Bitcoin Price Prediction: 1,500% Growth In Five Years?

Table of Contents

Factors Potentially Driving Significant Bitcoin Price Growth

Several converging trends suggest that substantial Bitcoin price growth is possible, although a 1500% increase in five years is an exceptionally bullish scenario.

Increasing Institutional Adoption

Large financial institutions are increasingly embracing Bitcoin, a shift that dramatically impacts its price. This institutional Bitcoin investment is no longer a fringe phenomenon. Companies like MicroStrategy, Tesla, and numerous others have added significant Bitcoin holdings to their balance sheets. This increased demand from major players injects significant capital into the market, pushing prices upward.

- Increased liquidity: Institutional investment brings greater liquidity to the market, making it easier to buy and sell large quantities of Bitcoin.

- Reduced volatility (potentially): The belief is that sustained institutional holding reduces the impact of short-term market fluctuations.

- Legitimacy boost: Institutional adoption lends credibility and legitimacy to Bitcoin, attracting more mainstream investors.

- Keywords: Institutional Bitcoin investment, corporate Bitcoin adoption, Bitcoin price impact, institutional Bitcoin holdings.

Growing Global Adoption and Regulation

The global adoption of Bitcoin as a legitimate asset class is another crucial factor. While regulatory landscapes vary widely across countries, increasing clarity and acceptance are fostering growth. Countries like El Salvador have even adopted Bitcoin as legal tender, showcasing a bold move toward wider acceptance. However, regulatory uncertainty in other regions remains a considerable challenge.

- Gradual regulatory clarity: As more governments grapple with Bitcoin regulation, clearer frameworks could stabilize the market and encourage investment.

- Emerging markets: Adoption in developing nations could significantly boost demand, given the potential for Bitcoin to provide financial inclusion.

- Keywords: Bitcoin regulation, global Bitcoin adoption, Bitcoin market growth, Bitcoin legal tender.

Scarcity and Limited Supply

Bitcoin's inherent scarcity is a powerful driver of its value. Only 21 million Bitcoin will ever exist, a fixed supply that contrasts sharply with fiat currencies. This scarcity becomes increasingly significant as demand grows, potentially leading to exponential price appreciation.

- Halving events: The periodic halving of Bitcoin mining rewards further restricts the supply, creating deflationary pressure.

- Lost coins: A significant portion of Bitcoin is lost or inaccessible, effectively reducing the circulating supply.

- Keywords: Bitcoin scarcity, Bitcoin supply, Bitcoin value proposition, Bitcoin halving.

Technological Advancements and Network Effects

Continuous improvements in Bitcoin's underlying technology are crucial for long-term growth. The development of Layer 2 scaling solutions, for example, addresses scalability challenges, enabling faster and cheaper transactions. As the network grows, attracting more users and developers, its value increases through network effects.

- Improved scalability: Layer 2 solutions like the Lightning Network improve transaction speeds and reduce fees, making Bitcoin more user-friendly.

- Enhanced security: Ongoing advancements in cryptography and network security enhance Bitcoin's resilience against attacks.

- Keywords: Bitcoin scalability, Bitcoin technology, network effects, Bitcoin Layer 2, Lightning Network.

Challenges and Risks Hindering a 1500% Bitcoin Price Increase

Despite the positive factors, several significant challenges could hinder a 1500% Bitcoin price increase within five years.

Volatility and Market Corrections

Bitcoin is notoriously volatile. Sharp price corrections are a recurring feature of the cryptocurrency market, and substantial drops are possible. Past market cycles demonstrate the potential for significant price swings, highlighting the risks involved.

- Bear markets: Historically, bear markets have seen significant price declines, lasting for extended periods.

- Market manipulation: The potential for market manipulation remains a concern, although regulations are attempting to address this.

- Keywords: Bitcoin volatility, Bitcoin price correction, cryptocurrency market risk, Bitcoin bear market.

Regulatory Uncertainty and Government Intervention

Government regulations play a critical role. While some countries are embracing Bitcoin, others remain hesitant or even hostile. Changes in regulatory landscapes can significantly impact the price, creating both opportunities and threats.

- Differing regulatory approaches: Inconsistency in regulatory frameworks across different jurisdictions creates uncertainty.

- Potential bans or restrictions: The risk of government bans or restrictions on Bitcoin remains a significant concern.

- Keywords: Bitcoin regulation risk, government Bitcoin policies, regulatory uncertainty, Bitcoin ban.

Competition from Other Cryptocurrencies

Bitcoin faces competition from numerous other cryptocurrencies (altcoins) that offer different features and functionalities. The emergence of successful competitors could divert investment away from Bitcoin, limiting its price growth.

- Altcoin innovation: The rapid pace of innovation in the altcoin space poses a constant challenge to Bitcoin's dominance.

- Market share competition: The competition for market share could put pressure on Bitcoin's price.

- Keywords: Bitcoin competition, altcoins, cryptocurrency market share, Ethereum.

Conclusion: Bitcoin Price Prediction: A Realistic Outlook

A 1500% Bitcoin price prediction within five years is a highly ambitious forecast. While several factors could drive substantial Bitcoin price growth – institutional adoption, growing global acceptance, scarcity, and technological advancements – significant risks remain. Market volatility, regulatory uncertainty, and competition from other cryptocurrencies could all significantly impact the price trajectory. Therefore, a balanced perspective is necessary. While significant growth remains a possibility, investors must approach Bitcoin with a clear understanding of both the potential rewards and the inherent risks. Learn more about Bitcoin price prediction, stay updated on Bitcoin price predictions, and analyze your own Bitcoin price prediction to make informed investment decisions.

Featured Posts

-

Fitore E Veshtire Per Psg Ne Pjesen E Pare

May 08, 2025

Fitore E Veshtire Per Psg Ne Pjesen E Pare

May 08, 2025 -

Re Examining The Thunder Bulls Offseason Trade A Look At The Real Story

May 08, 2025

Re Examining The Thunder Bulls Offseason Trade A Look At The Real Story

May 08, 2025 -

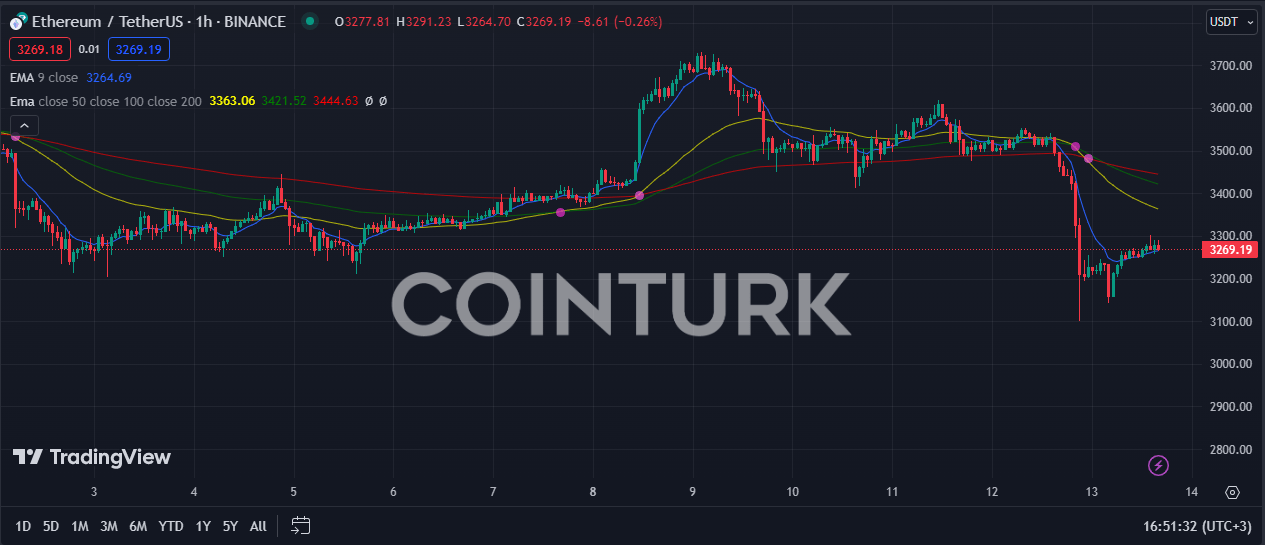

Ethereum Activity Surges Nearly 10 Address Increase In 48 Hours

May 08, 2025

Ethereum Activity Surges Nearly 10 Address Increase In 48 Hours

May 08, 2025 -

1 050 Price Increase At And T Sounds Alarm On Broadcoms V Mware Deal

May 08, 2025

1 050 Price Increase At And T Sounds Alarm On Broadcoms V Mware Deal

May 08, 2025 -

Over The Counter Birth Control Increased Access And Its Implications

May 08, 2025

Over The Counter Birth Control Increased Access And Its Implications

May 08, 2025

Latest Posts

-

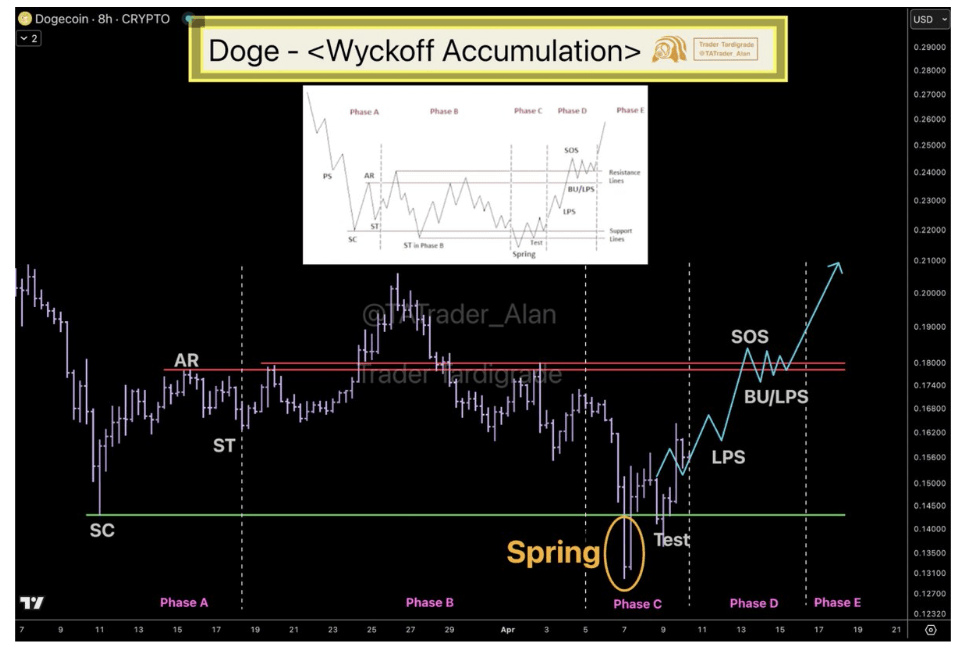

Ethereums Price Action Suggests 2 700 Is Achievable Wyckoff Accumulation Explained

May 08, 2025

Ethereums Price Action Suggests 2 700 Is Achievable Wyckoff Accumulation Explained

May 08, 2025 -

Technical Analysis Ethereums Potential 2 700 Surge Based On Wyckoff

May 08, 2025

Technical Analysis Ethereums Potential 2 700 Surge Based On Wyckoff

May 08, 2025 -

Ethereum Price Analysis 2 700 On The Horizon Wyckoff Accumulation Hints At Rally

May 08, 2025

Ethereum Price Analysis 2 700 On The Horizon Wyckoff Accumulation Hints At Rally

May 08, 2025 -

Ethereum Price To Hit 4 000 Cross X Indicators And Institutional Accumulation Suggest A Bullish Trend

May 08, 2025

Ethereum Price To Hit 4 000 Cross X Indicators And Institutional Accumulation Suggest A Bullish Trend

May 08, 2025 -

Wyckoff Accumulation In Ethereum Price Poised For 2 700 Breakout

May 08, 2025

Wyckoff Accumulation In Ethereum Price Poised For 2 700 Breakout

May 08, 2025