Assessing The Overvaluation Of The Canadian Dollar: A Call To Action

Table of Contents

Analyzing Key Economic Indicators Affecting CAD Valuation

Several interconnected economic factors influence the valuation of the Canadian dollar (CAD). Understanding these dynamics is crucial for assessing whether the current exchange rate accurately reflects the Canadian economy's underlying strength.

Interest Rate Differentials

Interest rate differentials between Canada and its major trading partners significantly impact the CAD's value. The Bank of Canada's monetary policy plays a pivotal role.

- Higher Canadian interest rates: Attract foreign investment, increasing demand for the CAD and strengthening its value. Investors seek higher returns, driving up the CAD's price.

- Lower Canadian interest rates: Can lead to capital outflow as investors seek better returns elsewhere, weakening the CAD. This makes the CAD less attractive compared to currencies offering higher yields.

- Comparison with other economies: Comparing Canada's interest rates to those in the US, Eurozone, and other key markets provides a clearer picture of the CAD's attractiveness to international investors. A widening gap between Canadian and foreign rates typically strengthens the CAD, while a narrowing gap or inversion can weaken it.

Commodity Prices and their Influence

Canada is a significant commodity exporter, with oil and lumber being key contributors to its economy. Commodity price fluctuations directly impact the CAD.

- Strong commodity prices: Boost the Canadian economy, increasing demand for the CAD as export revenues rise. Higher prices for oil, for example, translate into increased CAD demand.

- Weak commodity prices: Can negatively impact the Canadian economy, weakening the CAD as export earnings decline. A global downturn in oil prices, for instance, puts downward pressure on the CAD.

- Global commodity market dynamics: Understanding the complexities of global supply and demand for key commodities is vital to forecasting CAD movements. Unexpected disruptions or shifts in global demand significantly impact the CAD's valuation.

Geopolitical Factors and Their Impact on CAD

Global events can dramatically influence investor sentiment towards the Canadian dollar, impacting its value.

- Trade wars and protectionism: Disruptions to global trade, such as trade wars, negatively affect Canadian exports and investor confidence, leading to CAD depreciation.

- Political instability: Both domestically and internationally, political uncertainty can create volatility in the currency markets, impacting the CAD.

- Global economic crises: Major global events, such as recessions or financial crises, often lead to capital flight from riskier assets, including the CAD.

Evaluating the Current Market Conditions and Forecasting Future Trends

To determine whether the Canadian dollar is overvalued, we must analyze current market conditions and forecast future trends.

Analyzing Current Exchange Rates

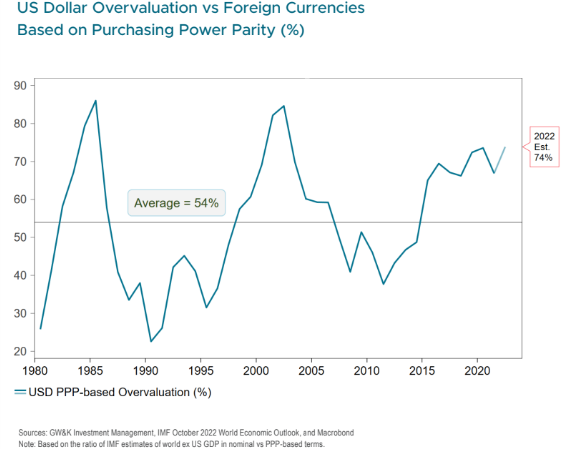

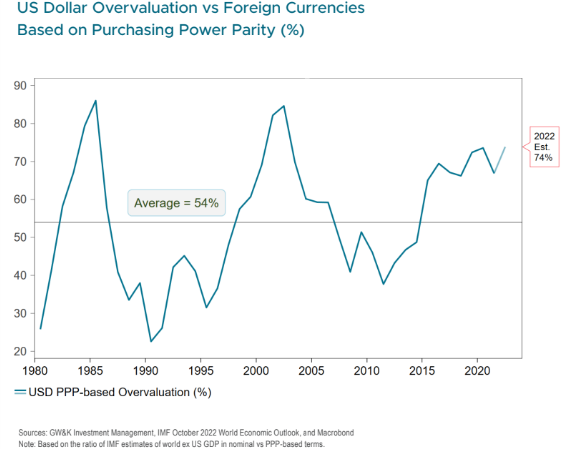

Analyzing current CAD exchange rates against major currencies like the USD, EUR, and GBP reveals recent trends and volatility. Charts and graphs illustrating these trends offer a visual representation of the CAD's performance. (Insert relevant charts and graphs here). The data should be sourced from reputable financial institutions like the Bank of Canada or major international banks.

Expert Opinions and Market Sentiment

Consulting leading economists and financial analysts' views provides valuable insights into market sentiment towards the Canadian dollar. Examining their forecasts, both bullish and bearish, allows for a more holistic assessment. (Cite reputable sources like the Financial Post, Bloomberg, or Reuters here).

Potential Risks and Opportunities

Identifying potential economic shocks that could affect the CAD's value is crucial for informed decision-making.

- Recessions: Both global and domestic recessions can significantly weaken the CAD.

- Trade disputes: Escalating trade conflicts can further disrupt the Canadian economy and lead to CAD depreciation.

- Hedging strategies: Implementing hedging strategies, such as using forward contracts or options, can mitigate the risks associated with CAD fluctuations for businesses and investors.

Strategies for Navigating a Potentially Overvalued Canadian Dollar

Depending on whether you are a business or an investor, different strategies can be employed to mitigate the risks of an overvalued CAD.

Strategies for Businesses

Businesses heavily reliant on international trade need to develop effective strategies to manage the risks of an overvalued CAD.

- Hedging: Employing hedging techniques to lock in exchange rates for future transactions minimizes the impact of currency fluctuations on profits.

- Diversification: Expanding into new markets less sensitive to CAD movements can reduce reliance on the Canadian dollar.

- Pricing strategies: Carefully adjusting pricing strategies to account for fluctuations in the exchange rate is essential for maintaining profitability.

Strategies for Investors

Individual investors can also implement strategies to navigate a potentially overvalued CAD.

- Currency diversification: Investing in assets denominated in other currencies helps to reduce exposure to CAD fluctuations.

- Foreign asset investment: Investing in foreign stocks or bonds can provide diversification and potentially higher returns if the CAD weakens.

- Consult a financial advisor: Seeking professional advice from a qualified financial advisor is essential for developing a personalized investment strategy.

Conclusion: Taking Action on the Overvaluation of the Canadian Dollar

Determining whether the Canadian dollar is truly overvalued requires a comprehensive analysis of multiple interacting economic factors. While this article presents a critical assessment, the ultimate decision rests on individual interpretation of the data and market conditions. The key takeaway is the importance of continuous monitoring of the CAD and its influencing factors. Don't wait for the market to dictate your next move. Proactively assess your exposure to the overvaluation of the Canadian dollar today. Conduct your own research, consult with financial advisors, and develop strategies to manage your exposure to CAD fluctuations effectively. The overvaluation of the Canadian dollar presents both risks and opportunities; understanding these dynamics is critical for making informed financial decisions.

Featured Posts

-

First Drive Review The 2024 Cadillac Celestiq Electric Vehicle

May 08, 2025

First Drive Review The 2024 Cadillac Celestiq Electric Vehicle

May 08, 2025 -

Paris Walk Off Homer Secures Angels Win Against White Sox Despite Rain

May 08, 2025

Paris Walk Off Homer Secures Angels Win Against White Sox Despite Rain

May 08, 2025 -

Arsenal Ps Zh Istoriya Protivostoyaniy V Evrokubkakh

May 08, 2025

Arsenal Ps Zh Istoriya Protivostoyaniy V Evrokubkakh

May 08, 2025 -

Wall Street Predicts 110 Gain The Black Rock Etf Billionaires Are Buying

May 08, 2025

Wall Street Predicts 110 Gain The Black Rock Etf Billionaires Are Buying

May 08, 2025 -

Another Aircraft Lost Second Us Navy Jet Goes Down Near Truman Carrier

May 08, 2025

Another Aircraft Lost Second Us Navy Jet Goes Down Near Truman Carrier

May 08, 2025

Latest Posts

-

Kriptoda Yeni Bir Cag Spk Nin Aciklamalari Ve Analizi

May 08, 2025

Kriptoda Yeni Bir Cag Spk Nin Aciklamalari Ve Analizi

May 08, 2025 -

Kripto Para Wall Street Kurumlarinin Degisen Tutumu Ve Gelecegi

May 08, 2025

Kripto Para Wall Street Kurumlarinin Degisen Tutumu Ve Gelecegi

May 08, 2025 -

Rusya Merkez Bankasi Nin Kripto Para Uyarisi Ne Anlama Geliyor Ve Nelere Dikkat Etmeliyiz

May 08, 2025

Rusya Merkez Bankasi Nin Kripto Para Uyarisi Ne Anlama Geliyor Ve Nelere Dikkat Etmeliyiz

May 08, 2025 -

Spk Nin Kripto Para Piyasalarina Etkisi Yeni Reguelasyonlar Ve Gelecek

May 08, 2025

Spk Nin Kripto Para Piyasalarina Etkisi Yeni Reguelasyonlar Ve Gelecek

May 08, 2025 -

Wall Street Ten Kripto Para Yatirimlarina Yeni Bir Bakis

May 08, 2025

Wall Street Ten Kripto Para Yatirimlarina Yeni Bir Bakis

May 08, 2025