BlackRock ETF: Billionaire Investments And A Potential 110% Return In 2025

Table of Contents

BlackRock's Market Dominance and ETF Expertise

BlackRock stands as a global leader in asset management, boasting unparalleled experience and expertise in Exchange-Traded Funds (ETFs). Their extensive range of ETFs caters to diverse investment strategies and risk tolerances, offering investors access to a broad spectrum of asset classes. This market dominance translates to significant influence and potential for outsized returns. BlackRock's investment philosophy, emphasizing index tracking and active management across various sectors, contributes to its success.

- Market share statistics: BlackRock commands a substantial portion of the global ETF market, consistently ranking among the top providers. (Source needed: Insert reputable financial data source here showing BlackRock's ETF market share).

- Examples of top-performing BlackRock ETFs: Several BlackRock ETFs have demonstrated strong historical performance. (Source needed: Insert specific examples with performance data and relevant timeframes, citing sources such as Bloomberg or Yahoo Finance). Mention specific tickers and their respective performance.

- BlackRock's investment philosophy: Their diversified approach, combining passive and active strategies, mitigates risk and seeks to capitalize on market opportunities. (Source needed: Link to BlackRock's official website detailing their investment philosophy).

Analyzing the 110% Return Projection for 2025

The 110% return projection for 2025 is undeniably speculative. Such a prediction relies on numerous factors and inherent uncertainties. However, several potential market trends and economic factors contribute to the optimistic outlook. (Source needed: Cite the source of the 110% prediction. This is crucial for credibility. If it's an internal projection, state this clearly). These include potential advancements in specific sectors, anticipated economic growth, and shifts in global investment patterns.

- Key economic indicators: Positive growth projections in key sectors, such as technology or renewable energy, could fuel substantial ETF gains. (Source needed: Cite economic forecasts from reputable sources).

- Potential market disruptions: Geopolitical instability, unexpected regulatory changes, and unforeseen economic downturns could significantly impact the prediction.

- Risk assessment and mitigation strategies: Diversifying your ETF portfolio across various asset classes and sectors can help mitigate risk. (More details on diversification strategies should be provided later).

Billionaire Investment Strategies and BlackRock ETFs

High-net-worth individuals often leverage ETFs for their portfolio diversification and strategic advantages. The ease of access, low expense ratios, and transparency of ETFs make them an attractive tool for sophisticated investors. Many billionaires utilize strategies aligned with BlackRock's ETF offerings, focusing on long-term growth and risk management.

- Examples of billionaire investment strategies: Value investing, growth investing, and global diversification are common strategies among successful investors. (Source needed: Cite examples from books or articles about billionaire investing strategies).

- Specific BlackRock ETFs aligned with these strategies: (Source needed: Identify specific BlackRock ETFs that align with the strategies mentioned above, ideally citing examples of billionaires using similar strategies or ETFs).

- Analysis of risk tolerance and investment horizons: Billionaire investors often have longer time horizons and higher risk tolerance, enabling them to ride out market volatility.

Investing in BlackRock ETFs: A Practical Guide

Investing in BlackRock ETFs involves several steps. For beginners, it's essential to proceed with caution and seek professional advice if needed.

- Steps to open a brokerage account: Choose a reputable brokerage, complete the application process, and fund your account.

- Factors to consider when choosing BlackRock ETFs: Consider your investment goals, risk tolerance, and desired asset allocation. Research the ETF's expense ratio, historical performance, and underlying holdings.

- Strategies for diversifying your BlackRock ETF portfolio: Diversification across various sectors, asset classes, and geographies can mitigate risk.

- Resources for learning more about ETF investing: Utilize educational resources from reputable financial institutions and websites.

Conclusion: BlackRock ETFs – Your Path to Potential High Returns in 2025

BlackRock's market leadership, the potential for high returns with BlackRock ETFs, and the importance of understanding investment risks are key takeaways. The 110% return projection for 2025, while speculative, highlights the potential upside. However, remember that investing involves risk, and no investment guarantees a specific return. Thorough research and professional financial advice are crucial before making any investment decisions. Start exploring the world of BlackRock ETFs and discover how you can potentially achieve significant returns in 2025. Learn more today! (Link to relevant resources, such as BlackRock's website or educational resources on ETF investing).

Featured Posts

-

67 Million In Ethereum Liquidations Whats Next For Eth Prices

May 08, 2025

67 Million In Ethereum Liquidations Whats Next For Eth Prices

May 08, 2025 -

Oklahoma City Thunder Vs Memphis Grizzlies A Crucial Matchup

May 08, 2025

Oklahoma City Thunder Vs Memphis Grizzlies A Crucial Matchup

May 08, 2025 -

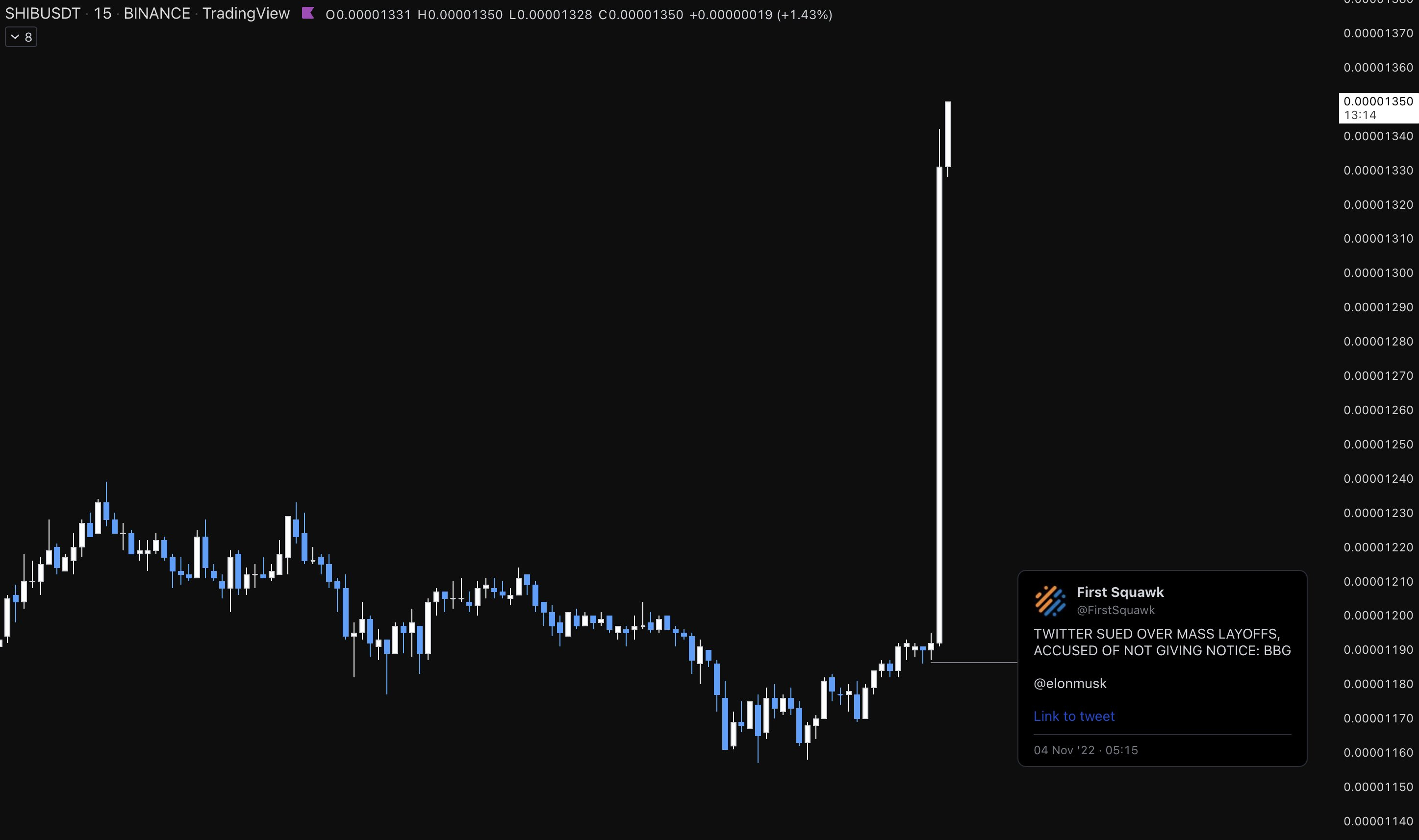

Why Are Dogecoin Shiba Inu And Sui Cryptocurrencies Rising

May 08, 2025

Why Are Dogecoin Shiba Inu And Sui Cryptocurrencies Rising

May 08, 2025 -

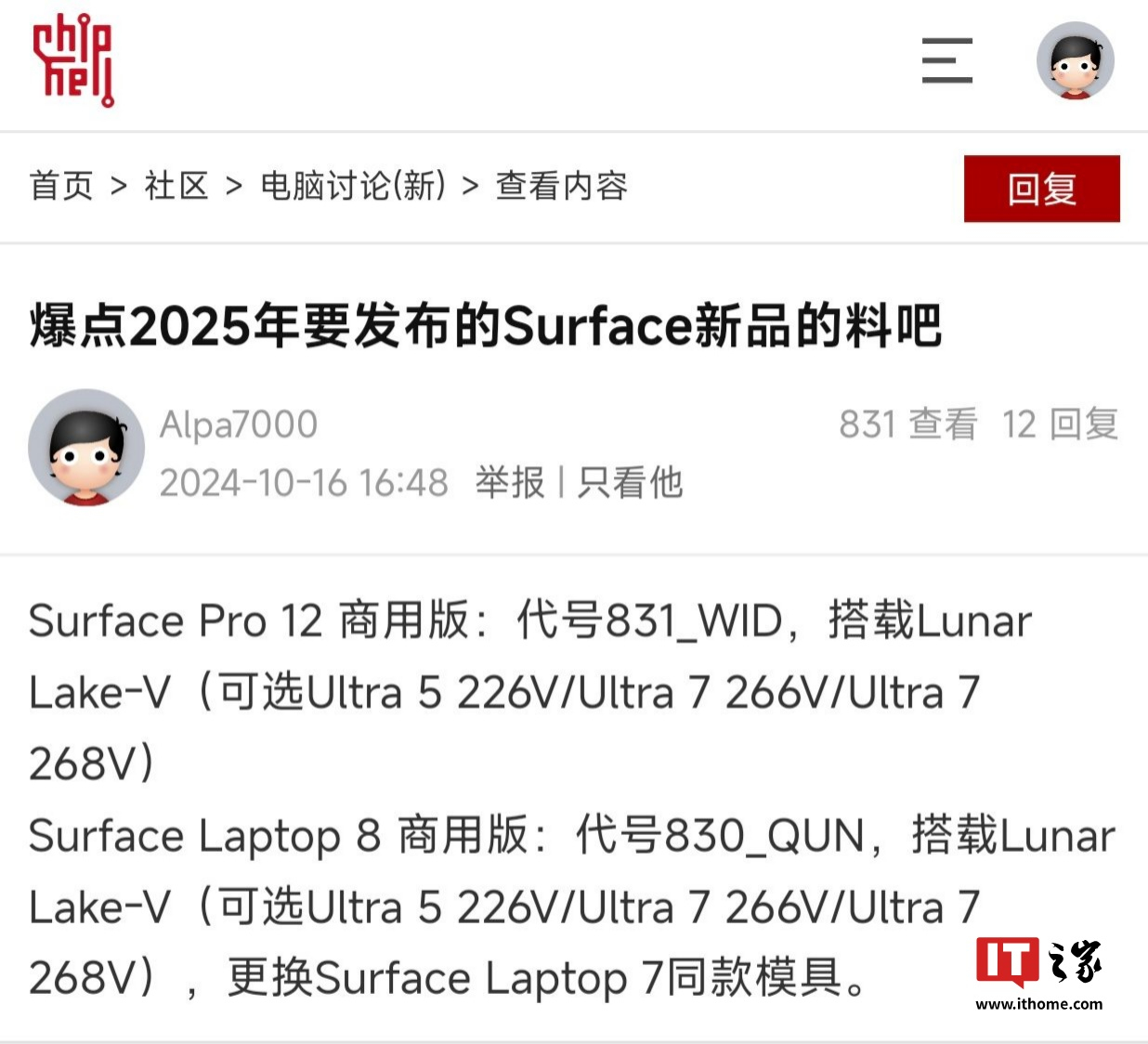

Surface Pro 12 A Detailed Look At The 799 Model

May 08, 2025

Surface Pro 12 A Detailed Look At The 799 Model

May 08, 2025 -

Arsenals Dembele Concerns Latest Injury News And Impact

May 08, 2025

Arsenals Dembele Concerns Latest Injury News And Impact

May 08, 2025

Latest Posts

-

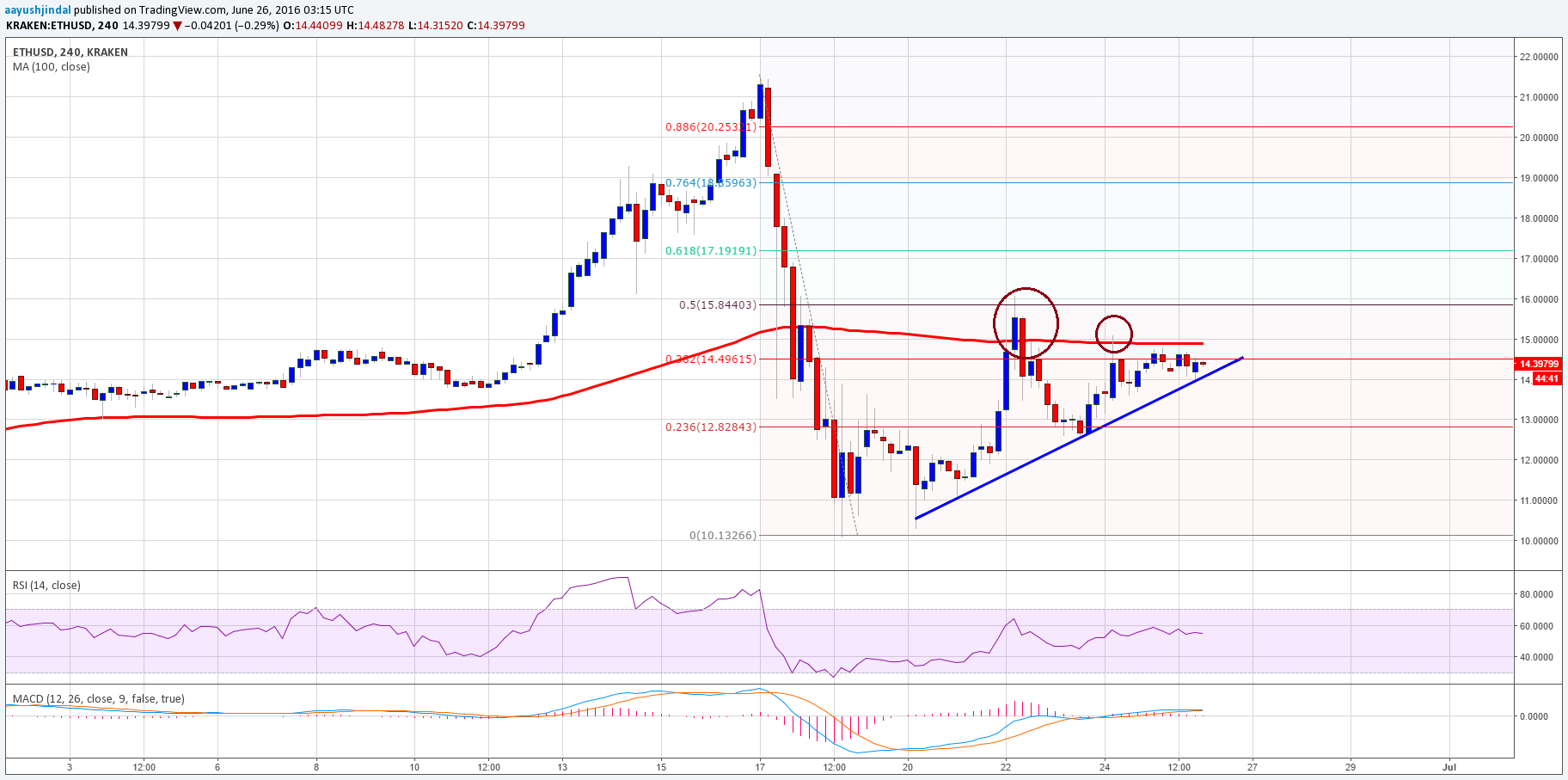

Ethereum Price Strength Bulls In Control Upside Potential High

May 08, 2025

Ethereum Price Strength Bulls In Control Upside Potential High

May 08, 2025 -

Recent 67 Million Ethereum Liquidation A Sign Of Market Weakness

May 08, 2025

Recent 67 Million Ethereum Liquidation A Sign Of Market Weakness

May 08, 2025 -

Ethereum Buy Signal Weekly Chart Analysis And Price Prediction

May 08, 2025

Ethereum Buy Signal Weekly Chart Analysis And Price Prediction

May 08, 2025 -

67 Million Ethereum Liquidation Event Market Analysis And Predictions

May 08, 2025

67 Million Ethereum Liquidation Event Market Analysis And Predictions

May 08, 2025 -

Ethereum Market Crash 67 M In Liquidations And The Potential For More

May 08, 2025

Ethereum Market Crash 67 M In Liquidations And The Potential For More

May 08, 2025