Bitcoin Investment Outlook: A 1,500% Potential Gain By 2028?

Table of Contents

Factors Driving Potential Bitcoin Price Growth

Several key factors could contribute to significant Bitcoin price growth in the coming years. Let's examine some of the most prominent influences on the Bitcoin price prediction for 2028.

Increasing Institutional Adoption

Large corporations and institutional investors are increasingly recognizing Bitcoin as a legitimate asset class. This institutional Bitcoin investment is a significant driver of price stability and growth.

- Examples: MicroStrategy, Tesla, and many others have added Bitcoin to their balance sheets, demonstrating growing confidence in the cryptocurrency.

- Impact: Institutional investment brings significant capital into the market, reducing volatility and potentially driving prices upward. This influx of capital adds legitimacy and reduces the perception of Bitcoin as a purely speculative asset. The increased liquidity provided by these large players can significantly impact the Bitcoin price prediction.

Growing Global Adoption and Regulatory Clarity

The global acceptance of Bitcoin as a legitimate asset is expanding rapidly. Positive regulatory developments in major economies are likely to accelerate this adoption.

- El Salvador's adoption: El Salvador's adoption of Bitcoin as legal tender is a landmark event showing a government's commitment to Bitcoin and cryptocurrencies.

- Regulatory clarity: As more countries develop clear regulatory frameworks for cryptocurrencies, institutional and individual investors will likely feel more comfortable entering the market, boosting Bitcoin's price. This contributes significantly to a positive 2028 Bitcoin forecast.

Technological Advancements and Network Upgrades

Technological improvements are vital for Bitcoin's continued growth. The Lightning Network, for instance, addresses scalability issues, enabling faster and cheaper transactions.

- Lightning Network: This second-layer solution significantly improves Bitcoin's transaction speed and reduces fees, making it more suitable for everyday use.

- Upcoming upgrades: Future upgrades to the Bitcoin protocol are expected to further enhance scalability and efficiency, thereby increasing adoption and driving demand. These improvements are essential to a favorable Bitcoin price prediction.

Deflationary Nature of Bitcoin

Bitcoin's inherent scarcity is a major driver of its potential long-term value. Only 21 million Bitcoins will ever exist.

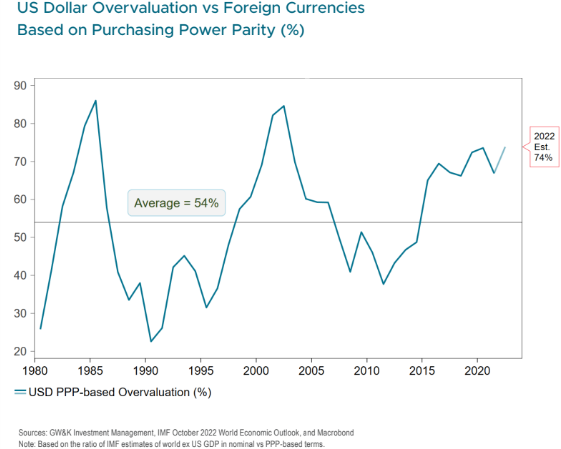

- Limited supply: This fixed supply contrasts sharply with traditional fiat currencies, which can be printed indefinitely, leading to inflation.

- Increased demand: As demand for Bitcoin grows, and the supply remains constant, the price is likely to increase. This deflationary nature is a significant factor contributing to a positive Bitcoin price prediction.

Risks and Challenges to Consider

While the potential for significant gains is substantial, investing in Bitcoin comes with inherent risks. Understanding these risks is crucial for informed decision-making.

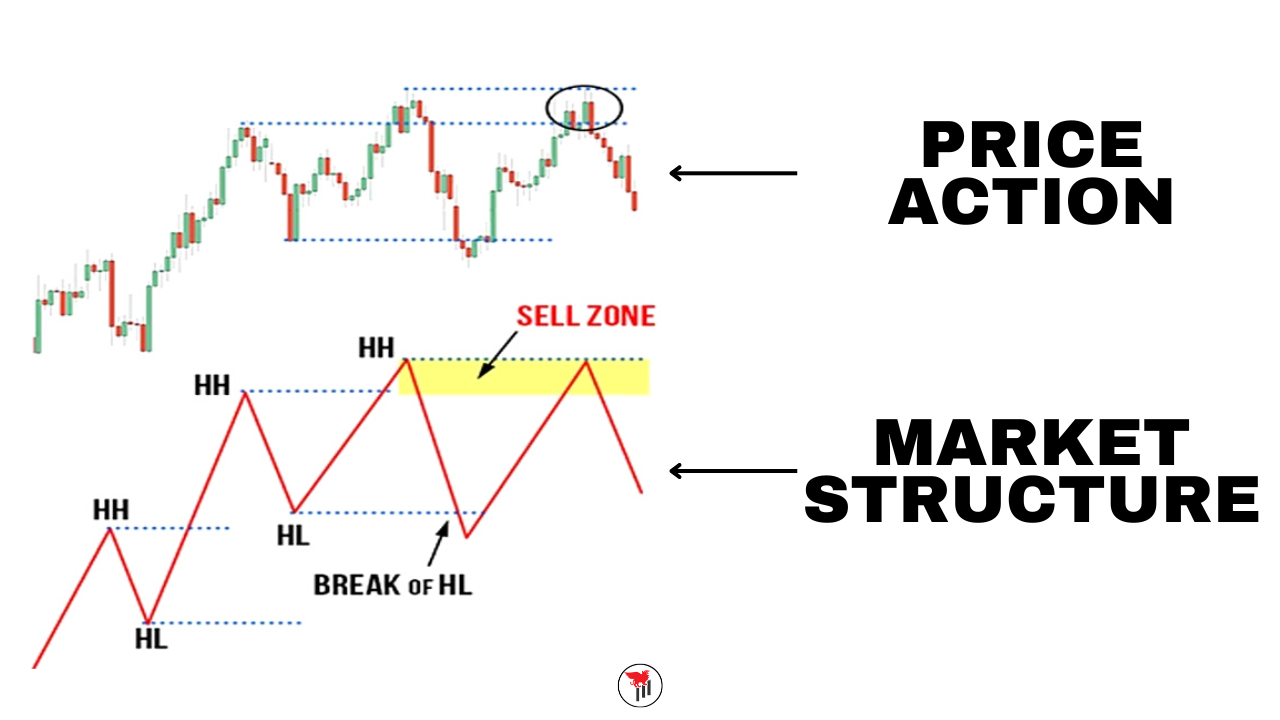

Volatility and Market Corrections

Bitcoin is notoriously volatile, experiencing sharp price swings. Market corrections are a normal part of the cryptocurrency market cycle.

- Historical fluctuations: Bitcoin's history is marked by periods of rapid growth followed by significant price drops. Investors must be prepared for this volatility.

- Risk management: Diversification, dollar-cost averaging, and avoiding emotional decision-making are crucial for managing risk.

Regulatory Uncertainty and Geopolitical Risks

The regulatory landscape for cryptocurrencies remains uncertain globally. Geopolitical events can also significantly impact Bitcoin's price.

- Regulatory crackdowns: Governments' actions can influence the price significantly, either positively or negatively.

- Geopolitical instability: Global events can trigger market-wide sell-offs, impacting Bitcoin's price.

Competition from Other Cryptocurrencies

The cryptocurrency space is constantly evolving, with new projects emerging and competing for market share.

- Altcoins: The emergence of altcoins presents competition to Bitcoin's dominance.

- Diversification: Diversifying a cryptocurrency portfolio can mitigate risk associated with the dominance of a single cryptocurrency.

Conclusion: Navigating the Bitcoin Investment Landscape for Potential Long-Term Growth

The potential for a 1,500% gain in Bitcoin's price by 2028 is driven by factors like increasing institutional adoption, growing global acceptance, technological advancements, and Bitcoin's inherent scarcity. However, the inherent volatility, regulatory uncertainty, and competition from other cryptocurrencies present significant challenges. Thorough research and understanding of both the potential rewards and risks are essential before investing in Bitcoin. Before making any investment decisions, it is crucial to conduct thorough research, understand your risk tolerance, and possibly consult with a financial advisor. Learn more about Bitcoin investment strategies, Bitcoin price prediction analysis, and responsible cryptocurrency investment approaches to navigate the exciting yet volatile world of Bitcoin and its potential future. Remember, while the Bitcoin future holds significant potential for growth, it also carries substantial risk of loss.

Featured Posts

-

China Responds To Tariffs Lower Interest Rates And Increased Bank Lending

May 08, 2025

China Responds To Tariffs Lower Interest Rates And Increased Bank Lending

May 08, 2025 -

Assessing The Overvaluation Of The Canadian Dollar A Call To Action

May 08, 2025

Assessing The Overvaluation Of The Canadian Dollar A Call To Action

May 08, 2025 -

Understanding Ethereums Price A Comprehensive Analysis Of Market Factors And Future Trends

May 08, 2025

Understanding Ethereums Price A Comprehensive Analysis Of Market Factors And Future Trends

May 08, 2025 -

The Long Walk First Trailers Simple Yet Terrifying Look

May 08, 2025

The Long Walk First Trailers Simple Yet Terrifying Look

May 08, 2025 -

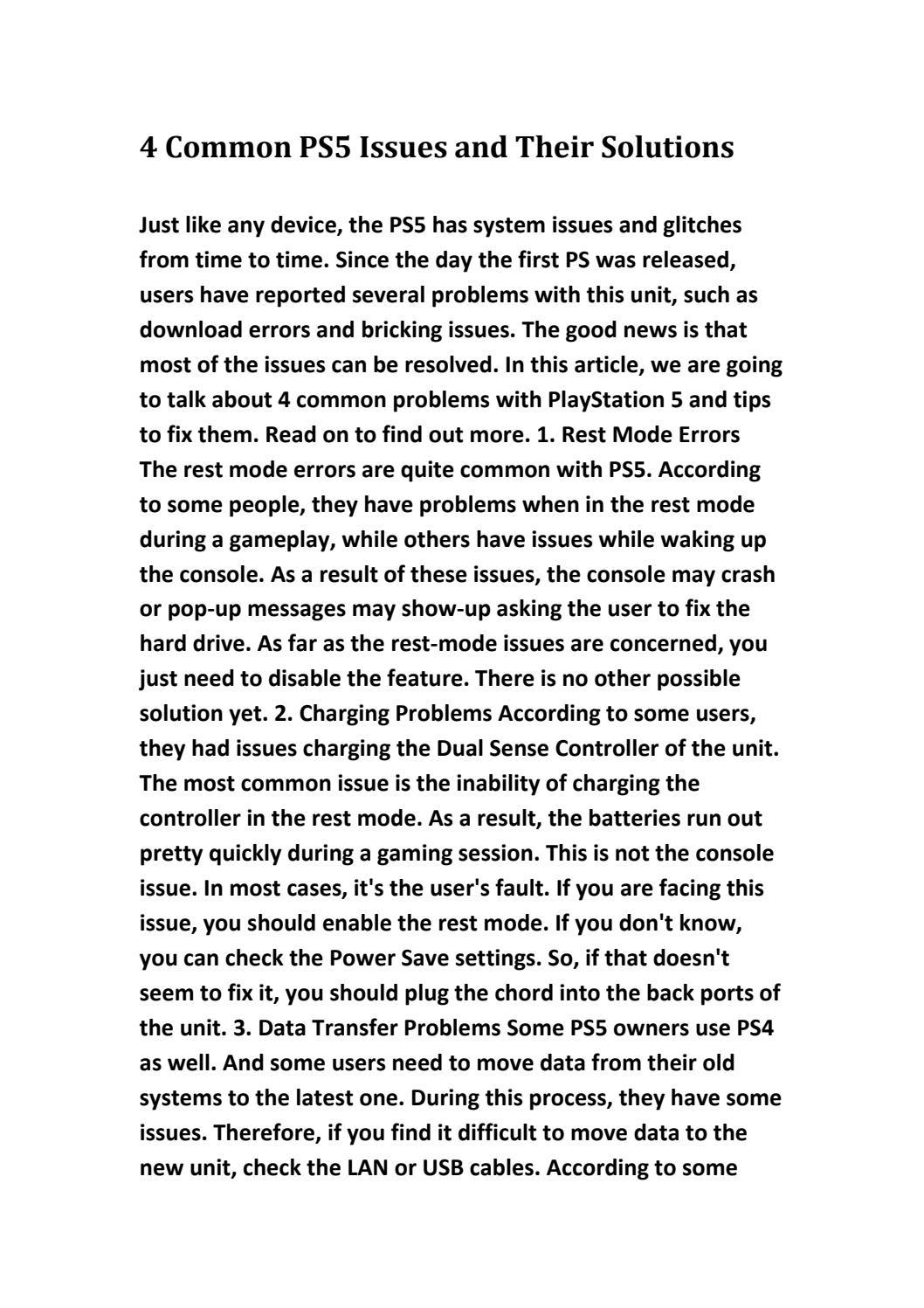

Are Ps 5 Games Stuttering Troubleshooting Common Problems

May 08, 2025

Are Ps 5 Games Stuttering Troubleshooting Common Problems

May 08, 2025

Latest Posts

-

1 500 Ethereum Price Target Is The Crucial Support Level About To Break

May 08, 2025

1 500 Ethereum Price Target Is The Crucial Support Level About To Break

May 08, 2025 -

Ethereum Price Holds Above Key Support Could A Drop To 1 500 Be Next

May 08, 2025

Ethereum Price Holds Above Key Support Could A Drop To 1 500 Be Next

May 08, 2025 -

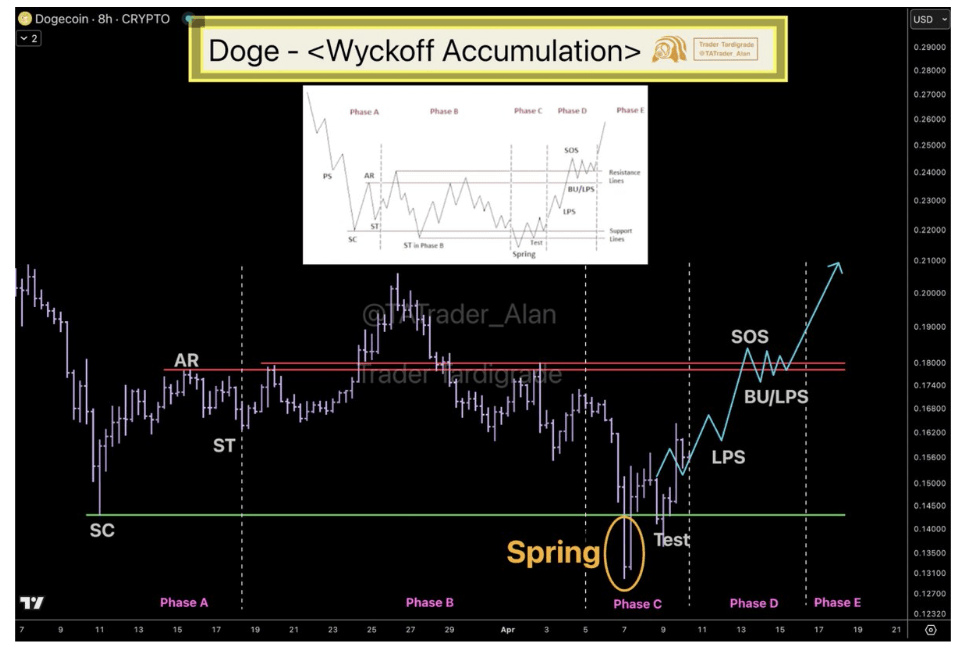

Ethereums Price Action Suggests 2 700 Is Achievable Wyckoff Accumulation Explained

May 08, 2025

Ethereums Price Action Suggests 2 700 Is Achievable Wyckoff Accumulation Explained

May 08, 2025 -

Technical Analysis Ethereums Potential 2 700 Surge Based On Wyckoff

May 08, 2025

Technical Analysis Ethereums Potential 2 700 Surge Based On Wyckoff

May 08, 2025 -

Ethereum Price Analysis 2 700 On The Horizon Wyckoff Accumulation Hints At Rally

May 08, 2025

Ethereum Price Analysis 2 700 On The Horizon Wyckoff Accumulation Hints At Rally

May 08, 2025