Ethereum Buy Signal: Weekly Chart Analysis And Price Prediction

Table of Contents

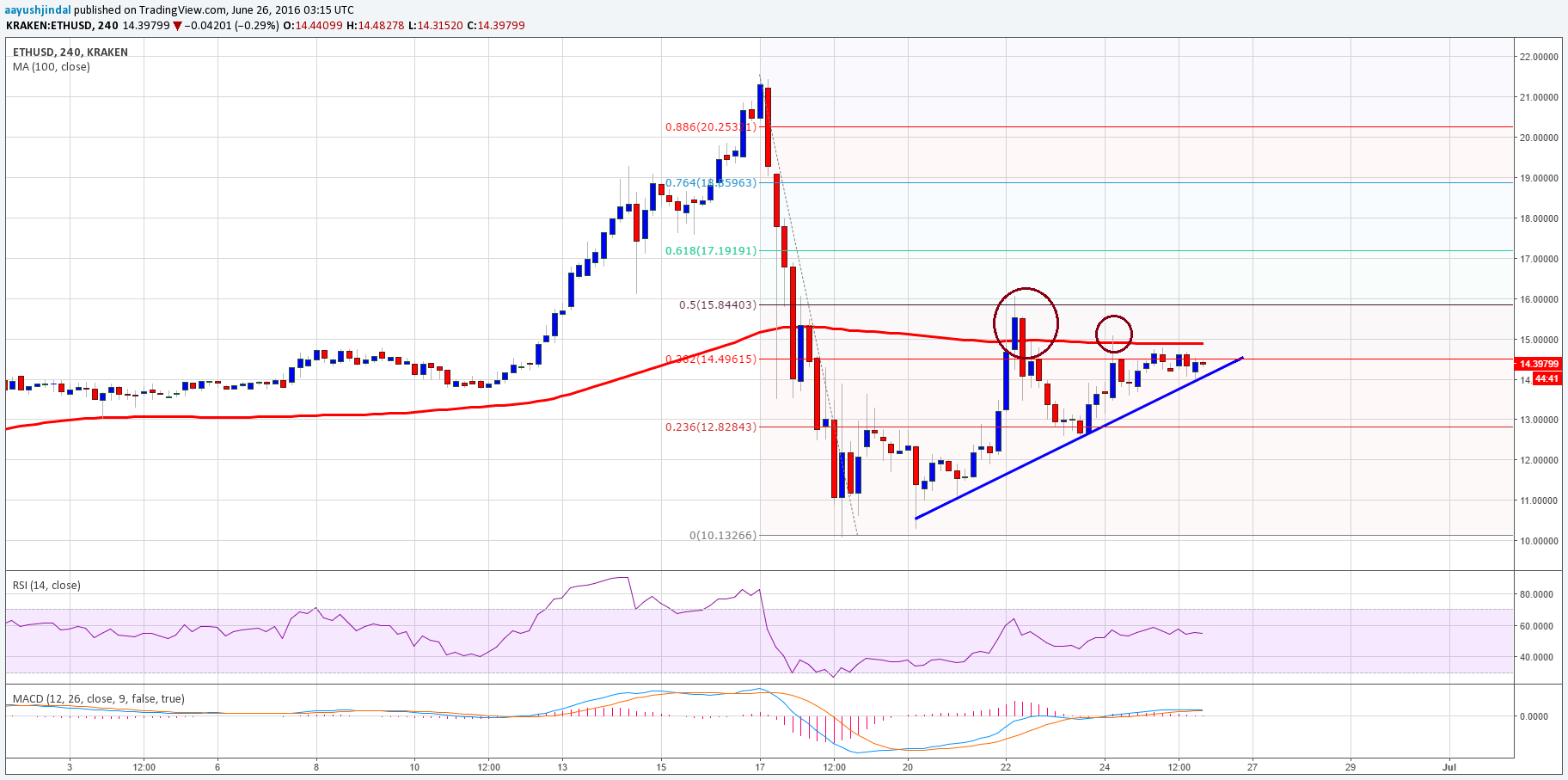

Analyzing the Ethereum Weekly Chart: Key Indicators

To determine if a strong Ethereum Buy Signal exists, we need to analyze several key indicators on the weekly chart. This longer timeframe helps filter out short-term noise and focus on significant trends.

Moving Averages (MA): Identifying Trends and Support/Resistance Levels

Moving averages, particularly the 50-day, 100-day, and 200-day MAs, are crucial for identifying long-term trends and potential support/resistance levels. These averages smooth out price fluctuations, revealing underlying trends.

- A bullish crossover occurs when a shorter-term MA (e.g., 50-day) crosses above a longer-term MA (e.g., 200-day). This is often interpreted as a strong Ethereum Buy Signal, suggesting a potential long-term uptrend. Conversely, a bearish crossover indicates a potential downtrend.

- Support levels are often found where the price has historically bounced off the moving averages, providing potential buying opportunities during pullbacks.

- Other relevant MAs, such as the 20-day or 150-day, can be used to confirm trends or find additional support and resistance zones. The interplay of different MAs can provide a richer understanding of potential Ethereum Buy Signals.

! (Replace with actual chart)

Relative Strength Index (RSI): Gauging Momentum and Oversold Conditions

The Relative Strength Index (RSI) is a momentum indicator that helps determine if Ethereum is overbought or oversold. It oscillates between 0 and 100.

- An RSI below 30 generally suggests that Ethereum is oversold, potentially indicating a buying opportunity. This is a classic Ethereum Buy Signal from a momentum perspective.

- An RSI above 70 suggests that Ethereum is overbought, potentially signaling a potential sell-off.

- It's crucial to consider the RSI in conjunction with other indicators, such as moving averages and volume, for confirmation before acting on any potential Ethereum Buy Signal.

! (Replace with actual chart)

Volume Analysis: Confirming Price Movements

Trading volume provides crucial context to price action. High volume confirms price movements, while low volume suggests a lack of conviction.

- Increasing volume during an uptrend strengthens the bullish signal and validates the potential Ethereum Buy Signal.

- Decreasing volume during an uptrend may signal a weakening of the bullish momentum, suggesting caution.

- High volume during a price drop confirms the bearish pressure, while low volume during a price drop may indicate a temporary correction.

! (Replace with actual chart)

Interpreting the Ethereum Buy Signal: Putting it All Together

A confluence of bullish indicators significantly increases the likelihood of a genuine Ethereum Buy Signal.

- A bullish crossover of moving averages (e.g., 50-day MA crossing above the 200-day MA) suggests a potential long-term uptrend.

- An oversold RSI (below 30) indicates potential buying pressure.

- Increasing volume accompanying price increases confirms the bullish momentum.

The combination of these factors strongly suggests a buy signal. However, remember that no indicator is foolproof. Always employ risk management techniques such as stop-loss orders to limit potential losses. Diversifying your portfolio is crucial to mitigating overall risk.

Ethereum Price Prediction: Potential Future Price Movements

Based on the combined analysis of moving averages, RSI, and volume, a cautiously optimistic short-term price increase for Ethereum is possible. However, several factors could influence this prediction, including overall market sentiment, regulatory changes, and technological developments within the Ethereum ecosystem.

- Based on our analysis, a price increase to $2,000 within the next 8 weeks is a possible scenario. This is not financial advice.

- This prediction is subject to market volatility and unforeseen events. Conduct your own thorough research before investing.

Conclusion: Actionable Insights and Next Steps for Your Ethereum Investment Strategy

This analysis has explored potential Ethereum Buy Signals through a detailed weekly chart analysis, incorporating moving averages, RSI, and volume. While a bullish outlook is suggested, it is crucial to remember that market predictions are inherently uncertain. Use this Ethereum Buy Signal analysis as a starting point for your own research before investing in Ethereum. Conduct thorough due diligence and consider consulting with a financial advisor before making any investment decisions. We encourage you to subscribe to our newsletter for more in-depth analysis and share this article with others who might find it valuable.

Featured Posts

-

Carneys Economic Agenda Dodge Advocates For Productivity Focus

May 08, 2025

Carneys Economic Agenda Dodge Advocates For Productivity Focus

May 08, 2025 -

Did Saturday Night Live Change Everything For Counting Crows

May 08, 2025

Did Saturday Night Live Change Everything For Counting Crows

May 08, 2025 -

Daily Lotto Results Wednesday 16th April 2025

May 08, 2025

Daily Lotto Results Wednesday 16th April 2025

May 08, 2025 -

222 Milione Euro Per Neymar Dokumentet Fotoja Dhe Deshmia E Agjentit Mbi Transferimin Te Psg

May 08, 2025

222 Milione Euro Per Neymar Dokumentet Fotoja Dhe Deshmia E Agjentit Mbi Transferimin Te Psg

May 08, 2025 -

Forza Horizon 5 Ps 5 Release Date When Does It Unlock

May 08, 2025

Forza Horizon 5 Ps 5 Release Date When Does It Unlock

May 08, 2025

Latest Posts

-

3 Key Indicators Suggesting Xrp Could Be Poised For A Significant Rally

May 08, 2025

3 Key Indicators Suggesting Xrp Could Be Poised For A Significant Rally

May 08, 2025 -

Xrp Price Prediction 3 Factors Pointing To A Possible Parabolic Move In Xrp

May 08, 2025

Xrp Price Prediction 3 Factors Pointing To A Possible Parabolic Move In Xrp

May 08, 2025 -

Xrp News 3 Reasons For A Potential Xrp Price Surge

May 08, 2025

Xrp News 3 Reasons For A Potential Xrp Price Surge

May 08, 2025 -

Aktuelle Lotto 6aus49 Ergebnisse Ziehung Vom 12 April 2025

May 08, 2025

Aktuelle Lotto 6aus49 Ergebnisse Ziehung Vom 12 April 2025

May 08, 2025 -

Lotto 6aus49 Alle Zahlen Vom 19 April 2025

May 08, 2025

Lotto 6aus49 Alle Zahlen Vom 19 April 2025

May 08, 2025