$67 Million Ethereum Liquidation Event: Market Analysis And Predictions

Table of Contents

Causes of the $67 Million Ethereum Liquidation

Understanding the factors contributing to such a substantial Ethereum liquidation is critical for mitigating future risks. Several interconnected elements likely played a role.

Market Sentiment and Price Swings

Negative market sentiment is a potent catalyst for liquidations. Sudden, sharp price drops can trigger margin calls, forcing leveraged traders to sell their assets to meet their obligations.

- Example 1: The release of unexpectedly negative economic data could have fueled a sell-off, impacting Ethereum prices.

- Example 2: A significant security breach or regulatory announcement related to another cryptocurrency could have created a contagion effect, pushing down Ethereum's price.

- Specific price drops of X% within Y timeframe directly contributed to the liquidation of leveraged positions.

Leveraged Trading and High-Risk Strategies

Highly leveraged trading significantly amplifies both profits and losses. While offering the potential for substantial returns, leverage increases the vulnerability to liquidations during market downturns.

- Leverage Explained: Leverage allows traders to control a larger amount of assets than their actual capital allows. A 5x leverage means a trader can control five times their investment.

- Risky Strategies: Using maximum leverage, employing aggressive trading strategies without proper risk management, and ignoring stop-loss orders all significantly increase the likelihood of liquidation.

DeFi Protocol Vulnerabilities

The decentralized finance (DeFi) ecosystem's rapid growth has also introduced potential vulnerabilities. Smart contract bugs or algorithmic flaws within DeFi protocols could have contributed to the liquidation event.

- Smart Contract Bugs: Unforeseen interactions between smart contracts could lead to unexpected failures, impacting users' positions.

- Algorithmic Instability: Flaws in the algorithms governing certain DeFi protocols may exacerbate price swings and trigger liquidations.

- [Mention specific DeFi protocols involved if any, e.g., "The liquidation event appeared to disproportionately affect users of Protocol X."]

Impact of the Liquidation on the Ethereum Ecosystem

The $67 million Ethereum liquidation had far-reaching consequences across various aspects of the Ethereum ecosystem and beyond.

Short-Term Price Volatility

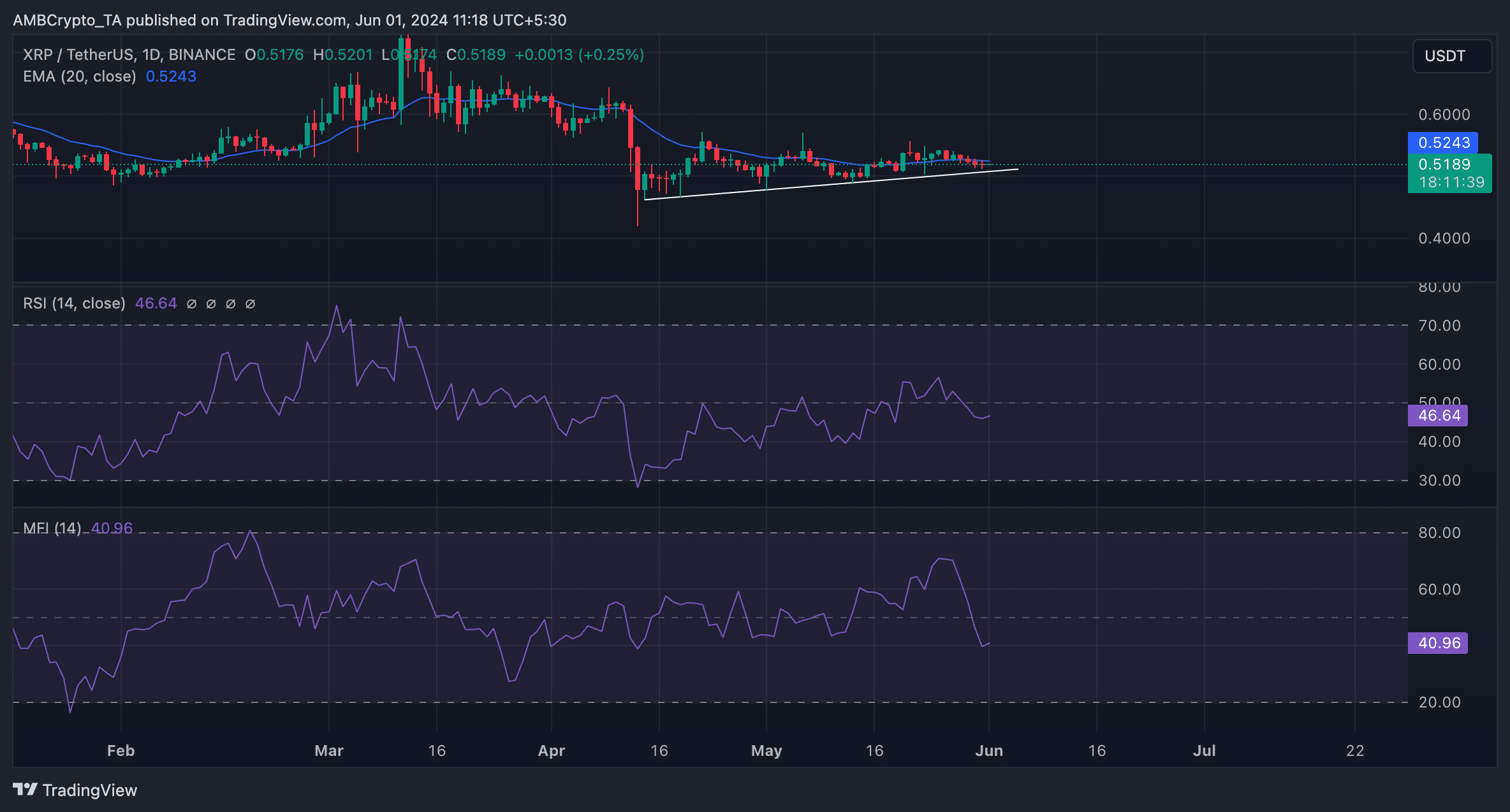

The immediate impact was a sharp decrease in Ethereum's price. [Insert chart/graph showing price drop and recovery].

- Peak Price Drop: Ethereum's price dropped by X% within Z hours.

- Recovery Time: The price recovered to its pre-event level within approximately Y days/weeks.

- Trading Volume Spike: Trading volume increased significantly during the event, reflecting heightened market activity.

Impact on Decentralized Finance (DeFi)

The liquidation event had a notable impact on several DeFi platforms and their users.

- Affected Protocols: [Mention specific DeFi protocols and their losses].

- User Trust and Confidence: The event likely eroded user trust and confidence in certain DeFi protocols, highlighting the need for enhanced security measures.

Wider Market Implications

The Ethereum liquidation's ripple effects extended to the broader cryptocurrency market.

- Correlations: The price movements of Ethereum often correlate with those of other cryptocurrencies. This event likely influenced other crypto assets.

- Market Sentiment: The liquidation contributed to a general sense of uncertainty and risk aversion within the crypto market.

Predictions and Future Outlook for Ethereum

Predicting the future of Ethereum's price is inherently challenging, but analyzing past trends and current market conditions offers some insights.

Price Predictions (Short-Term and Long-Term)

[Provide cautious price predictions, emphasizing uncertainty. Base predictions on technical analysis or market indicators.]

- Bullish Scenario: Ethereum could reach X price by Y date if [conditions].

- Bearish Scenario: Ethereum may fall to Y price by Z date if [conditions].

- Neutral Scenario: Ethereum price might fluctuate within the range of X and Y during this timeframe.

Regulatory Implications

Regulatory responses to events like this are likely to impact the Ethereum ecosystem.

- Increased Scrutiny: Expect increased regulatory scrutiny of DeFi protocols and cryptocurrency exchanges.

- New Regulations: New regulations could be introduced to enhance market transparency and consumer protection.

Technological Advancements and Mitigation Strategies

Technological advancements can help prevent similar events in the future.

- Improved Smart Contracts: More robust and rigorously audited smart contracts can help mitigate vulnerabilities.

- Enhanced Risk Management: Sophisticated risk management tools can help traders better manage their positions and avoid liquidations.

- Stronger Regulatory Frameworks: Clearer regulatory frameworks can create a more stable and secure market environment.

Conclusion: Understanding the $67 Million Ethereum Liquidation Event and Preparing for the Future

The $67 million Ethereum liquidation event serves as a stark reminder of the inherent volatility within the cryptocurrency market. Understanding its causes, evaluating its impact, and formulating future predictions are crucial for navigating this dynamic landscape. This analysis highlights the importance of responsible risk management, thorough research, and a keen awareness of market dynamics. Conducting thorough Ethereum liquidation analysis and understanding Ethereum market predictions are vital for informed decision-making. Before investing in cryptocurrencies, particularly those involving high leverage or DeFi protocols, ensure you've conducted comprehensive research and developed a robust risk management strategy. Focus on ETH risk management to protect your investments.

Featured Posts

-

Singapores Largest Bank Advocates For Polluter Reform

May 08, 2025

Singapores Largest Bank Advocates For Polluter Reform

May 08, 2025 -

Billions In Bitcoin And Ethereum Options Expire Market Volatility Expected

May 08, 2025

Billions In Bitcoin And Ethereum Options Expire Market Volatility Expected

May 08, 2025 -

Top Krypto Stories Of All Time

May 08, 2025

Top Krypto Stories Of All Time

May 08, 2025 -

Psg Ve Nantes Berabere Kaldi Ligde Puan Kaybi

May 08, 2025

Psg Ve Nantes Berabere Kaldi Ligde Puan Kaybi

May 08, 2025 -

Grand Theft Auto Vi Trailer Breakdown Bonnie And Clyde Duo Revealed

May 08, 2025

Grand Theft Auto Vi Trailer Breakdown Bonnie And Clyde Duo Revealed

May 08, 2025

Latest Posts

-

Ripple And Xrp Remittix Ico Boost And 3 Factors Fueling Xrp Growth

May 08, 2025

Ripple And Xrp Remittix Ico Boost And 3 Factors Fueling Xrp Growth

May 08, 2025 -

Xrp Price Prediction Is A Parabolic Move Imminent Remittix Ico Raises 15 M

May 08, 2025

Xrp Price Prediction Is A Parabolic Move Imminent Remittix Ico Raises 15 M

May 08, 2025 -

Xrp News 3 Reasons For An Xrp Price Surge And Remittix Ico Success

May 08, 2025

Xrp News 3 Reasons For An Xrp Price Surge And Remittix Ico Success

May 08, 2025 -

Xrp Market Analysis Three Reasons Why Xrp May Be Ready To Explode

May 08, 2025

Xrp Market Analysis Three Reasons Why Xrp May Be Ready To Explode

May 08, 2025 -

3 Key Indicators Suggesting Xrp Could Be Poised For A Significant Rally

May 08, 2025

3 Key Indicators Suggesting Xrp Could Be Poised For A Significant Rally

May 08, 2025