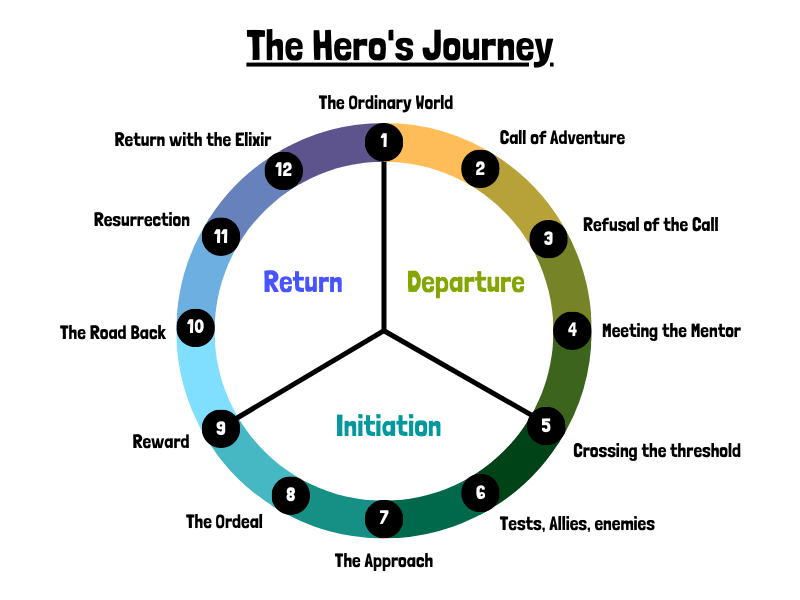

Assessing The Overvaluation Of The Canadian Dollar A Call To Action

May 08, 2025

Assessing The Overvaluation Of The Canadian Dollar A Call To Action

May 08, 2025

Latest Posts

-

67 Million Ethereum Liquidation Event Market Analysis And Predictions

May 08, 2025

67 Million Ethereum Liquidation Event Market Analysis And Predictions

May 08, 2025 -

Ethereum Market Crash 67 M In Liquidations And The Potential For More

May 08, 2025

Ethereum Market Crash 67 M In Liquidations And The Potential For More

May 08, 2025 -

67 Million In Ethereum Liquidations Whats Next For Eth Prices

May 08, 2025

67 Million In Ethereum Liquidations Whats Next For Eth Prices

May 08, 2025 -

Bitcoin And Ethereum Options Billions To Expire Impact On Market Volatility

May 08, 2025

Bitcoin And Ethereum Options Billions To Expire Impact On Market Volatility

May 08, 2025 -

A Lasting Impression Nathan Fillions Impact On Saving Private Ryan

May 08, 2025

A Lasting Impression Nathan Fillions Impact On Saving Private Ryan

May 08, 2025